Just a few weeks ago, on December 16, I wrote about how I was buying Australian Clinical Labs shares to take advantage of the exploding demand for PCR testing. Since that time, the share price has increased from $4.85 to about $5.99, a rise of approximately 23%.

However, quite a few fundamental developments have occurred, driving that change.

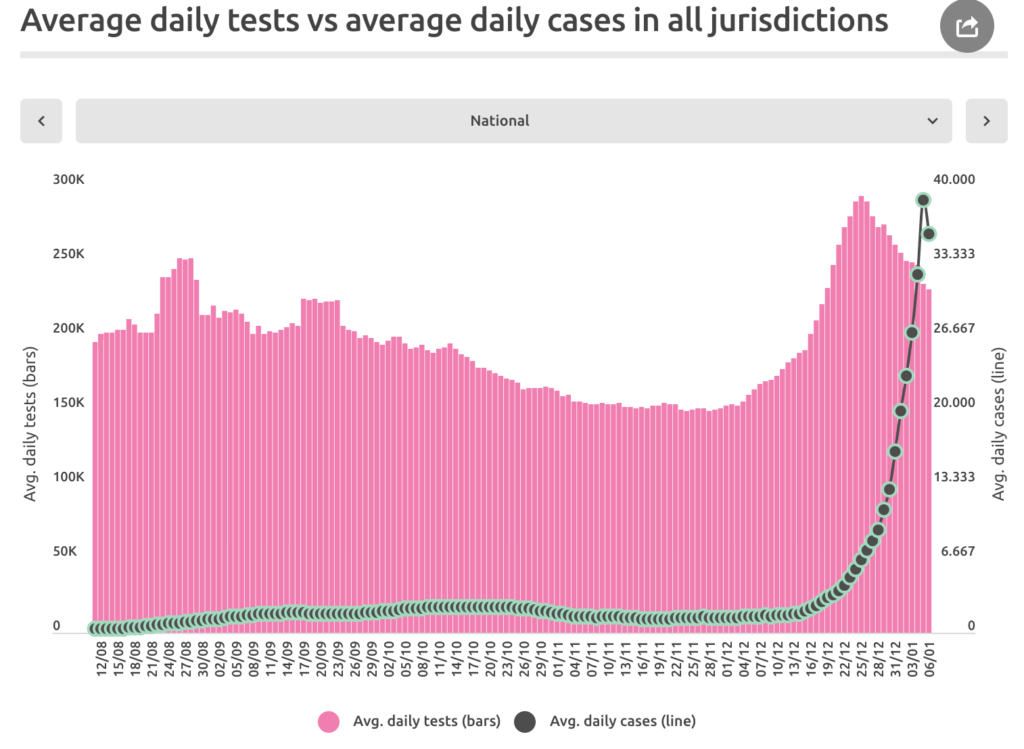

First of all, we saw a massive increase in PCR testing, which peaked in the 7 days leading up to Christmas. This makes sense, because lots of people would have wanted a test for travel purposes

Second, major shareholders Crescent Capital put out an announcement implying that they had no intention to sell their shares, writing that “Crescent has no intention to seek further liquidity of Crescent V’s shareholding at this current time and will not enter into any block trade or share sale of any of Crescent V’s shares when the first tranche is released from escrow at the company’s interim results release (February 2022).”

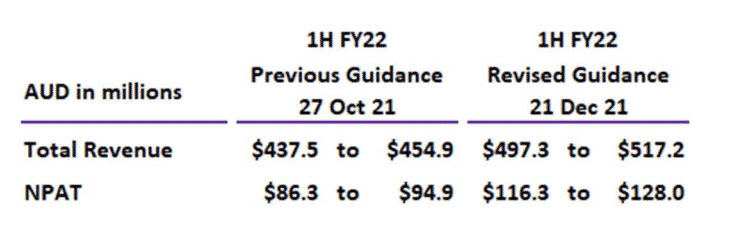

Third, the company upgraded its guidance for the half to December 2021, as you can see below:

And finally, most significantly, the Australian government has changed the rules to massively reduce the number of people who will require a PCR test. To quote the ABC; “People with a positive rapid antigen test (RAT) will no longer be required to get a PCR test, regular testing for truck drivers is being scrapped, and international arrivals will not be required to get multiple tests.”

This removes one of the major reasons to get a PCR test, but it is not clear exactly how much this will reduce demand, since people with symptomatic covid will still have the option of a PCR test, and the states will still be directing people to get tested in certain scenarios. What is clear, though, is that the demand for covid testing should reduce from here.

In the short term, some people may choose to get a PCR test if they cannot find rapid antigen tests (RAT), but once those tests become available more widely — which will probably be very soon — then many people will simply choose a RAT over a PCR test. Some people will presumably still seek the certainty — and proof — that an official PCR test provides.

However, this move will definitely increase the proportion of people with covid who do not get a PCR test.

Should I Sell My Australian Clinical Labs shares?

In my opinion, it is a bad mistake to reduce PCR resting, because PCR testing is far more accurate than rapid antigen testing and it detects covid infection earlier in the infection course. However, PCR is of little use if it takes too long to get results, so clearly we did need to either increase capacity or decrease demand. I think that there is a substantial possibility that the Liberal party lose the next federal election, and a Labor government increases expenditure on PCR testing, once again.

That said, in the short term, this is clearly bad news for Australian Clinical Labs. I would not be surprised if its profits halve from the elevated level in the first half of FY 2022, but the reality may be a lot less severe.

If that happens, then the company would be trading on about 11 – 12x normalised earnings; or potentially a little higher if the profit drops off more sharply. At a share price of $6, Australian Clinical Labs has a market capitalisation of $1.2 billion. If we are willing to pay 15x normalised earnings, then we need those normal earnings to be at least $80 million, once covid testing volumes return to a more “normal” level.

In the prospectus, Australian Clinical Labs forecast $74 million in NPAT in FY 2021. Since then, the company acquired Medlab, which is expected to contribute normalised EBITDA of about $10.5 million. That should take normalised profit to around $80m, even assuming a significant reduction in covid testing.

That said, all this suggests that the current price of $6 is “about right” for Australian Clinical Labs, which means that in my view there is no real upside at the current price. In all likelihood, the short term headwinds will spook the market somewhat, so my current plan is to sell at least some of my Australian Clinical Labs shares when the market opens today.

The key metric for me to watch will be the number of tests each day. If I see test numbers drop significantly in the next couple of weeks, I will likely sell more shares. But for now, I will just sell some of my shares (probably between one quarter and one half of my holding).

If you’re reading this after 10.05am, I’ve probably already sold some!

At the moment, I want to keep some of my shares for the same reasons that Crescent Capital are holding some shares, and because I think that it’s quite likely a change of government would see a more favourable PCR testing regime. After all, fast and accurate testing is a very important tool for controlling covid, and the current uncontrolled spread is very bad for the economy and healthcare system.

The ABC reports this morning that some businesses in the hospitality industry say that “we are at 2020 levels of restrictions but without any of the support”. Clearly, it is better for the economy to have lower levels of covid. Ultimately, it is likely Australia will bring back test, trace and isolate protocols, which have been essentially abandoned by the “let it spread” NSW premier Dom Perrottet, who is now widely known as Domicron.

When too many people get sick at the same time, systems start to breakdown. In the end, some degree of free PCR testing will be well worthwhile, as (if results are delivered quickly) it allows people to ascertain their covid status with better accuracy than a RAT provides.

Please remember that these are personal reflections about a stock by author. I own shares in Australian Clinical Labs and will sell some of them today when the market opens. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.

For early access to content like this, join our Free newsletter!