Ambertech (ASX:AMO) Thesis Plays Out In FY2022 Results

Ambertech (ASX:AMO) is up 40% so the value thesis has played out.

Ambertech (ASX: AMO) is a distrubutor of audio visual (AV) equipment. It gained scale by acquiring the acquired the AV business of Hills in 2019. The precursor Ambertech group of companies were founded in the 1980’s, and Ambertech was listed on the stock exchange in 2004, at a share price of $1.

Ambertech has three business segments, being professional services, retail and integrated solutions. Ambertech says its professional services division “has a strong reputation as a preferred supplier of high technology equipment for live sound in many different industry segments, including touring artists, live stage shows, film and television productions” and many other categories.

The integrated solutions division focuses on “Audio visual and infrastructure brands for home cinema, multi room AV and more,” while the retail segment “works with home electronics retailers nationally, mass markets retail chains and independent specialist outlets to supply home entertainment solutions.”

Ambertech (ASX:AMO) is up 40% so the value thesis has played out.

While investing in the future is the best long term strategy, buying lower quality stocks like Ambertech (ASX:AMO) and Yellow Brick Road (ASX:YBR) can still pay off.

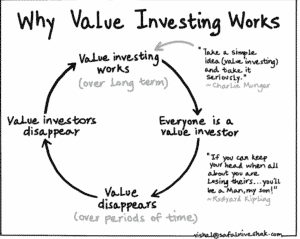

With a P/E of around 8, this business is either unsustainable, or cheap; welcome to the world of the “value investor”…