One of the themes that I’m going to be thinking about over the next little while is how I can find little undervalued companies to put money into. The problem with stereotypical value investing is that it doesn’t necessarily land you in great long term business. Rather, the idea is to buy something decent for less than it is worth, then sell it when it is trading at closer to its real worth.

Below, I thought I’d share a snapshot of Ambertech (ASX: AMO) as it is a good example of what I consider to be a value stock.

What is it Ambertech?

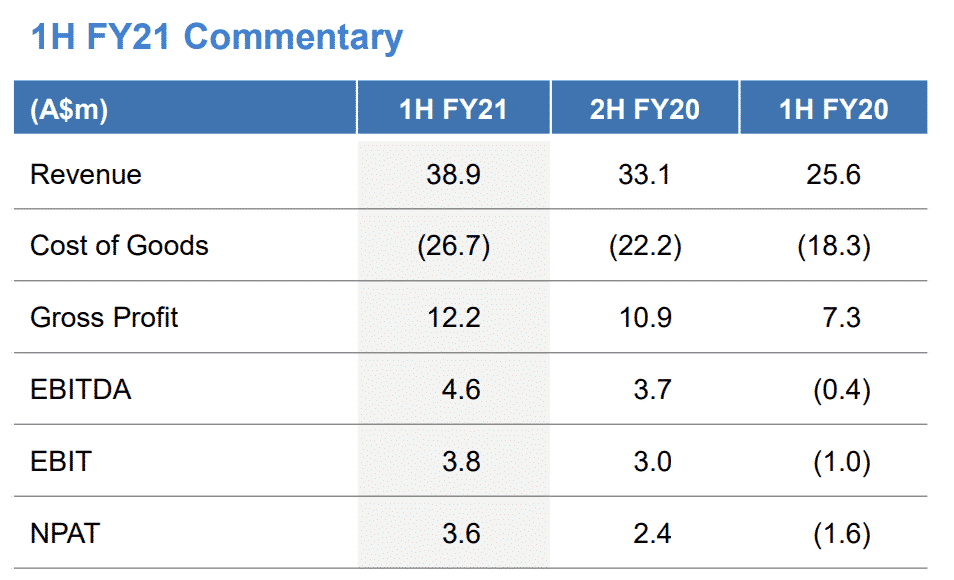

Ambertech is a distrubutor of AV equipment. It isn’t a very sexy business and it has struggled to make money for years. More recently, the company has managed to grow by acquisition. Most notably, it acquired the AV business of Hills. This has impacted its last two halves, which, as you can see below, has allowed it to turn a profit.

Now, in the most recent half, Ambertech gained $1.5m from JobKeeper. Furthermore, you can see that it doesn’t pay normal taxes, because it has so many accumulated losses. If we subtract JobKeeper from EBIT, we would get $2.3m. And if we applied a normal tax rate to $2.3m, we would get $1.6m. If we were a little conservative, we could then just say that we think the company has a normalised profit of $3m.

On the other side of the equation, Ambertech has about 79m shares, fully diluted. At the current price of 22.5 cents, then, it has a market cap of about $17.8m. Add to that net debt of $3m and we get to just under $21m. If we use the normalised profit of $3m then the company is on a P/E of about 7. The most recent director purchase was $23,000 spent on shares at 23 cents. The company has paid out 1.5 cents of interim dividend for the first half, and if it can achieve the same in the next half, then it is trading on a dividend yield of 13%.

Now, obviously, the market does not believe that Ambertech will continue to achieve its current levels of profitability. However, in the company’s most recent result it said: “Whilst it is too early to provide guidance for the full year results, the early trading in the second half has followed on from the trend of the first half of the financial year.”

I am not a stereotypical value investor and nor do I claim to be. I try to put capital in the highest quality, sleep at night, ethical businesses. However, those businesses are often only offered at a premium share price and of course to make money I need to be buying those businesses at an attractive share price. That is of course the main game but right now the prices of many of my favourite growth stocks are flying way too high.

If Pro Medicus goes to $25, then I will be buying that instead… but just because I’ll buy the best at 80 times earnings (and sell it at 160 times) doesn’t mean I won’t buy the mediocre at 8 times earnings… “¿Por qué no los dos?” So I bought some Ambertech shares and I might even buy some more.

This is not advice. These are investment notes of mine; not a recommendation. I could have made mistakes in the notes; and I still have many loose ends to explore. I own shares in Ambertech at the time of writing. Please read our detailed disclaimer.