Volpara (ASX: VHT) Reports Minimal Cash Burn In Q1 FY 2024

Volpara (ASX: VHT) remains close to profitability in Q1 FY 2024, showing good cost control and continuing revenue growth.

Volpara (ASX: VHT) remains close to profitability in Q1 FY 2024, showing good cost control and continuing revenue growth.

10 quarterly snapshots: Raiz (ASX: RZI), Volpara (ASX: VHT), SciDev (ASX: SDV), NextEd (ASX: NXD), Ensurance (ASX: ENA), Playside Studios, Wisr (ASX: WZR) and more…

Volpara (ASX: VHT) has experienced impressive growth in annualised recurring revenue over the last five years; but it’s still uncomfortably far from profitability.

Quarterly reports of Rightcrowd, IntelliHR and Volpara update us on free cash flow and annualised recurring revenue growth…

Even though growth stocks are down considerably, in my view the top quality growth stocks are still up pretty overvalued.

These growth stocks are still losing money, but seem to be heading in the right direction.

These five stocks all have very high quality businesses that I want to buy more shares in, if only the market would offer a slightly better price.

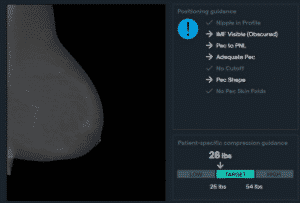

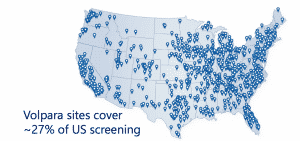

Volpara is on a mission to increase early detection of breast cancer.

Some stocks have high multiples and higher growth rates, others have lower multiples and lower growth rates. Here’s how I decided which one to choose.

The Volpara share price has been languishing for quite some time, but the opportunity to expand from mammograms to lung scans is promising…

Volpara (ASX: VHT) has a winning product but its pattern of expanding through acquisitions funded by capital raises poses questions for long-term investors.

Tuesday morning’s market announcement spruiked strong underlying financials, but the effect of Covid-19 on non-infectious medical procedures remains to be seen.