On Friday 29 May, Volpara Health Technologies (ASX: VHT) released its preliminary full-year financial report, based on the New Zealand 1 April to 31 March reporting calendar. By close of trade, Volpara Health Technologies’ share price was down 10 cents to $1.405.

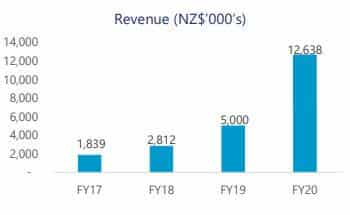

Headline news for Volpara was its NZ$18m in annual recurring revenue (ARR). The company also reported subscription revenue up 106% to NZ$9.1m and cash receipts from customers up 193% to NZ$16.3m.

The difficulty is that most of this growth was non-organic, deriving from the acquisition of Seattle-based MRS Systems, which has significantly expanded the company’s reach. Following the acquisition, Volpara software is now used in 27% of breast cancer screening in the US.

Volpara’s year-on-year accounts remain in the red, posting a NZ$22.3m loss for the financial year, almost double its 2019 loss. The ostensible good news is that that figure is largely a result of ‘spending for growth’ and arguably within the company’s ability to ameliorate.

For the time being, however, Volpara continues to be reliant on capital raising. The MRS acquisition was funded by an A$55m capital raising in June 2019, and this was followed by a further capital raise of A$35m announced to market on 21 April 2020.

Thus, when CEO Dr Ralph Highnam said on Friday, “We are now set to capitalise on the opportunities that will be presented due to Coronavirus,” investors may have been wondering if further acquisitions funded by dilution of shareholdings are on the cards for Volpara. Drawing from the investor presentation, what investors do know is that the company has “been tracking M&A opportunities for many years that would add to US market share.”

Fortunately, Friday’s announcements also brought much-needed information about the likely impacts of the pandemic on Volpara Health Technologies. In particular, the majority of Volpara’s customer contracts are signed on a five-year rolling basis. Thus, the company’s exposure to losing customers during the pandemic should be minimal.

This post is not financial advice, and you should click here to read our detailed disclaimer.

Christian Tym does not own shares in Volpara Ltd.

If you’d like to receive a occasional Free email with more content like this, then sign up today!