“Know thyself” is an ancient Greek phrase that emphasises the importance of understanding one’s own character because this allows you to be aware of one’s limitations. Lovisa (ASX: LOV) is a vertically-integrated fast-fashion jewellery retailer, selling mostly to 15 to 45-year-old women at cheap prices ranging from $6.99 to $49.99. Management’s unwavering focus on providing the most fashionable products at this price range is the key reason for Lovisa’s success since 2010. You could say that these days, Lovisa knows itself.

The founders, Brett Blundy of BB Retail Group and Shane Fallscheer (former CEO) realised the big opportunity that fast fashion jewellery presented after their rendezvous with Diva between 2005 and 2012.

Diva sold cheap jewellery mainly to young and teenage girls and experienced similar growth rates until it started dabbling with its product range. Diva decided to include Playboy-branded accessories and started selling phone covers, phone plugs, headphones, coin purses and hair accessories. Know thyself? I think not.

Straying from what was working best turned out to be a mistake for Diva. And Blundy recognised it.

Blundy started to convert Diva stores into Lovisa stores in 2012, which produced much higher returns on capital. As a result, all remaining Diva stores were converted by 2014.

Blundy and Fallscheer learnt their lesson and have repeatedly told analysts on investor calls about their laser focus on improving Lovisa’s core product offering, fast-fashion jewellery.

Lovisa taking on a global giant Claire’s

Lovisa’s growth in the last decade has stemmed from starting locally in Australia and New Zealand and prudently expanding across Singapore, Malaysia, South Africa, the UK and the Middle East. It has managed to produce substantial sums of net profit and free cash flow showcasing a proven and scalable business model.

After securing 114 stores across Germany, Switzerland, The Netherlands, Belgium, Austria and Luxembourg and France for a mere 60 Euros in November 2020 and slowly tallying up to 81 stores in the USA since 2018, these two regions represent the biggest growth drivers.

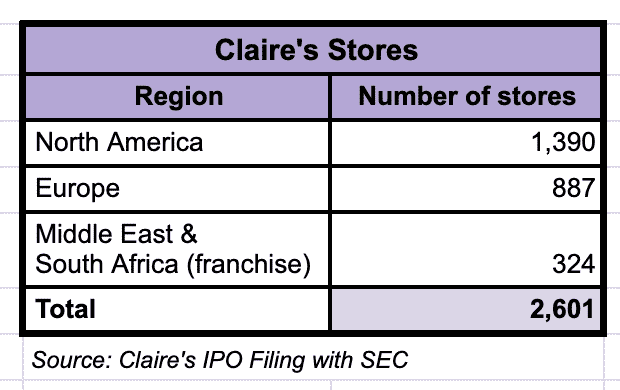

However, the global incumbent, Claire’s stands in its way. Claire’s was founded in 1961 and targets a much younger demographic relative to Lovisa.

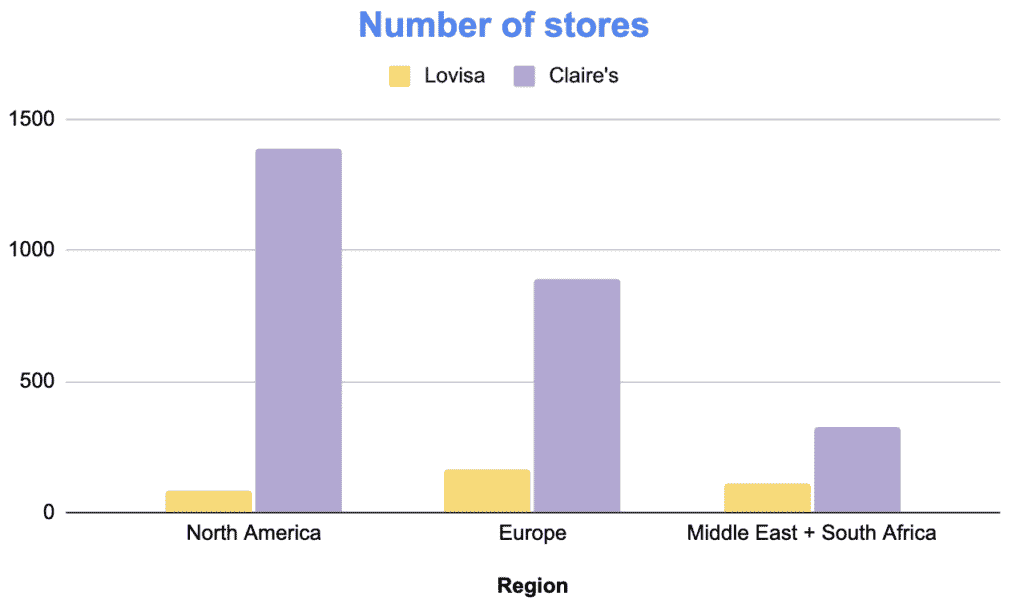

As you can see below, Claire’s already has a big presence across Lovisa’s growth runways.

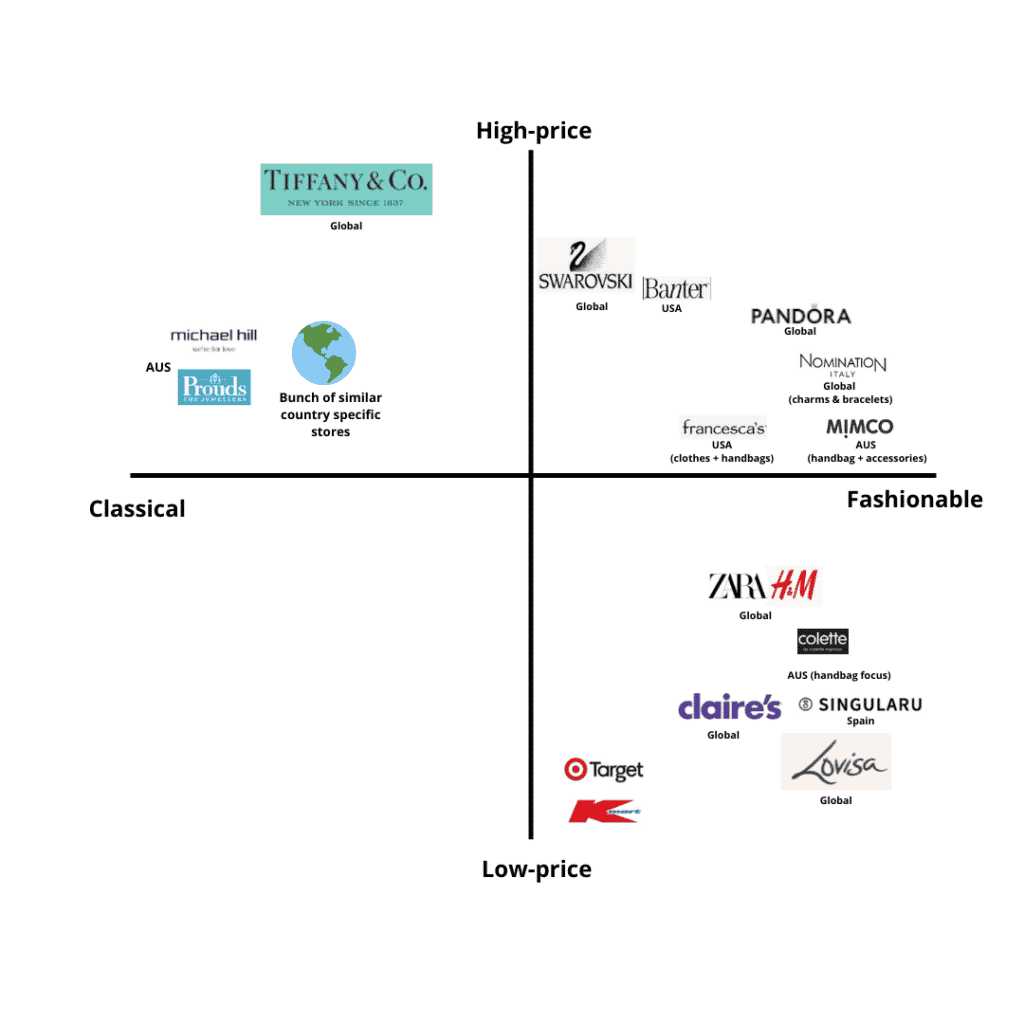

Some might say this is going to be an absolute dog fight for Lovisa to claw market share from Claire’s as well as the abundance of similar competitors in the jewellery space like Swarovski and Pandora (CPH: PNDORA).

I don’t view Swarovski and Pandora as direct competitors because their products are priced at much higher bands. Claire’s is the only other jewellery retailer that competes in the same price bracket as Lovisa.

This leaves two players in the niche customer segment of cheap fast-fashion jewellery. Such a duopoly dynamic could confer sound returns on capital. But if we dig deeper into Claire’s product offering and financials, I believe Lovisa is currently a first-mover in its niche. And Lovisa’s management team is capitalising on this as it rolls out more stores in the vicinity of Claire’s stores.

What is Lovisa’s Main Competition?

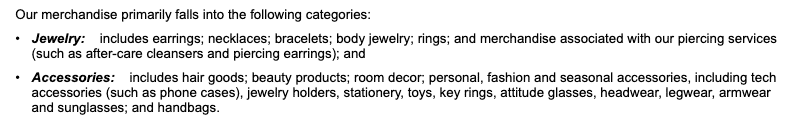

First, look at Claire’s key product categories below.

Accessories make up 52% of Claire’s sales for FY21 and FY20. Remember what happened to Diva when it tried to pull off the exact same diworsifiction manoeuvre? Remember to “Know thyself!”.

With half of its revenue coming from outside jewellery and in products where there is a lot of competition already, it’s no wonder Claire’s (55-58%) gross margins are much lower than Lovisa’s (75-80%).

By possessing a much wider product range, it makes it harder for Claire’s to focus on identifying fast-fashion jewellery, detracting from its ability to cater for a more fashionable range than Lovisa. Claire’s is also selling highly commoditised products like toys, stationary, sunglasses etc., making it much harder to lift gross margins.

It seems management is hell-bent on rolling out new stores, disclosing it’s identified 500 potential new standalone store locations, which includes Central and South America and potentially exploring Mexico and the Asia-Pacific region.

Such a growth strategy appears to be driven by management’s incentives being pegged to EBITDA performance, which is not ideal because depreciation makes a material difference to a retailer’s bottom line. Lovisa’s management team is rather focused on EBIT.

And let’s not forget Claire’s was saved from bankruptcy in 2018 after a private equity takeover. Claire’s is still holding onto $490M (USD) in long-term debt and $254M (USD) as derivative liabilities. Whereas Lovisa has no debt and is reinvesting substantial free cash flow in store expansions and refurbishments.

Lovisa’s greater focus on improving its jewellery offering along with better-aligned incentives and its financial prowess makes for better positioning than many people imagine.

Why Spain Saw Stiff Competition For Lovisa

You will learn more from your failures than your successes

-Lynda Resnick

Whilst a lot of valuable insights into a business’s underlying moat can be extracted from past successes, I think failures can instil greater conviction in such assessments.

When former CEO, Fallscheer was asked what management was thinking about over the next 10 years given Lovisa hit its 10-year anniversary in 2020, he responded with the following quote.

So it’s all about quality of product, quality of offer to our customers and not letting them down, so every experience they have in the Lovisa store, be it a physical store or online, as being a good one. So we — our simple belief is if we can stay true to our product offering and be first in market with great pricing to our customers that we’ll continually grow our customer base. And we really just try and keep it as simple as that, keep the store economics in each store tight.

So we’ve got tight disciplines in our leasing and then tight disciplines in our buying and product selection. And those 2 things, combined with some strong operational discipline in the field, has allowed us to achieve what we’ve achieved to date. So if we stick to those basics, we should continue to see achieve a good outcome in the future. – HY21 Earnings Call

I think this quote summarises the key reasons for Lovisa’s past success. Note, in particular, his point about being first in the market with great pricing. Without that, it is much harder for Lovisa to achieve compelling store economics.

This is what ultimately occurred with the rollout in Spain.

Lovisa tested a few stores in Spain around 2017, which showed promise but once it hit nine stores, management was not satisfied with its performance. A few businesses focused on providing the exact same fast-fashion jewellery targeting the exact same customer demographic had already built a strong presence.

I deliberately put Spanish jewellery competitor, Singularu next to Lovisa in the competition graph because it’s the only like-for-like competitor I’ve come across in my extensive Google search of major shopping districts across the globe. The Singularu shop fit-out is of similar size selling similar products at roughly the same price range and the Spanish locals seem to love it based on the Google reviews in Madrid and Seville below.

On a smaller scale, Lovisa also had to compete with Alvent, which only has two stores in Valenica and one in Madrid. But the important thing is Alvent captured market share earlier than Lovisa selling the exact same products to the exact same demographic, making it difficult for Lovisa to find quality locations with high foot traffic. And that’s before considering the additional burden of having to sway customers away from incumbents that have already developed decent brands.

The key takeaway for me is that being first to market offering this niche product range at the right price point makes a huge difference in hitting scale. Once a fast-fashion jewellery retailer finds the right location with high foot traffic, and the products resonate with customers, profitable scalability can be achieved.

Why Lovisa Is Super Scalable

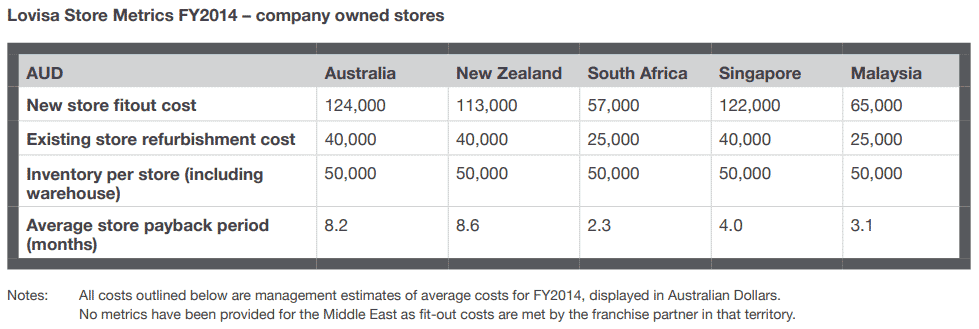

Lovisa has been able to record incredibly high returns on capital because of the quick payback period on stores.

When a new store is set up, the key additional costs include the following:

- Raw material in the form of metals

- Upfront store fitout cost

- Additional employees with the same structure, being one store manager supported by two to three FTE staff and around five part-time employees with casuals for busy periods

- Lease

- Distribution costs

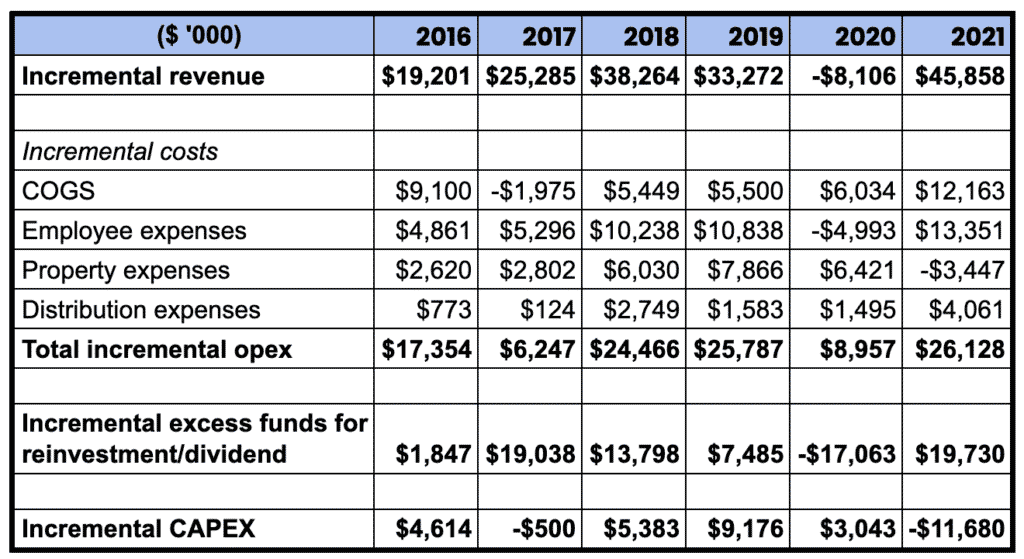

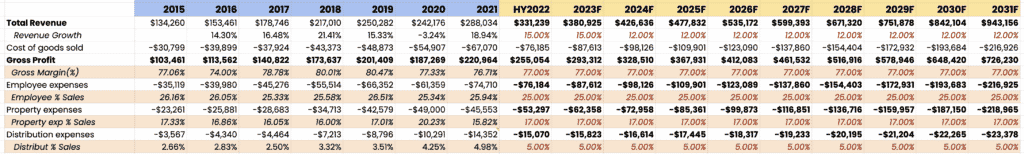

The below table demonstrates the scalability of Lovisa’s business model as the above operating costs maintain a steady pace whilst the top line continues to expand at a faster rate.

Does Lovisa Have A Long Growth Runway?

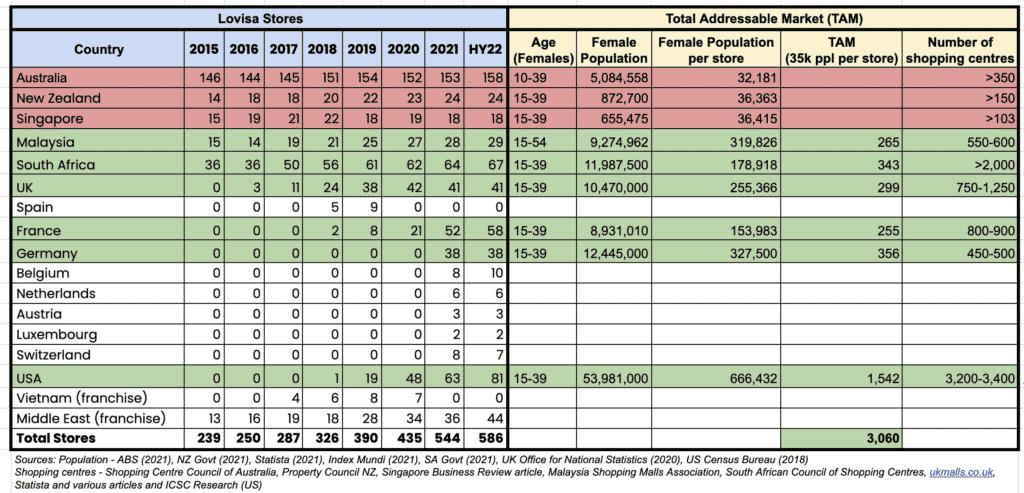

A deceleration in growth or a decline in the number of stores is a strong signal of a maturing market. I think this is occurring in Australia, New Zealand and Singapore based on recent growth rates.

These regions are highlighted in red below.

On the basis of the estimated female population aged between 15-39, it seems like growth stalls at around 35,000 women per store. Mind you, this is likely a conservative figure for Australia and New Zealand given there is still a vast expanse of land for new communities and shopping centres to be built. The same can’t be said for Singapore due to its limited size and dense population.

I arrive at a total potential store estimate of 3,060 using a conservative maturation population limit of 35,000 per store for the key growth pillars highlighted in green.

I’ve listed the number of potential shopping centres in each country as a rough sense check of whether the TAM appears reasonable.

When you compare this to the number of Claire’s stores, it’s very achievable. Remember Claire’s unveiled its plan to open an additional 500 stores in its IPO filing, which would bring the total store number to 3,100.

Even if Lovisa manages to achieve half the potential TAM, this still presents a significant growth runway. Let’s not forget this doesn’t include new markets like Canada and Poland where Lovisa recently opened the following flagship stores.

Who Is Leading Lovisa?

Blundy still holds 43.2 million shares representing 40% ownership and has acted as Chairman since November 2018. Shane Fallscheer was the CEO from inception to October 2021 and has recently handed over the reins to CEO Victor Herrero.

Disciplined capital allocation

The Lovisa management team has acted like astute long-term investors. They have been really disciplined with store rollouts and acquisitions.

Lovisa fails fast if new markets do not meet their high thresholds. The management team is not afraid to cut ties quickly if the economics are not favourable as illustrated by Vietnam and Spain. This is best summed up by Fallscheer’s response in the HY20 call when asked about why Lovisa isn’t proceeding with rolling out stores in Spain.

Just a conservative approach, to be honest. We need to make sure we’ve got positive sales growth and get to a point where we’re comfortable. – Fallscheer (HY20)

A number of stores have also been cut in more mature markets like Australia and New Zealand, reflecting management’s obsession with maintaining stores that contribute high returns on capital.

And again, we will not sacrifice quality of stores or our operating metrics to deliver on a store number target – Fallscheer (HY19)

As for acquisitions, I think even Warren Buffett and Charlie Munger would be impressed with the prices that Lovisa paid for the following acquisitions.

- 21 stores in South Africa for $2.25 million with a forecast that the stores would contribute EBIT of $1.75M in FY16.

- 114 stores across Europe for 60 Euros along with receiving an existing cash level of 9.87M Euros.

The European acquisition was a classic investing play of being greedy when others are fearful as it was executed during the pandemic. Global fashion giant, H&M pulled off a similar move in a recession.

Great understanding of its moat

It’s important to note Blundy’s deep experience in retail with Sanity, Adairs (ASX: ADH), Dusk (ASX: DSK) and Bras N Things. He knows what works and what doesn’t.

Take management’s marketing approach as an example. Lovisa doesn’t carry out large-scale mass media advertising campaigns but rather uses targeted customer marketing and opens stores in high foot traffic retail precincts.

When management gets peppered with ideas of expanding its product range, it is consistently addressed with a similar response. Management is fully aware that its current product offering is the underlying reason for its success and any strategic decisions will be based on optimising the quality of the product and offering to its customers.

When one investor asked whether Lovisa is considering offering premium-quality jewellery like black-label, Fallscheer’s response below demonstrated not only management’s focus on its core competency but also a relentless drive to improve this.

So we ran a higher end concept but basically showcase cabinet in 5 to 8 of our stores around Melbourne metro, just to get a feel for how that worked. We had mixed results, to be honest. So we’re trialing sort of Stage 2 or Series 2 of that concept in the next month or so. So keep an eye on online and so on because that will sort of flag when that comes out. So we did a trial of 9-carat gold and some other things. And it wasn’t — it didn’t really do it for us, and it’s probably not something we intend to continue with, but that’s just a continual sort of trialing that we run across the business. So we learn some lessons. We intend to keep the sort of lockable cabinet in a series of stores and try some different products. We’re just going to rotate different products through that cabinet and sort of find a sweet spot that suits our business – Fallscheer (FY21)

Great management teams don’t rest on their laurels.

Execution

Reflecting on the medium-term and long-term goals set out in the 2014 prospectus, the Lovisa management team has achieved all its goals to date, opening more stores than its initial target of 20-30 stores per year due to capitalising on attractive acquisitive opportunities.

Evidence of excellent execution in a sensible fashion with a laser-like focus on its core competency provides me with confidence in management.

Valuation

Using a discount rate range of 9-10%, the current share price range of $15-$16 over the last few weeks bakes in the following forecasts.

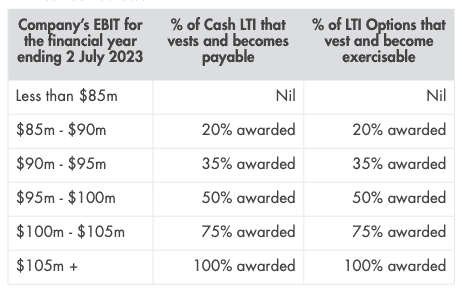

I believe current share price range is reflects an expectation of earnings before interest and taxation (EBIT) of $76M for FY23. However, I think this will prove conservative considering management’s current long-term incentive targets outlined below.

Management has managed to attain its LTI objectives nearly every year.

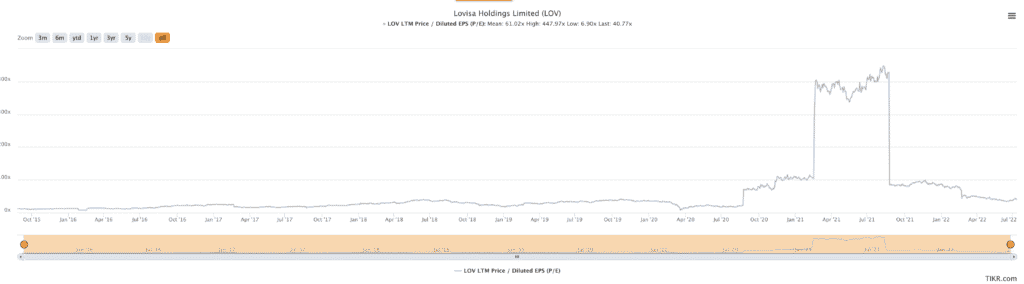

On a relative basis, the price to earnings (diluted EPS) is currently at around 40x. The average P/E multiple is skewed due to the extreme multiple expansion and earnings compression during the pandemic lockout period. If this is excluded, Lovisa seems to historically trade at a PE of around 25x.

On an absolute level, I don’t think the assumptions required at the current share price ranges are ambitious. The valuation also arguably under-appreciates the vast opportunity ahead in North America and Europe.

Comparatively, the PE multiple is indeed priced at a premium and it could very well drop on the back of growing interest rates. Sentiment could keep falling from here, as Lovisa gets lumped along with the rest of the retailers. However, in my view it is possible that recessionary conditions will see some customers in the higher income tax bracket spend more at Lovisa (while lower earning customers spend less). So while Lovisa may well be impacted by the economic cycle, I think the low cost nature of their inventory means they will be less impacted than many other retailers.

Risks For Lovisa

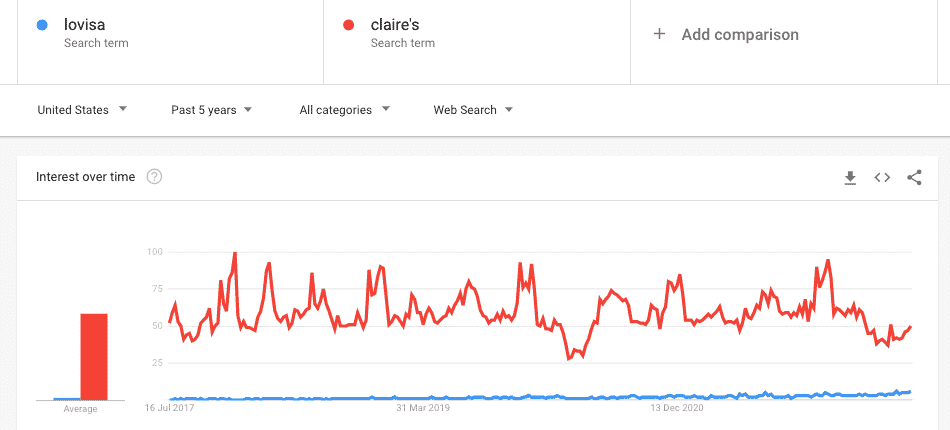

Since Lovisa’s core offering is providing fast-fashion jewellery, it’s at risk of going out of fashion due to rapidly changing trends. Google trends of the search term, ‘Lovisa’ compared to Claire’s can provide a health indicator as seen below for the United States.

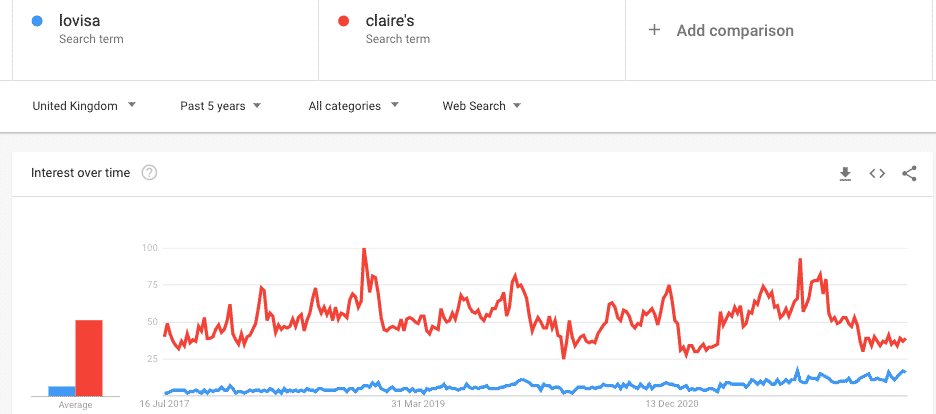

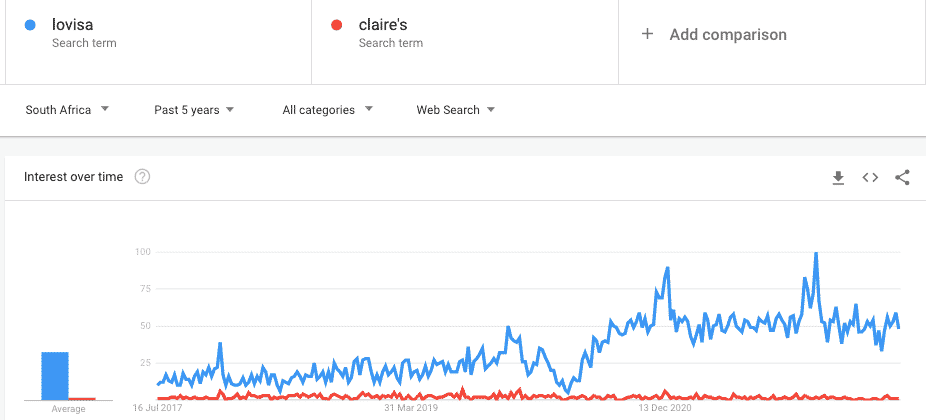

Lovisa is closing the gap in the United Kingdom and continues to race ahead in South Africa.

A step change in strategy

If there are any signs of management thinking about expanding the product range and undertaking aggressive store rollouts, this would be a thesis breaker.

I think the biggest red flag indicator of Lovisa struggling to sell its core product is when it starts adding other products to cushion the blow to its bottom line.

As mentioned previously, Lovisa needs to continue to be first to market in highly attractive retail locations. If management becomes overly bold in taking on difficult battles like the one it faced in Spain, this will likely lead to deteriorating returns on capital.

Inflation and supply chain disruption

The price of key material inputs to manufacture the jewellery has been rising since the start of the year but appears to be showing signs of decline in recent weeks. In this respect, gross margins should be monitored to understand whether there may be structural material input cost pressures.

Lovisa has distribution centres set up in Australia, China and Poland at the moment. Distribution costs have historically hovered around 4-5% of revenue but there was a big ramp since the pandemic due to supply chain disruption. It’s something to keep a close eye on over the next few years.

Recession

A recession caused by inflation and higher interest rates could reduce Lovisa’s earnings, and the market might in turn award it a lower multiple of earnings. One one view of it, Lovisa will be a more attractive, less risky investment once we have a better understanding of near-term recession risk.

Why I Think Lovisa Stock Is A Rare Gem

Excuse the pun, I just couldn’t help myself! But I mean it, it’s extremely difficult to find high-quality compounders on the ASX.

Lovisa is currently priced as if it will continue to grow steadily, but I believe the rate of growth in Europe and North America will likely exceed market expectations over the long run. Being first to market in prime foot traffic locations, disciplined store rollouts and an unwavering commitment to product market fit are the key rays of light to ensure Lovisa shines ever so brightly.

With the threat of inflation, interest rate rises, and recession, there may be more attractive times to buy Lovisa shares than today. But the business appears to be a compounder with many years of potential growth ahead of it, and that makes it well worth following.

Sign Up To Our Free Newsletter

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in Lovisa. Business editor Claude Walker does not own Lovisa shares. This article is not intended to form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives. Any statements considered advice under the law are authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.