It’s time to examine my ASX portfolio return in FY 2021. I hope that by publicly diving into my wins and losses, you can see how you might do the same for yourself. After all, the best investment you can make is in your own skill and knowledge. Regular performance assessments are essential for improvement.

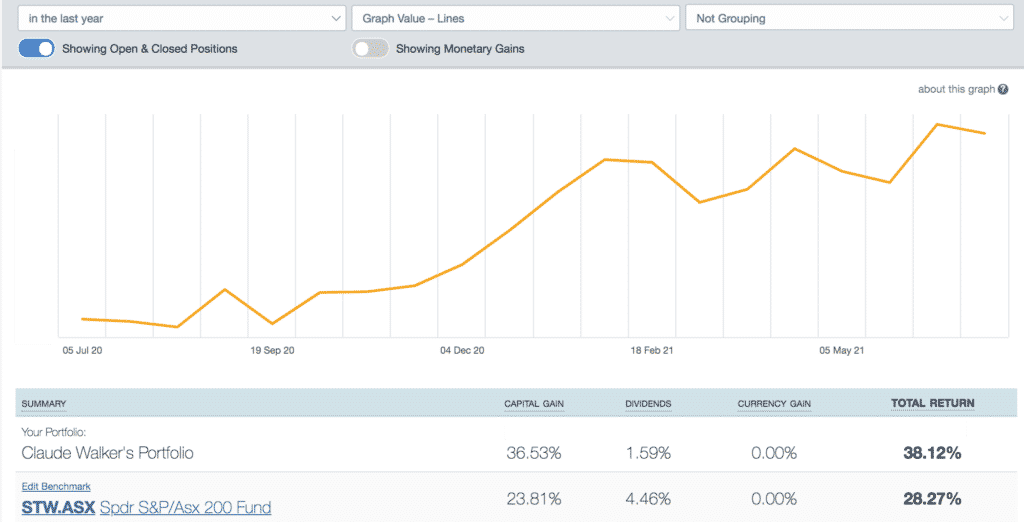

As you can see below in the image from my Sharesight account, I made a gain of 38.12% in FY2021.

Zooming out a little, you can see that this year was a good result compared to FY 2020, but lagged well behind FY2019. Still, over the last 5 years I’ve made a bit over 50% per year, on a money weighted basis.

As a reminder, my performance figures are dominated by just one investment, Pro Medicus (ASX:PME), which remains my largest holding to this day. The reason that FY 2019 was so much better than FY 2021 is that in FY 2019 my Pro Medicus holding was about 30% – 40% of my portfolio, whereas in by FY 2021 Pro Medicus was only around 15% – 20% of my portfolio, due to my unfortunate decision to take significant profit above $30.

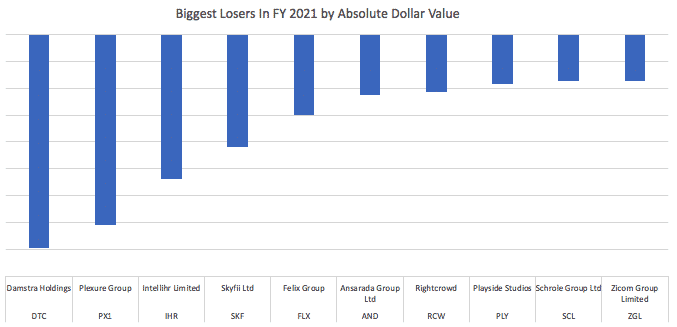

My Biggest Losers in FY 2021, By Absolute Value

Below you can see the ten worst performers in my portfolio in FY 2021, measured by absolute dollar loss.

Of these, I am still bagholding DTC, IHR, FLX, and RCW.

The stupidest and most embarrassing loss was Zicom Group. When I was doing my performance review I had to actually go and search my notes to find out why I bought this terrible stock. The reason was that they announced they were going to be producing surgical masks, and I thought the reddit crowd would be dumb enough to jump on it and make it fly. Turns out I was the patsy and I sold the position the next day for a fast loss. Turns out r/ASX_Bets isn’t as dumb as I am.

In terms of more profound lessons, I think there are a few.

First of all, I should have sold SkyFii (ASX:SKF) after I wrote this damning assessment of the SkyFii half year results. The refusal of the company to articulate management performance pay hurdles says it all. I actually believe assessing management is my biggest strength, as I am fiercely independent. I should trust that assessment. If you see me stray again, let me know.

Second, I should have taken profits on Damstra (ASX:DTC) when it was flying high above $2 on high sentiment more than anything else. Furthermore, the company’s merger with Vault created an incentive to give bullish guidance, which they subsequently abandoned. Although I still think this company is good, sociological signals can be important to maximise returns.

Third, I should never invest in a binary thesis like Plexure (ASX:PLX) , where the company will do well if and only if it wins another big contract. The chequered history of Plexure should also have warned me away. On top of that, a smart investor friend who had followed the company for longer than me told me it was overvalued. I bet against the smart money and lost. Sorry.

Regarding IntelliHR (ASX:IHR) I think I just got a bit too excited and paid too much; the company hasn’t done anything wrong in my books.

My Biggest Losers in FY 2021, By Percentage

Now, if we look at the worst positions by percentage loss, the picture is a little different. First of all, I am pleased to report that I have remained disciplined and avoided any loss of greater than 50%. Generally speaking, -50% is my maximum tolerance, from purchase price. Keep in mind, however, these are just the returns of FY2021, and do not represent my actual return on the position.

Notably, one thing that all of these big losers have in common is that they are not profitable businesses. Secondly, they are all very small companies, with market caps under $100m, other than Damstra. That should tell you something about the risk vs reward of loss making micro-caps. Perhaps I should be stricter with myself and invest less often in these unproven little businesses. Of these stocks I only hold IHR, DTC and FLX, today.

| PX1 | Plexure Group | -42.15% |

| SKF | Skyfii Ltd | -41.69% |

| DTC | Damstra Holdings | -34.73% |

| ZGL | Zicom Group Limited | -28.20% |

| FLX | Felix Group | -27.03% |

| IHR | Intellihr Limited | -26.61% |

| SCL | Schrole Group Ltd | -25.14% |

| ID8 | Identitii Limited | -24.67% |

| PLY | Playside Studios | -23.66% |

| PYG | Paygroup Limited | -22.75% |

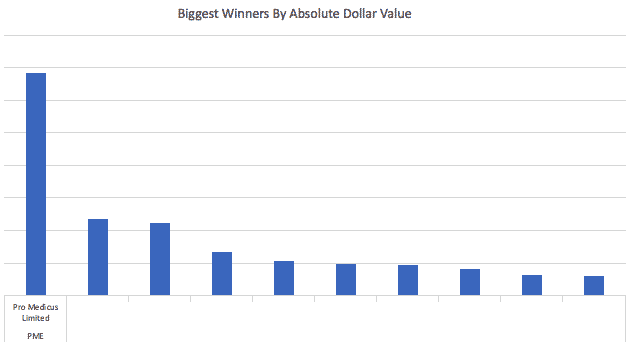

My Biggest Winners in FY 2021, By Absolute Value

Below you can see the ten best performers in my portfolio in FY 2021, measured by absolute dollar gain.

I will be saving my commentary on these companies for my Supporters, so suffice it to say at the time of publication that you can see how even with a reduced position size, Pro Medicus was still the most important contributor.

My Biggest Winners in FY 2021, By Percentage

In the table below I have removed the identity of some of the positions which I plan to write about separately for Supporters. However, a few conclusions can be made.

| Best performer | Best performer | 137.55% |

| PME | Pro Medicus Limited | 113.11% |

| STG | Straker Translations | 100.38% |

| Fourth Best Performer | Fourth Best Performer | 66.71% |

| Fifth Best Performer | Fifth Best Performer | 65.39% |

| Sixth Best Performer | Sixth Best Performer | 64.42% |

| Seventh Best Performer | Seventh Best Performer | 59.32% |

| Eighth Best Performer | Eighth Best Performer | 56.78% |

| WSP | Whispir Limited | 53.84% |

| XRO | Xero Ltd | 52.15% |

First of all, I should have had a bigger position in the best performer, which was a profitable, growing software company that pays dividends and has high quality management. I hesitated to buy since I felt it was already expensive; twelve months later it’s gone from strength to strength.

For me, Straker (ASX:STG) was a painful hold as I was underwater for quite a while. You can see below that even though it was a great performer in FY2021, it has underperformed for me overall. I have now sold the stock. I didn’t capitulate on a drawdown, and I’m grateful to myself to that. However, my anti-bag-holding philosophy prevented me from accumulating near the lows, so I didn’t emerge a winner. My philosophy is generally averse to averaging down, given proliferate evidence on social media of the kind of low IQ brain rot (and devastating losses) that averaging down is often (but not always) associated with.

Happily, I can give myself a small pat on the back for using my skills of analysis to play the Whispir trade reasonably well. Returns were driven first by taking a big position at $2, which I explained in this post at the time. But second, and far more importantly, I trusted my plan to Take Profits On Whispir (ASX: WSP) By August 2020, which I outlined to supporters in May 2020, as you can see below.

I’m not sharing that entire post publicly, because I don’t want to deal with any more abuse from nasty bag-holders, which I have already received as a result of this public post, which explains my subsequent sale. But I think that the share price since August 2020 speaks volumes.

In contrast to my Skyfii mistake, in the case of Whispir I actually trusted my analysis and took profits at the right time. However, my returns would have been far, far better if I had sold all of my shares by August 2020. Close, but no cigar.

My Big Lesson For FY 2021

The lesson to me is that I probably have a structural advantage in analysing management quality. Many great fund managers and smart market participants have excellent understanding of spreadsheets, and data analysis, so it’s hard to get better insights than them, using excel. What I have is a first class honours degree in law, the experience of advising on the deployment of millions of dollars each month, while I was still in my mid-twenties, and the good fortune to have started investing more than a decade ago. And most importantly, I have an independent, skeptical view.

I know 100% and for certain that the vast majority of analysts and journalists who write about stocks must be very mindful not to alienate management of companies they cover. Previously, in my own personal experience, I know of a company that refused to talk to one fund manager, because someone in the same organisation (but not that fund) had offended the CEO with their coverage. The truth is that this can create a bias to be insufficiently skeptical, among many market professionals. It also makes skeptical coverage by named authors quite rare.

When people are muzzled en masse it creates an environment where truth does not prevail, and by finding an trusting that truth, I can find an edge.

I Could Have Done Better

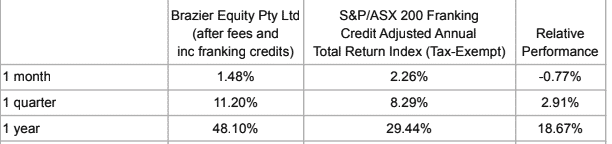

Finally, it must be said that I am somewhat disappointed by my results in FY 2021. This morning, I saw that my investment in Brazier Equity returned 48%, for the last year, a full 10% above my achievement.

Meanwhile, Rapley Investments also reports a gain of 48% in Luke’s International Fund, and 47% in Luke’s ASX Fund.

These are appropriate comparisons for me because we are all running a relatively small amount of money. I would expect to outperform funds that are running $100m, because of the advantages of being a smaller investor. Furthermore, I am a strong believer in the power of expectations, and so I do strive to keep up with these fellows. While every year is different, I’ve come second best this year. I’ll use their achievements to motivate myself!

Finally, it’s worth mentioning that one major drag on my performance was having more than 10% of my portfolio in gold, at the start of the year, when I should have been more fully invested. Being too cautious for too long can be costly.

Zooming out, this reflection reminds me that their are endless ways to succeed as a small cap investor. Sure, it definitely takes effort to run your own portfolio in ASX small caps. But that effort is what gives rise to the rather inefficient market; which in turn creates endless opportunity.

Whether you beat the market or fell short in FY 2021, every year is another year of learning, and there is no doubt that learning was once again the best investment I made.

Wishing you a lucrative lucky, and most importantly a happy financial year ahead.

Please remember that these are reflections on the past performance of the author. This article includes mention of companies the author owns shares in, and may be active trading (buy or sell) in coming days. This article should not form the basis of an investment decision. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!