This morning occupancy data modelling company Skyfii (ASX: SKF) reported revenue of $7.5 million up 11% on the same half last year. During H1 FY2021, the company made a loss before tax of $2.8 million, which was considerably worse than the $2.2 million loss before tax it made in H1 FY2020. The main expense driving the increased loss was $2.3 million in share-based payment expenses, up on about $900,000 in the same half last year.

We have recently covered the SkyFii’s cash flow in this recent post. Suffice it to say that that free cash flow was better than profit, with a positive $700,000 generated. Notably, free cash flow would have been negative in the absence of government grants.

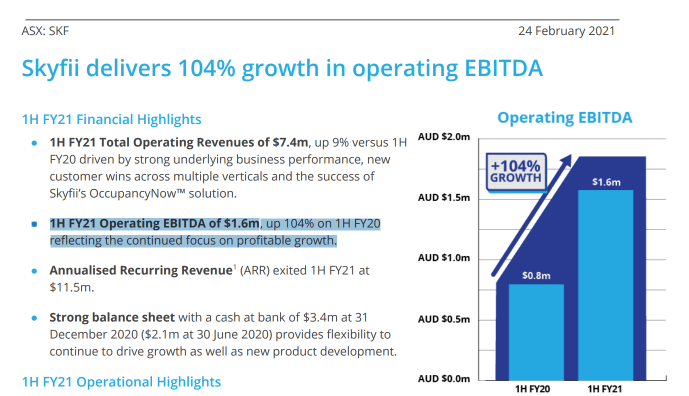

Now, if you look at the materials, the company is working hard to highlight how its “operating EBITDA” has doubled, as you can see below:

Charlie Munger has famously described EBITDA as bullshit profit. But if EBITDA is bullshit, then I don’t dare subject you to the expletives that describe Skyfii’s “operating EBITDA”. Lets delve into the detail.

The company says:

The Group reported a positive operating EBITDA (Earnings

Before Interest, Tax, Depreciation, & Amortisation and

adjusted to be inclusive of any R&D tax incentive grants

accrued or received, and exclusive of share, option-based

payments and acquisition expenses) of $1,603,729 (1HFY20:

$786,954) and net loss after tax of $1,740,653 (1HFY20:

$1,850,057).

Now, this is patently absurd. The operating figure excludes employee share based payments (a major expense, which has more than doubled year over year) and includes R&D tax incentive grants which are not even part of the business operations. This is one of the most absurd metrics I’ve ever seen, and the company has chosen to highlight it.

As a result, I can no longer say I have confidence in this management team. So lets zoom out.

- I still believe the business itself is worth more than 20c per share, probably closer to 30c per share.

- The company is its own worst enemy; what sensible investor could feel comfortable with this sort of reporting?

- One day, I suspect the company will earn enough money to earn actual profits, though they will likely still be touting ludicrous EBITDA numbers

When I read a report like this, I want to vomit. The company is so patently in a good spot, with the ability to grow, and the likelihood of doing it. And yet, this company is paying its top executives lavishly, and refuses to even say what the hurdles for the “performance pay” is.

The most likely outcome, to my mind, is that this business does end up creating value, but that insiders will take the lion’s share of it. Long-sighted institutional investors will continue to pour in money in discounted capital raises until one beautiful day when the insiders decide it’s payday.

At that point, it’s likely that the company will stop diluting shareholders, stop increasing executive remuneration, and focus on getting the share price higher. Then we will see the longterm large shareholders (currently stuck in the company), and potentially insiders, start to sell.

So what now? Well, suffice it to stay Skyfii is my new “least favourite holding”. My instinct is to dump shares and move on, but my instincts generally cause me to react more quickly than is necessary. I think if I’m willing to be patient, and have faith that eventually management will want to boost the share price, then I could probably walk away a winner from this investment.

However, the old axiom goes that if you lie down with dogs you’re going to get fleas, so there’s a good chance I will end up selling Skyfii shares. One thing we have learnt is that the company’s cash flows always look better than its real accounts. For this reason, I suspect, the company prefers to do a conference call on the quarterly results, rather than the half yearly report.

Therefore, it seems to me that all else being equal the best time to sell Skyfii shares is after the quarterly results. As a result, I am strongly considering waiting until the next quarterly results then dumping my shares (depending on the price). Alternatively, if the share price randomly went up prior to that, I might sell.

This is a typical investor quandary. I believe the business is undervalued but I don’t feel comfortable with management, the board, or their style of touting “operating EBITDA”.

Please remember that these are notes on a company the author owns shares in and are not a recommendation. This article should not form the basis of an investment decision. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive an occasional Free email with more content like this, then sign up today!