As we all know, my favourite industry to invest in is the software industry. There are many reasons for this and I will not rehash them. Today, I’m looking at two software companies that I think will benefit from favourable macroeconomic conditions over the next couple of years.

Felix Group (ASX: FLX)

When Covid-19 started spreading around the globe it had profound effects on economic activity. Surprisingly, one of the hardest hit sectors included the construction industry. To quote Macrobusiness in November 2020:

“The Australian Construction Industry Forum (ACIF) has forecast that construction activity will fall by 3.2% in 2020-21 due to the impact of COVID-19. Construction work in the accommodation sector is tipped to fall by 34%, while a 23% decline in entertainment and recreation projects is expected.”

However, fast forward to December 2020 and Macrobusiness were adding a little nuance to that grim picture:

“New research from CBA senior economist Kristina Clifton has cemented this view, calculating that public capex from all state and federal budgets will be up 37% this fiscal year and will contribute 1.7 percentage points to GDP growth in 2020-21.”

We are currently on track to be spared the grief, illness and anti-vitality impacting those countries where pro-spread mind-rot won; and millions suffered illness and death as a result. That should set us up for an extremely strong rebound in immigration, once we start opening our borders. The early 2020’s should be boom years for residential construction and the infrastructure required to support it.

But for now, the construction industry is languishing below baseline.

In that context, December 2020 was perhaps a suboptimal time to lPO for a small, software as a service company serving the construction industry. And yet, that is what Felix Group Holdings (ASX: FLX) did, issuing new shares at $0.36, raising $12m; with the majority earmarked for platform development, and research. Importantly, the existing shareholders did not sell shares into the IPO.

Notably, one of the existing shareholders is David Williams, one of the savviest market operators around. He was the former chairman of Medical Developments International (ASX: MVP) during the half decade it increased from around $1 to $6. He is currently a director of hot stock Polynovo (ASX: PNV). I have witnessed him trade in and out of companies without hesitation, so I tend to pay attention to his shareholdings. He owns about 14% of the company through his Moggs Creek entity and 100% of those shares are escrowed until 2023. To me, the fact he is willing to hold for two years (rather than selling into the IPO) suggests he assessed the risk versus reward for holding to be comfortable.

In addition to that, other company insiders will be escrowing their shares for various time periods. One set of shareholders have agreed to hold their shares for up to 2 years unless the share price trades at above 54 cents after the half year results to December 2021. To me, the capital structure of this listing suggests that company insiders see good short term momentum in the business and expect a higher share price within the next couple of years. But for now, the share price sits just above the IPO price, at 38 cents per share.

What Does Felix Do?

You can see a high level overview of the Felix Procurement Platform in the video below. I thoroughly suggest watching it, but the short version is that Felix digitises the construction procurement project for project managers. Customers come from mining, construction, utilities and facilities management. Felix links service vendors (who might for example be offering plumbing services, or earth moving services) with the organisations who need them. You can think of this software as sitting adjacent to, and even competing with, some of the Urbanse.com offerings.

Contractors can use the Vendor Marketplace for free or upgrade to the enterprise solution and be charged an annual SaaS licence fee based on the number of modules they utilise and the scale of their usage. Felix is successfully growing its contractor revenue albeit off a low base. At the end of FY 2018 it had just 8 contractors; but at the end of FY 2020 it had 24.

Vendors are able to use Felix for free to engage with Contractors who have engaged with them through the platform. However, by upgrading to a monthly or an annual subscription, Vendors can create a public profile and receive further business opportunities through the Vendor Marketplace. Felix has not been successful growing its vendor revenue over the last couple of years. However, at the end of FY 2020, only 1,238 Vendors had subscribed out of a total 34,066 Vendors using the platform. In my view, as the company grows its contractor numbers, it should be able to convert more vendors into subscribing vendors, because the prospects of finding work over the Felix platform are stronger.

Now, what we have just described is a very early stage network effect. I believe the majority of my readers know what that is, but here is a short primer for the beginners.

This is the absolute crux of the thesis. Essentially, the most important thing over the next couple of years is that the company strengthens its network effect. This means increasing both the number of vendors and the number of contractors.

If the company achieves this there are two reasonably likely positive outcomes.

First, higher contractor numbers will increase the value proposition to existing vendors, increasing the likelihood that they will pay a subscription. Second, more vendors will be brought into the ecosystem, strengthening the value proposition to contractors. This will fundamentally make the business much stronger, increase revenues, justify further product investment, which will (one would hope) attract more customers. This is a basic flywheel effect and if it gets spinning, then it is not unreasonable to project a steady increase in revenues over a sustained period. These are some of the ingredients of a multibagger.

Second, if the network effect becomes more pronounced and strengthened, then the ‘network effect thesis’ is likely to ender the mindset of would-be investors. At present, there is very little chatter about Felix. Once some runs are on the board, I believe that will change.

Who am I trusting?

As mentioned above, David Williams has helped float Felix (and retains shares). The five person board consists of Michael Bushby, Mike Davis, George Rolleston, Rob Phillpot and Michael Trusler.

Mike Davis and Michael Trusler are the co-founders of the company. Mike is the CEO. Michael Bushby is a former director of Eroad, among other things. George Rolleston is a savvy momentum trader, among other things. And Rob Phillpot is a co-founder of former ASX tech darling, Aconex.

Now, my list of scumbags is long, but my list of savvy market operators is short; and we have three associated with Felix. Without understanding people I have no hope of holding long term, and while I always let actions speak louder than names, I do feel comfortable with the leadership team of Felix.

The numbers

Right now, there are 141 million shares on issue, giving Felix a market capitalisation of about $54 million at the current share price of 38 cents. In FY 2020, the company produced sales revenue of $3.7 million. That means the company is trading on about 14.6 times revenue.

This may seem high, but the company added $0.7m during the difficult 2020. If it does that again, then it would be at $4.4m in revenue for FY 2021, about one twelfth of its market cap, growing at around 20%. That’s not unreasonable.

Finally, though, it’s worth noting that buying newly listed companies is always risky, and so it is with some degree of caution that I have bought a position in Felix.

Skyfii (ASX: SKF)

Skyfii is a company that provides “omnidata intelligence” for organisations that have large venues. Obviously, pandemic induced social distancing has impacted their customers badly, and led me to sell the stock (near its lows). However, fast forward a year and the end of the pandemic is in sight.

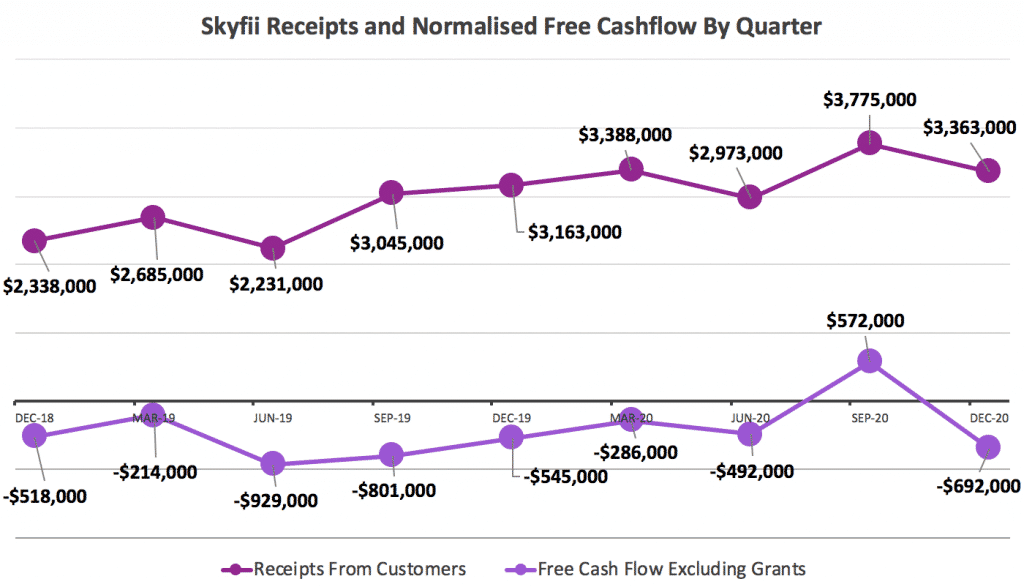

Not only that, but the Skyfii business has proved remarkably resilient given that many of its largest customer groups found themselves hurtling towards redundancy. As you can see below, quarterly receipts from customers still managed to trend upwards over 2020, even though customers like malls were under pressure.

The thesis here is painfully simple. As vaccines make it easier to have people gather together indoors, many large venues will start reopening. At the same time, tracking where people go and what they are doing is still going to be important until sufficient people are vaccinated. In the meantime, there should be a sweet spot where large crowds are allowed but still risky. In that scenario, managing crowd numbers, through people counting, wi-fi tracking, and video camera should be part of a covid-safe reopening. If that’s true, then Skyfii should feel headwinds turn into tailwinds over the next couple of years.

What does SkyFii do?

Skyfii collects data from existing systems (like wifi networks) and/or newly installed systems (such as people counters). The data is collected and monitored using IO Connect and IO Insights. The software is broadly homogenous across venues, but can be tailored to each venue. Finally, the company offers IO Labs for bespoke data analytics provided to venues if they have subscribed to this part of the platform.

What are the numbers?

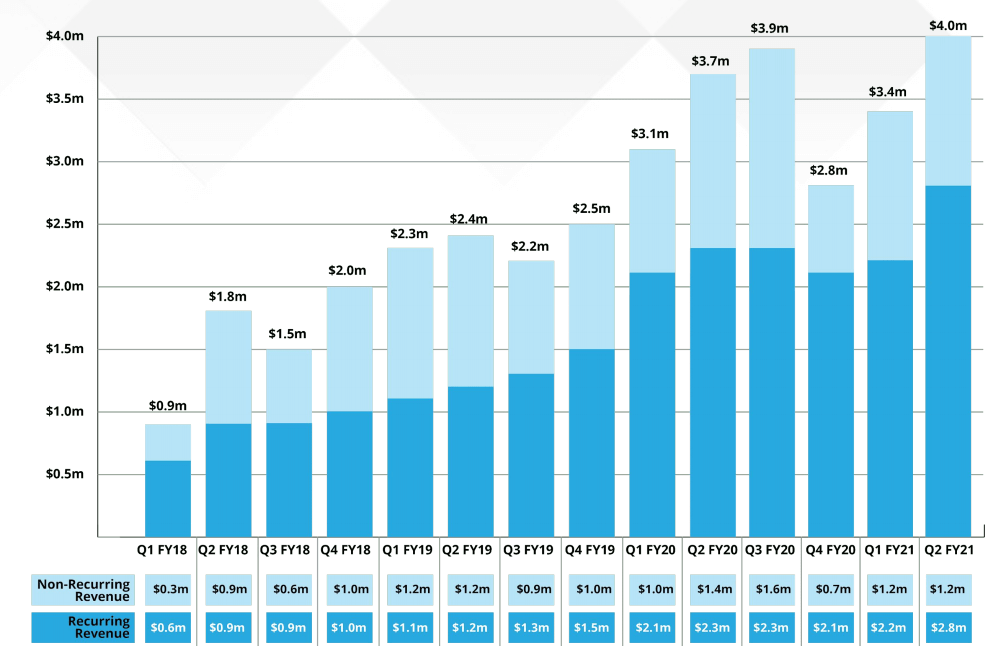

The key focus for me is the growth in recurring platform revenue. As you can see below, Skyfii is moving in the right direction, after dropping in March. Recurring revenue is sitting above $10m annualised, and the market capitalisation at 22c is about $64 million. That puts it on about 6.4x recurring revenue. This does not seem extortionate and leaves room for a sentiment-based re-rate.

A negative worth noting

While I have been happy to buy Skyfii shares, there is one negative aspect of the company. In order to minimise cash burn and incentivise employees, Skyfii remunerates employees, especially senior employees with options. The downside is that this can lead to substantial dilution, assuming all the options vest. The problem is, we don’t know what performance hurdles are required for the options to vest.

As part of my investigation into Skyfii, I was in touch with their investor relations representative.

Edit for the fact investor relations got back in touch with me.

Investor relations for the company has been in touch with me, regarding my questions, but have not been able to give any information regarding what the performance requirements are for performance pay to vest. Therefore, I would assume that there will be considerable ongoing dilution.

Conclusion

I see the potential for Skyfii to have a strong couple of years. Co-founder and CEO Wayne Arthur owns over 11 million Skyfii shares (worth a cool couple of million). He stands to more than double his holding if all his options vest, and I consider it a good sign that he wants to increase his holding.

Corporate dealmaker Jon Adgemis is the largest shareholder on the board, with an interest in 33 million shares. Biretku, an entity associated with Bruce Gordon, the largest shareholder in Nine Entertainment, is also a major shareholder.

To my mind Skyfii could re-rate if favourable macro tailwinds drive operating leverage, leading to sustained free cash flow. In that scenario, the company would become more valuable because it would be less likely to require capital. Even at its pandemic lows, the Skyfii share price wasn’t much more than 50% lower than it is today, so I do not think that the downside risk is particularly bad. While Skyfii is far from my perfect setup, I think the risk is more than tolerable given the potential for a strong couple of years ahead.

Please remember that these are notes on two companies the author owns shares in and are not a recommendation. This article should not form the basis of an investment decision. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive an occasional Free email with more content like this, then sign up today!