Just under a year ago, I wrote an article titled “Why Whispir Ltd (ASX: WSP) Is One Of My Largest Holdings“. In that piece, I argued the stock was undervalued and would benefit from significant tailwinds due to the pandemic. At the time, it was trading at all time highs of around $2. I subsequently wrote an article called “Why I Plan To Take Profits On Whispir (ASX: WSP) By August 2020” and accordingly sold some shares by August, at around $5, before shares were released from escrow. After that, the company raised capital at $3.75, with the stock now trading at $3.32.

If you ask me, things have turned out very nicely for insiders who were able to sell into share price strength, then raise capital. At this point, the supply of Whispir shares has overwhelmed demand, pushing the price down 34% off its highs. Notably, it is early shareholders and the company itself flooding the market with shares.

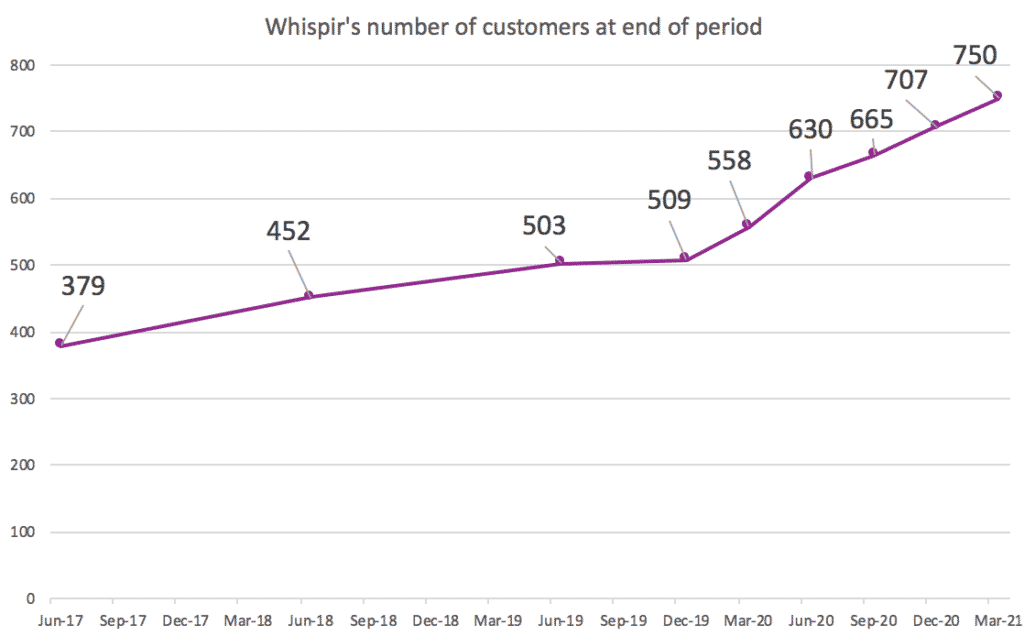

During the week, the company announced its quarterly results. The good news is that the company has continued to grow customer numbers.

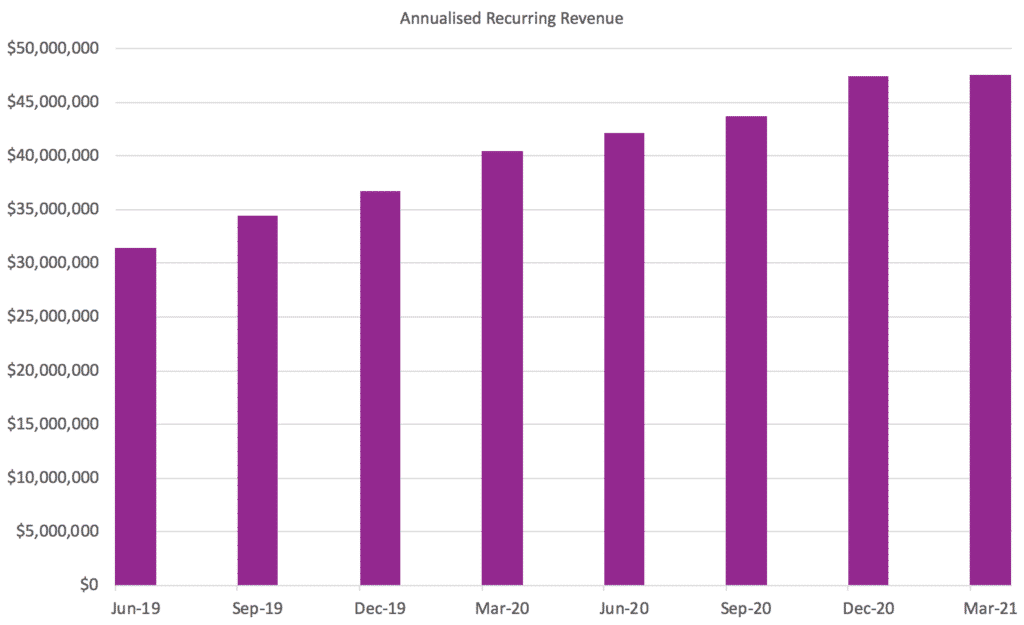

Whispir’s quarterly report disclosed that it had grown its ARR to $50.3 million, but this is an adjusted number because the company has decided to adjust it for the fact that February has fewer days than the other months, and much of Whispir’s revenue is essentially transactional (and thus charged on a per day basis.) If the company used the same methodology it did last year, then ARR would have been basically flat (albeit hampered by a slightly shorter quarter).

When I asked the CEO a question last year, he basically didn’t answer it properly, and so I had to follow up subsequently with the CFO. The CFO did answer the question properly, giving me comfort. However, that CFO, Justin Owen, is leaving the company after the FY2021 report. I have zero intention of holding Whispir stock after Justin Owen leaves, as he was previously giving me confidence.

During the most recent quarter, Whispir generated just under $11m in receipts from customers though according to management, this was negatively impacted by working capital, implying an increase in receivables and reported negative free cash flow of $3.2m. This is not a major concern, given that the company has over $50m in cash

I think it’s fair to say that using the hypothetical ARR of $50.3m, is on the generous side, but I’ll work with it for valuing the company. At a share price of $3.32, Whispir has a market capitalisation of around $386.1m. Subtracting cash, we get an enterprise value of about $335m, and an ARR to EV multiple of about 6.6. That’s not too bad, but considering the factors above, I’m not enticed to hold shares in the hope of a higher price.

Ultimately, I consider Whispir to be well worth following and of decent quality. However, Whispir’s platform occupies a fairly unfavourable position in the technology stack, which is why we see its margins are under 61%. This compares poorly to companies like Damstra (75%) and Nearmap (69%) and very poorly to the best software companies, which frequently have margins over 90%. As a result of all this, I will sell my Whispir shares.

This post is not financial advice, it is general in nature, and you should click here to read our detailed disclaimer. The author owns shares in Whispir at the time of writing but plans to sell them. The author owns shares in Damstra.