8Common (ASX: 8CO) and Mach7 Technologies (ASX: M7T) Quarterly Reports In Focus

8Common (ASX: 8CO) and Mach7 Technologies (ASX: M7T) are two small Aussie software stocks with strong share price momentum.

8Common (ASX: 8CO) and Mach7 Technologies (ASX: M7T) are two small Aussie software stocks with strong share price momentum.

Yesterday, I appeared on Ausbiz’s the Call to discuss a range of stocks with Adam Dawes and Nadine Blaney. Of particular interest may be our discussions of Ansarada (ASX: AND) and Eroad (ASX:ERD). The discussion of Eroad starts at 2 minutes and 40 seconds, in the video below, while the discussion of Ansarada starts at … Continued

The Neuronode (device) and Trilogy (software), are used to help people with motor neuron disease, multiple sclerosis, cerebral palsy, and similar conditions

This makes the claimed “remaining short to medium term enterprise pipeline of some 15-20,000 connected vehicles,” in Australia seem more achievable than ever.

SkyFii’s acquisition of CrowdVision will add annualised recurring revenues (ARR) of around $2.3m (AUD) bringing pro forma SkyFii ARR to $13.3m.

By cultivating a strong relationship with retail shareholders, Rightcrowd (ASX:RCW) could increase its capital raising options…

These 3 stocks remained profitable throughout the pandemic, are positioned for a stronger 2021, and are not too far from attractive value…

“In 3 – 5years we want to be a $100 million revenue company and be profitable and grow that profit.”

Rightcrowd (ASX: RCW) and Playside (ASX: PLY) are both small ASX stocks with high growth potential.

The Oneview Share Price is up 150% after it paid S3 Consortium to promote its research and thesis for investing in Oneview stock…

Objective Corporation (ASX: OCL) has the markings of a high quality business, and the market has bid it up to a pretty optimistic price.

In this clip I joined Nadine and David to chat about the ASX, the rotation from tech to value stock, Vista Group and Objective Corp.

Given its show of both resilience, and the acceleration of its online business, KME is clearly one of the better micro-caps on the ASX.

Part 1 focusses on smaller, illiquid, relatively unknown micro-caps that could fall sharply as bond rates rise.

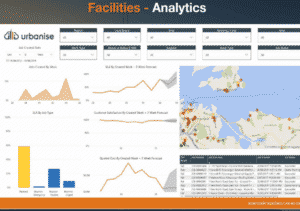

Urbanise.com grew its ARR strongly in H1 FY2021 and is planning on reinvigorating its facilities management software division.

Alcidion shares are trading at near to all time highs, the business is growing recurring revenue, and it’s winning new contracts in the UK.

As we had suspected would happen, project delays have seen Damstra abandon its full year revenue guidance.

Dicker Data (ASX: DDR) boosted underlying profit by almost 20% in a year that benefitted from more people working from home.

American Express Company (NYSE:AXP) or Amex might not be as hot as Square (NYSE:SQ), but it’s still hitting all time highs…