During the week, health tech company Alcidion (ASX: ALC) announced its half year results, showing a loss of $1.35 million on revenue of $11.1 million, with a gross profit of $9.8 million. Because Alcidion reports quarterly cashflow, you can read our prior report on its cashflow (which was weak). On the other hand, a recent larger contract win with South Tees has buoyed market.

For Alcidion, it makes sense to keep an eye on gross profit, since it has started re-selling OpenEP software (which has lower margins). Indeed, just today it announced that it has signed its “First strategic implementation of OPENeP in Southern Hemisphere”, being one out of the five district health boards in New Zealand. This contract is worth at least $600,000, but it’s not clear how much of that is recurring, if any. Given that Alcidion is reselling this software, gross margins are likely to be in the order of 30% to 40% rather than 80%.

How Much Recurring Revenue Does Alcidion Have?

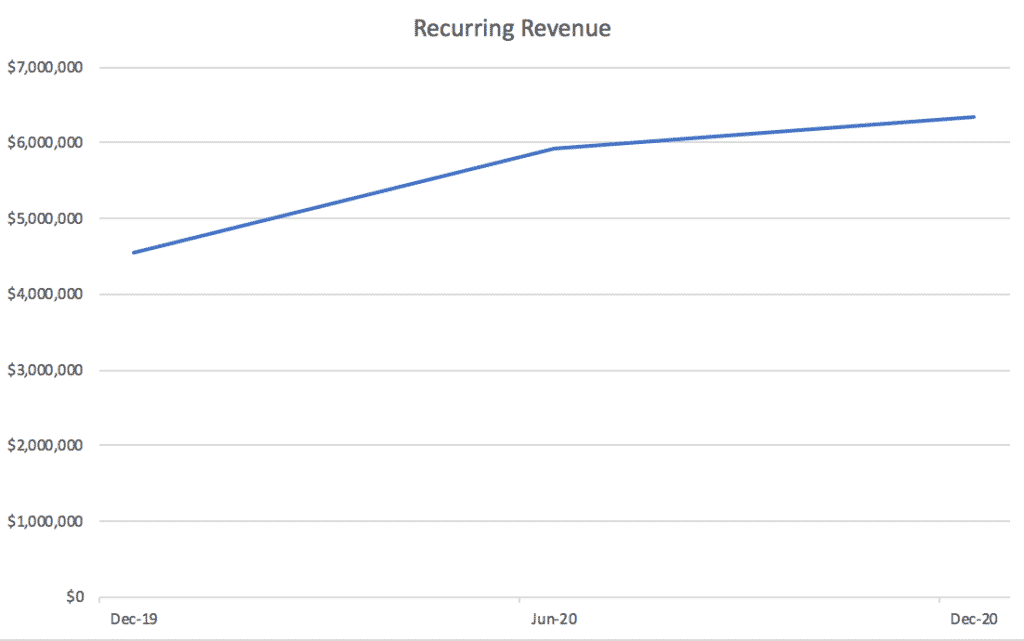

However, it is also worth tracking recurring revenue since in my view that gives a more solid basis for understanding the downside. To this day, Alcidion likes to report “contracted future revenue” but I find recurring revenue a more conservative figure, and I’m glad they have reported it for the last 3 halves.

Recurring revenue of $6.3 million in the first half leaves Alcidion capable of achieving at least $14m in recurring revenue for the full year. In that scenario the company is growing quickly and trading on around 18x recurring revenue at a share price of 25 cents.

On the conference call, the CEO said that operating expenses are around $22m per year, and unlikely to increase sharply. This implies that the company really is on the cusp of breakeven and it would be reasonable to be disappointed if it can’t turn a profit in FY 2022 at the latest.

Are Alcidion Shares Cheap or Expensive?

My gut says the current multiple of 18x recurring revenue is on the high side for a company that isn’t yet possible (though most growth stocks look optimistically priced right now).

Offsetting that, the company is still growing its recurring revenue, and if it hits $14m in recurring revenue then its growth rate will be over 30%. Alcidion has also expanded its sales team over 2020 without blowing out losses inordinately. Finally, and most importantly, it isn’t too far from breakeven once you account for its non-recurring revenue.

Of course, this is not advice, but rather my own diary entry for these Alcidion half year results; and these views may change. I do not have a particularly large holding in Alcidion and I’m tempted to take more profit based on the fact that sentiment is riding high.

However, I am cognisant that “Only two of ~223 NHS Trusts have Miya Precision implemented, highlighting significant opportunity to scale”. This holds out the possibility that the next couple of years could be company-making, and so I’m reticent to sell out on valuation reasons. The largest Miya Precision contract the company has signed is worth over $1.4m per year (including upfront costs).

Even if we assume the average NHS trust would only generate $500k in revenue per year, and that Alcidion only gets 20% market share, that would be an additional $20m in recurring revenue. Therefore, for now I am holding.

This article is not financial advice, it is general in nature, and our disclaimer is here. The author owns shares in Alcidion.

Many of our articles do not appear on the homepage immediately, rather they are first shared with our Supporters and subscribers to our Free email (so sign up below).

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.