This morning, two small ASX listed software companies in 8Common (ASX: 8CO) and Mach7 (ASX: M7T) reported quarterly results. Below, I’ll take a quick look at the news, and share my thoughts on how these results change the way I view the companies.

8Common (ASX: 8CO)

8Common is a small ASX software company that supplies its expense8 expense management software to government departments and large corporates. Prior to the quarterly results today, 8Common had enjoyed a strong share price run from around 12.5c to around 22c, off the back of its first major contract win for its CardHero and CardHero+ products. We’ve touched on this opportunity in our prior coverage of 8Common, so I won’t rehash it here. Unfortunately, shareholders will have to be a little patient to see this new contract impact the results, because the “initial beta card roll out,” is only beginning this month.

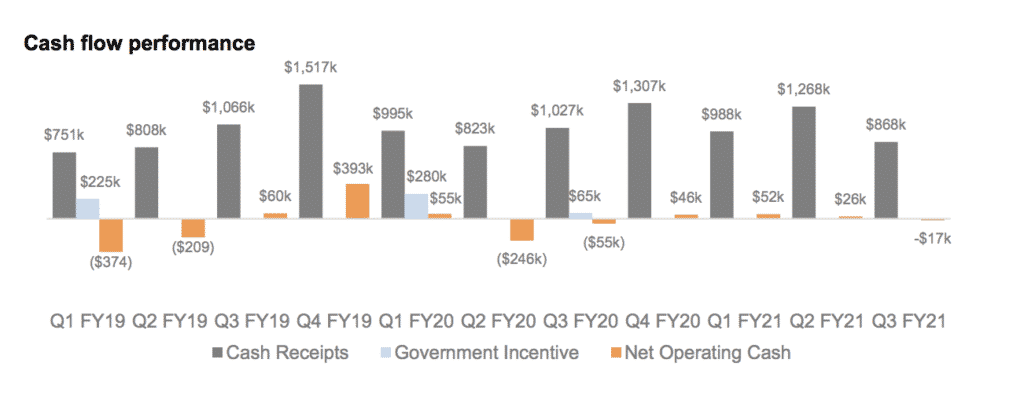

Fortunately, 8Common makes it easy to assess its quarterly cashflows by providing the historical chart below. As you can see, this was a weak quarter for receipts from customers.

However, the good news is that the company maintained cost discipline, and total cash burn (including investing cash outflows) was just under half a million dollars for the quarter. Given the company has about $3.6m cash in the bank, that means the company could operate for well over a year at current rates of cash burn.

The main reason for the lower receipts from customers was a dearth of implementation revenue. That’s hardly good news, since implementation revenue generally precedes growth in subscription and transaction based revenue. But again, we have a silver lining in the fact that this higher margin software revenue increased, showing a continued recovery since covid impacted demand. After all, many of the expenses processed through the company’s expense8 software pertain to employee travel, which understandably dropped off due to covid.

Overall, I can understand why the share price is down around 5% today, since the drop in implementation revenue may bode poorly for upcoming growth. Having said that, the company continues to claim that “the CardHero and CardHero+ products are a significant engine of growth and will further expand the client footprint of the Company.”

I now expect to see the first financial impact from Card Hero in the next quarter, and if the thesis holds, we should see significant progress in this business line over the 2021 calendar year. The reason for this is the company has repeatedly made bullish comments about CardHero as a growth driver for the company.

CardHero is important because the core expense8 software is resilient and sticky revenue, but not growing very fast. Essentially, CardHero extends the capabilities of the expense8 software, and should be useful as both an up-sell to existing clients and as a leading feature to attract potential new clients.

At current prices of around 20c, my investment in 8Common is up over 60% since I first bought it in October last year. While I do believe the company has made notable positive progress since then, I think that the share price has moved to reflect that, and all before the actual cash has arrived in company coffers. Therefore, I am waiting to see the actual cash arrive before upgrading my valuation, and am currently taking a ‘wait and see’ approach to the investment.

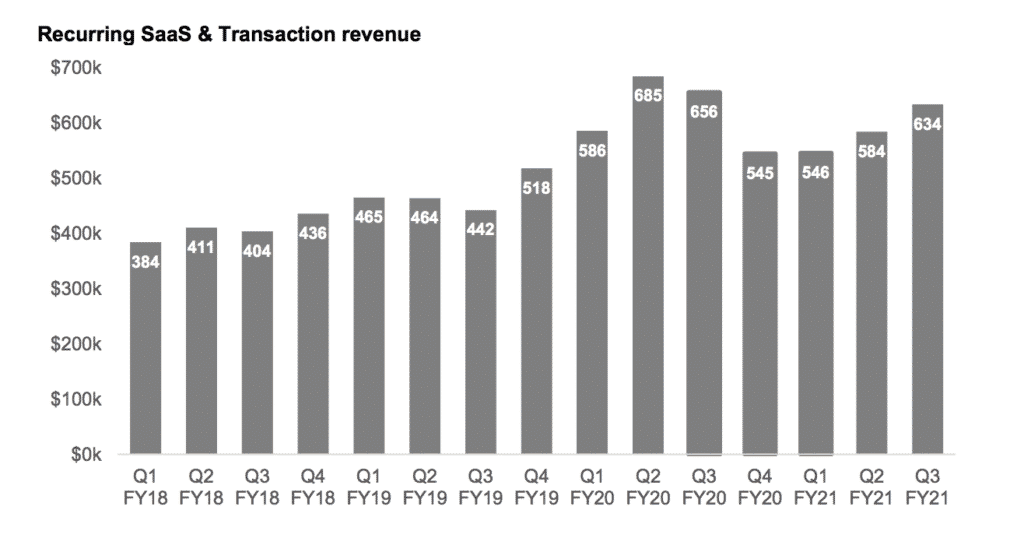

At the end of the day the company remains capable of breaking even, or so it would appear, and operates in an attractive software niche. Although quarterly results can be a bit volatile due to the implementation and transaction based revenue, the longer term story is one of recurring revenue growth, with the potential for accelerating growth if Card Hero matches expectations.

If you annualise recurring SaaS and transaction-based revenue for March, 8Common is currently on about $2.7m per year, putting it on about 15x ARR at the current price of 20.5 cents per share.

Mach7 (ASX: M7T)

Mach7 (ASX: M7T) sells a diagnostic radiology viewing platform, workflow management software and vendor neutral archiving to hospitals. Like Pro Medicus (ASX: PME), Mach7 is capable of helping larger organisations (like hospitals) workflow inefficiencies associated with slow or outdated radiology imaging software.

This is an important similarity to note, because the needs of larger organisations (with high volumes of studies) are very different to the needs of smaller organisations, such as a single radiology clinic. Mach7 boasts St Teresa’s Hospital in Hong Kong, with just over 1000 beds, as a client.

However, a hint to Mach7’s difference to Pro Medicus is given in its marketing materials which say “Mach7 was designed to provide

an affordable bridge from legacy systems to a future-ready

infrastructure that brings imaging to the enterprise, now and into the

future.” [My emphasis].

This is different because Pro Medicus optimises not for affordability but for efficiency gains, health outcomes and hospital return on investment, meaning that its software is the most expensive (but also best) on the market, boasting world-famous hospitals like the Mayo Clinic.

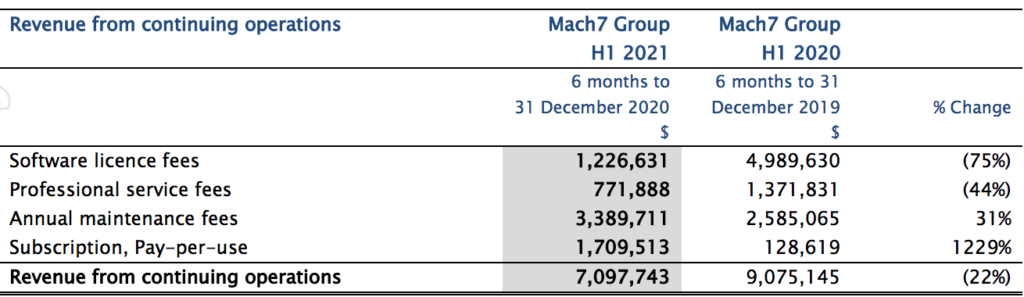

As a result of the nature of the software, Mach7 has lower recurring revenue and higher implementation revenue, than many software companies. This can lead to volatility in results, as you can see from the table below, taken from its most recent half year report.

Obviously, it is far from ideal when your revenue goes down, year over year, simply because the prior period included a significant software license sale which was not repeated. However, it is still legitimate (if a little conservative) to focus on the high quality recurring or quasi recurring revenue, being the subscription revenue, pay per use revenue, and annual maintenance fees.

The half year result showed strong growth on this measure (in part driven by acquisitions) but there was no explicit update on recurring revenue in today’s quarterly result. Having said that, it is not possible to deny that this quarter was a good quarter for Mach7.

First of all cash receipts reached a record $8.4m, and operating cashflow was positive, at $3.3 million. After the first three quarters of FY2021, Mach7 has generated free cash flow (excluding acquisition costs) of about $1.1m and the company says it is “on track to deliver a positive free cash flow for the full year.” If true, it would appear that through its latest acquisition of Client Outlook, Mach7 has crossed over to becoming a self-sustaining business. This makes the investment fundamentally less risky.

In the latest update, the company said “Of the year-to date sales orders, $2.75 million is annually recurring revenue over the life of the contracts.” At the end of Q2, the company noted only “$0.6 million will recur annually over the life of the contracts,” of the year to date sales. This implies that the company added what will eventually be around $2m in ARR in the latest quarter.

Based on the table above, the company had around $5.1m in recurring revenues at the end of the last half, in a single half, implying $10.2m for the full year. And that will go to $12.9m after its recent sales eventually come online. Unfortunately, Mach7 contracts can often take over a year to fully implement, so we won’t hold our breath; but we will expect to see recurring revenue trend up over time.

Based on this forward looking ARR, Mach7 could still be considered expensive, given it has a market capitalisation of around $325m at the current Mach7 share price of $1.40. That puts it on around 25x forecast ARR. That’s too expensive for my taste, particularly for a cash burning, loss making company.

However, this quarterly result suggests that Mach7 may be on the verge of profitability and sustainable free cash flow. I do not own shares, given the high multiple of recurring revenue, but I note that Mach7 has now attained adequate scale to reach free cash flow, albeit largely by acquisition.

Mach7 is a software company with a significant proportion of recurring revenue, serving an attractive niche. Given the potential to reach profitability in the near term, I believe it deserves a spot near the top of my watch list.

This article documents some of the factors influencing a company’s share price, but the article is not financial advice, it is general in nature, and our disclaimer is here. Claude owns shares in 8CO.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

Be the first to receive some of our exclusive hidden content by signing up to our free newsletter below.