As I discussed in this article yesterday, I see a number of factors that are likely to increase the chance of volatility (both to the upside and downside) in the coming months. However, in my opinion there are a number of micro-caps with sound fundamentals and decent thematics that are worth following closely. Each could have a short term win if it catches the attention of the retail crowd, though that is not particularly high probability. Each could have a long term win since they have growing businesses. And, because they are illiquid, each could offer compelling buying opportunities in a macroeconomic sell-off, because their businesses should be fairly robust (and none are recent listings; thus having proved some resiliency).

I have only bought small positions in each of these stocks as I need to do more to understand the investments. I may sell in the short term if further research leaves me underwhelmed.

Secos (ASX:SES)

Buy price: ~16c

Secos makes biodegradable plastic products, including biodegradable plastic bags. The business has been slow to take off, but one would hope it is benefitting from a multiyear tailwind, given the profound damage single use plastic is doing to the natural environment.

In the last financial year, Secos made a loss of about $1.2m on revenue of about $21m. Revenue growth was minimal but cashflow approximately matched profit. After the period end, Secos strengthened its balance sheet with a $15m capital raising at 17c per share (above the current price).

The chairman said the funds would be used “to increase production and sales of the Company’s compostable and biodegradable products. Building on the Company’s recently announced supply contracts with Woolworths in Australia and NASDAQ listed Jewett-Cameron Trading Company in the US. SECOS sees significant opportunities to capitalise on the need for a sustainable solution…”

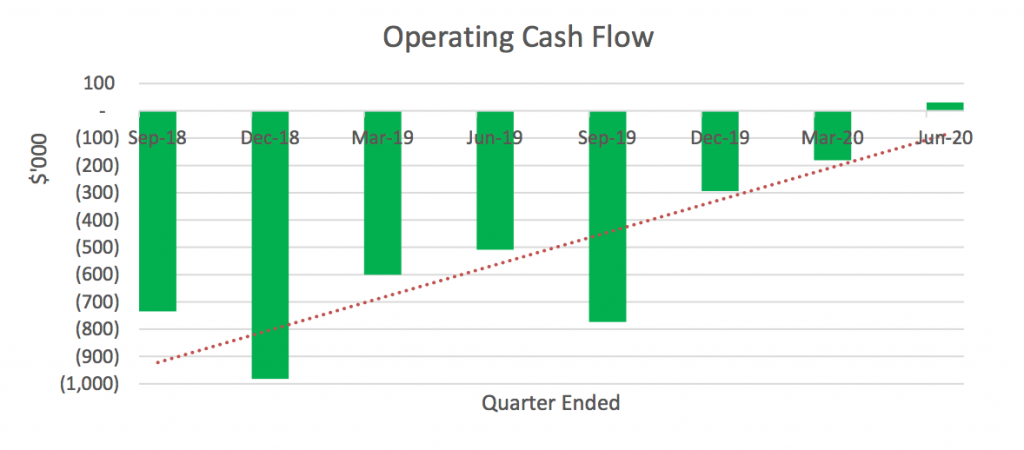

In the best case scenario the company is already close to a breakeven inflection point:

More recently the company announced a new sale in Mexico. It said: “ISOI Mexico has achieved initial commercial orders of over $1.5m in Cardia™ compostable resin for delivery to Latin American converters.” With continuing sales, a strong balance sheet, and a market capitalisation of $85m, it’s not hard to imagine the company will justify its price. If it can add $5m revenue, and make $2.5m profit, in a few years downside will be minimal, and given the hypothesised tailwind growth could actually continue for a very long time indeed.

Rectifier (ASX:RFT)

Buy price: ~4.2c

Rectifier makes electrical components that are in greater demand as electric systems become more sophisticated to incorporate more solar, batteries, and electric vehicles. Supporting this claim, revenue has more than doubled over the last 5 years. Profit has been volatile due to operating leverage and order cadence.

I was concerned about the impact of the pandemic, since the company’s factory in Malaysia was required by local authorities to shut down in the middle of March, causing a year on year revenue and profit decline. However, it has since resumed operation.

In FY2020 the company made a profit of $1.8m on revenue of $16m, putting it on a heft P/E ratio of approximately 33. Free cashflow was strong at just under $4m, including least costs. While these results benefitted from government subsidies, it previously achieved a similar level of profit before tax so I think it’s reasonable to assume $1m – $2m as an eminently achievable profit level given the current product suite.

The company says; “in addition to the major developments of our ‘Highbury DC Bi-Directional Charger’ and ‘RT22 50KW EV Charger Module’, we are also developing a high voltage input rectifier for the defense industry. We are now anticipating these products to be released in 2021.” Given a track record of product releases preceding sales increases, this is a positive.

8Common (ASX:8CO)

Buy price: ~12.5c

8Common is that category of company that I spend so much time looking at; the sub-scale software company. Of the company’s in this group, I have the least confidence in Expense 8, expense managment software for governments and corporations. I think it is an unremarkable product in a crowded space, but I note it has some reasonably big name clients such as Woolworths; so that is a positive.

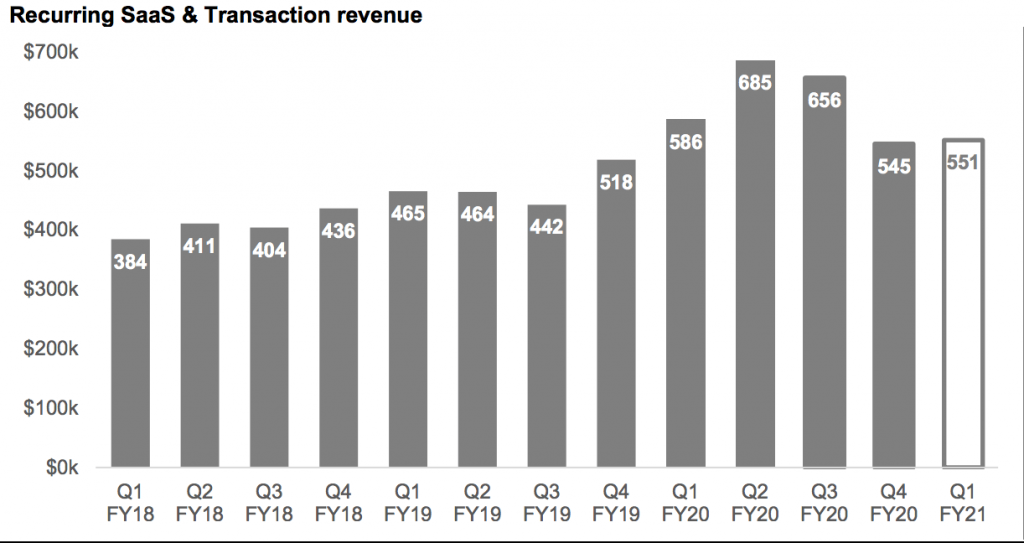

Perversely, while it is the lowest quality company in this group of four, it’s probably the most likely to be mistaken for a higher quality company. One reason I think it is low quality is that its growth is anaemic:

It’s not entirely clear how much of the recent reduction in recurring SaaS & Transaction revenue is due to churn, and how much is due to lower transactional revenue.

The other reason I am suspicious of 8common is that the CEO and founder Nic Lim says he was a co-founder of catcha.com group. Catcha floated stocks like iCar Asia and iProperty. Investors in the former got absolutely and repeatedly shafted while investors in the latter got lucky with a takeover offer.

Nonetheless, I see 8common as having stability, since it has reached cashflow breakeven. It doesn’t have much cash to invest and it recently started hyping CardHero, the latest in a long line of new business lines it has launched with fanfare. Previously it has touted Realtor8, Benefits8, Perform8 and PayHero. The founder also invests in a diverse array of other software startups (I do not see this as a good thing, as it means he isn’t close to being ‘all in’ on 8common).

In August, 8common announced a few new contract wins with 5 government agencies and said “Significant upside remains with a further 40+ entities under the shared services hub agreements to be onboarded onto expense8.” I believe there is a significant chance we could see the company pass a breakeven inflection point and if it does that then it might attract positive attention.

8Common currently trades on a market cap of about $23m which is approximately 10x recurring & transaction revenue. This is also the least attractive valuation of the lot and based on my preliminary research, 8common is the least likely of these stocks for me to hold long term.

Shorter term, I see it as the most prospective to attract the eye of the naive new investors flooding the market, as it announces many inconsequential bits of news, looks superficially decent, has a founder linked to past ‘success’ (just not for ASX investors) and may have a strong couple of quarters ahead.

Corum Group (ASX:COO)

Buy price: ~6.2c

Corum is, to my mind, the most interesting of these companies. It has two main existing businesses; one in pharmacy dispensing software and another absurd business that processes transactions on behalf of real estate agents. I looked at this business back in 2013, and noted it had a very strong foothold in the pharmacy software game. However, the market was consolidating in favour of its competitors that were (I think) much better optimised to suit the needs of larger pharmacy groups. With the pharmacy industry heading in that direction it is no surprise that Corum was being left behind. Back then — and for many subsequent years — the company was controlled by its major shareholder (who made his money in oil and gas). Minority shareholders were treated with undisguised contempt.

The stock was therefore no investment quality until more recently when the prior major shareholder lost control of the board and was diluted. I’m not quite sure of the mechanics of how all this happened, but the result has been that the company has made a reasonable adjacent acquisition.

Corum recently undertook a $5.6m capital raising at 4.2c, which I believe has seen a few quality micro-cap investors join the register. The funds were used to complete the acquisition of PharmX, which allows over 5,500 pharmacies to connect with major pharmacy suppliers for re-ordering medicines.

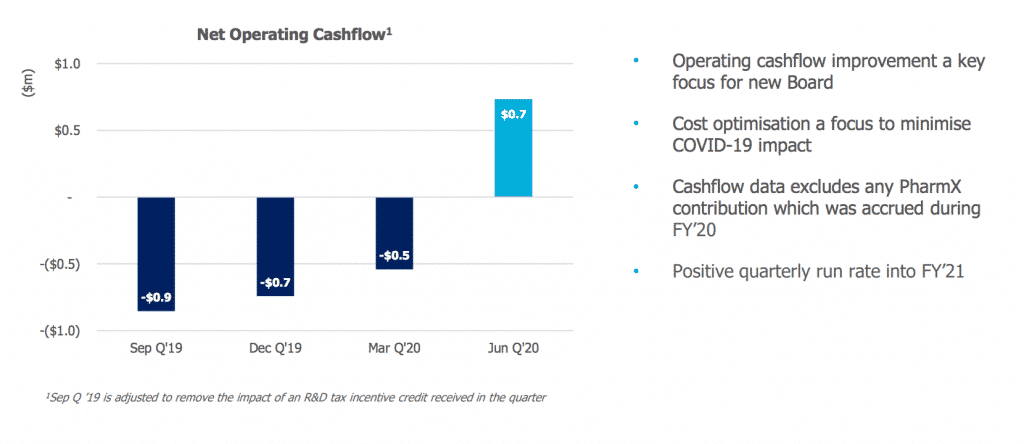

In the last year, Corum made a profit of $176,000 on revenue of about $10m (which is not growing). As with a few of the other micros I’ve selected, it is hovering around cashflow breakeven.

I need to do more work on Corum, but it’s possible that the acquisition of PharmX will give it additional scale and boost profitability. Longer term, I believe investment in its pharmacy software will need to increase if that business is to remain sustainable. Therefore, I don’t expect a fast recovery in profits. However, the acquisition should generate additional cashflow for investment which — if done wisely — could capitalise on a decent foothold in a reasonably attractive market.

With a market capitalisation under $35m it is trading on under 2.5x pro forma revenue for last year. Given the poor repair of the legacy businesses this is probably not as insane as it sounds, but you can imagine there is a huge potential for valuation uplift if the new team can restore growth. As with Urbanise.com, I am investing alongside the fairly astute emerging companies team at Australian Ethical. As with Urbanise.com, the thesis basically relies on the supposition that a decent business was run into the ground by prior management, but can be resurrected by capable and decent humans. I need to do more work to better understand the odds of this happening, but it seems prospective.

This post is not financial advice, and you should click here to read our detailed disclaimer.