Dicker Data (ASX: DDR) Shows Green Shoots In 2024 Full Year Results

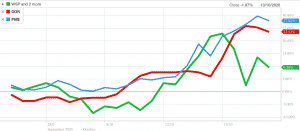

Dicker Data (ASX: DDR) showed a strong profitability improvement in the second half of its CY 2024 reporting year.

Dicker Data (ASX: DDR) is an Australian IT distribution company founded by David Dicker and Fiona Brown. The company competes with international distributors like Ingram Micro and is famous for paying out 100% of its earnings per share as a dividend.

Dicker Data (ASX: DDR) showed a strong profitability improvement in the second half of its CY 2024 reporting year.

The H1 FY 2024 result was ever so slightly better than I’d feared, but still not good enough to deserve an upgrade, in my view.

Albeit hardly thesis changing, there is some new information to consider regarding each of these stocks.

Dicker Data (ASX: DDR) still has demand tailwinds.

Both these businesses have significant insider ownership, and a history of long term earnings per share growth.

Dicker Data earnings per share came in at 41.5c compared to analyst consensus estimates (per CapIQ) of 43c per share.

The Dicker Data (ASX: DDR) Q3 FY 2022 Quarterly Update is a good time to revisit my valuation of the stock

When fear reigns it is hard to force yourself to buy growth stocks, but these three have all stood the test of time and showed their quality in good times and bad.

The H1 FY 2022 Dicker Data results were the weakest we’ve seen in a while, largely due to factors outside the company’s control.

Dicker Data declared its first quarterly dividend for the year suggesting it will yield around 4.2% at current prices.

Dicker Data (ASX: DDR) achieved another year of very strong profit growth, assisted by the acquisition of Exeed.

Even though growth stocks are down considerably, in my view the top quality growth stocks are still up pretty overvalued.

These five stocks all have very high quality businesses that I want to buy more shares in, if only the market would offer a slightly better price.

What are the best ASX dividend stocks to buy? I don’t know, but when I look for dividend shares I prefer to buy growing dividend stocks.

Motley Fool probably caused the Dicker Data (ASX:DDR) share price to drop on Monday, because they issued simultaneous sell recommendations.

Dicker Data (ASX:DDR) continued its excellent operational performance in the half to June 2021; but are the shares still priced attractively?

The Dicker Data share price moved considerably today because it announced a decent acquisition in New Zealand.

Dicker Data is forecasting a record profit which allays my concerns about its transition to a bigger warehouse.

Dicker Data (ASX: DDR) boosted underlying profit by almost 20% in a year that benefitted from more people working from home.

Whispir, Pro Medicus and Dicker Data have seen share price gains off recent announcements. So are they still worth buying?