I don’t usually write an update on the Dicker Data (ASX: DDR) quarterly reports, but I thought it would be worthwhile to do one this time, because I think this quarterly report means my prior dividend expectations are too high. When I covered the Dicker Data half year report and capital raising, I concluded that “I’m expecting a yield of around 3.8% to 4.7% based on a share price of $11, being a dividend range of 42 cents to 52 cents.”

Based in part on this analysis I subsequently wrote that “my desired buy price for Dicker Data shares is $8.71 – $9.63.” As a result, I actually bought more shares at $9.50 not long ago.

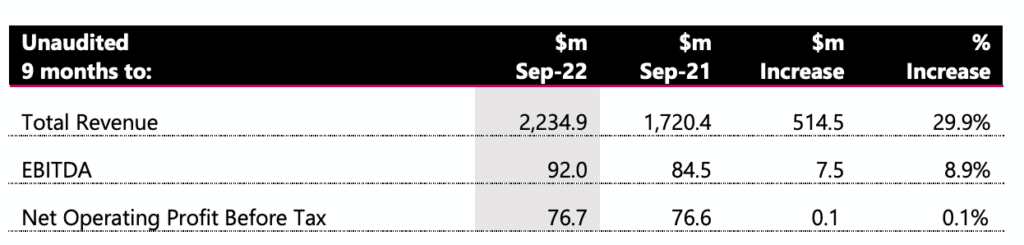

However, today the company has updated on its Q3 quarterly performance, disclosing that year to date the company will earn $76.7 million in profit before tax, as you can see below.

In the half year to June 2022, Dicker Data reported Net Operating Profit Before Tax (NOPBT) of $51.76 million. That means that third quarter NOPBT was about $25 million, being generous. Assuming the same performance is repeated in the final quarter, we would see NOPBT of about $102 million (or slightly less).

During the half we’ve also seen shares on issue expand from about 173 million to over 180 million, being dilution of about 4%. Last year, we saw NOPBT of about $106m, or 61.2 cents per share. Using this basic forecast (repeating the third quarter), we’d see NOPBT of about 57 cents per share, if you use the 180 million to calculate the per share figure. Note that data providers would use a lower weighted average of the shares, but I think the actual number of shares on issue is more relevant to forecasting the future than the weighted average, given the recent dilution was for ongoing business expenses.

As a result of all this, it is clear that my prior forecast of 42c to 52c in dividends per share for the current year is on the optimistic side of things. I would now estimate that the bottom end of that range (say 45c) is probably the highest it would go, with some prospect the dividend will actually be lower than last year (which was 42c).

Now, the short term difficulties due to inflation and supply constraints don’t really change my longer term thesis. However, with Dicker Data now sitting above my (old) desired buy price, and with the short term forecast below my expectations, I think it is prudent to take some profits on my fairly large Dicker Data position. Therefore, I will look to sell at least 14% of my holding tomorrow or in subsequent days, assuming I can achieve around the current price of $10.83.

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in ASX:DDR and plans to sell a bit over 14% of his holding the day after this article is published. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. To the extent that this article is advice under the law, it is general advice only. It has not considered your investment objectives. To the extent that this article is financial advice, it is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.