I can’t say I’m much of a dividend investor, but perhaps I should be. Generally speaking I’ve found that I rarely lose money when investing in growing dividend stocks. They key, for me, is to ensure that I sell the stock if I think it will stop growing. So today I thought I’d take a look at three dividend paying companies that I believe will grow their earnings over the next couple of years.

Monash IVF (ASX: MVF) trailing dividend yield 4.4%

Monash IVF is the evolution of the same group that achieved the third IVF baby in the world, and implanting IVF embryos is still its main business. These days, it also owns ultrasound clinics for pregnancy (3D images of your baby!) and does a lot of testing embryos (pre-implantation), and fetuses for abnormalities.

Monash IVF makes money by selling the time of its medical specialists, and the use of its high end technology. This means top specialists have a lot of power, limiting the ability for Monash IVF to grow its business without poaching new talent, and keeping existing talent engaged. As a result Monash IVF has a lot of operating leverage, and profit can be quite sensitive to demand levels. Importantly, Monash IVF plays exclusively at the premium end of the IVF market, so arguably, its clients are less sensitive to macroeconomic shock.

FY 2021 net profit was $25.5 million, but it received $3.5 million in JobKeeper, so let’s call it $22 million. Market cap is currently $370 million at 95 cents per share, so it trades on about 17 times normalised earnings. Having raised capital near the bottom in FY2020, the company now has a net cash balance sheet and generated more than $30m in free cash flow in FY 2021. Macquarie Bank forecasts dividends to remain above 4.2 cents per share for the next couple of years, putting the company on a decent yield of at least 4.4%, fully franked.

In its most recent results, Monash IVF said that “2H21 new domestic patient registrations were 8% higher than 1H21,” so that should imply half on half growth of over 5%, as registrations convert to paying customers. The company has profitable operations in Malaysia though they have been negatively impacted by covid, particularly the clinic in Johor Bahru, which usually serves Singaporean clientele. This pressure should ease if and when Singapore loosens travel restrictions. Considering this, I think it will grow.

Dicker Data (ASX: DDR) trailing dividend yield 2.8%

Dicker Data is an IT equipment and software distribution company in Australia and New Zealand. It is remarkable because it pays out 100% of its earnings in dividends and the CEO doesn’t take a salary.

I expect it to grow since the company said recently that it is “experiencing strong demand with a backlog of orders to fulfil and as supply improves, we expect to continue to meet this demand in the second half of 2021.”

It made $32.1m of profit in the first half. Annualising that, allowing for some growth and adding in profit from the recently acquired Exeed, full year profit might be around $68m, putting aside acquisition costs. That should see the dividend increase somewhat.

However, the share price has seen some weakness recently, likely because a large sale of shares by the founder created an overhang, and spooked some shareholders into selling. I do not believe this sale indicates a reduced commitment of belief in the business, but it may do.

On the other hand, since that time, both the CFO and COO have bought shares on market. Personally I already own shares and am hoping for slightly lower prices to buy more. Dicker Data is one of the few dividend stocks I always cover each results season, because I believe it’s a high quality business. You can see our prior coverage of Dicker Data shares here.

Ansell (ASX: ANN) trailing dividend yield 3.1%

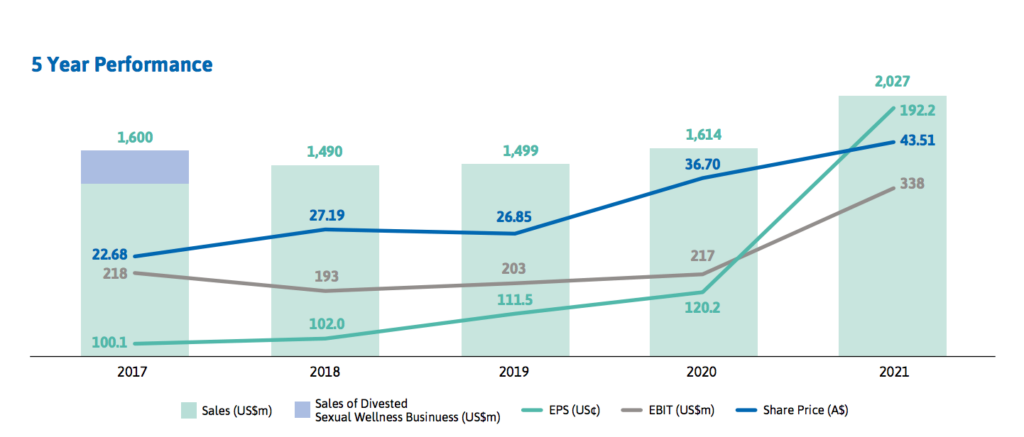

Ansell is the well known hospital and healthcare supplies company. It says “COVID-19 continued to drive demand for some of our products but also disrupted some operations due to temporary enforced government shutdowns,” so we wouldn’t extrapolate recent growth rates. Having said that, you can see below how it has grown both sales and earnings per share over the longer term.

Because the company says “lower demand is expected in areas which benefited most from the onset of COVID-19 i.e. Chemical Body Protection and undifferentiated Exam/Single Use gloves” and “ increased COVID-19 cases in South East Asia in the recent months may disrupt supply,” analysts are sanguine about earnings per share growth over the next year. Increased shipping costs are also impacting profits. As a result, analysts think that EPS will actually drop slightly, but that revenue will grow.

Personally, I think that with a P/E ratio of about 13, it doesn’t matter if the business contracts slightly over the next year, because the longer term trajectory is for steady growth. Therefore, I’d class Ansell as a growing business, even if growth prospects for FY 2022 are muted.

With a yield of about 3.1%, and a very defensive resilient business model, it actually looks to me like Ansell is a fairly solid dividend stock in the current environment. I also think that it’s likely that hospitals will remain stretched by covid for longer than we think, and that the elevated use of body protection equipment is likely to stick around for longer than we think.

Why Do I Have ASX Dividend Stocks In My Portfolio?

Even though I mostly invest in growth stocks, I like to keep some dividend stocks in my portfolio to give myself some ‘thesis diversity’. Generally speaking, dividend paying companies are profitable and more established businesses. Now, buying a shrinking business can be risky, since its trajectory will lead it lower over the long term. As a result, I focus on dividend stocks that I think are growing over the short term and long term, even if that growth is quite modest.

If you’re keen to hear more about these three stocks then check out the video below.

If you’d like to be alerted when I appear on Ausbiz, you can follow me on Ausbiz by clicking here.

Please remember that these are personal reflections about a stock by author. I own shares in Dicker Data and will not sell for at least two days after publishing this article (but I reserve the right to buy some). This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.