My Biggest Investing Mistake of 2022

I made a very bad investing mistake in 2022. By beating myself up for it, I hope not to lose the lesson.

I made a very bad investing mistake in 2022. By beating myself up for it, I hope not to lose the lesson.

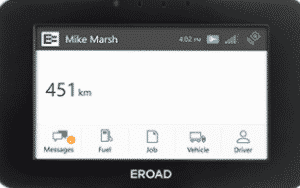

Eroad (ASX: ERD) is a good business but management is too optimistic about underlying business conditions improving, in my opinion.

The thesis is certainly off track but it’s much better to think things through slowly, than panic.

Eroad (ASX: ERD) had a decent quarter but continues to blame the pandemic for tough operating conditions, undermining confidence in management.

Eroad has excellent growth prospects and trades at an attractive valuation, but its actual growth is disappointing, and my confidence in management is reduced.

Eroad continues to grow but at a slower rate than it had thought…

Eroad has more success in New Zealand than the USA, but acquiring Coretex may well be the best move to drive international growth faster.

Eroad’s FY2021 results showed weak half-on-half revenue growth, but there are signs of an exciting future.

AVA Risk, Eroad and Audinate are all ASX small caps worth following, given their long term business growth.

This makes the claimed “remaining short to medium term enterprise pipeline of some 15-20,000 connected vehicles,” in Australia seem more achievable than ever.

This was a weak quarter, but the long term story hasn’t really changed…

Software ✓

Reasonable multiple ✓

Reasonably under the radar ✓

Reason to believe in long term tailwinds ✓

Eroad’s half year was a grey cloud with silver linings…

The Eroad (ASX: ERD) share price is trading below peers. Is this fast growing tech stock with a global market still under the radar?