Eroad (ASX: ERD) is a dual listed logistics telematics company that we have covered extensively on these pages, because of its long term growth and sticky, recurring revenue model, with over 90% retention rates. Slightly more than a month ago, when the share price was over $3.20 per share, I announced that My Eroad Thesis Was Broken. Predictably, the price has languished since then, as it did not take a genius to figure out that the stock would come under pressure due to negative newsflow.

Do not take that as a boast. I have been wrong about the stock. I have lost a modest amount of money on it overall, and I still own shares in it, for my sins. Mercifully, sold a significant amount of my holding at more than double the share price in December last year, after announcing my intention to do so, in late November. The lesson for me is that I shouldn’t have just sold part of my holding, I should have sold all of it, once I realised the worm had turned, and locked in some handy profits.

Eroad FY 2022 Full Year Results

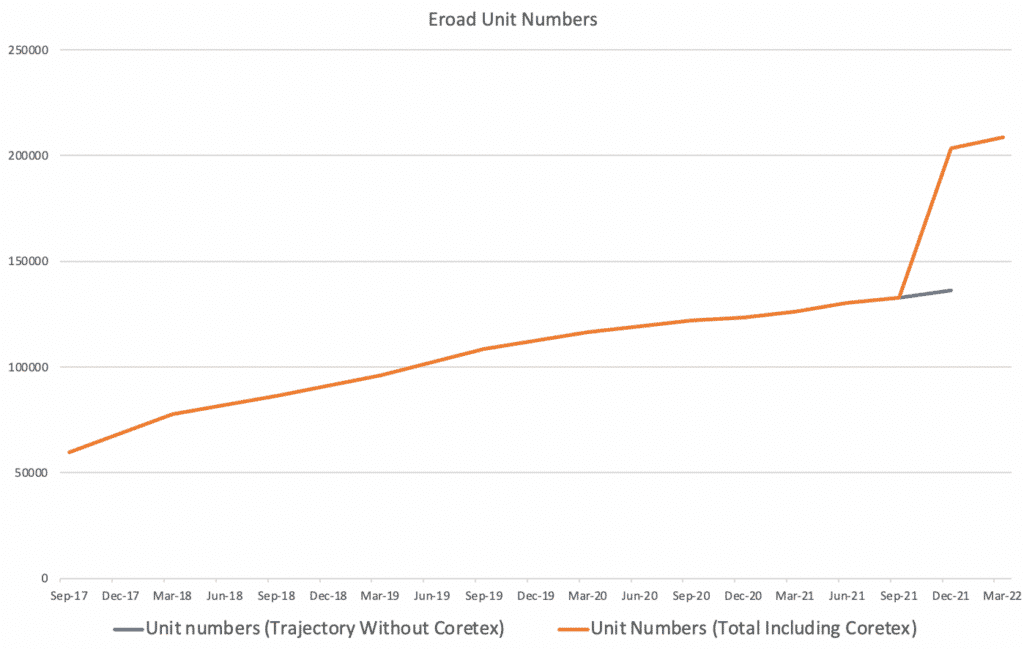

These results were the first results to include the Coretex acquisition, which was first included in December 2021. However, you can see that organic growth has continued, as unit numbers continued to grow to 208,697 which was a decent 2.6% gain quarter over quarter. Please note dollar figures are in New Zealand Dollars unless otherwise stated.

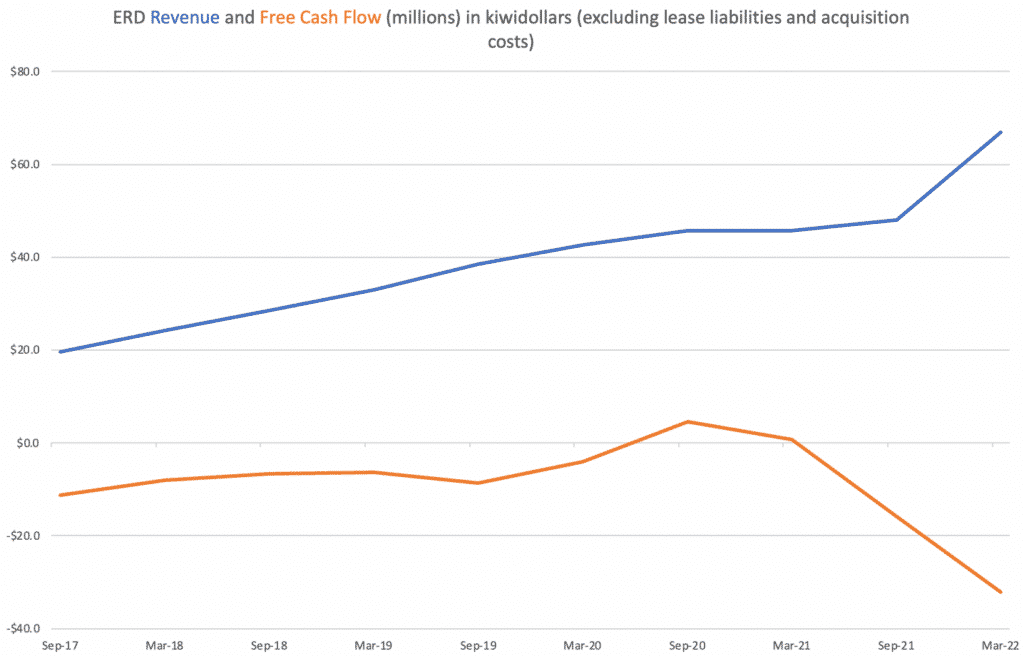

The Coretex acquisition has also boosted revenue, though it is important to note that only 4 months of Coretex is included in the half year to March 2022. Unfortunately, integration costs, acquisition costs, a growing engineering team, increases in marketing expenditure, and a deliberate decision to significantly increase inventory in response to supply chain challenges saw a massive free cash outflow during the half, even excluding direct acquisition consideration. Plant property and equipment almost doubled from around $35m to almost $62m.

This massive expenditure on growth is well worth noting. I am not against it, but it will prove problematic if it does not result in faster growth rates, since the company has about $32m in debt already and a little less than $15m in cash, once you exclude the restricted cash representing Road Users tax collected from clients due for payment to the appropriate government agency. While the company can burn cash if it chooses, the decision to do so seems to reflect a hope that underlying market conditions will improve going forward.

Arguably, the most useful metric we got in these results was the annualised monthly recurring revenue of $134.6m. Because Eroad consistently boasts retention rates of well over 90%, this number gives us a good guide to the approximate revenue the company will earn in the forthcoming year. I would expect Eroad to at least maintain its current level of customer sales, so we should expect at least $135m in revenue for FY 2023 (though I suspect they will get at least some growth).

Personally, it looks to me like Eroad is growing at around 2.5% per quarter, or just over 10% per year (after churn). Its AMRR is around $122m in AUD and its market cap is about $260m AUD at the share price of AUD $2.35. Therefore, even though I think Eroad’s communications, execution, and general way of being deserves some savaging, I do still consider the stock undervalued.

Even though I really do not think Eroad has been putting its best foot forward, it is still a high retention rate business, with the ability to make a profit if it cuts back on expenditure. It is trading on around 2.15 times its annual recurring revenue which just shows that the market has lost faith in the company. That said, I think that the main problems at the company are fixable. As I will argue below, I think the decision makers at Eroad need to plan for harsher business conditions than they are. Despite that, they are still building the business for the long term, and that is the most important thing.

Eroad Toking Hopium In A Hotbox

Urban dictionary defines Hopium as “The metaphorical substance that causes people to believe in a false hope… Opposed to copium, which represents the rationalization of the current situation, hopium represents the belief that the situation will someday improve.”

Please note: this extended metaphor does not imply actual drug use of any kind, it’s just an amusing, satirical way to describe how excessive hope (and cope) can lead to overly optimistic viewpoints. I think all the individuals running Eroad are good people who just happen to be relying too much on hope as part of their business plan.

When I announced my intention to start selling Eroad shares last year, I wrote, “I think that Eroad blaming the pandemic for its sluggish growth is only half the story, at best.” Essentially, the “cope” was that the pandemic could be blamed for business weakness, even when competitor Samsara was growing revenue strongly. And so I sold some shares.

Unfortunately, and this is a lesson for me, the scent of copium should have seen me hit exit completely, not just reduce my position size. Quelle doleur! You live and learn.

As I write today, the share price has worse than halved since then, so the decision to sell isn’t so obvious; I actually think the market is now pricing in a certain degree of cognitive dissonance in the board room.

Metaphorically speaking, I imagine board room door opening to emit plumes of hopium smoke and a pronouncement springs forth, as if the hopium has facilitated connection with divinity. “Longer term”, they say, “EROAD is targeting to deliver ongoing strong growth in revenue, of at least $250m by FY25.”

Having been excluded from the hopium sesh, one analyst on the earnings call displayed an appropriate skepticism of this claim. I have produced his question and the response below. Please note it is lightly edited since not everything was audible to me:

Question: “On your FY 2025 Target, is that organic or do you need M and A?”

Answer: “That’s organic”

Question: “How have you arrived at that number? I guess optically, it does look like a high growth rate well above what is currently being delivered.”

Answer: “We have reasonable predictability around our NZ business… that NZ core is relatively straightforward… if you look at the North American market the market itself was growing somewhere in the range of 15% – 20% in the years leading up to covid, covid has sort of impacted that quite significant and probably halved that, most of the reads are between 7 and 10 % growth in the underlying market. We are expecting that the underlying market growth once we shake off the effects of supply chain and covid will go back to close to what they were pre-covid. So we’re sort of dealing with an underlying market growth in the mid teens and then we look at our pipeline and we look at the features that we’re building and the investment we’re putting in the R&D… and we think an overall growth rate of slightly over 20% per year which is what that represents, is a realistic target in that context…”

Essentially, what this tells me is that Eroad is hoping that the underlying market jumps back to pre-covid growth rates. However, I fail to see any reason why it should. One of my pet peeves is when companies refer to the “post-pandemic” world as if covid will somehow massively disappear. Sure, market such as the USA have a vaccine now, but they have had a vaccine for ages. In what possible world will the impact of covid be less in the next six months than it has been in the last six months (except, perhaps, if the exact timing of infection waves are impacted by the weather).

Yes, we have vaccines now, but the USA has had vaccines for more than a year. Even the pathetically slow to vaccinate Australian and New Zealand markets have had virtually everyone vaccinated since late 2021. We all understand the allure of hopium, and it would appear that Eroad has gotten hold of some strong stuff, but until it stops toking with all the enthusiasm of teenagers in Amsterdam, it’s going to be very difficult to take their long term targets seriously.

I remain a shareholder for now, but I still plan to sell my shares if and when the market ever offers me a sufficiently more attractive price.

I’m not exactly sure how Covid impacted the trucking industry, but if airlines are anything to go by, the impacts are not over.

Please remember that these are personal reflections about a stock by a diarist. I own shares in Eroad but might sell them at some point, especially if the price increases significantly.

This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.