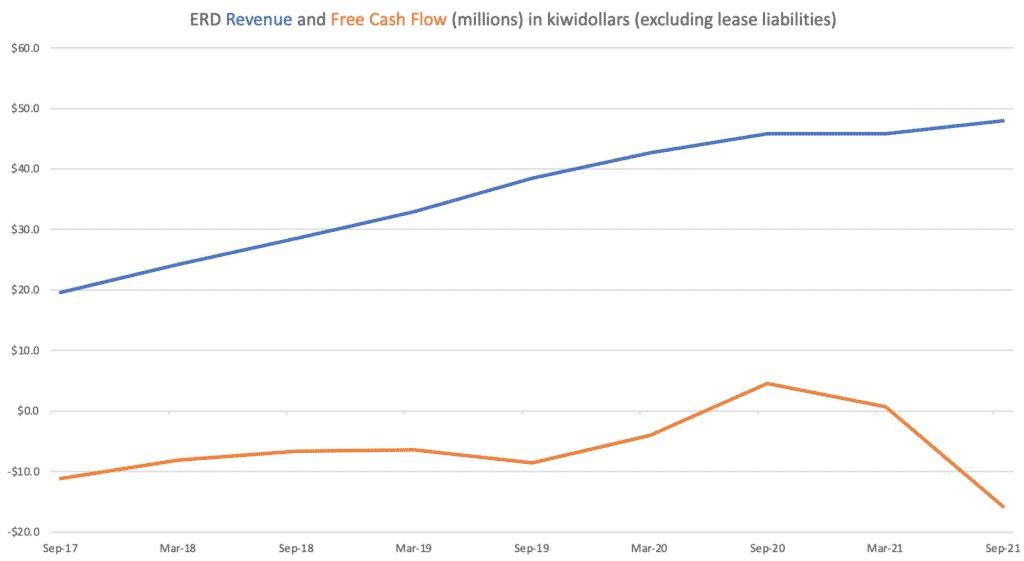

On Friday las tweek trucking telematics company Eroad (ASX: ERD) released its results for the first half of FY 2022, showing sluggish revenue growth of just 4.8% on the prior corresponding period, to $48 million NZD. Meanwhile, a significant increase in both R&D and investment in hardware to support future sales, saw a dramatic reduction in free cash flow, to negative $15.8 million, for the half. You can see these metrics on the chart below.

However, it’s important to note that the prior corresponding period included $1.6 million of one-off covid grant income which did not repeat, so if we exclude this non-operating revenue, revenue growth would have actually been about 8.6%, which isn’t great, but it’s not too bad either.

In October, Eroad gave a quarterly update that disclosed its subdued unit growth due to a large US client who was lost when it was acquired. At the same time, the company downgraded its revenue growth forecast from “a range of 13% to 30% growth” to “between 10% and 13%.” You can read my coverage of that update here.

The low end of the updated guidance equates to $100.8 million in full year revenue. With the first half result of $48 million, that leaves $52 million in the second half, if the company is to achieve its new, downgraded guidance.

However, the company also said that “The Coretex acquisition is expected to complete with effect from 1 December, therefore it is now appropriate for EROAD to withdraw its FY22 stand-alone guidance as it is no longer relevant for the combined entities.” To me, this indicates that the company is washing its hands of a requirement to inform the market if its core Eroad business looks like it will achieve less than the 10% growth it forecasted.

When it comes to the drop in free cash flow, I’m not overly concerned. The company explained on the call that the supply chain issues with computer components meant that it wishes to hold more inventory, which is fair enough.

The increase in R&D spending is a precursor for future revenue growth. The company is already showing how this can certainly pay off, since its newer products such a the Clarity Dashcam are finding good traction. The Clarity Solo Dashcam, which does not require an eHubo to be installed, was launched in October, and I am hopeful that it will achieve good initial sales. On the call, the company described it as a “Trojan horse” because “it expands EROAD’s addressable market into a wider range of fleets (e.g. US Light Commercial Vehicles), without the need to also install an EHUBO, and it can also be installed alongside other telematics providers.”

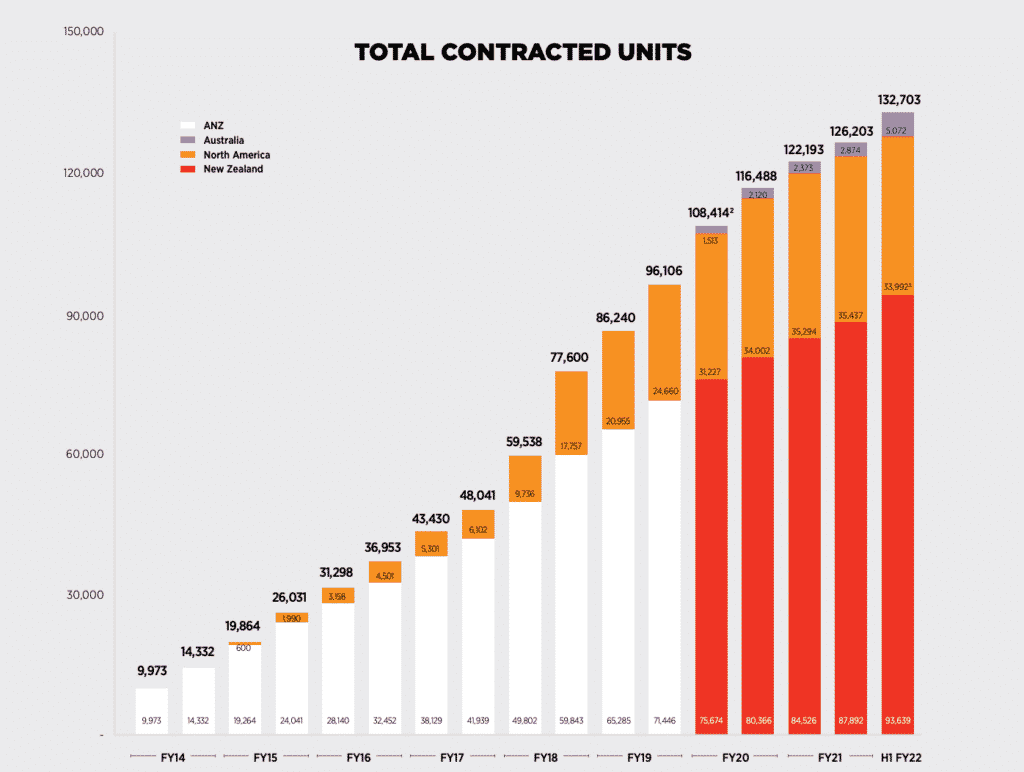

Zooming out, Eroad grew slowly off a large base in New Zealand, quickly off a small base in Australia, but it actually went backwards in the USA, as you can see from the chart below.

The Worst Negative About This Report

One of the features of this report is that the company continues to blame covid for its sluggish growth. For example, the company said:

“While good growth is still being experienced in both Australia and New Zealand, some anticipated growth has been deferred to either later in FY22 or into early FY23 due to COVID19 lock-down restrictions delaying piloting activity, installation roll-outs and lengthening sales lead-times. North America continues to experience ongoing impacts of COVID-19 and its associated economic challenges, in particular significant driver shortages and supply chain issues impacting mid-market customers. As a result, growth to date has been below EROAD’s expectations.”

On the call the company elaborated and explained how larger trucking companies have been poaching drivers from the smaller ones, which are the core market for Eroad. Specifically, the presentation documented, “Lagging COVID-19 related impacts of driver shortages, loss of underlying contracts and broader macro-economic concerns,” under the heading “Challenging macroeconomic environment” in the US market.

However, as Rask Finance analyst Raymond Jang put it in a Rask subscriber-only report, “Given a lot of competitors in the US have experienced rapid growth, it seems like EROAD’s reasons don’t entirely stack up.”

Jang pointed to the fact that competitor Keep Truckin’ has recently boasted 70% annualised growth since the onset of the pandemic and the strong quarterly revenue growth of competitor Samsara, which increased revenue by 13% quarter on quarter in the last quarter and a whopping 101% year over year.

My view is a little harsher than Jang’s. I think that Eroad blaming the pandemic for its sluggish growth is only half the story, at best, and their presentation of this issue undermines the credibility of management. That’s important; more on that later.

So Why Is Eroad Really Growing Slowly In The USA?

Given the company has failed to give a compelling explanation for its low growth relative to competitors, we are left to intelligently speculate. The truth of the matter is that the selling point for the Eroad devices in New Zealand has been partially driven by regulation. While similar regulation is taking shape in the USA and Australia, these jurisdictions do not have the same regulatory drivers as New Zealand, and so it is more difficult to grow there.

Secondly, it seems extremely likely that their competitors are spending very extensively on marketing in order to boost revenue growth. For example, in the 9 months to October 2021, Samsara spent a whopping USD$166.5 million on marketing versus revenue of $302.6 million. On top of that, the company spent $78.7 million on R&D.

Now, before we Eroad shareholders get too worried about the fact that the company is out-gunned by competitors, from a marketing point of view, Eroad is arguably holding its own. In the last half Eroad said its cutomer acquistion costs (which include sales and marketing) had actually reduced on the prior half.

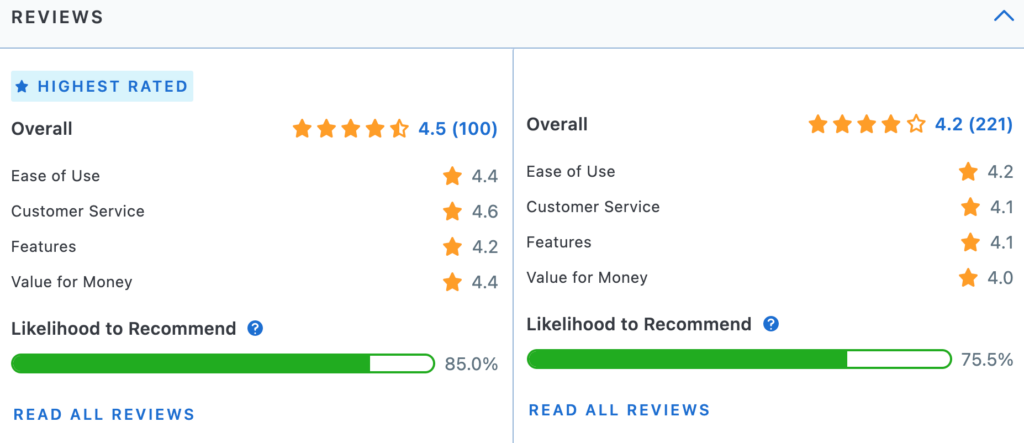

Despite spending far less on marketing (unfortunately we don’t know exactly how much), Eroad seems to hold its own as a product, at least according to Capterra. In the screenshot below Eroad is the higher rated solution on the left and Samsara is on the right.

Indeed, I cannot help the feeling that the board has somewhat unwisely gone the route of blaming its growth challenges on the pandemic, rather than calling out the aggressive marketing of its competitors. This is bad, because it erodes trust. However, there are two reasons to believe that the situation may improve.

First, when I pushed the CEO, Steve Newman, to specifically name and talk about competitors, on the call, he said words to the effect that: “Samsara are about to IPO, so there is some interesting commercial activities with them trying to maximise their pre-IPO situation, which we see as not sustainable for much longer.“

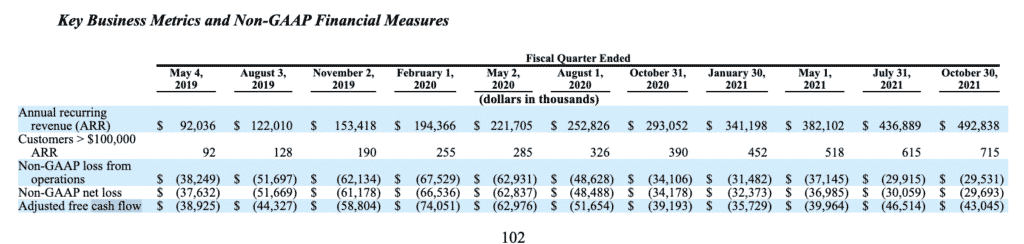

Now, I don’t agree with Newman’s suspicion that the marketing spend is unsustainable. However, I do think this is a far more useful insight into why Eroad might be struggling to grow quickly in the USA. It is usually painful to have competitors who are happy to burn seemingly infinite amount of money on customer acquisition. And that is what Samsara is doing. Check out its key non-GAAP metrics below:

As you can see, it is burning through an “adjusted” $43m USD of cash, per quarter, and it has been burning that much or more throughout the pandemic (unlike Eroad, which actually generated some free cash flow, prior to this half). Over the 9 months to October 2021, statutory operating and investing cash outflows totalled more than USD $130m.

Are Eroad Shares Still Cheap?

Now, the comparisons don’t stop there. If we assume Samsara has ARR of around $500m USD, and hark back to its 2020 capital raising that valued it at $5.4 billion, we can see that the stock is trading on more than 10x recurring revenue.

Now admittedly, it is growing much faster than Eroad, but that is just the pre-IPO round, with the IPO round likely to be dearer still.

In comparison, Eroad had Annualised Monthly Recurring Revenue of $92.9 million NZD and Coretex is expected to add at least NZD $50m AMRR. Together, that makes about $153m NZD or about $146m AUD. At the current share price of about $4.78, Eroad has a market cap of $456 million AUD. We should then add the market capitalisation associated with the ~13.3 million shares the company will issue the Coretex vendors, which takes us to a pro forma market cap of about $520 million. That means it’s trading on a pro forma market capitalisation of about 3.5x AMRR.

Obviously, you can’t expect a company growing at 8% to trade at a similar multiple as a company growing at 100%, but it’s fair to say that it is priced for much lower growth than its competitors.

Once the acquisition of Coretex is completed in early December, “The initial focus will be on North America and promoting the Coretex 360 platform and CoreHub hardware solution as EROAD’s next generation product within weeks of completion to enable sales momentum to increase in that market.”

Certainly, given Eroad doesn’t want to spend as aggressively as Samsara, it makes sense to try to grow by dominating little niches. On the call, the CEO said that the “waste and recycling [niche] seems to be a very open market because it has typically had quite generic solutions, so Coretex looks quite exciting in that [niche].” He also noted that the “recent infrastructure bill will see heaps more activity around concrete which Coretex specialises in.”

So all in all, there are reasons to believe that Eroad’s growth could re-accelerate, despite the fact management seem to be misguidedly blaming the low growth on the pandemic. If that happens, or if the pandemic truly is the reason for the low growth (which I doubt) or if the company merely gets through a half without losing a big contract, then it seems very likely indeed that the growth rate will in fact re-accelerate.

Unfortunately, this will take some time, and I’m quite concerned about the reputational damage the company will suffer from blaming its guidance downgrade and low growth purely on the pandemic. Indeed, the downgrade to guidance in and of itself was a black mark.

On top of that, the company only has $119 million cash but about $80m in of that in upfront cash consideration, even after issuing abut 13.3 million shares as part of the scrip consideration.

That puts it in a weak position relative to its competitors, like Samsara, which can raise money at higher valuations because it is growing more quickly.

Overall, these results made me think less of Eroad, particularly because the management did not confront head-on the issue of fierce competition, but rather tried to blame macroeconomic conditions for their weak results. It is also damaging that the company raised capital at A$5.25 on guidance that it then downgraded, and withdrew.

In Conclusion

While I still believe that Eroad is an interesting investment trading below its intrinsic value, the factors above have sufficiently undermined my trust in management that I no longer believe it is appropriate for Eroad to be such a large position in my portfolio. It is currently an 8.5% position for my portfolio, but I will look to reduce that to around 6% in the very near future.

I still believe that in the medium term, this stock will probably resume growth at around 15% per year, and trade on closer to 5 or 6 times AMRR. That implies very substantial upside in the share price, which I think could easily double or even triple over the next few years.

However, the fact that the company has missed its guidance, then blamed it on the pandemic, in the face of evidence that the slower growth comes from competitive pressure, means that management is on thin ice. If they miss guidance again or make other errors in communicating with shareholders, they could find that investors flee the the stock. This would break down the thesis that they can win more fans over time, by being honest and competent management with high integrity.

Of course, this impulse must be tempered by the fact that the CEO himself invested millions at $5.25, and remains well aligned. It is important to remember that the major acquisition of Coretex has slowed down the sales cycle, because many potential clients are reportedly waiting for the combined “Corehub” product, rather than simply buying the current eHubo2 device.

Overall, I still see Eroad as a high quality business with excellent long term prospects trading at a significant discount to fair value. However, I am stylistically inclined to overweight my assessment of management and I do not want to ignore the warning signs arising from this report.

All things considered, I will look to sell around 20 – 30% of my Eroad shares in the very near future, potentially by the time you are reading this, starting tomorrow. However, please note, I may sell my shares quite slowly, given I still think that the company is undervalued. My only concern is that I have allocated too much of my portfolio to it. If I didn’t own any shares at all, I’d probably still buy some (just not as many as I have).

Please remember that these are personal reflections about a stock by a diarist. I own shares in Eroad and intend to sell some of them tomorrow.

This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.