In the last two weeks, we have seen the predictable and predicted capital flight from growth stocks. Dogecoin and a whole range of ludicrous cryptocurrencies are gaining 10,000%, but the “meme growth stocks” of 2020 are crashing.

Legendary short seller John Hempton has pointed out that if you type in “how to” from an incognito browser into google, right now, the first suggestion is “how to buy dogecoin”. Further, he has pointed out in this blog post, that the first dogecoin pump coincided with the peak in the market in February, but this second pump is independent of the market.

This is a good chart (@John_Hempton‘s idea)

— A Rich Life (@ARichLifeAu) May 8, 2021

See Interest over time on Google Trends for how to buy stocks, How to Buy Dogecoin – Worldwide, 2004 – present – https://t.co/rQAszUuK4V

This is pure speculation on my part, but it feels to me like hot Robinhood money that was once in Fastly and Square and Tesla and Shopify, went to Gamestop, and is now in Dogecoin. Only one of those is an actual growing business.

It takes a nimble footed trader to win in all seasons. Just as one fellow might emerge a huge winner from the dogecoin bubble, another will buy the peak, more or less, and do his dough completely. Similarly, in the markets you would have to be very nimble to benefit from the massive bull market in growth stocks and also be perfectly positioned (ideally by February or earlier) in value stocks, ready to benefit from their relative outperformance.

Of course, the inevitability of failure does not mean one shouldn’t try. For me, within the limits of being mostly invested almost all of the time, I still want to try to maximise returns. And indeed, I did somewhat expect this sell off. As I said in January:

The high valuations and immense buzz about investing is making me nervous. It has been a big couple of years for many of us, in terms of returns. Personally, I am thinking now is the time to be more cautious.

Now we’re in it, of course, I’m glad for my caution but wish I did more. Should I have sold some more Pro Medicus? Have I weeded out the stocks I don’t want to hold in a bear market?

One thing to remember is that growth stocks and small caps do tend to go through periods of outperformance and underperformance versus the broader market. For example, I can remember a time only a few years ago, around 2017, when small-cap growth did underperform. Pro Medicus dropped about 25% from its share price highs and most of the picks I’d done in Hidden Gems that year were underwater. What happened of course is that I held all my Pro Medicus shares and kept on allocating capital into small-cap growth stocks. And eventually markets turned again and some of those pain trades paid off big time. Even the failures went up. Such is the nature of the market.

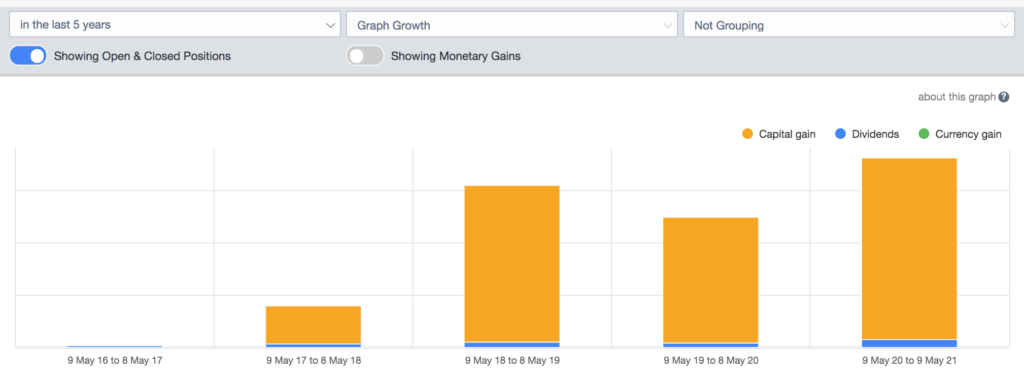

You can see below that in May 2016 to May 2017 I made basically no money.

So What Now?

One thing to remember is that small-caps often lag macro trends. Given that the big growth stocks internationally, and at home, have all been falling, I believe smaller growth stocks will suffer the same fate.

To my mind (and this is just a guess) now is really the last chance to be ditching anything that I don’t want to hold throughout a bear market in growth stocks. And as you will see from my disclosures, I have been a net seller this week, as well as last week. However, I have also continued allocating to more traditional low-PE “value investor” style stocks.

Personally, given my expectation that my major growth stocks will fall back, I am more interested in buying value stocks that might be too cheap right now. Having said that, I’m also consulting my two fluffy dog watchlists that I completed recently:

These two lists give me 6 stocks that I would most like to buy, that are all reasonably close to a buy price for me. I have already started to nibble at 2 of them, as per my recent disclosure.

As a result, the main thing I am doing is sitting tight, and continuing to ensure that I have money in companies that I have sufficient confidence in that I would hold them throughout a downturn. One example of how this has impacted my portfolio is that I reduced my Ansarada holding slightly. The fact that the company shares a chairman with Nearmap makes me less comfortable, since I think Nearmap has been massively overhyped. Then again, the chairman has been involved with a real mix of businesses on the ASX, some of which have been successful (eg Macquarie Telecom).

Ultimately, I think that the most attractive stocks right now to buy are still probably cheap value stocks that have not yet got caught up in the “rotation to value”. Of course, before long we will probably reach the end of the growth stock bear market. I can’t say when that will be, but my guess is a lot of these growth companies will not trade as low as they did in the panic of March 2020. In any event, I plan to work on another fluffy dog watchlist of the highest quality stocks to buy in a downturn. These high quality stocks may never get cheap enough, but it’s still worth having buy prices in mind.

In the near term, I think the winners of 2021 will be “reopening stocks”, such as Lastminute.com NV (LMN, on the Swiss exchange), and which I own. Closer to home, I suspect something like Dusk Group (ASX: DSK), which I hold, and Apollo Tourism (ASX: ATL) which I do not hold, will do well. Having said that, companies like Nanosonics (ASX: NAN) and Eroad (ASX: ERD), both of which I hold, have ostensibly had trouble making sales in a socially distant world, and so should benefit in the near term. Finally, I’ll also keep any eye out for undervalued little “value investor” companies like Ambertech (ASX: AMO).

This is not advice. These are investment notes of mine; not a recommendation. I could have made mistakes in the notes; and I still have many loose ends to explore. I own shares in PME, AND, DSK, NAN, ERD, AMO, SHOP, FSLY at the time of writing. Please read our detailed disclaimer.