This article is not really aimed at identifying stocks that will go up during what is a tragic and difficult time for economies, and the humans that drive them, all over the world. It is, however, aimed at beginning to outline the “fishing pond” where investors will (probably) find businesses that are well positioned to ride out this storm, and even come out stronger. The data around market cap P/E and enterprise value to revenue are not meant as an indication that a stock is cheap or expensive, but just to give a quick look at what that company is.

Each company section starts with a recent quote from the company itself, regarding the impact that the pandemic is having on the business. Please keep in mind none of this is intended as a recommendation or advice, these are just some notes and observations, documenting the public statements companies have made.

ResMed (ASX: RMD)

“Revenue in the U.S., Canada, and Latin America, excluding Software as a Service, grew by 12 percent driven by strong sales across our mask and device product portfolios, including increased demand for our ventilators due to COVID-19.”

I’m not usually a large-cap investor because I don’t think I have so much of an advantage investing in big companies. I initially bought RMD shares because I thought it might raise capital, but given the quote above, it doesn’t look that likely.

Nonetheless, I retain the stock because I think it’s an easy one to buy if markets tank again because the disease starts spreading more quickly in the USA. Unless countries want to suppress the disease until there is a cure or vaccine, there may be places such as Sweden and the USA that take the approach of just letting it rip through the population. This won’t benefit their economies (in my view), but it will mean demand for breathing apparatus like ResMed’s ventilators will remain stronger for longer. Although its trailing P/E is high at 44, accounting for growth the forward P/E is probably closer to 35 (or even below that).

- Market Cap: $34.34b

- P/E (trailing twelve months, excluding extraordinary items per capIQ): 44.1

- Enterprise Value / Revenue (trailing twelve months per capIQ): 8.2

Fisher & Paykel Healthcare Corporation (ASX: FPH)

“Our respiratory humidifiers and consumables are directly involved in treating patients with coronavirus. We have seen an increase in demand globally and have ramped up our manufacturing output. At the same time, we have benefited from stronger sales in our Homecare product group and a weakening of the NZ dollar.”

FPH was one of the first companies to flag a coronavirus driven tailwind, upgrading its guidance on February 21 and noting strong sales of hospital products due to the pandemic. This meant that it was one of the surest beneficiaries in the market throughout the March sell-off, making it a natural flight to safety for investors. As a result, I believed that the move had happened without me. Given the strong profit growth, the forward P/E is closer to 50, but that’s still fairly expensive. Nonetheless deserves its spot on the watchlist as it is probably the most obvious and first beneficiary of the pandemic (amongst ASX listed stocks).

- Market Cap: $15.33b

- P/E (trailing twelve months, excluding extraordinary items per capIQ): 70.5

- Enterprise Value / Revenue (trailing twelve months per capIQ): 14.5

EBOS Group (ASX: EBO)

“During the third quarter ended 31 March 2020, the Healthcare segment experienced unprecedented levels of demand in response to COVID-19 developments”

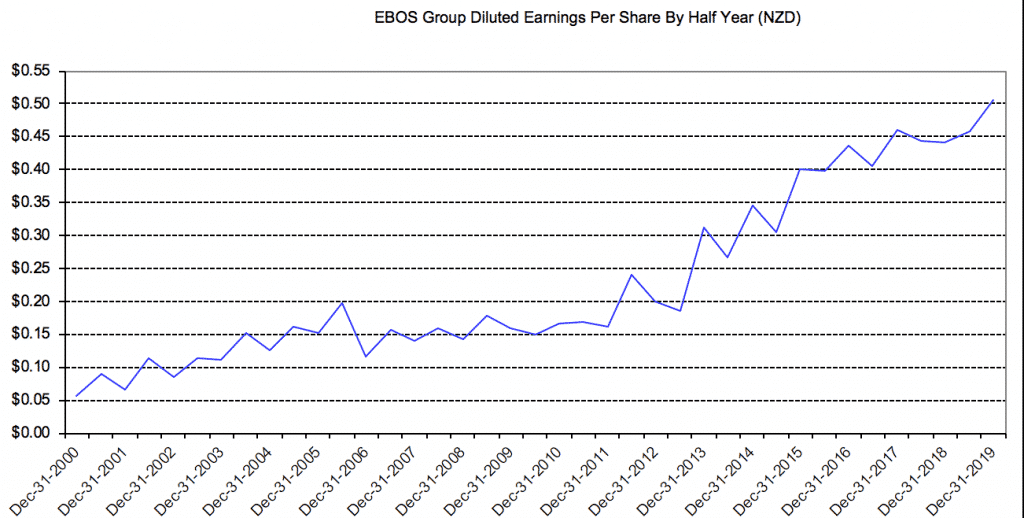

EBOS is a conglomerate in the pharmacy distribution, retail pharmacy and owner of retail brands. Overall, I would expect it to show its resilience as a business throughout this pandemic. During March, I refrained from looking closely at the stock due to the concerning timing of its CFO resignation (announced March 10), after only about 2 years. Also disappointing was the 2019 resignation of the long-serving chairman (and former CEO) after more than 2 decades. However, EBOS has performed so well over the years that it may simply have great DNA as a business. You can see that despite plenty of ups and downs, its earnings per share has increased 9-fold in less than 20 years.

With a trailing yield of 3.2%, this should do ok in a low interest rate environment. However, if we’re willing to set aside the CFO resignation, this is one that could be a good buy during a sell-off.

- Market Cap: $3.4b

- P/E (trailing twelve months, excluding extraordinary items per capIQ): 22.3

- Enterprise Value / Revenue (trailing twelve months per capIQ): 0.5

Dicker Data (ASX: DDR)

“With many organisations enabling their workforces to work remotely we have seen a surge in demand for remote working solutions across both our hardware and software portfolios, highlighting IT distribution’s role as an essential component for business continuity.”

Dicker Data is notable for its high insider ownership as well as considerable recent director buying. While I did not sell any shares in this company, I also failed to buy any in March, even when it fell to prices I deemed attractive. My hesitance at the time was due to the fact that I think that the velocity of money — spending in general — will slow down during a recession. Having said that, in hindsight computing equipment will probably be less effected by this due to the need to enhance remote working capabilities. While I’m not so sure the advantage will be long-running, low interest rates associated with stimulus efforts by central banks will be a longer lasting tailwind for Dicker Data, which uses debt to finance its inventory purchases.

Dicker Data appears on my latest fluffy dog watchlist with a target buying range of up to $5.40.

- Market Cap: $1.14b

- P/E (trailing twelve months, excluding extraordinary items per capIQ): 20.9

- Enterprise Value / Revenue (trailing twelve months per capIQ): 0.7

Temple And Webster (ASX: TPW)

“Being an online-only business, we can scale quickly and are responding to the increased demand by expanding our customer service team.”

Temple and Webster never seemed a particularly attractive business to me. However, I should have been buying the (share price) dip during March, just as my partner was buying a whole bunch of items from them to furnish our new abode. In my opinion, the first thing people do when they have to spend more time at home is to cover the basics. Next, they will try to improve their situations. This should see houses become more attractive relative to apartments, and spending on household accoutrements relatively attractive compared to spending on (for example) expensive dinners out or holidays abroad (not likely!). Retail won’t fair well in a recession, but I reckon Temple and Webster will go well, at least until the boosted Jobkeeper and Jobseeker payments expire (not before October). This is a short term “pandemic tailwind” stock for me at the moment.

- Market Cap: $442m

- P/E (trailing twelve months, excluding extraordinary items per capIQ): 128.4

- Enterprise Value / Revenue (trailing twelve months per capIQ): 3.4

MNF Group (ASX: MNF)

“MNF’s Direct business is experiencing higher than normal usage volumes, given the surge in demand for voice services from small business, enterprise and government customers as they seek to remain connected. The Express Virtual Meetings service, (formerly known as CCI), is experiencing the strongest demand in this segment with conferencing minutes in March up 186% from the prior month.”

I consider MNF Group to be an investible company generally due to its long history of EPS growth, as you can see below. Trading on a FY 2020 P/E of around 30, I do think that analyst expectations might be a bit too high at the moment. Having said that, I also think it may just be in the right place at the right time to benefit from increasing Unified Communications As A Service, like Twilio and Zoom. MNF helps provide voice connectivity to these kinds of companies, so benefits if they become increasingly important.

It’s on the latest fluffy dogs watchlist with a target buying range up to $3.50, but I have since paid a little more to top up my holding given their bullish update announced last week. I sold this in early March only to buy back as the share price dropped. Unfortunately, I did not buy back as much as I should have, given the likely tailwind for the business model.

- Market Cap: $391m

- P/E (trailing twelve months, excluding extraordinary items per capIQ): 29.3

- Enterprise Value / Revenue (trailing twelve months per capIQ): 1.8

Whispir (ASX: WSP)

“Increased demand for communications software during the COVID-19 pandemic, and the ready availability of Whispir’s new easy-to-use templates, has contributed to a record 49 net new customers in the quarter.”

Digital communications at scale are becoming more important regardless of the pandemic. For example, one of my challenges at the moment is building a system that can ensure Supporters receive the kind of communications they desire when they desire. We currently use Mailchimp, which is not integrated with SMS, so incorporating SMS notifications is a lot of extra work. However, something like Whispir could potentially satisfy our email and SMS needs at the same time. Depending on price this may be the way to go. One thing that is certain is that it is a hassle to change this kind of provider, and the more integrated it is, the more annoying it is to change. For example, if I started using Whispir for communications management (and I am exploring this) then there is no way in hell I would move of it any time soon. It is just too much hassle.

I have trouble deciding whether this is a shorter term “pandemic tailwind” stock or a longer term “growth compounder”. It could be either but I’m leaning towards the latter.

- Market Cap: $197m

- P/E (trailing twelve months, excluding extraordinary items per capIQ): losing money

- Enterprise Value / Revenue (trailing twelve months per capIQ): 5.3

MedAdvisor (ASX: MDR)

“COVID-19 has radically accelerated the shift to digital health, advancing a cultural change that may have taken 5 years or more. MedAdvisor is extremely well placed to capitalise on this cultural shift as we provide an end-to-end solution that improves medication adherence and patient engagement in their medication management.”

With MedAdvisor, we’re getting to the riskier end of the spectrum of pandemic beneficiaries. On the positive side of the ledger, MedAdvisor’s services simply make sense. Why on earth do we rely on paper scripts and needless waits at pharmacies while they are filled. MedAdvisor allows us to order scripts to be filled in advance, then pop in some time later and pick them up, ready and waiting. I’ve tested it and it works well enough, though it makes changing pharmacy a pain (which is, I suppose, the selling point for the pharmacies that use it). Now, you can even get scripts delivered.

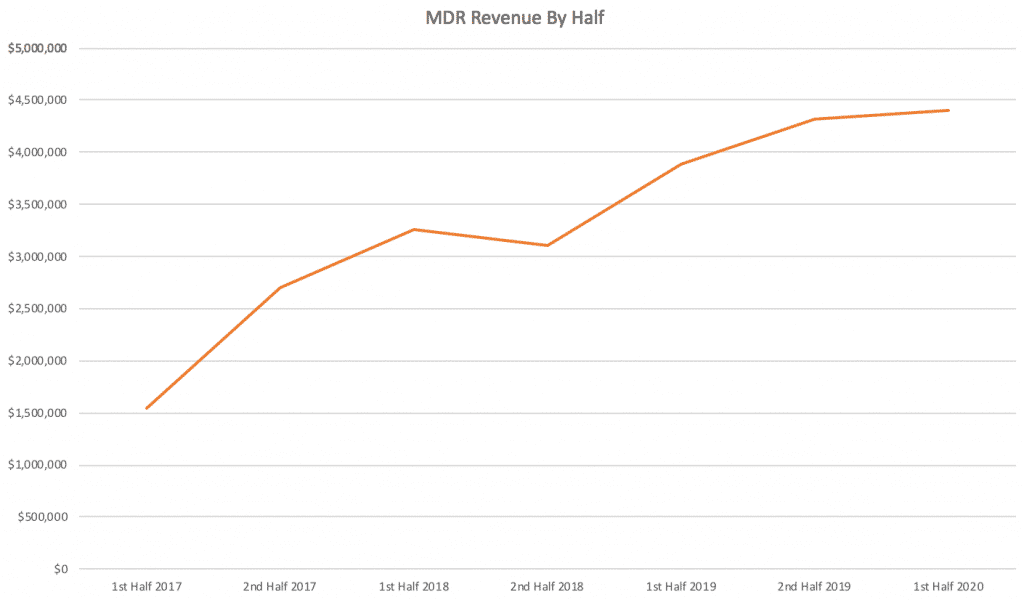

Relative to some of the other opportunities here, I’m not super excited about MedAdvisor given it is burning cash at a whopping $2.7m a quarter and its founder recently sold a bunch of shares. Having said that, its market position could be much more valuable than its market cap in the long term. It has over $13m in cash so it has no acute need for cash. As shown below, revenue growth is slow given the high expenditure.

- Market Cap: $116m

- P/E (trailing twelve months, excluding extraordinary items per capIQ): losing money

- Enterprise Value / Revenue (trailing twelve months per capIQ): 11.5

3P Learning (ASX: 3PL)

“Although we’ve seen increased demand, full year revenue and EBITDA will be moderated by our product sales mix (3P Learning owned vs 3rd party owned products), timing (when we can recognise associated revenue) as well as increased sales commissions and variable wage costs to support customer demand, which are recorded immediately.”

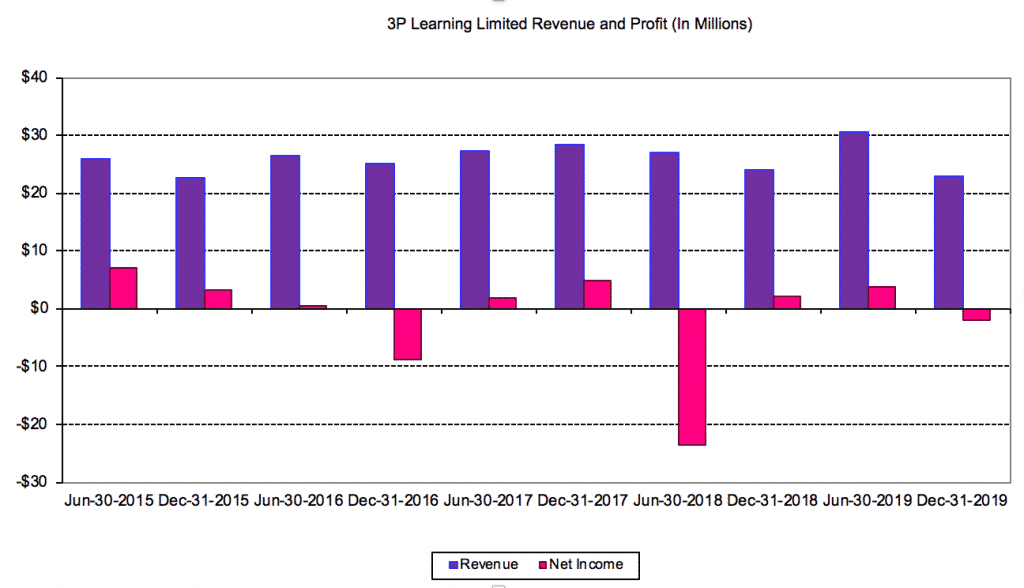

In my opinion, 3P Learning is a troubled business plagued by overpaid management who have no proven track record of creating value for shareholders. As you can see below profit has been unreliable and revenue falling.

Having said that, it only has an enterprise value of just over $110m which is only about 2x trailing revenue. If this was run properly, it should be enormously profitable. At a net profit margin of just 10% (hardly a big ask for a company providing an automated service) the company should be capable of paying out a sustainable growing dividend of 5% or more. I don’t expect this disgracefully run operation to change its colours, but I don’t need it to, given the market is generally ignoring it. I just need the market to start believing for a moment that management might do a halfway decent job and this should re-rate upwards. I’d look to sell this on gain of anywhere near 50% unless it does something particularly impressive.

- Market Cap: $105m

- P/E (trailing twelve months, excluding extraordinary items per capIQ): 51.6

- Enterprise Value / Revenue (trailing twelve months per capIQ): 1.8

Open Learning (ASX: OLL)

“Record enrolment growth was driven by increased interest in online education due to COVID-19 and the launch of previously planned courses from existing clients. The Company’s business in Australia saw an increase in enrolments in university-level courses as well as lifelong learning and professional development courses.”

I have some concerns about OpenLearning (which I still own shares in) since it only managed to grow its recurring revenue by about 10% in the last quarter. At that rate it would take about 6 years to reach $10m ARR. On the other hand, it did announce that it “has already won new business as a result of the partnership” with Alibaba Cloud. If it can profitably expand into China, then it could really accelerate growth, though that seems like it’s a low probability possibility at this point, rather than a likelihood. The widespread disinterest in this stock from respectable professional managers still reminds me of Volpara at 30c, which was similarly mocked for its early stage and big vision (before subsequently becoming a much loved meme-stock). Risky, but worth following until the mess up, in my view.

- Market Cap: $25.1m

- P/E (trailing twelve months, excluding extraordinary items per capIQ): losing money

- Enterprise Value / Revenue (trailing twelve months per capIQ): 11.1

If you haven’t already tried Sharesight, it saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade, you’ll get at least 4 months free (recently increased) and we’ll get a small contribution to help keep the lights on.

Disclosure: at the time of writing author holds shares in OLL, 3PL, MDR, WSP, TPW, DDR, RMD