Over recent months I have had many readers ask me whether the recent market falls make me want to buy stocks. As it happens, I have not meaningfully increased my exposure to markets for many months, even in the face of significant share price falls. As a result, I have quite a bit of cash on the sidelines. This article is about the signs I want to see in order to deploy that cash into stocks, particularly small cap ASX stocks, which is my main area of focus.

Now, I’m not saying that I try to time the market perfectly. I’m invested now, and I’m always invested, but I do vary my capital allocation.

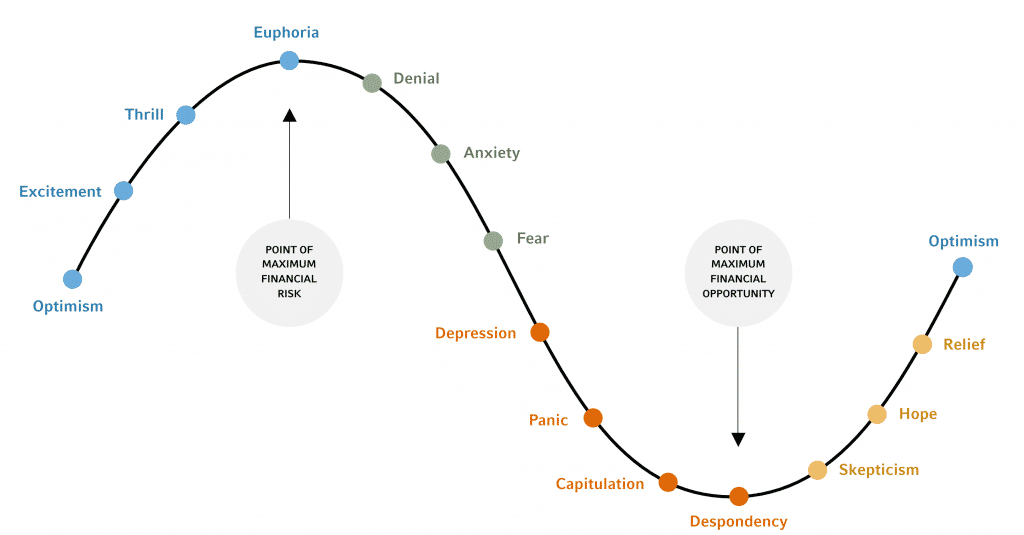

In order to understand why I am happy to hold so much cash relative to my stock portfolio, it is necessary to take a look at where we are in the sociological and economic cycle. The general idea is to allocate more capital to risk assets (like ASX small cap shares) when we are between capitulation and hope, in the chart below, and more selling when we’re between thrill and denial.

As the novel coronavirus known as Covid-19 made its way around the world in 2020, authorities reacted with hugely impactful measures. Alongside massively changing citizens behaviour, authorities drastically decreased the cost of debt, while also providing citizens with significant amounts of free money, in order to keep them spending.

Tragically, central banks kept the cost of debt far too low for far too long, even after vaccines were reducing the threat posed by Covid-19. As a result, asset bubbles were created everywhere you look; real property, stock markets, bonds, commodities, used cars, jpegs, and hell, even cryptotulips.

These bubbles were obvious.

As far back as January 2021 I wrote an article asking “Are Markets Euphoric Now?” and concluded that “over the next six months I will try to avoid putting any incremental capital into the market. That means that I will be doing less buying because first I will need to sell some stocks to fund the purchases.” Then in March 2021 I explained why rising interest rates would hit growth stocks. It wouldn’t be until November 2021 that markets reached their peak, reminding me that cycles can take longer than one might expect, to turn.

In December 2021, I wrote about inflation, outlining our plans to sell our investment property in order to “put myself in a position to be deploying capital into the growth stocks worst hit by inflation during 2022.” I added that: “I’m not in too much of a rush because with inflation still running high, it’s hard to see any further multiple expansion in the already bubblicious small cap tech growth sector.”

By May 2021 I realised that inflation was going to be a lot worse than I had thought in December and explained “Why I’m not ignoring Inflation”.

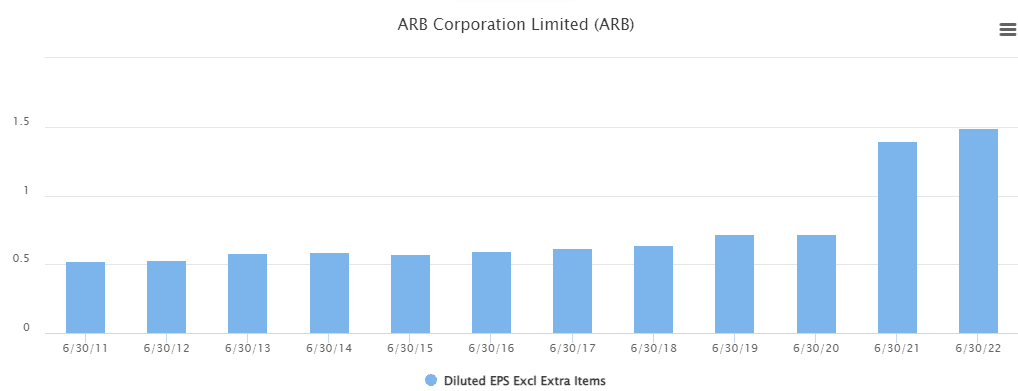

Of course, not only did easy money drive up stock price valuations, but many companies themselves actually received massive boosts to earnings, as a result of huge stimulus. An extreme, but illustrative example is bullbar and 4WD accessory company ARB Corporation (ASX: ARB). You can see how covid stimulus massively boosted its earnings, below, courtesy of Seaforth Ben.

More recently, in June, I outlined my view that a recession is coming and highlighted that the most important thing for ASX Small Cap investors is to have plenty of cash to deploy when things get really tough. Therefore, for the purposes of this article, I assume that all investors have plenty of dry powder set aside to take advantage of opportunities as they arise.

Now, since I have plenty of cash, I need to think about when to deploy it.

When Should I Buy Small Cap Stocks?

During a bear market, wealth is transferred from the financially weak, who don’t have any cash and may be forced sellers, to the financially strong. Small cap stocks are high volatility, so they tend to exhibit the biggest swings in price. Since you are unlikely to pick the exact bottom, that means that at some point or another, it is very likely small cap investors will be underwater on their investments. It is important to mentally prepare for that reality.

And the reality is, when it is time to buy, it will be scary to do so. Existing holdings will mostly be down, and uncertainty and pessimism will ride high. Therefore, I’m going to force myself to buy something when I see the following signs:

- Inflation rates fall below 6%, (or otherwise significantly declines from its peak).

- Forbes reports that the Reserve Bank forecasts inflation “to peak at 7.75% in the December quarter of 2022.”

- Keep in mind inflation could fall… then go back up!

- Developed nation central banks like the Federal Reserve or the RBA actually cut interest rates, rather than hiking them.

- Discretionary spending companies like ARB Corporation see very significant declines in earnings.

- The Buffett Market Valuation Indicator, as defined by this website, hits the long term trend line.

- There are multiple ways to define this and use this indicator, but I think the website linked above is useful because it is well explained.

- Newspapers start blaming a “property price crash” on politicians, and calling for action.

- Everybody accepts we are in a recession and the government agrees to “do something about it”

- Rising levels of unemployment becomes a political issue.

- Loss making micro and small companies with no discernible business moat such as BeforePay (ASX: B4P), Dubber (ASX: DUB), Emerge Gaming (ASX: EM1), Zoono (ASX: ZNO), Marley Spoon (ASX: MMM), Sezzle (ASX: SZL), Respiri (ASX: RSH) and Douugh (ASX: DOU) cease trading, go bankrupt or are taken over.

- People no longer talk about altcoins or NFTs as investment.

- Second hand assets like cars, jetskis and campervan trailers drop significantly in price (though admittedly we’re already seeing this to a degree). I’ll be looking for evidence of distressed sellers.

- Multiple high quality stocks start hitting my pre-calculated desired buy price range.

Not the bottom, just time to buy!

If your goal is to “pick the bottom” there is no point in trying, because you will probably fail. If anyone does pick the bottom, it is mostly luck… and that’s from someone who (through luck) bought his first shares in February 2009, almost the exact bottom.

However, I do think it is useful to have pre-arranged signals to force myself to buy. More than anything, this is simply a psychological hack. Generally speaking, when things look really ugly, the natural human instinct is to play it safe.

Now, I’m not saying I’ll only buy when these things happen, because certain stock specific opportunities are bound to come up independent of macroeconomic events.

But by promising myself to buy, beforehand, when certain ugly things happen, I increase the chances that I will deploy capital at a favourable time, even if it is not the most favourable time.

Supporters can consult my list of target buy prices for these 6 quality stocks to get an idea of how far I think the market is from offering attractive opportunities.

Sign Up To Our Free Newsletter

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Disclosure: This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).