There’s an old saying that the “stock market climbs a wall of worry”, and that can probably be applied to help explain an almost 3% rise in the S & P 500 last night, after the US Federal Reserve raised rates.

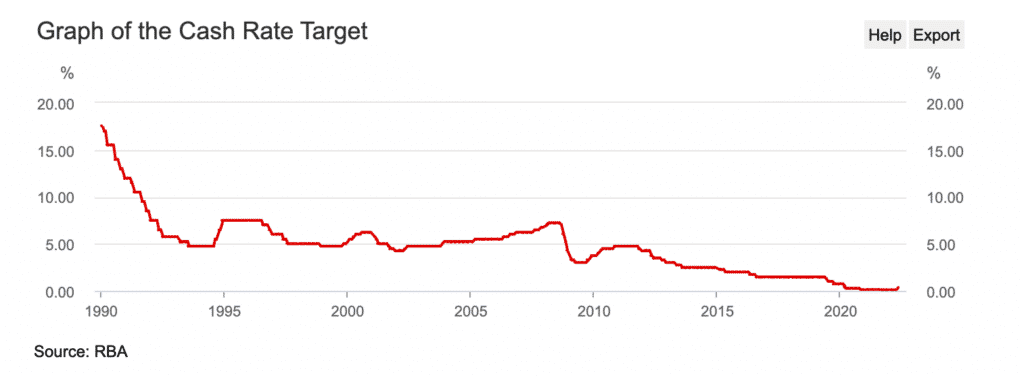

Closer to home, the Reserve Bank of Australia has just increased interest rates from 0.1% to 0.35%, marking the end of a decade-long cycle of interest rate cuts. And as you can see below, there is a lot of room for rates to increase, even if they just get back to 2015 levels.

So, what does this mean for you and I?

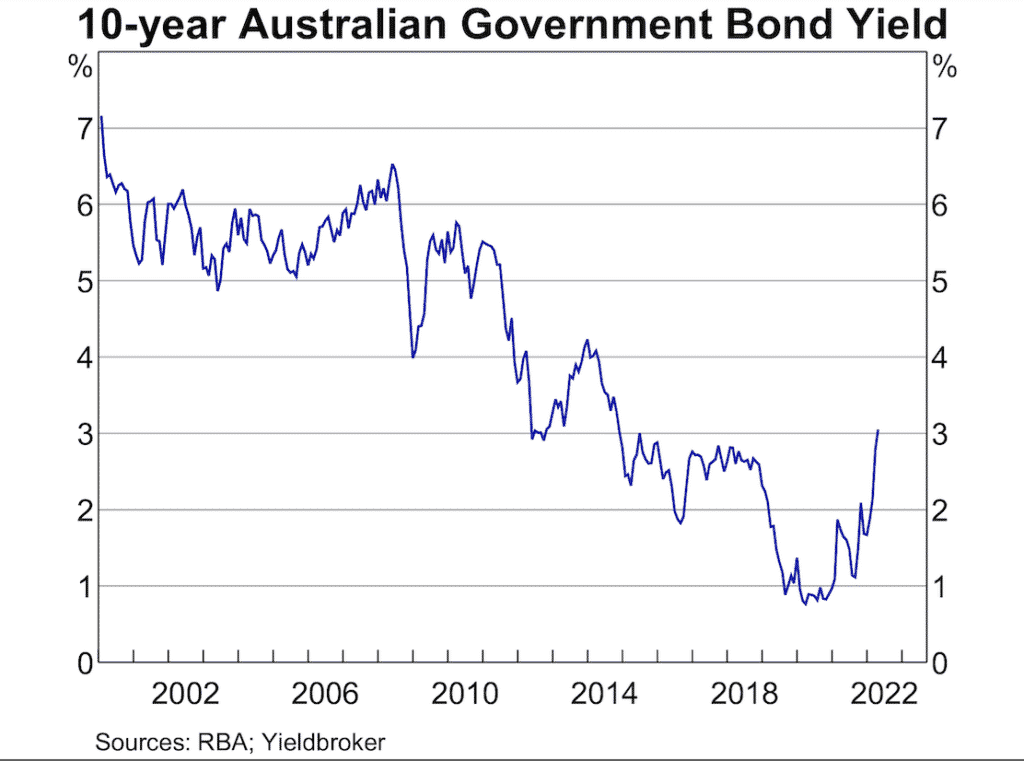

First of all, it means growth stocks will see multiple contraction. If you invest in small-caps, or growth stocks, let alone growthy small caps, your portfolio will have already borne the brunt of the rising interest rates. That’s because the Australian bond market (which basically is the price Australia can borrow at) has already seen rising rates for 6 months now., as you can see below. That is what has been hitting our portfolios.

But the rate increase yesterday is still a reminder that, if you’re not prepared now, then you should be.

Inflation Impact On Stock Prices

As an investor in small cap growth stocks, the rate rising cycle is sure to create many opportunities. However, it is also going to absolutely savage companies who have poor leadership who do not understand the “regime change”. What do I mean by that?

Well, a year ago, the market didn’t seem to care about earnings or free cash flow at all. In fact, the mantra of “spend more for faster growth” was the be-all and end-all. That’s definitely over now.

As it happens, spending more to grow more can make sense, but only if you have the money to spend. When share prices are riding high, companies can burn cash for growth without too much dilution. The economics can stack up. But when share prices are in the toilet, incapacity to fund business operations means permanent dilution at very low prices. If a company has to increase its shares on issue by 50% just to fund its losses for another year, then its share price is probably going to fall a lot.

I don’t mean down 50%. I mean down 85%. If a company is doing significant dilution at 85% below its peaks then like as not, you’ll never see the share price get back to its peak.

So the first key takeaway is to throw out any sense that loss making cash burning small caps will get back to their peak. They may never do so.

That leads us to the second key takeaway, which is that the risk versus reward is simply far more attractive in companies that are trading at or close to break even, or are profitable. These companies could fall 50%, but they are very unlikely to fall 85% or 95%. And if they fall 50%, then they have every chance to recover that and go on to higher highs, as long as they don’t need to dilute. Whereas the company that is burning cash, might need to “lock in” that -85% share price by raising capital.

Over recent months I have been much better served by the profitable businesses in my portfolio; and best served by stuff like DGL Group (ASX: DGL) which arguably benefits from inflation, at least in the short term. On the other hand, almost without exception, my cash burning companies have performed poorly.

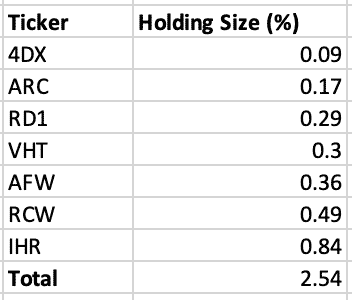

In particular, I’d draw your attention to these seven stocks:

Collectively, these stocks are only about 2.5% of my portfolio. I own them for a variety or reasons, but they have all performed poorly. Each of them is quite likely to need to raise more capital. As a result, they all fall into the dangerous zone described above. As a result, I’m considering selling all of them.

On the other hand, if any of these companies transition from cash burning to sustainable, it’s likely there would be upside for investors. To my mind, it’s probably reasonable enough to have up to 0.3% of my portfolio in such a stock since it probably would remind me to monitor the story. However, until these companies get their act together, we simply don’t know how bad the pain could get.

As a result, I’m planning to reduce both RCW and IHR to around 0.3% of my portfolio.

Inflation impact on Property Prices

The impact of rate rises on property prices is very easy to understand. Higher rates mean that people can afford to borrow less money which means that property prices will go down. In the short term, both political parties are promising policies which will boost the property market, so I’m not expecting a near term decline. But over the rate rising cycle, property prices are likely to stagnate at best.

As a result, Chloe and I are making final preparations to sell our beautiful investment property in Thora. Ideally, we would already have had it on the market by January this year. It will be on the market by September.

Our investment property was originally where we wanted to live; across the road from the highest rainfall, cleanest river in NSW. Backing on to national park boasting waterfalls in walking distance and trees with trunks as big as a car. Of course, then the pandemic came along and we decided to move to Canberra and bought a house on the South Coast of NSW.

The natural buyer of our investment property is a relatively wealthy city slicker who wants out of the rat race. As a result, the core driver of how much someone can pay for our investment property is how much they sold their house in the city for. So, for example, if the Sydney property bubble takes a step back, then so will the realisable value for our place. If we can’t sell for a decent price, we might even consider moving to Thora to oversee some building on the property; if we built another dwelling on the property, we could charge more to rent.

In an inflationary environment, *positively geared* landlords will do OK, if they have a secure job with potential for pay rises or are otherwise able to increase their income. In theory, rents will increase, income will increase, and so the debt will become easier to pay off.

On the other hand, landlords who cannot cover the (increasing) interest payments with the rental income stream will become distressed, and will become forced sellers with time. I would not dream of borrowing so much money that the income from rental did not easily cover the interest payments from any mortgage.

Inflation Impact on The Economy

As you can imagine, a weaker stock market and (in particular, for Australia) a weaker housing market, could have a very detrimental impact on our economy. While Australia is blessed with lots of natural resources (which should help our economy in an inflationary environment) the increasing cost of fuel, rent and shelter means that there will be an awful lot less spending money sloshing around the economy.

In fact, it’s quite possible Australia could enter a recession. If this happens, it will be the ideal time to deploy the cash I have sitting on the sidelines.

In the meantime, it is probable that certain industries will face a massive reduction in demand. In particular, I have in mind the no-moat retailers like Temple and Webster, Adairs or Dusk Group, all of which I have owned at one time or another. It’s likely these retailers will get absolutely smashed by increasing wage costs, increasing rental costs, increasing working capital (more inventory spending) and falling demand.

The reality is, candles are a luxury, not a need, and might be one of the first things cut from a household budget. And when it comes to buying the new couch from Temple and Webster, most people can simply delay the transaction.

For a recessionary environment, it is much better to own companies that extend the useful life of existing equipment. Examples from my portfolio include Laserbond (ASX: LBL) which extends the life of mining equipment, Supply Networks (ASX: SNL) which extends the life of busses and trucks. A classic resilient business for a recessionary environment is Bapcor (ASX: BAP), which allows people to extend the life of their existing automobiles. However, that is a mixed bag because it has di-worse-ified over recent years and now includes more discretionary retail elements in the business.

Generally, healthcare businesses have resilient demand during a recession, so I will be looking to add more healthcare stocks to my portfolio just in case that scenario does eventuate.

Overall, the outlook for investors remains quite negative in my view. It’s not so bad that I’m going drastically to cash, like I did when Covid hit in February 2020. But I do think that it’s prudent to have a fair bit of dry powder, in the likely event that financial markets start offering much better bargains, later in the year.

Of course, the most important thing to remember is that it’s best to own capital light businesses with pricing power. That is absolutely my strategy in all seasons. In the next few days, I’ll publish another fluffy dog watchlist with more capital light businesses, and the prices I’d like to buy them.

I own shares in a number of the companies mentioned including DGL, LBL and SNL. I plan to sell some of my IHR and RCW shares today, as explained above. While this article does cover financial subject matter, the article is not financial advice, and should not be the basis for any buy or sell decision. It is general in nature, and our disclaimer is here.