When the going gets weird, the weird turn pro. – Hunter S Thompson

I got an email yesterday morning advertising the final frontier of investing, made accessible via new breakthrough technology — or that was the impression I got, anyway. It turned out the frontier referred to was US stocks, or so it seemed. I still don’t know what the breakthrough technology was.

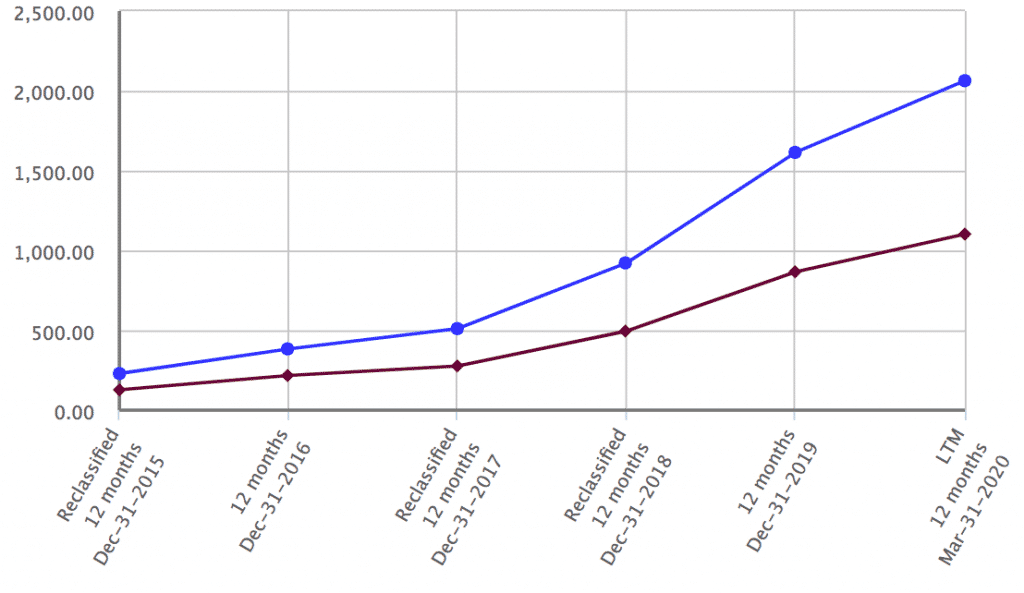

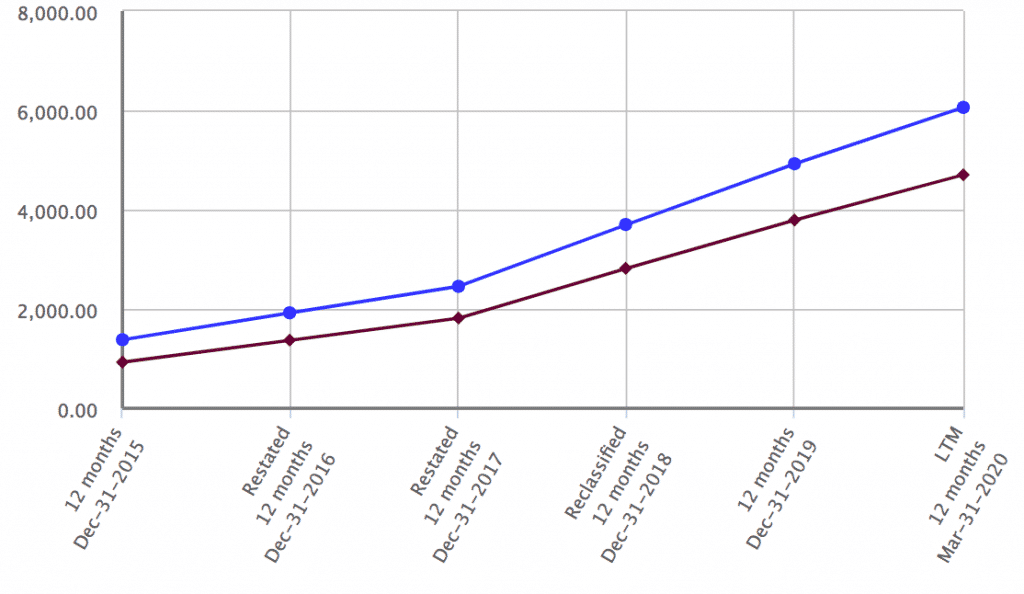

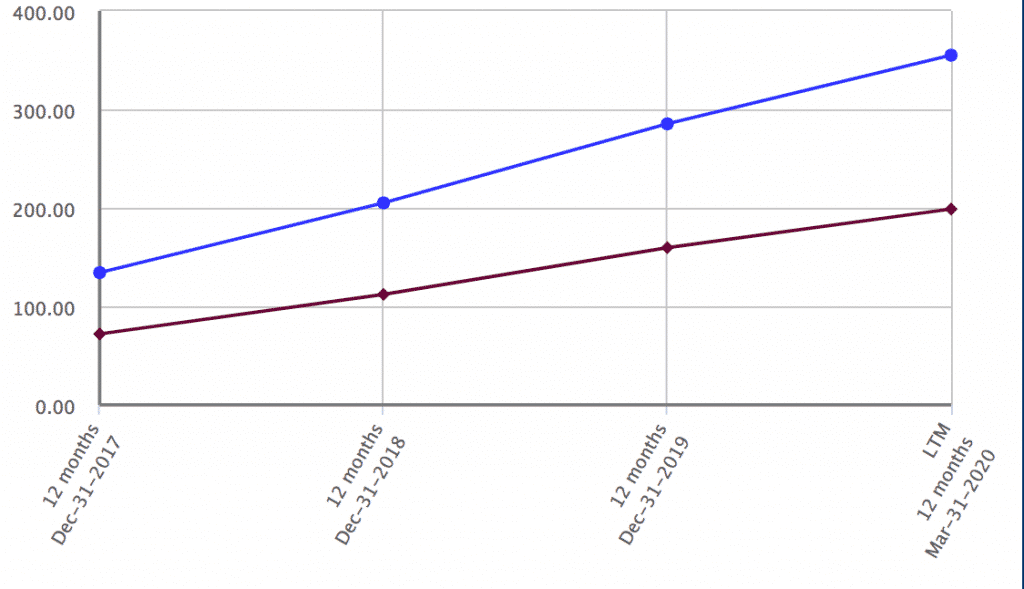

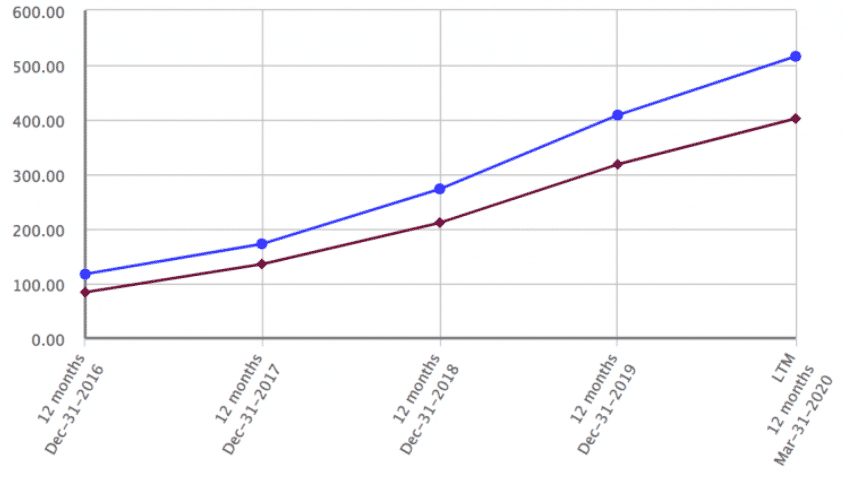

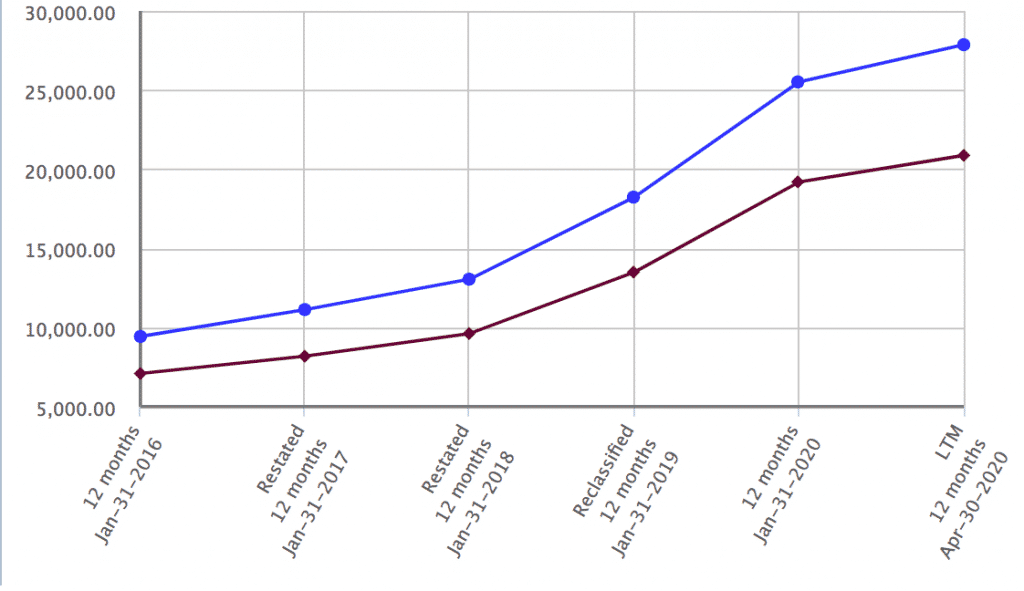

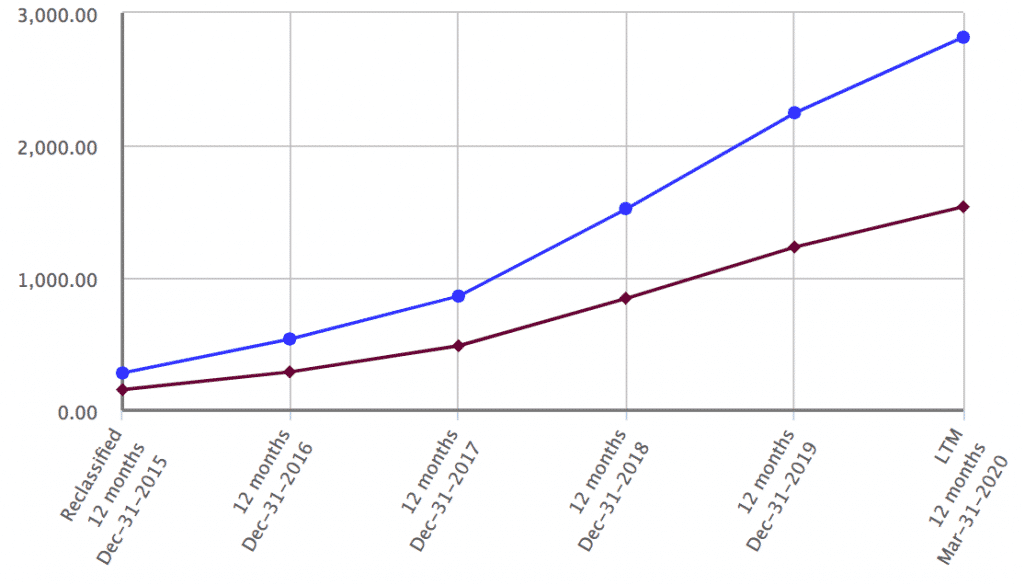

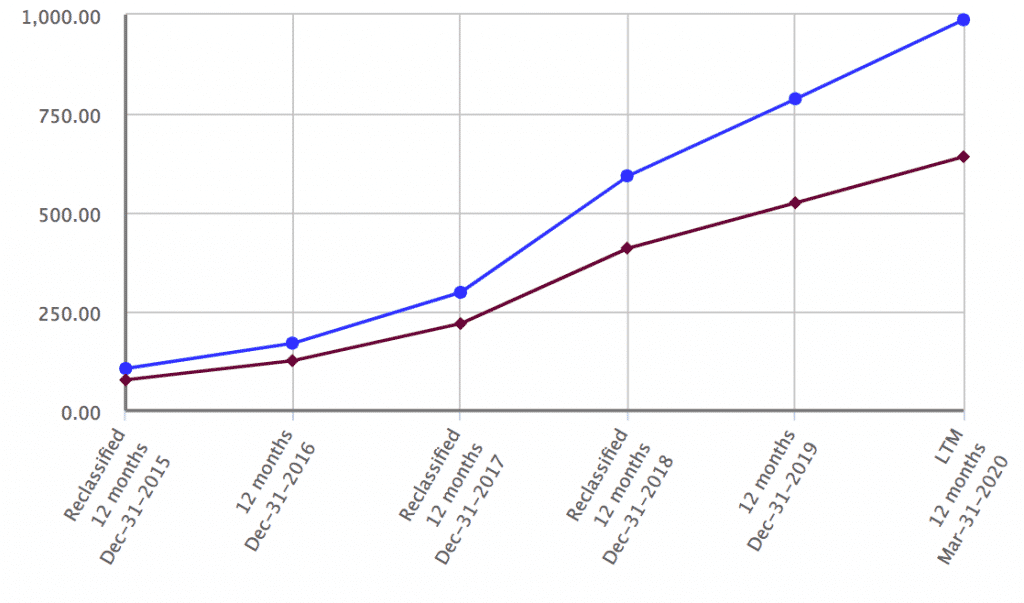

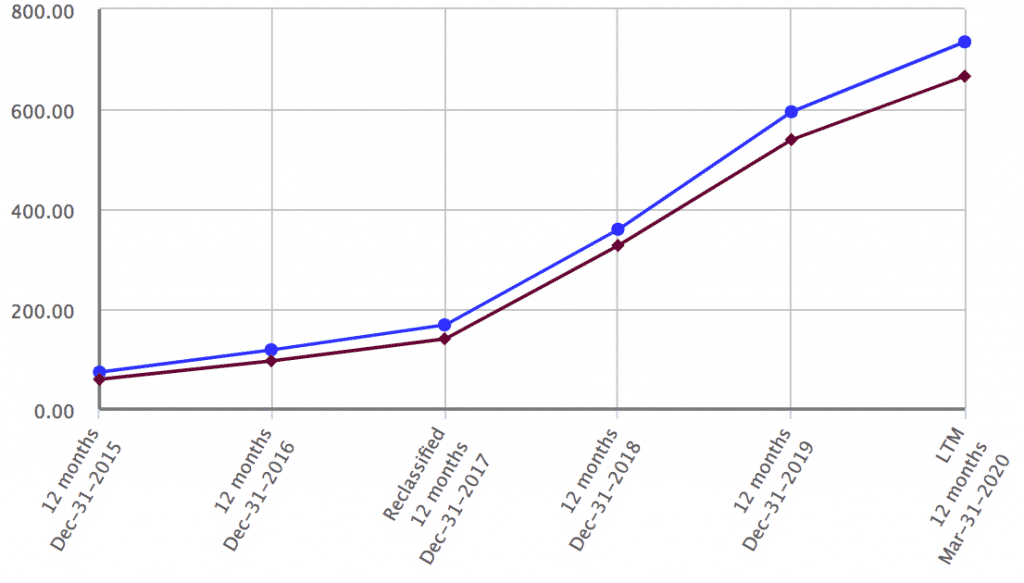

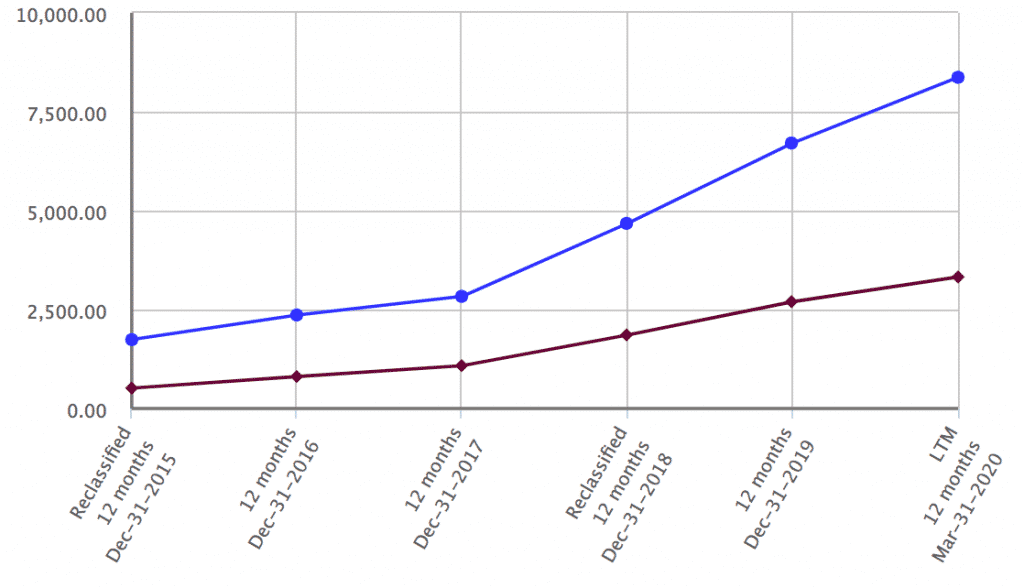

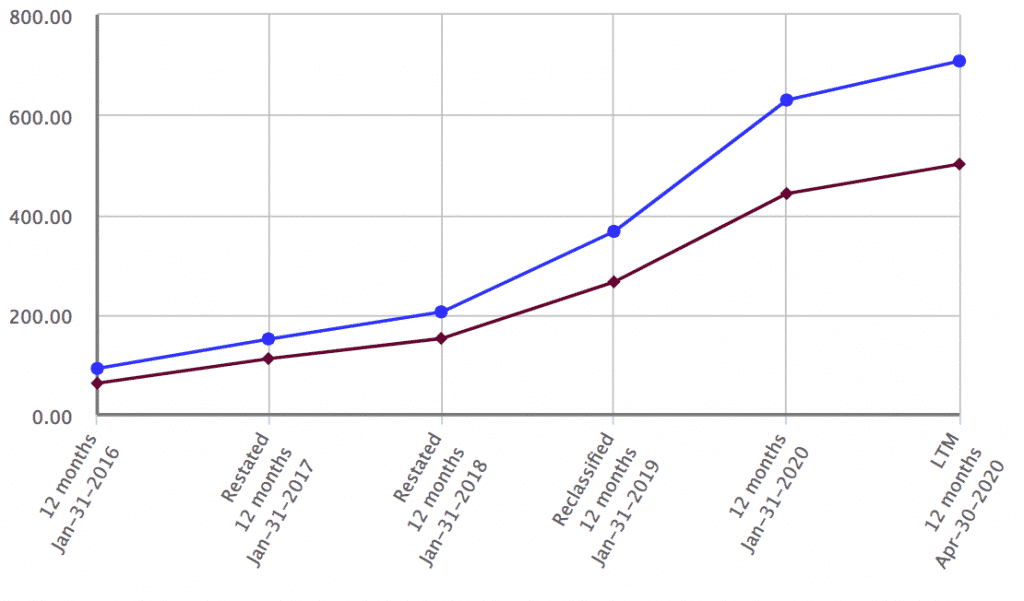

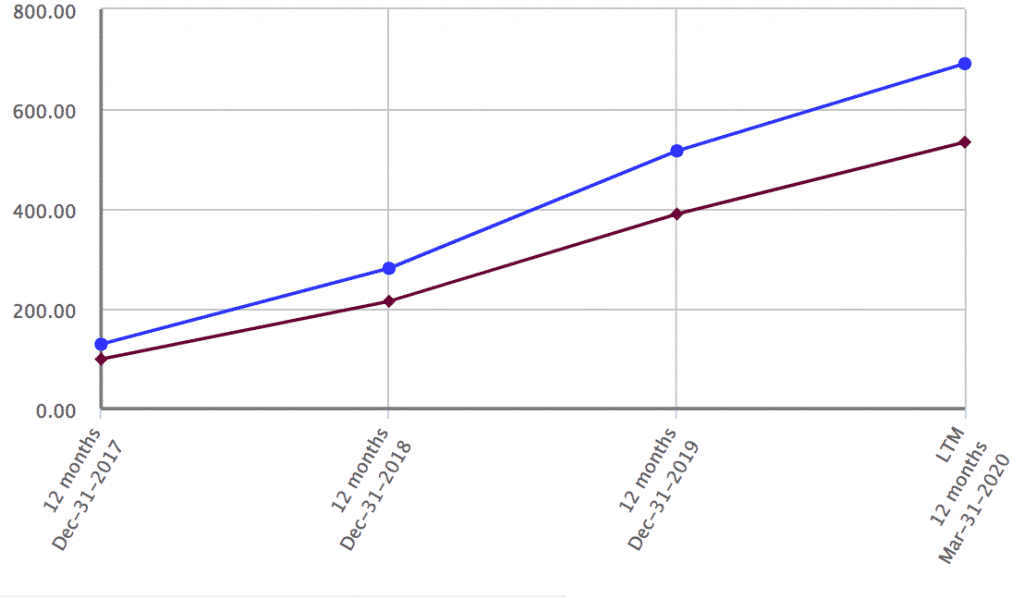

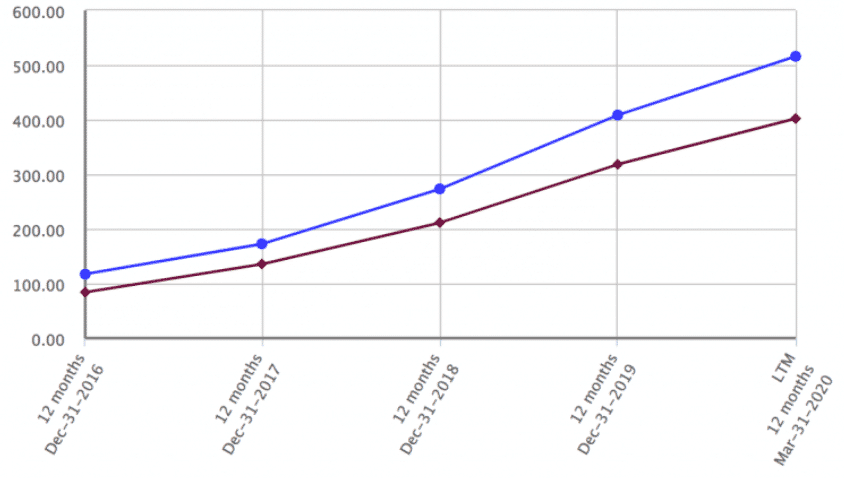

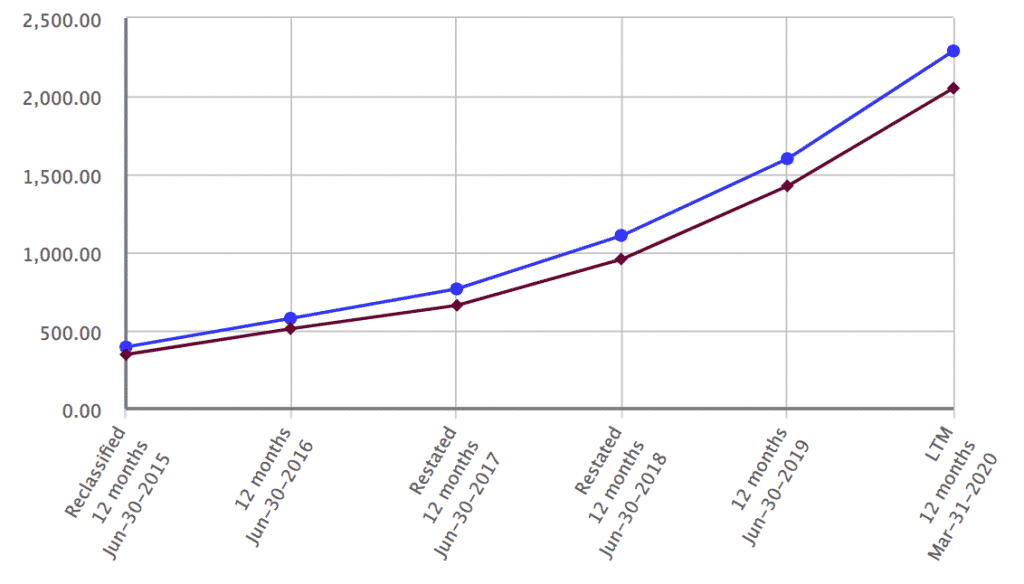

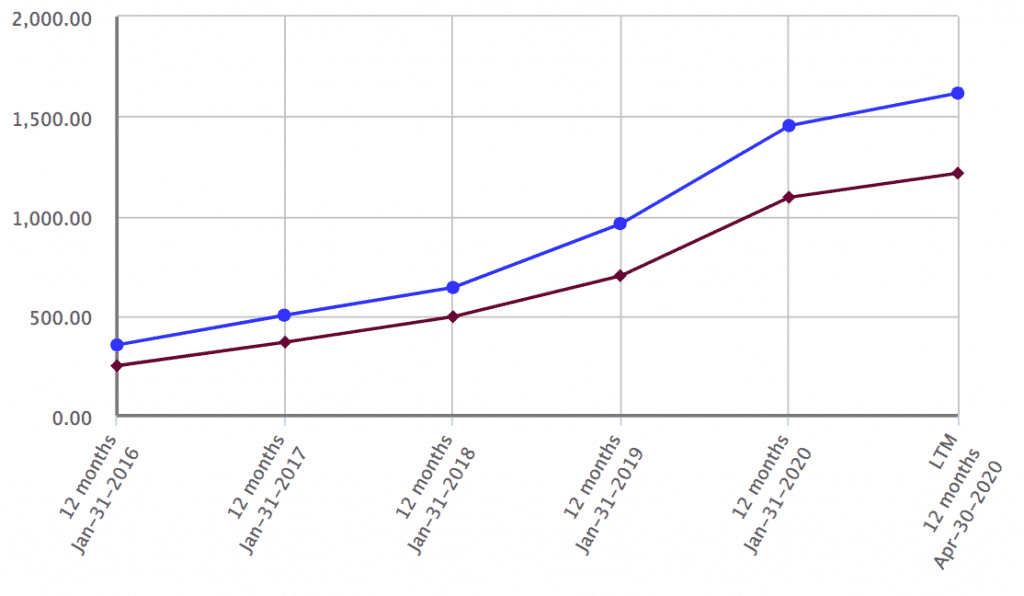

I stopped reading at that point but it did get me thinking about what on earth a ‘shooting star’ stock was and what stocks I would describe as being ‘moonshot’ or a ‘cloud rocket’, if I had to. I wrote down some growth stocks that came to mind with a specific emphasis on ‘cloud’ stocks then checked their revenue (blue line) and gross profits (maroon line) on Capital IQ. You can see the list below.

Then, after lunch I jokingly tweeted this:

Guys I’m very excited about my new blogpost called

— Claude Walker (@claudedwalker) June 17, 2020

**Topline Shooting Star Moonshot Investing***

I will choose 10 US-based Stocks with good revenue and gross profit growth.

This blog post will be FREE, and include the names and tickers 10 stocks. Should I back it with $10k?

I wasn’t really intending to outsource my decision making but I was surprised by a very strong ‘yes’ vote.

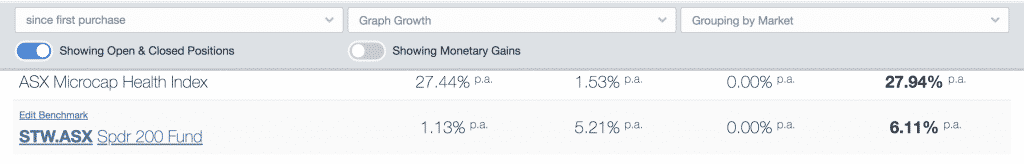

That got me thinking about how well my random list would perform. More than 5 years ago I once came up with the “Ethical Equities micro-cap health stock watchlist”. You can find the original post by simply googling that phrase.

If I had simply bought evenly sized positions of each one of the companies invested in that theme, I would have done quite well out of it, as you can see below (I entered the hypothetical trades into a sharesight portfolio).

However, that list outperformed almost entirely because of Pro Medicus.

I therefore propose a real-life experiment, where readers pick their top 8 stocks from the list below, judging purely from whatever they themselves think. Then, I will invest $10,000 (AUD) split between the most popular 5 stocks, plus give myself up to 3 wildcard entries creating an instant ‘shooting star’ index. I make no promises about how long I will hold the index, but my intention would be to keep the money there for a year at least, but maybe longer, and then perhaps re-assess the situation.

In any event, I will be able to track the index performance over time as another interesting experiment in thematic investing.

Below, you’ll find revenue (blue line) and gross profits (maroon line) on Capital IQ

Twilio Inc (NYSE: TWLO)

ServiceNow Inc (NYSE: NOW)

Fastly (NYSE: FSLY)

Crowdstrike Holdings Inc (Nasdaq: CRWD)

salesforce.com, inc (NYSE: CRM)

Shopify Inc (NYSE: SHOP)

Teladoc Health Inc (NYSE: TDOC)

Alteryx Inc (NYSE: AYX)

Square Inc (NYSE: SQ)

Mongodb Inc (Nasdaq: MDB)

Datadog Inc (NYSE: DDOG)

Cloudflare Inc (NYSE: NET)

Atlassian Corporation PLC (Nasdaq: TEAM)

Docusign Inc (Nasdaq: DOCU)

This post is not financial advice, and you should click here to read our detailed disclaimer.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.