Early stage companies that have not yet established long term positive cashflow are obliged by the ASX to report quarterly cashflow every April. With dozens of quarterly cashflow reports out over recent days, here are two that we thought showed strong improvement, in the latest quarterly. So without further ado, here are two early stage growth stocks with promising quarterly reports.

DUG Technology Ltd (ASX: DUG)

DUG Technology specialises in high-performance computing (HPC) software and hardware solutions to enable clients to leverage large and complex data sets. This could include equipping oil and gas companies with tools to interpret reams of data or assisting research departments in universities to achieve groundbreaking discoveries. However, not all of DUG’s revenue is recurring, with plenty of project based work involved.

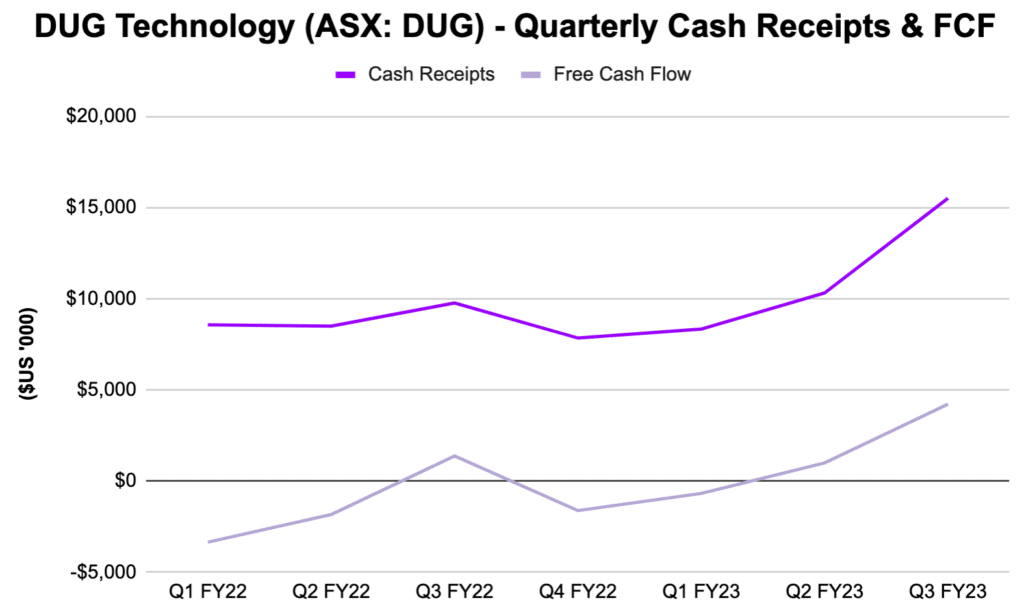

DUG Technology recorded its highest quarterly cash receipts and free cash flow of US$15.5 million and US$4.2 million for the March 2023 quarter. The business is showing possible signs of hitting an inflection point as depicted below.

Management noted the current quarter included US$7.5 million in new projects for the Asia-Pacific region, which appeared to be a nice surprise given its historically lower activity levels compared to the US and UK. Perhaps the growing focus on artificial intelligence and machine learning may be driving this demand. Recently, the Principal and CEO of Singapore Polytechnic Mr Soh Wai Wah noted the need for HPC to, “pave the way for more game-changing scientific, technological, industrial, and societal innovations in the future”.

As Claude highlighted in his introduction to DUG Technology about 3 months ago, the business remains heavily services-orientated, and recurring revenue is yet to show signs of consistent growth. That said, the DUG Technology share price is up more than 20% in the last quarter, so shareholders would have been well rewarded for looking past this potential drawback.

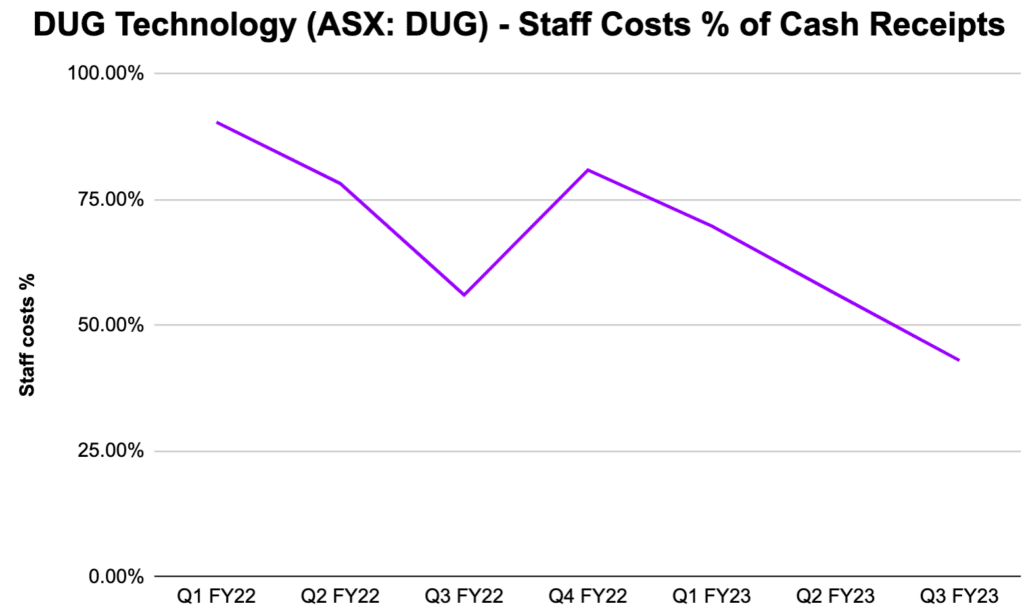

Despite the lack of recurring revenue, DUG Technology appears to be really hitting its stride in services. Not only is it producing strong growth in revenue but is also showing signs of profitable growth. Staff are the biggest operational cost, which continues to fall as a percentage of cash receipts.

Since the restructuring of the services business stream in November 2021, management has executed quite well. The most prominent aspect of the restructure was management’s focus on reducing support staff through improvements in software efficiency and functionality, which appears to have streamlined workflows. DUG Technology management also switched its focus from smaller and more complex projects to larger, more compute-intensive projects.

DUG Technology cofounder and managing director Matthew Lamont appears to be showing strong signs of a level 5 leader and founder and this set of results has prompted me to take a deeper look into the business.

Sign Up To Our Free Newsletter

FINEOS Corporation Holdings (ASX: FCL)

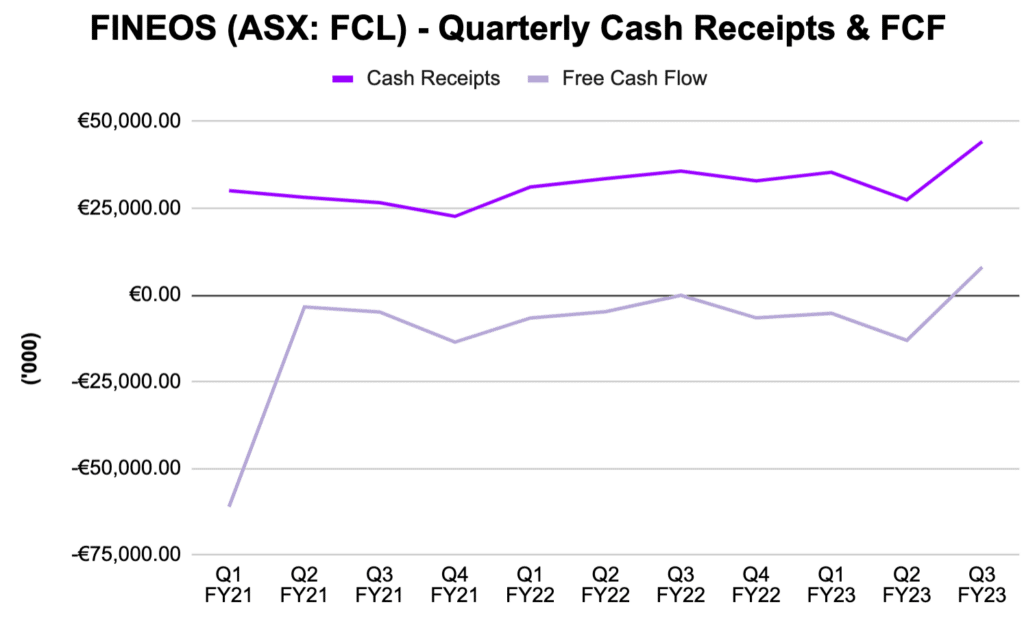

FINEOS provides consulting and software services to the Life Accident & Health insurance industry, focussing on claims management. The FINEOS share price continues to languish near historic lows, falling to a record low of $1.11 per share last month. However, FINEOS looks like it may be on the mend after reaching free cash flow positive for the first time in the last two years for the March 2023 quarter.

The outlier in the September 2021 quarter was due to the large acquisition of Limelight Health, a US-based provider of underwriting, rating and quoting software. FINEOS raised €56.48 million to fund this purchase and readers should be mindful that the insurance software business again raised capital of €46 million in 2022 to pursue further growth opportunities. Whilst it looks like FINEOS is in much better shape, the business has required capital to make this happen.

The promise of Limelight Health providing FINEOS with exposure to the US market is starting to come to fruition as it signed up new customers in the US for the FINEOS Absence product. It would be interesting to dig deeper into management’s comment on that, “The North American Group insurance industry is going through a period of rapid change and opportunity…”. This could represent a long tailwind if the insurance is undergoing structural change.

The FINEOS management team is taking steps to execute its €10 million operating cost reduction plan laid out last month, as headcount dropped from 1,063 in the last quarter to 1,052. As a percentage of cash receipts, staff costs appear to be heading towards the right direction.

Management noted the reduction in the usage of contractors played a role in the lower staff costs for the March 2023 quarter. Staff costs has historically been the key barrier to FINEOS’ ability to scale so I would pay particular attention to whether management is taking the right steps to achieve the following planned measures to reduce operating costs.

- Eliminated non-essential headcount with work redistribution

- Reduced usage of certain higher cost based 3rd party contractors

- R&D CloudOps automation driving greater efficiencies

- Tight management of salaries in a changed employment environment

Such cost-cutting measures ought to be carried out with prudence given the significant levels of R&D spending required for FINEOS to remain competitive.

Although FINEOS has needed to dig deep into the pockets of shareholders to fund its growth ambitions in the US market, the business is in a much healthier position with €31 million in cash and is now currently free cash flow positive. It’s one ASX tech stock that is worthy of keeping an eye on especially when the market has coated it with a lot of pessimism.

Sign Up To Our Free Newsletter

Disclosure: neither the author nor the editor of this article own shares in any of the companies mentioned. Neither will trade shares of these companies within 2 days of publication. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.