Sometimes, observing my own actions can expose flaws in my thinking. Not long ago, I was reducing my “risky growth” holdings but I’ve noticed over the last week I have been attracted to certain opportunities. As a result, I’ve made small purchases in a handful of riskier small caps. Most of those purchases were in stocks I already own: 8Common, IntelliHR, Dusk, KipMcGrath, and 4D Medical. However, two are new additions to the portfolio, so I thought I’d mention them below.

SomnoMed (ASX: SOM)

Last week, I mentioned SomnoMed because directors have been buying shares. SomnoMed is a company I know well, and have owned in the past. The main reason I like it is that its SomnoDent device seems to be a great fit (pun intended) for those people with moderate to mild sleep apnoea. Not being able to breathe well at night can be extremely bad for your health, but many may not have such a bad situation that they immediately need a CPAP machine.

In one of the worst “self-owns” in companies I’ve followed, the prior SomnoMed Executive Chairman, who did a lot to build the business, thought it would be a good idea for SomnoMed to compete with its own distribution channel. It wasn’t.

After years of heinous performance, the SomnoMed board finally took responsibility for their ineptitude and the chairman who presided over the value destruction took the honourable path (belatedly) and fell on his sword.

It will take a long time for SomnoMed to re-capture the respect of the market but I do think this turnaround may have already turned.

Knosys (ASX: KNO)

Knosys is another little microcap stock I’ve followed for years. Indeed, I think I first looked at it around 5 years ago when it was around its current price.

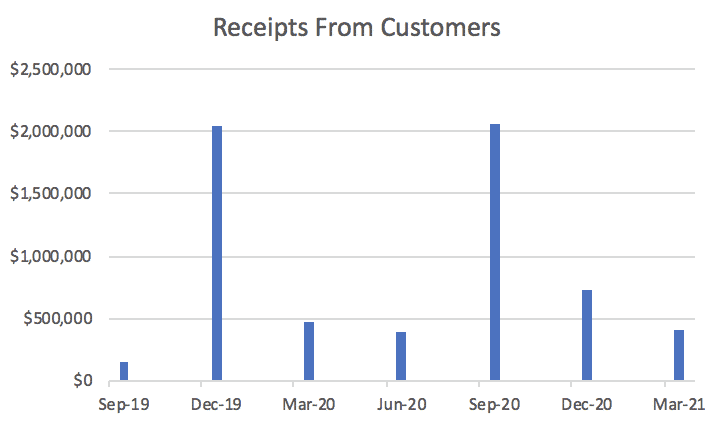

The main problem for Knosys is that it had a couple of large customers for its boutique knowledge management system, with the main customer being ANZ. Over the years, it hasn’t been successful in growing its business very much. You can see its customer concentration in its quarterly receipts from customers, which skew massively to a single quarter each year (presumably when its largest payments are due).

The reason Knosys is now a more interesting business is its recent acquisition of GreenOrbit, which is intranet software with smaller contract sizes and many more customers, including Webjet and Harvey Norman. After this acquisition, Knosys says that “it expects to enter FY22 with base ARR of over $5.8m, which should be complemented further with new business, project fees and R&D grant.”

At its current price of 13.5c, Knosys has a market capitalisation of $27m, so it really is tiny, and I’m only dipping my toe in the water. Having said that, it’s trading at less than 5 times annualised recurring revenue, so if it can show some growth, I think that it will be worth a lot more, perhaps even double its current price.

Conclusion

Overall, I wonder how I will look back on my recent purchases of microcap stocks. It’s unusual for me to buy such a spattering in a short amount of time. However one of the things I like about smaller stocks is that they often lag the larger stock zeitgeist. Therefore, if larger growth stocks continue their rebound rally, and the Nasdaq surpasses the February high, I suspect these two companies could do well on sentiment alone.

Just so I can look back on my recent purchases and judge them, here are the prices I paid in my recent (very tiny!) purchases:

4DX – $1.39

IHR – $0.26

KNO – $0.14

KME – $1.19

DSK – $3.51

SOM – $2.42

Please let me know which of these you find most interesting and I’ll write a longer article about it!

Edit (20 June): IntelliHR was the peoples’ choice and you can see my resultant report on it here.

This post is not financial advice, and you should click here to read our detailed disclaimer.