Under usual settings, I’m around 90% – 100% invested. I realise this is more heavily invested than most people, but I think it makes sense given my age and the tendency for businesses to generate value over time.

Taking into account cash, gold and hedges, I’m currently only around 50% net long which is very low for me. That means when the market rallies, I don’t capture all the gains (but I have ample liquidity in a variety of currencies and gold).

3 Reasons I Don’t Mind Missing Some Gains

First, while the 20% gain over the last few weeks seems large, it’s not so large in the context of the historically hard and fast 33% drop from the peak. While I wouldn’t expect to see markets go to new highs any time soon, there is clearly reflexive tendency for a bounce.

Second, I care about absolute returns, not relative returns. As an investor, I take Warren Buffett’s rule number one (don’t lose money) quite seriously. Capital is never more valuable than when people really need it, and given there is a real chance of prolonged economic suffering until we get a vaccine, I want to be sure that I have plenty of capital in that environment.

The advantage of having capital in the environment where things get much worse is far greater than what I see to be the maximum likely gain that I would miss out on by positioning conservatively. I think that the markets won’t reach new highs in the short term, which means there is perhaps another 20% at most that they will gain before (in my opinion) turning again. By being only 50% long, I’d only make a gain of around 10% in that scenario, rather than 20%. In exchange for that forgone potential gain, I will be in an immensely stronger position if markets resume their fall.

Third, the dominant narrative at the moment isn’t as obviously wrong as the ‘just a flu’ narrative was in early March, but it seems very provably off the mark. Essentially, headlines are currently blaring that the worst is over and that countries currently shut-down will soon begin to open again. Indeed, the president of the USA said 8 hours ago that the opening up of the country will “be sooner rather than later”.

However, there is no real evidence to suggest that the USA is in a position to end social distancing protocols without immediately hurtling into yet another period of fast spread, which will once again see hospital systems on the brink of failure.

The reason I say that the contention that we can get back to work soon isn’t as obviously wrong as the just a flu contention was is because, to an extent, some countries probably can ease some restrictions. On top of that, all signs suggest that if we implemented Chinese style testing, tracing, temperature checks and masks, then we could open up a lot more.

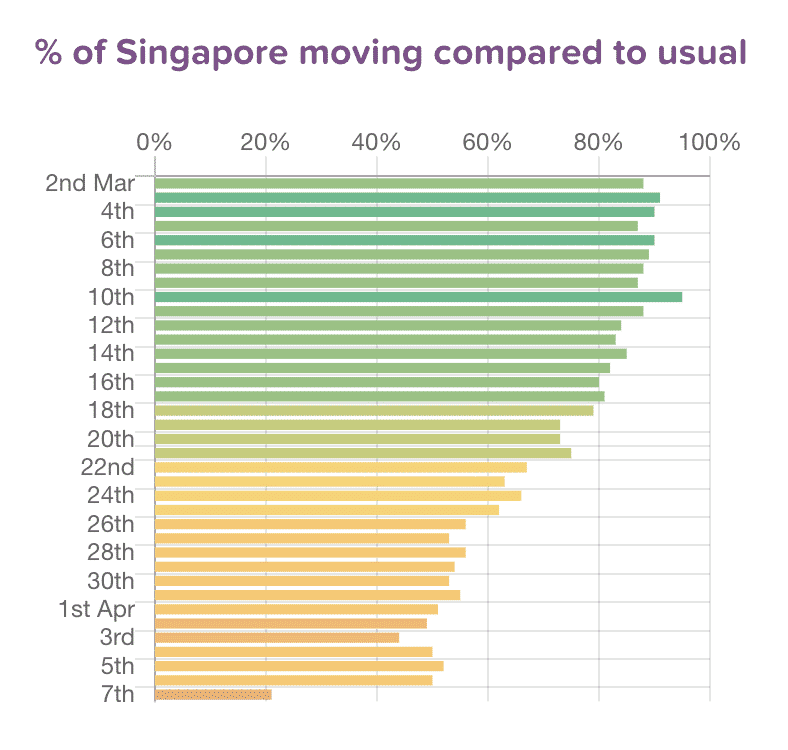

But most of all what this view misses is that no country has figured out how to get back 100% or even 90% of its activity sustainably. In fact, even after managing 90% mobility, Singapore has had to shut down again in order to control the disease. Given how proactive that nation-city has been relative to other countries, I find it hard to believe America will be able to miraculously open up again without a corresponding increase in infections.

You can see what I mean below:

At the moment, I don’t see many people grappling with the cold harsh truth that we currently do not know how to get a city back to 100% without huge surveillance that would go well beyond our current capacity.

20 Signs The Market Bottom Is Near

We currently have only seen a couple of our 20 Signs The Market Bottom Is Near. Even if the market is higher at the time (which I highly doubt it will be) I’d prefer keep significant dry powder until the fundamental data points to improving economies and improving life on the ground for the majority of the people. At present, we simply don’t know how long this crisis will last, though we do know that social distancing helps save lives.

I’m an investor for profit and for progress. I think markets can and do continue to go up as capitalism creates value. But I’ve seen an awful lot of disprovable statements from fund managers. Most recently, one said covid19 would “burn out” within 12 months if we don’t get a vaccine. On the other hand, a virologist I asked disagrees.

If magical levels of human separation were to happen, which would starve the virus of hosts…globally…it could be burnt out. So this virus is with us forever IMO.

— ɪᴀɴ ᴍ ᴍᴀᴄᴋᴀʏ, ᴘʜᴅ 🦠🤧🧬🥼🦟🧻 (@MackayIM) April 8, 2020

Clearly, the people who control the capital are betting their own understanding of this epidemic is better than the people who study diseases. That might be true, but I’m not going to be fully invested on that basis. I still think the majority of the people controlling the majority of the capital have got it wrong. The art, for me, is not to be neutral or even short, but simply to ensure I have more dry powder in the event that this is a gruelling, protracted battle against a global threat the likes of which we have not seen in my lifetime (or even my parents’ lifetime).

Tax time is coming: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves me heaps of time doing taxes.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!