Over the last few months there have been plenty of companies that saw significant director buying. One of the most notable, to me, was Dicker Data (ASX: DDR) which I own shares in. However, those directors were buying near lows in March, not now in May. I thought it might be interesting to have a look at which insiders were buying stock this month, to see if it highlighted any interesting opportunitites.

After considering more than 45 different companies, I selected 5 that I thought looked interesting. I present them below.

Please note; none of this is intended as advice or a recommendation and you should not trade shares on this information. Rather, this is an attempt to consider whether a perusal of recent director buying can throw up any ideas for future research.

Reece Ltd (ASX: REH) – Share Price $8.85 – Insider Purchase Price $7.60

I couldn’t possibly avoid covering plumbing product distribution company Reece Ltd (ASX:REH) on this list, given the huge investment made (as part of a capital raising) by the founding Wilson family. Various family vehicles, being related parties of board members, have bought tens of millions of dollars worth of shares at a price of $7.60 per share. Other directors also chipped in.

That’s a 14% discount to the current price of $8.85, and in my view suggests that the founding family, who run the company see great value at that price. My base case scenario, then would be that there’s not much more than 15% likely downside, but there is decent long term upside.

The reason for this is that this company knows how to run a distribution network business, and these kinds of business benefit strongly from scale. Ubiquity allows them to offer lower prices as a distributor, as well as greater convenience for plumbers and builders who use their services. These are the kinds of businesses that have a defendable moat, partly due to scale, partly due to established relationships, and partly due to the fact that hot money is focussed on higher growth opportunities.

Of the companies I looked at as part of this piece, Reece is my favourite, though I do think it is more likely to ‘chip away’ at improving the business over decades, rather than surprise or impress in the short term.

Vista Group International Ltd (ASX: VGL) – Share Price $1.32 – Insider Purchase Price $1 (AUD)

Vista Group (ASX:VGL) provides software to assist with running cinemas, including extremely variable marketing business. By March, it said “a number of customers have asked for us to help them by varying their payment terms,” and it’s pretty clear their business is going to be badly impacted by Covid, potentially on a longer term basis.

Having said that, the share price has come down a long way, and it now trades at about 20 times pre-covid earnings. If earnings do bounce back longer term, then it is probably well positioned to continue adding value (and profiting from) the cinema industry for many years to come.

Its Chairman added a serious chunk of shares at the equivalent price of $1 Australian, as part of the rights offer recently conducted. My take on this business is that it has fantastically sticky customers and will be very hard to kill. Having said that, given the covid-related headwinds, I’m not excited about the stock, in case the pandemic drags on a lot longer than people think.

Swift Media Ltd (ASX: SW1) – Share Price 3.4c – Insider Purchase Price 1.5c

Swift Media Ltd (ASX: SW1) has proven to be a trap for long term investors.

The share price has fallen from heady highs of 45c at the end of 2017, to the recent capital raising of 1.5c. I note Wilson Asset Management were sellers at the start of 2018. Great timing by them!

Having said that, I should note that the directors were more than happy to chuck in cash at 1.5c per share this month.

I don’t think the current valuation is particularly special, but I bet that post capital raising they will do an investor relations push, that may push the price up higher. At a business level, it does have around $20m in revenue and a market capitalisation of around $45m, so if they could even just briefly achieve decent margins, it would look (temporarily) cheap.

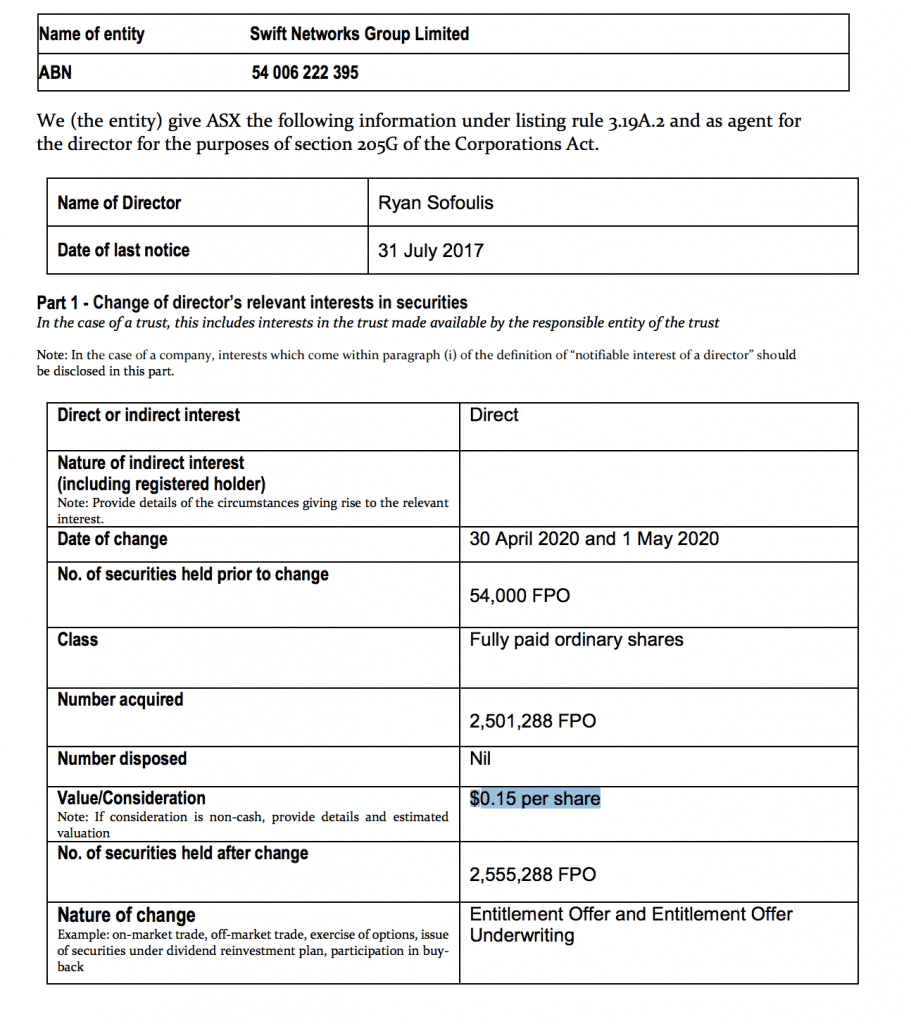

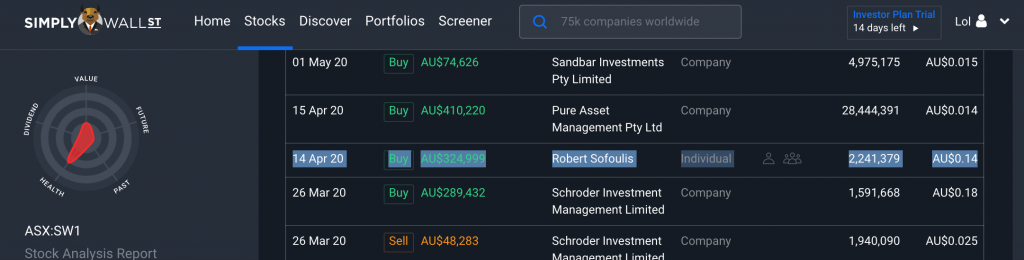

I note that an ASX announcement from the company claims Executive Director of Swift Media Ryan Sofoulis bought shares at 15c instead of 1.5c.

That typo misleads the data aggregators, who then go on to mislead innocent retail investors. The company should correct it in my opinion.

I think this stock goes up from here (temporarily) — but its sloppy disclosures (it also had to correct its quarterly cashflow report, though I don’t know why) are a symbol of why I have no intention to own the stock.

United Malt Group Ltd (ASX: UMG) – Share Price $4.29 – Insider Purchase Price $4.01

United Malt Group is a recent demerger with Graincorp, and provides malt to major brewers, craft brewers, and distillers. It has lots of debt and recently announced a capital raising to strengthen the balance sheet.

I have lots of trouble valuing the business given its lack of history as a standalone entity, but demergers do occasionally create value. If nothing else I think the recent director purchases at $4.01 are a good sign.

AMA Group Ltd (ASX: AMA) – Share Price 65.5c – Insider Purchase Price 44.5c

AMA Group is largely a panel beating company, so it derives its profits from fixing up cars that have been in minor car accidents. Initially, it looked like there would be fewer cars on the road during the pandemic as Australians locked down at home. However, as it turns out, we seem to have controlled covid quite well, but public transport is relatively unattractive due to being higher risk.

As a result, we may see that traffic recovers reasonably well, and thus, so too will demand for panel beaters.

In the time after directors bought shares, the company has updated the market to say “Volumes for May and June are likely to still be impacted across the business.” However, they also added that “Covid-19 has brought positive changes and opportunities for our business. The consolidation of

some sites will create a more efficient infrastructure for the future when volumes return, and in the coming months we expect to see an increase in potential acquisition opportunities.

This post is not financial advice, and you should click here to read our detailed disclaimer.

If you haven’t already tried Sharesight, it saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade, you’ll get at 4 months free and we’ll get a small contribution to help keep the lights on.

Sign up to our infrequent newsletter to get ideas and entertainment Fresh and Fast to your inbox!