Today, expense management and funding disbursement company 8Commmon (ASX: 8CO) submitted its quarterly report, showing a second consecutive quarter of increased cash burn and a lack of growth in receipts from customers. This has seen the share price drop to around 12.5 cents per share.

A few months ago, I opined that 8Common might be worth buying in a sell off, because it should benefit as its customers do more travel, once the pandemic is over. Unfortunately, the pandemic is still not over, but as it happens, the stock has now reached my target buying range of 11c to 13.5c, and I will put a small bid in after publishing this article.

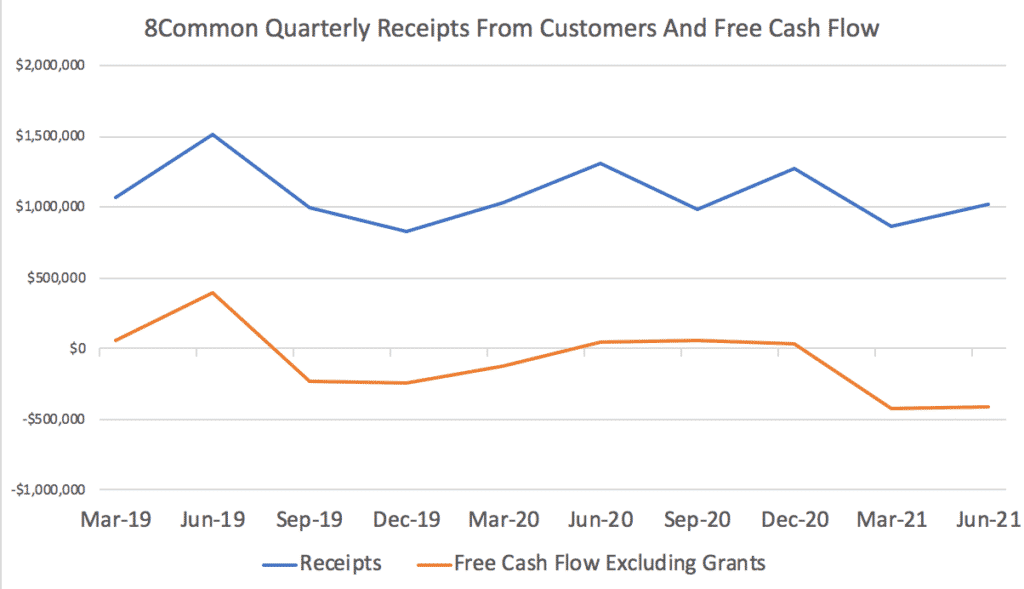

However, one thing to keep in mind is that the company has increased its cash burn over the last half, as you can see below:

On the plus side, the company says this is due to the costs of implementing its previously announced large Card Hero Life Without Barriers (LWB) contract, and that “The roll out is progressing well with CardHero beta cards in live production (and transacting) and LWB expected to go live within the current quarter”. That means we should see some impact from the contract in the second quarter of FY 2022.

Overall, it remains to be seen whether the company actually can start growing in a sustained way, but it still looks to me as if it could. Generally speaking, I think management is too promotional, and this isn’t a high conviction holding for me, but I’m willing to make it a slightly larger position since it is currently only trading at around $26 million, and seems likely to finally start growing in the coming twelve months. However, the risk here is that the much touted growth never eventuates, in which case, the stock is massively overvalued given its lack of profitability.

Please remember that these are personal reflections about a stock by author. I own shares in 8Common and may even be active in the stock in the coming days (although I will not sell any shares for at least 2 business days after this article). This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.