With my largest shareholding Pro Medicus (ASX: PME) recently moving to new all time highs, I thought it would be worth thinking about when I might be interested in selling some shares.

For those not familiar with the company, the (now out of date) video below is still a good explanation for why the business has been my largest holding for many years.

PME and EOL from Claude Walker on Vimeo.

However, for the purposes of this exercise, I’m more interested in what someone else might be willing to pay for my shares, as opposed to what I think they are worth.

Personally, I could not bring myself to pay even $30 for Pro Medicus shares. The reason for this is that the company had trailing revenue of about $57 million in FY 2020, up only about 13% on the (admittedly very strong) FY 2019 revenue of about $50.1 million (which was an almost 50% increase on FY 2018).

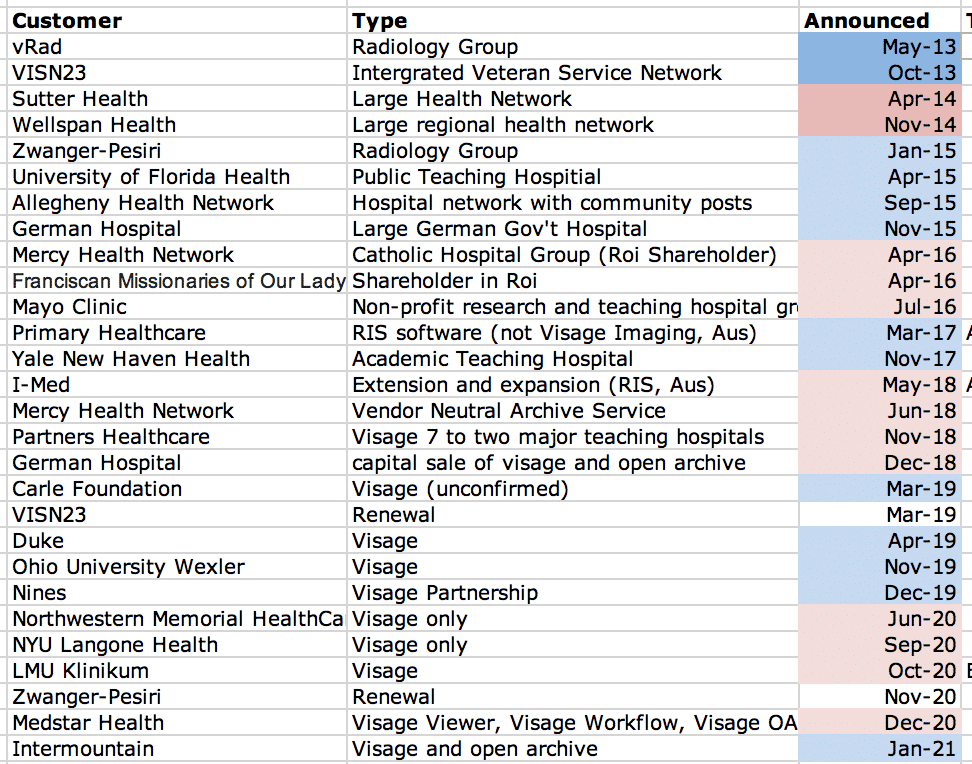

Now, in my opinion there is every chance that revenue growth will be negatively impacted by the pandemic in FY 2021, just as it was in FY 2020. Happily, the pandemic has not had a noticeable impact on the rate at which the company can win big new contracts. As you can see below, Pro Medicus won 4 new contracts in calendar year 2020, just as it has in 2019 and 2018.

Generally speaking, the company has won 2-4 new big contracts each year. However, in 2020 we saw the deals concentrated towards the second half of the year, and it just so happens the company is off to a strong start in FY 2021.

This relatively high frequency of contract announcements over a 6 month period may well have convinced investors that the rate of contract wins is accelerating. However, the CEO Sam Hupert recently said on Ausbiz that this timing was partly just coincidence. Therefore, I don’t see why I should change my assumption that PME will land 4 big contracts in a good year. But even if the rate has increased due to higher market awareness, I doubt it will have increased by much.

On that basis, then, it’s reasonable to assume profit growth of between 10% and 40% per year in the next few years, probably to the low end of that range. Analyst consensus is for about 27% profit growth in FY 2021 to 28 cents per share, 32% growth in FY 2022 to 37c per share, and 24% growth to 46c per share in FY 2023. This is not unreasonable.

But even if we say that PME gets to 50c per share in FY 2023, then the P/E multiple at $30 is still 60. In March, the PME P/E ratio fell to about 70, so it’s not impossible that the PME share price is only around $33 at the end of FY2023, if it sees multiple compression again.

And that is certainly possible. In my view there is every possibility that PME will see muted growth until the pandemic is no longer impacting the USA healthcare system so badly. The reason for this is that PME gets its growth in two ways:

- Through winning new customers.

- Through its existing customers winning more business, and using its software more.

While the company is still growing with the first lever, it isn’t having so much luck with number 2, right now.

Having established, then, that $30 is an uninspiring, but not insane price for shares (assuming you have an optimistic view on the company), one must ask oneself what is an insane price for shares. Or rather, what is the most insane price I’m likely to be offered in the foreseeable future.

Analysts believe that PME will make just under $70m in revenue in FY 2021. This is certainly possible, but will not be assisted by the stronger AUD, given so much of their revenue is in USD. If we assume PME beats analyst expectations and lands $72m in revenue for FY 2021, then I think it would be fair to say that while 20x revenue is defendable, 50x revenue is definitely on the insane/euphoric/high-on-something side of the equation.

Well, 50x FY 2021 revenue, assuming it beats estimates, is $3.6 billion, or approximately a share price of $36. The current share price is $38. Seems punchy. Juicy. #Yolo. Hectic. Rather optimistic indeed.

So having established that we’re in the zone where I think the price might be higher than is wise, I have to still think about if it is high enough to justify selling. Personally, I’m not in a particular hurry, not least because I was buying the stock in June, and I haven’t even held those purchases for a year.

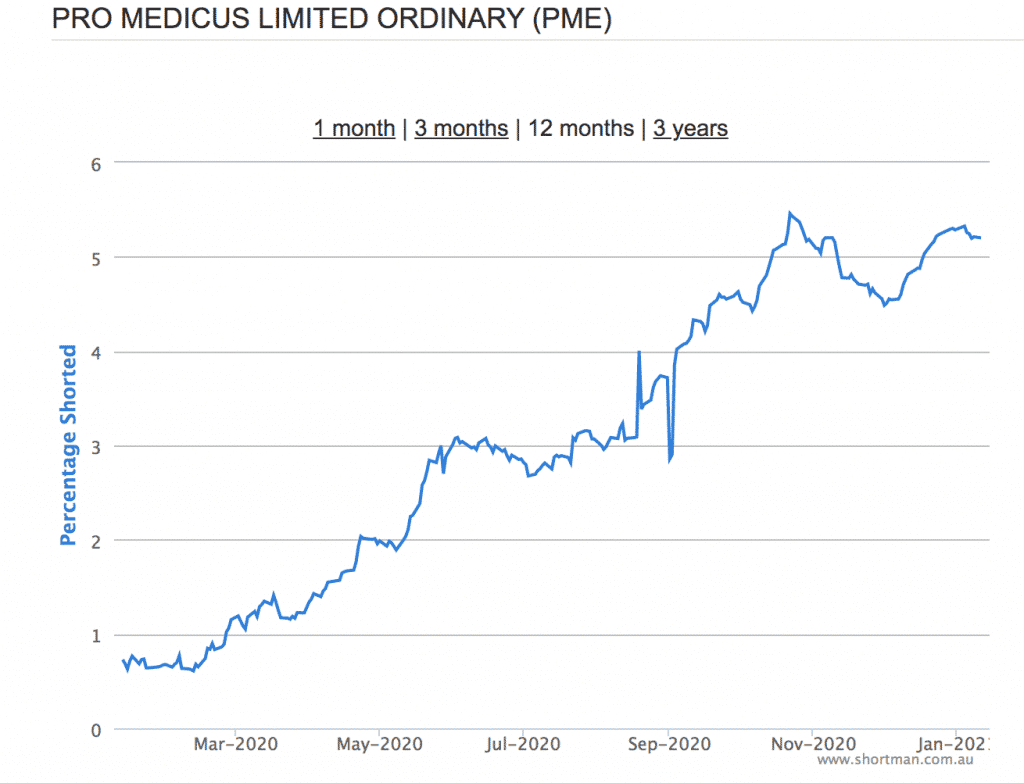

Having said that, I could see a situation where a sell is warranted. You see, shortsellers have been short selling PME stock, which means they are on the hook for losses if the share price storms higher.

As you can see above, 5% of the company was sold short as long ago as November, when the share price was around $33 or less. Those short sellers are therefore down by at least 15%, and the ones from March – July are down anywhere from 50% – 100%.

While some short-sellers will be unconstrained, others will have risk management strategies which mean that after a certain loss their position must be reduced.

From November, 5 million shares have been sold short. So far in 2021, an average of about 330,000 shares have traded each day. This means it would take 15 days of 100% of normal volume for all the short sellers to cover. In other words, if just 20% of the short sellers decide they no longer want to be short, then that is 100% of 3 days of normal volume that they would need to buy to cover. That kind of action is bound to push share prices up.

Therefore, the best possible result is that a short squeeze triggers irrational buying in the coming months and days. And it could be that the fortuitous confluence of contract wins will prove powerful enough to kick off that process.

I care about this because if a risk management mandate means a company needs to cover a position it means they need to cover whatever the price is. With luck, these mandates will kick in like cascades in the comping weeks and months to force the share price higher. 10% is not a huge rise in that context.

Therefore, I think it is reasonable to at least for me to wait for share prices above $40 before beginning the process of selling a few of my shares. Of course, I will take my time doing this, because I want to maintain Pro Medicus as a large position in my portfolio. Even at a price above $40, I only plan to sell my position in very small increments, of perhaps 1% – 2% per week. Also, I’m not saying that I would sell at $40.01, simply that I think that $40 would be a sufficiently frothy price to tempt me to part with a small amount of my shares.

I must note here that none of this is a promise. These are merely my thoughts for my investment diary. This is so I know what I should be doing according to me. I cannot be certain it is the right path for me, let alone anyone else, and I remind readers that nothing on this website is intended to be financial advice or a recommendation.

Finally, the other thing I will keep in mind is the level of shares sold short. Ideally, I want to see the total short at above 5%, in order to indicate the potential for forced buyers in the future. If the number of shares sold short were to drop, after a sustained rise in share price, I would take that as a signal that the squeeze is on — and prices are likely to be toppy in the short term.

This is not advice. These are investment notes of mine; not a recommendation. I could have made mistakes in the notes; and I still have many loose ends to explore. I own shares in PME but may sell some if the price keeps rising. Please read our detailed disclaimer.

If you’d like to receive an occasional Free email with more content like this, then sign up today!