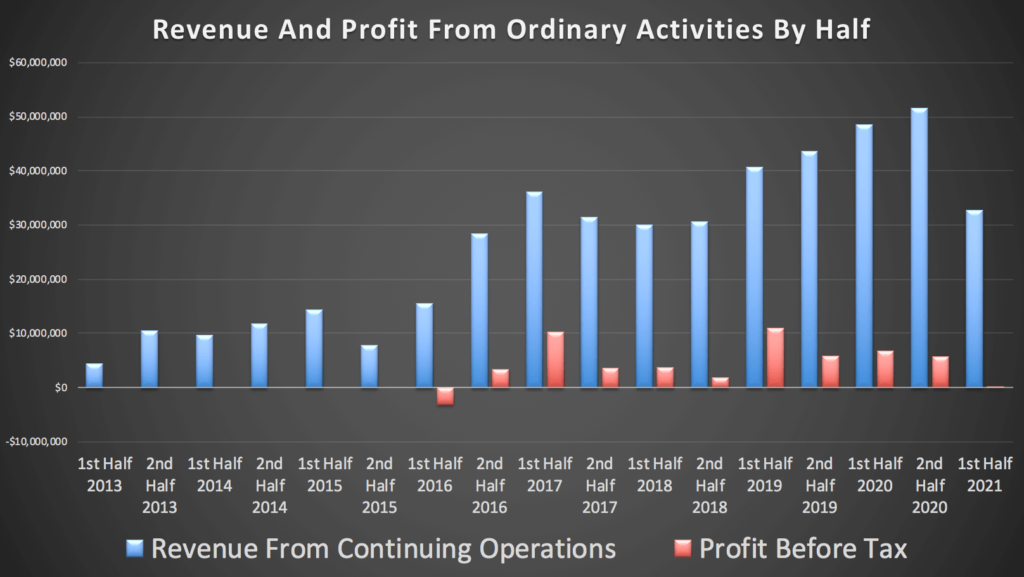

The Nanosonics (ASX:NAN) share price fell a hefty 14% on open this morning after the well respected infection control company reported how the pandemic had caused half year revenue to fall by 11% to $43.15 million. This revenue drop completely obliterated any profit, though the company did manage to essentially breakeven, avoiding the ignominy of falling into loss. The company seemingly sacrificed every bit of available profit to keep its growth plans in place, as you can see below.

Now, I have written about Nanosonics too many times to count, over the last five years, so I won’t rehash all the basics of this razor + blade business model. You can find past articles here.

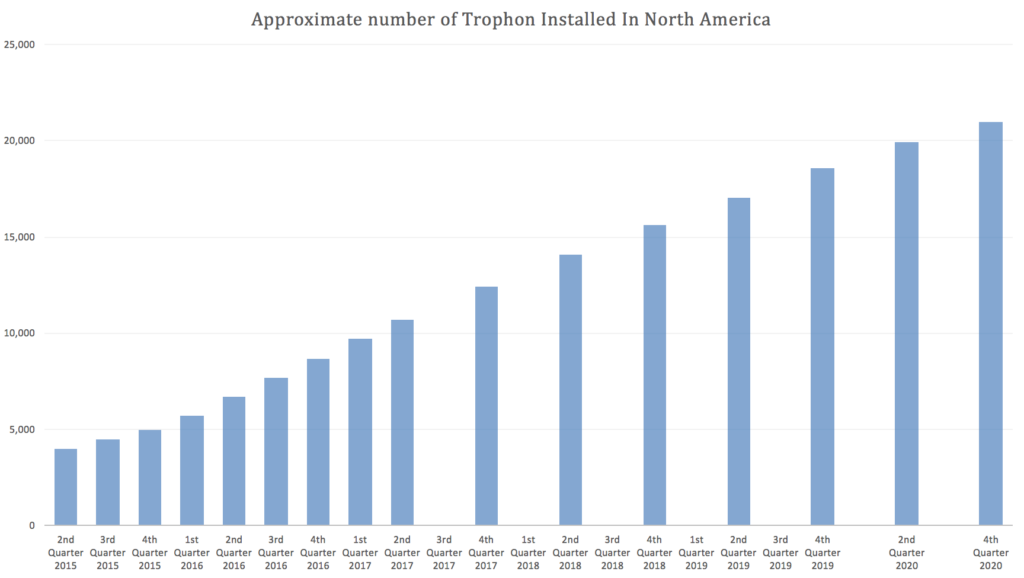

Suffice it to say, that one key metric to watch is the number of Trophon units installed. The bigger this installation base, the higher the recurring revenues can grow, because each time it is used the clinician uses a NanoNebulant capsule containing as every time a clinician uses a trophon device, the device consumes a Nanonebulant capsule containing a proprietary disinfectant liquid with 35% hydrogen peroxide. The machine turns this liquid into nanoparticles, thus achieving the gold standard of disease destruction.

As you can see below, the installed base in Nanosonics’ biggest market actually continued to grow.

This caused me to reflexively buy some shares at $5.45, I couldn’t help it. My gut feel was so opposite to the market. I felt amazed that this deep cleaning company could continue to expand in the middle of a horrific pandemic impacting just about every single customer they have in that poor country that has just lost half a million souls.

On the call, the CEO described how “revenue from consumables was down 1% but up in constant currency”. By the second quarter, the demand for consumables had rebounded strongly and the CEO said on the call that it was “the company’s highest quarter on record from consumables.”

From the sounds of it, GE essentially ran down inventory in the first quarter. Half year capital revenue of $9.4 million, down 35% compared with prior corresponding period. On the call, the CEO said that capital units revenue was down 64% from q4 2020 to q1 2021, and that capital revenue grew 148% from q1 2021 to q2 2021.

Unfortunately, the company was unable to remain above free cash flow breakeven, and free cash outflow (cash burn) amounted to $2,373,000 compared with free cash inflow of $10,016,000 in the prior corresponding period. However, this is hardly a squeeze given it still has almost $88m in the bank and no debt.

The future value of the company rests on the return it may, or may not get from its investments in:

a) Rolling out the trophon to grow recurring revenues

b) Rolling out its second product to grow recurring revenues (Due FY2022)

These results give us a look at what the economics of the recurring revenue business provide. In a horrible half, the company could still afford to spend $7.6 million on R&D and not make a loss. By now, the company has spent tens and millions on research, and a lot of that research is yet to make a profit. The outcome to shareholders from here will depend on whether that profit comes.

One optimistic thing the CEO said is that “Uptake of new products might be a bit faster than for Trophon because I think the fundamentals for adoption are stronger than when Trophon was launched.” On the other hand, the new products are definitely taking longer than many had hoped a few years ago. Disappointment here could easily see the share price fall 50% from current levels.

Optimism could easily see the company have revenues of double what they are now, and a profit of $40m. Of course, even then the company would still be on a P/E ratio above 40. It’s hard to argue the shareprice is overly pessimistic.

Therefore, I am happy holding at these levels but do question whether my impulse buy was wise. Given that I have seen the company do good, grow massively and also remain profitable over quite a few years now I feel fine as a long term holder and should the price ever crater badly I could see myself buying more shares.

Please remember that these are notes on a company the author owns shares in and are not a recommendation. This article should not form the basis of an investment decision. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.