One of the most interesting stocks to watch over the pandemic period is a company called Redbubble (ASX:RBL) which at its most basic is a website selling everyday items with custom designs printed on them. Essentially, the way the business works is that someone (anyone) uploads a design to the website, which Redbubble will then have applied to wide number of items such as mugs, t-shirts, and facemasks.

While the concept itself is neither unique nor particularly clever, Redbubble is an interesting stock because it became subject to a mania driven by a wide range of actors, from sensible professional stock pickers all the way to clueless amateurs infatuated with their own perceived abilities, giving provably wrong unlicensed financial advice on Youtube, Twitter and Facebook.

You can see below how the company had struggled to make meaningful headway prior to the covid pandemic, before flying some 400% to its peak, when the Redbubble share price was being ramped by a wide number of actors.

At the heart of this share price action is a prima facie reasonable yet actually incorrect investment thesis: the “network effect”, which the company itself promotes, as seen below from an old investor presentation.

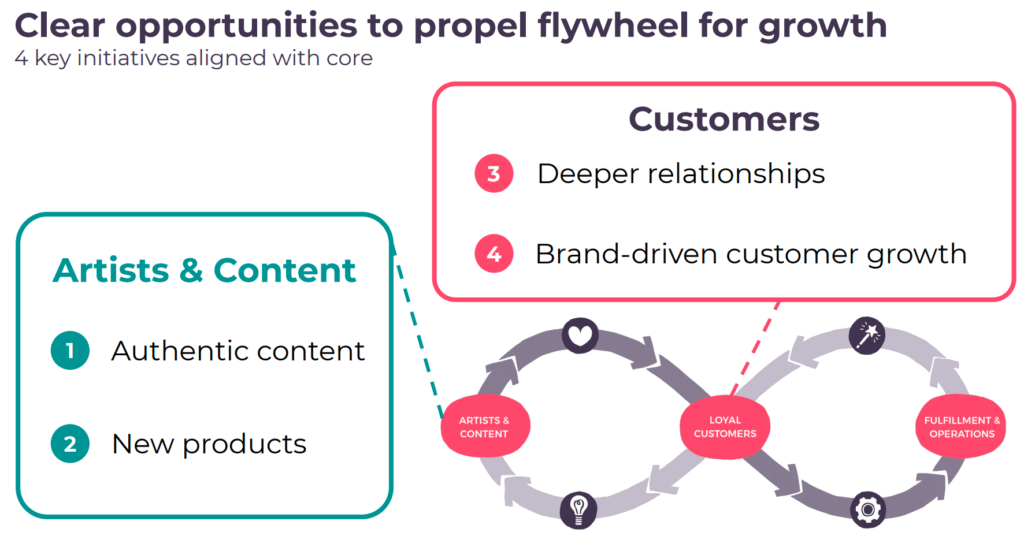

Subsequently, the company has honed this narrative to talk about a flywheel, as seen in this old investor presentation.

With these metaphor, stock promoters invoke the solid-as-a-rock business models of REA Group (ASX: REA), which is only encouraged by the fact that a former CEO of REA Group, Simon Baker was previously a substantial holder of Redbubble, though he ceased to be a substantial holder in 2018 as a result of selling shares.

The basic implication from the use of the words “flywheel” and “network effect” is that Redbubble has a business moat that looks something like this:

- People buy items on its site giving an incentive for artists to list designs on the site.

- Growing numbers of designs on the site mean more people are attracted to buy items on the site.

- This means the site can access better volume discounts from the factories that make the items, allowing lower prices.

- This attracts more people to the website.

- This attracts more artists to the website.

- This allows even more volume discounts, and lower prices/ bigger range.

- And so on, and so forth.

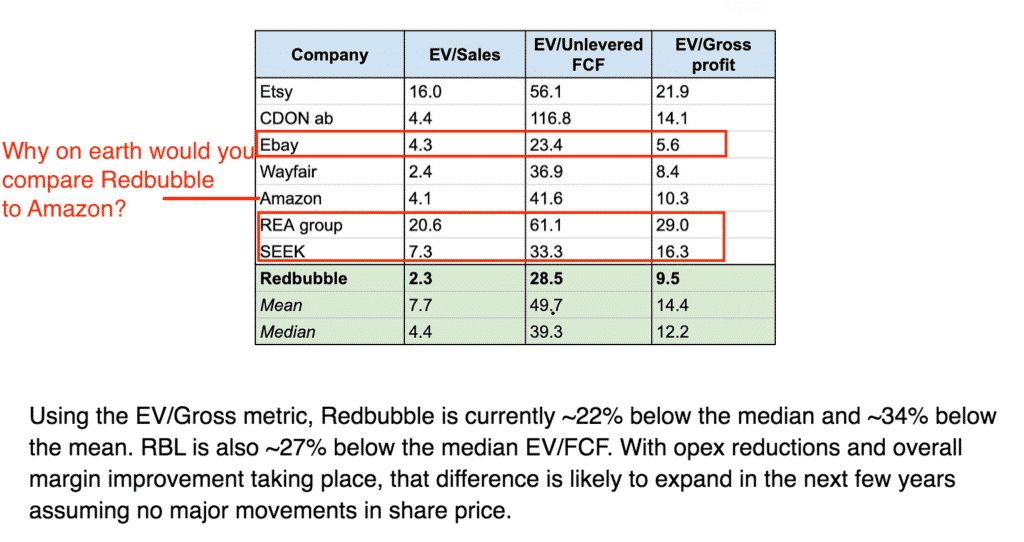

Predictably, this has translated into valuation comparisons from stock promoters such as the comparative valuation chart shared by a #finfluencer in the screen shots below. I’ve chosen not to link to the original piece because I believe that in total the analysis is so bad as to be dangerous (and indeed anyone who followed his advice would be sitting on a loss). Rather, I provide the screenshots below as evidence that investors believe these myths about Redbubble, which I believe the company is encouraging through its presentations.

Predictably, this has resulted in the same investors making valuation comparisons with true network effect businesses like Seek (ASX:SEK) and REA Group (ASX:REA), when in fact Redbubble’s business model is better compared with smaller online apparel retailers which need to advertise extensively on google (which Redbubble does). This is distinct from a world-beater Amazon which literally has millions of paying subscribers to Amazon Prime and sells the broadest range of products in the world.

When you want to sell a house in Australia, you need to list it on realestate.com.au if you want the best price. Equally, if you are looking to buy a house in Australia, you are going to look on realestate.com.au in order to see all the houses available. In neither instance is it necessary for realestate.com.au to advertise on google to get your click, and brand building for realestate.com.au translates directly into more pricing power (as it allows it to stay ahead of its only real competitor, domain.com.au). That’s a network effect in action.

In comparison, Redbubble spent about $45m, more than 10% of its revenue, on marketing costs in the last half, largely to companies like Google, Facebook, Pinterest, TikTok and SnapChat. This is not a choice; Redbubble needs to keep spending on customer acquisition to keep the myth of its “three-sided network effect” alive.

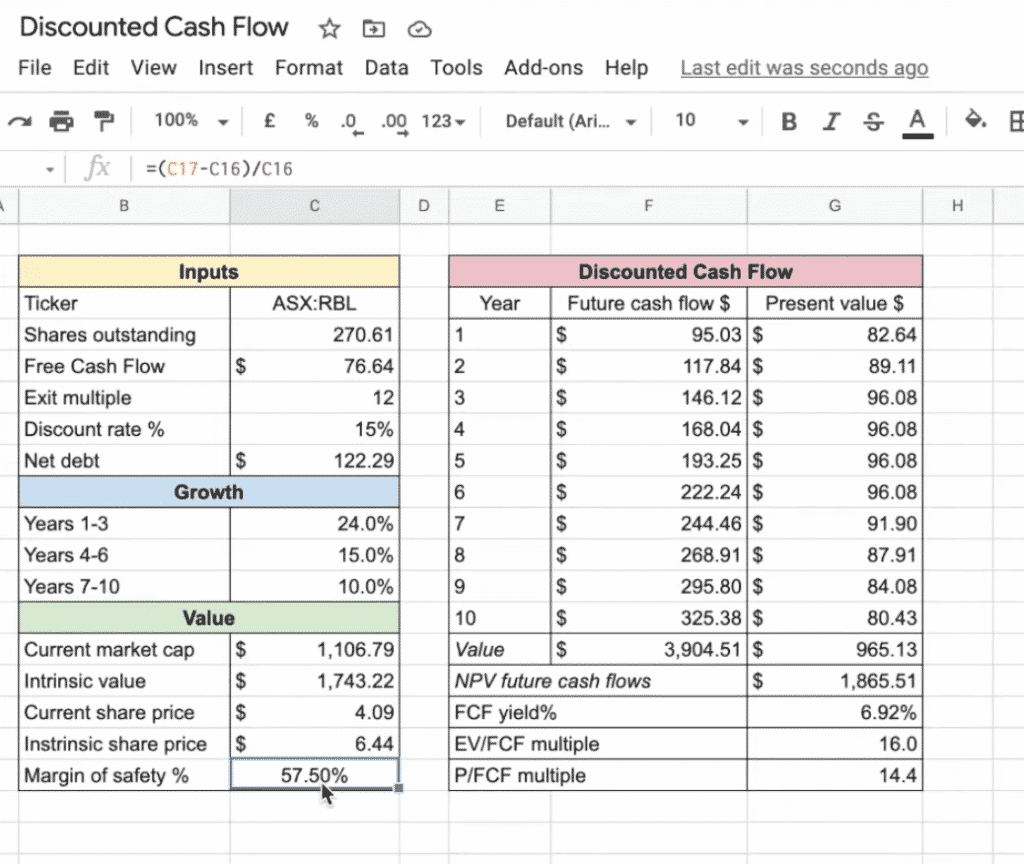

Redbubble, on the other hand, is light years away from being a “must visit” location for anyone to buy anything, and has to spend more on marketing to make more revenue. In the last half, its revenue gained 49%, but its marketing expenses grew closer to 53%. Nonetheless, the aura of a “three sided network effect” has lead social media finfluencers (financial influencers) to model smooth ever increasing free cash flow generation over the next ten years. You can see an example below in a screenshot from a youtube video shared by our aforementioned finfluencer.

In the video below, I explain how the market is likely to gradually realise that Redbubble is more like a stock-standard retailer than a network effect business, but if you’re already convinced of that point, read on. In the next sections we will examine Redbubble as an online retailer, rather than a network effect flywheel business that its shareholders paint it as.

Is Redbubble An Impressive Retailer?

In major product categories, Redbubble’s pricing and product range is far less compelling than its promoters would have you believe.

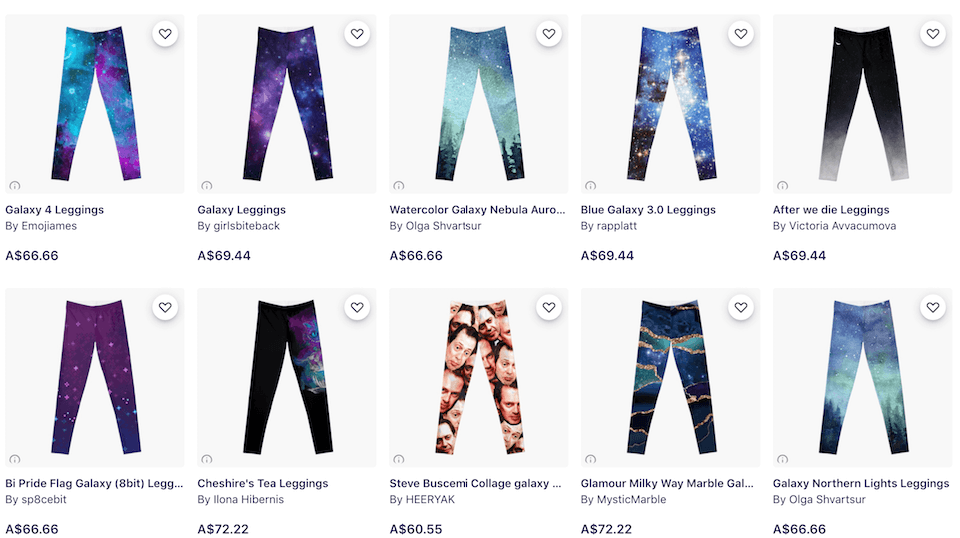

For example, when I was at university, there was a trend that saw a lot of young women suddenly start appearing in what were colloquially called “galaxy tights”. These definitely took off as a thing, such that the category still exists today.

Search google for “galaxy tights” and you’ll find a plethora of results. I’ve shown the 5 top ones below, but there are literally dozens, at low prices, presented professionally by models, with infinite variations on the theme. Check it out for yourself.

If we put the same search into Redbubble we also get a bunch of results. I’ll leave it to you to decide which offering is more compelling.

While I accept that some customers might aimlessly peruse redbubble for gift ideas, the site is just one of literally thousands they could peruse. Consumers don’t care whether their designs come from amateurs on Redbubble or professionals at any number of online stores. People just like what they like.

Redbubble’s Competitive Advantage

Now, any true analyst can figure out for themselves whether Redbubble has a better range than the entire internet, but we do need to first acknowledge Redbubble’s true competitive advantage, which is real, albeit far more modest than the “network effect”. You see, what Redbubble really does is provide an easy and fast way for someone to monetise designs without risking a single dollar.

As budding designers upload designs, they also have an incentive to sell them. Therefore, they relentlessly link people to their “shop” in Redbubble, directly monetising their own audience to Redbubble’s benefit. This amounts to low cost customer acquisition for Redbubble, and this is why the business should be profitable (ex growth). There is no doubt Redbubble is worth something, though it’s questionable whether it is worth almost $1b, as implied by a share price of around $3.50.

For a certain level of artist, Redbubble is a good fit. They may have the designs already, and a small following on social media. Using Redbubble is a low risk way of making some coin. If they already have a small fan base, they can easily upload a design to Redbubble, share the link on social media, and start making money.

However, for truly successful artists with large followings, Redbubble makes little sense. The take rate is far too high and it’s relatively easy to produce a lot of different items yourself (here’s an example). A Shopify shop does all the tricky stuff for you, and the economics are vastly better once you build that direct relationship with the buyer (who you may be able to bring back to your site through email marketing, and special offers). Of course, as we will see in the next section, that does not stop the work of successful artists appearing on Redbubble.

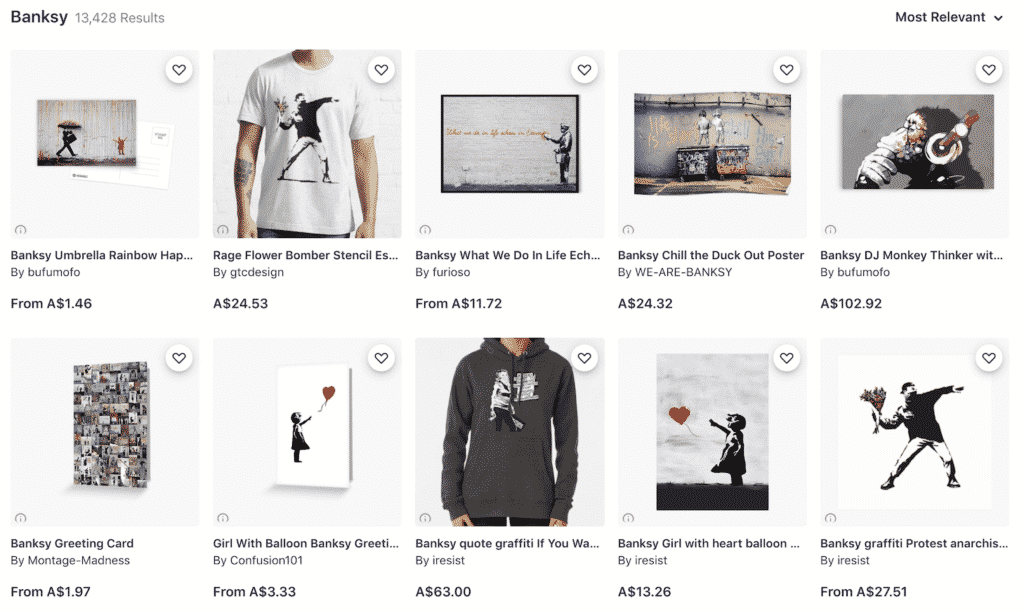

Redbubble Profits From Stolen Intellectual Property

Perhaps the ugliest part of the Redbubble stock promote is the complete disregard some shareholders have for the fact that the company profits from the stolen IP of artists around the world. If you are a Redbubble shareholder there are only two possibilities: you have not done your research, or you simply do not care that theft is a part of their business model. Simply search “Banksy” into Redbubble and you’ll see what I mean:

Now, I think we can rest assured that Banksy won’t be suing the grifters listing his work as their own art on Redbubble, but the same can’t be said for everyone being ripped off by the company.

For example, Law360 reports that, “Print-on-demand marketplace Redbubble owes teen fashion retailer Brandy Melville $520,000 for contributory counterfeiting of two of its trademarks, a California federal jury found Wednesday in a finding that holds Redbubble liable for printing and distributing works listed by its users.”

And there are plenty more artists being ripped off by the company. Take for example more commercial artists like Kaws, who collaborates with larger businesses. You can see how much Kaws’ designs cost on legitimate sites below.

And yet, on Redbubble, the best-selling Kaws products seem to simply have taken images of his work and uploaded them to Redbubble.

I could go on and on but quite frankly, I feel a bit dirty using Redbubble. Instead, I’ll quote U.S. Circuit Judge John B. Nalbandian, who, Law360 reports, said that “Because Redbubble’s marketplace involves creating Redbubble products and garments that would not have existed but for Redbubble’s enterprise, we find that the district court erred by entering summary judgment for Redbubble under an overly narrow reading of the Lanham Act.”

Prominent Analysis Of Redbubble Underestimates Litigation Risk

US courts may eventually put an end to Redbubble’s practise of freely profiting from stolen intellectual property. To date, Redbubble has managed to avoid catastrophic judgements against it by arguing it is merely a platform, similar to Ebay. Of course, this is not quite true. In fact, Redbubble actively helps create knock off products through its business model.

There is a huge difference between Ebay selling some knock-off glasses which it did not help create in any way and Redbubble, which has literally contracted with manufacturers to bring knock-off items into existence.

You can be sure that the authors promoting Redbubble stock would reporting social media posts for copyright infringement if someone started posting their entire reports verbatim onto Hotcopper or Facebook. And yet, those same analysts somehow think its OK for Redbubble to literally bring into being items that rip-off the designs owned by others.

If courts put a stop to Redbubble selling items with images it has no right to use, how would that impact the value of Redbubble shares? How long do you think it will take before some enterprising law firm figures out how often this happens, and starts a class action? To date, only particular aggrieved parties have sued the company, and no single judgement has been particularly large. But what if all the aggrieved parties, even the smaller artists, teamed up?

I do not have a view on the Redbubble stock price and I do not have a position, long or short, in the shares. The only thing I do know is that the public discourse around this stock is deeply flawed. To me, Redbubble shareholders are unreasonably blasé about the litigation risk to Redbubble. But even if Redbubble can escape responsibility for the IP theft it profits from, any assessment of the amount of stolen or derivative IP on the platform should highlight its lack of competitive moat. Wouldn’t it be ironic if someone literally ripped off Redbubble’s business model, forcing it to increase its marketing spend?

The truth is that Redbubble’s “flywheel” is both a legal liability and a competitive advantage.

The author has no position in Redbubble shares. This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.