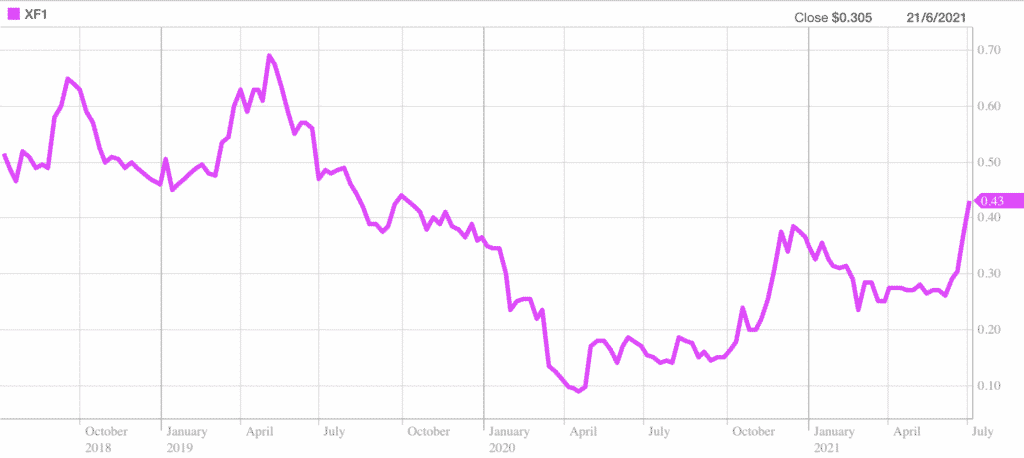

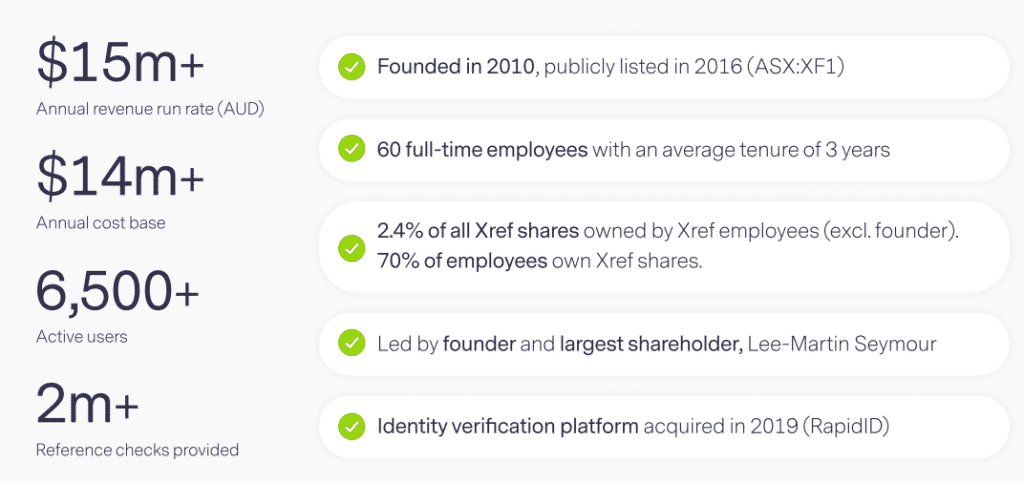

The Xref share price has gained over 16% to 43 cents as I write, after reporting a record quarterly result. Xref (ASX:XF1) is a reference checking software company which was founded in 2010 and listed on the ASX in February 2016. The company has raised capital multiple times, at varying prices, including above 60c. The CEO is co-founder Lee-Martin Seymour, who still owns about 30 million shares, worth a bit over $15m at current prices.

Xref provides reference checking software large organisations such as Zoom, Woolworths, Xero and KPMG, to name but a few. Reference checks can take as little as 15 seconds to request and are usually completed within 24 hours. The candidate is able to monitor the reference checking process which means the onus is on them to chase up their referee, rather than the hiring company. Finally, the software also automatically analyses the digital footprint of candidates and referees in an attempt to detect any fraudulent referees.

Why Is The Xref (ASX:XF1) Share Price Flying?

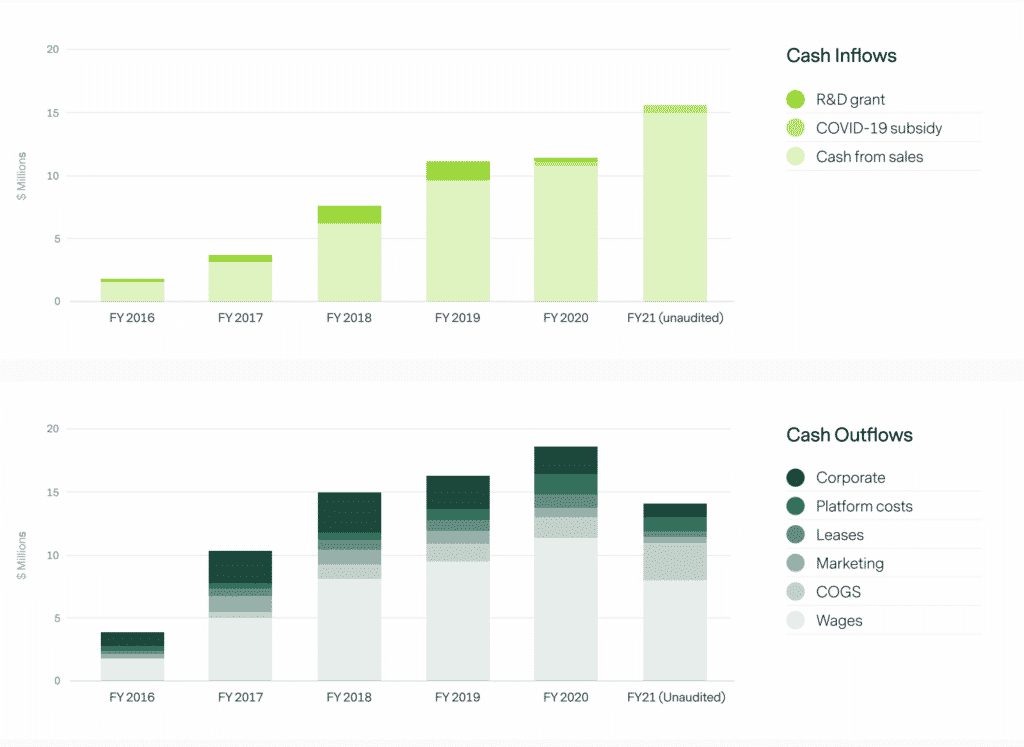

The Xref share price is flying today because the company has produced its maiden annual free cash flow. In the quarter to June 2021, Xref has received receipts from customers of $5.9 million, generating free cash flow of about $2m for the quarter. However, it is important to remember that Xref’s receipts are massively skewed to the fourth quarter, so it is better to look at the full year.

Even looking at the full year, Xref has reached a free cash flow inflection point with this result, generating free cash flow of around $900,000 from receipts of about $14.8 million. Once you exclude R&D grants, that drops to about $300,000.

When studying the Xref accounts, it’s important to remember that the company sells reference checking credits ahead of booking revenue. That means cashflow (and sales) is usually larger than revenue, since a client will first pay for credits, then use them over the subsequent months. Therefore, I have also looked at the unaudited revenue as reported in the last two quarterlies to estimate the Xref revenue result for FY2021

| Revenue (millions) | |

| H1-2021 | $4.7 |

| Q3-2021 | $3.0 |

| Q4-2021 | $3.7 |

| Total Revenue For FY 2021 | $11.4 |

A Note Of Caution

Historically, Xref has over-promised and under delivered. One major problem has been rather lavish spending on expenses, especially employee expenses. This saw me sell shares in the stock, for mild loss, back in 2019. Furthermore, the company was saw growth disappear during covid, proving that it is not really a “recurring revenue” software business but rather, is leveraged to global hiring patterns. You can see the rollercoaster shareholders have suffered, in the chart below.

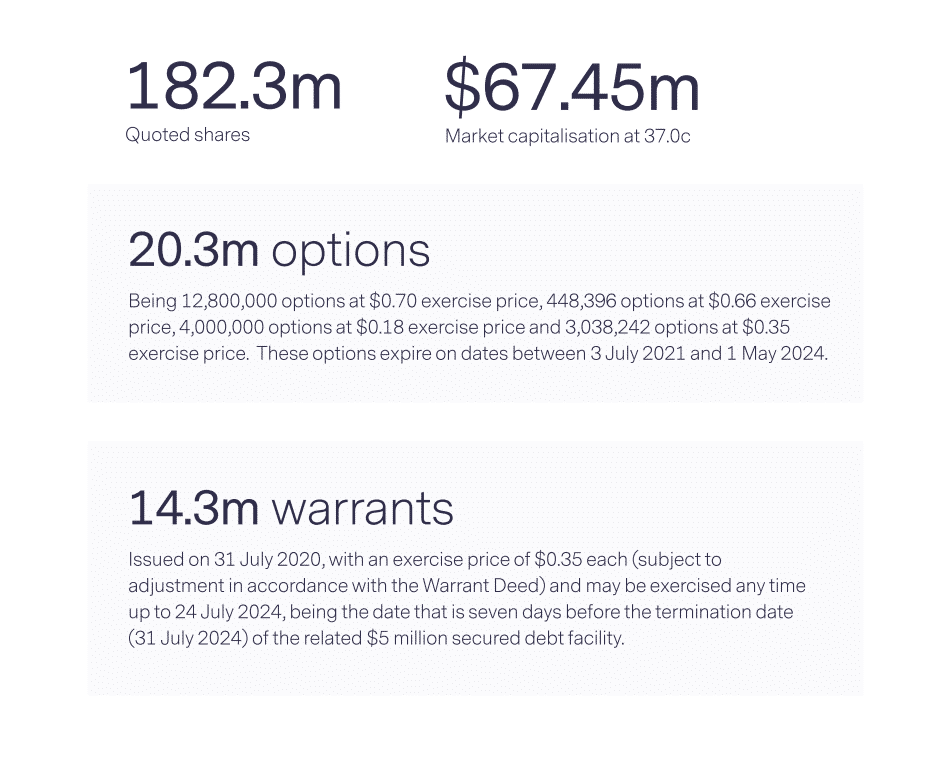

Even after the Xref share price rise of almost 20%, today, many long term shareholders will still be underwater on their investment. Usually, that’s an indication that the stock was previously overhyped. A good example of the way this company is too promotional the way they present their market capitalisation in today’s presentation.

In the image above, you can see that the company has presented their “market capitalisation at 37c” as $67.45m, which is only including their quoted shares. However, if we include all the warrants and options, which one would hope get exercised, we get a fully diluted share count of 216.9m shares.

I am not sure what the perceived benefit of using the un-diluted number is, as it gives an incorrect impression of the real market capitalisation. The lowest exercise price of the options is 18c, and many are at 35c. I suppose this makes unsophisticated market participants think the stock is cheaper than it is, but it just makes me feel uncomfortable as this practice does not correlate with high quality businesses in my experience.

Did Xref Get Its House In Order?

As mentioned above, one of the main issues with Xref previously has been the lavish spending which lead the market to disbelieve that the company could achieve a cash flow positive result. However, as you can see in the slide below, Xref cut its costs significantly during the pandemic. The company says that “Since November 2019, Xref’s primary focus has been on preserving cash and reaching cash flow break even,” and these results are firm evidence that they have had success in that regard.

Importantly, it would appear that the company has made the most of the pandemic, commenting that it has redirected “marketing efforts from sales support to online lead generation has led to a 66% reduction in marketing cost.” It’s anyone’s guess whether this can be sustained but as a general rule when revenue accelerates and a company is able to generate free cash flow, it puts the company in a very strong position to grow.

When fund manager Luke Winchester asked about costs going forward, the CEO said that, “I can certainly suggest to you that our costs will remain flat and our focus is to bring in 2022 with a cash surplus [but] there may be fluctuations throughout the year.”

Is Xref Still Good Value At 45 cents Per Share?

On a fully diluted basis, Xref has 216.9m shares on issue, giving it a fully diluted market capitalisation of $98 million at a share price of 45 cents. Taking its unaudited revenue from its quarterly reports for the last year, we see that Xref achieved revenue of $11.4m in total, over FY2021.

That means that Xref is trading at about 8.6x revenue for FY2021. Meanwhile, it says that its revenue run rate is $15m+.

Now, Xref has a history of overpromising and under delivering, and it’s possible that volatility in hiring patterns mean, so I will take that with a grain of salt. Nonetheless, even if the company achieves just $14m in revenue over FY2022, then it should break even, and also record revenue growth of over 20%. At that point, a 41c share price would represent a multiple of just 7x revenue, which seems low for a company running at cashflow and profitability breakeven and growing at over 20%.

As I have mentioned today, the company generally has a strong quarter in Q4, so it’s quite possible that the next quarter will be disappointing, and the share price might drop. Nonetheless, as a long term follower of the company, I have to admit that reaching free cash flow breakeven was the main thing I’ve been waiting for, so I bought a tiny amount of shares this morning (around 0.6% of my portfolio at the time of writing). I bought my tiny holding so I don’t forget about the stock, as I would like to pick up a more meaningful position around 39 cents per share. Of course, there is no guarantee it will fall back.

What Else Can We Gain From This Interesting Result?

One thing that I think could be interesting is to take a look at CV Check (ASX:CV1), which is another ASX listed company that operates in a similar space. It is possible that you could interpret this result from XF1 as evidence that hiring is running hot at the moment. If that’s the case, then CV Check might represent good value at the current price of 14.5 cents, which is a market cap of about $65m.

CV Check reports about $12m in ARR at the end of May, 2021, so it would appear to be trading on around 5.5x ARR. If it experiences growth in the same manner as Xref, that may be too low. CV Check is very close to breakeven excluding grants and at this point trades at a notable discount to Xref. I have not bought shares in CV Check (yet) because I haven’t followed it closely enough to make a snap decision, but I am definitely putting it on my watchlist!

I own shares in XF1 and will not sell any shares within 2 days of publication of the article though I reserve the right to buy more shares. This post is not financial advice, and you should click here to read our detailed disclaimer.

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.

For early access to content like this, join our Free newsletter!