Last week, Ansarada announced that it had acquired complementary corporate governance software company TriLine GRC for 2.3 EV/ LTM revenue, which would seem to be a great buy. As a result, I bought shares at $1.48, on the hunch that the market would like the multiple. You can check out my past coverage of Ansarada here.

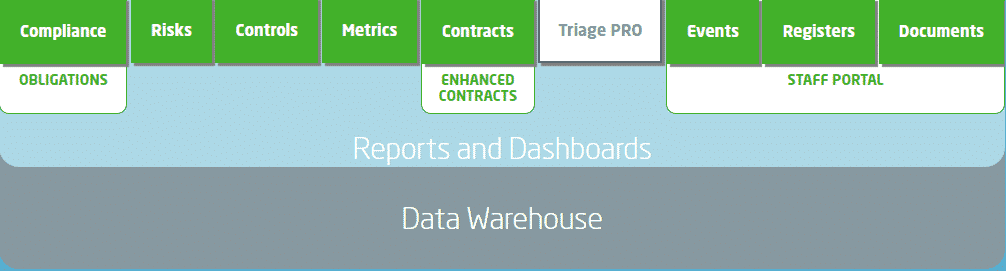

Triline GRC must not be growing very quickly if it was available for sale at such a cheap price. It offers software for regulatory compliance (such as anti money laundering controls, supply chain integrity, contract management and environmental reporting). Therefore, it is serving the same customers (board members and senior management) for a similar purpose (high level governance process management). Therefore, you’d hope some cross selling would be possible. You can see Triline GRC’s modules below.

I’m no longer buying at $1.755 but it’s definitely a company I feel is exceeding my expectations. Having said that, Ansarada has a few negatives as well, such as their awkward transition to SaaS style subscriptions, and the relatively poor reputation of the company, given it’s difficulty running a normal IPO.

That said, the company has changed in a good way since listing. Whereas previously it had negative operating cashflow, in the last quarter it did operating cashflow of over $2.5 million and free cash flow of around $1.3 million. If it can continue to be cashflow positive, then it could grow a fair bit by acquisition given that it should have more than $15 million cash in the bank, even after this acquisition.

You can view the CEO’s somewhat corny video advertising the acquisition by clicking here. The video says that Triline has high retention rates, and like Ansarada, has a client based skewed towards the financial services industry. However, it is not clear why the sellers would sell it for such a cheap price if it is such a good company.

Ansarada is also looking to maintain decent organic growth, but this is the first example of a growth by acquisition since the company listing (which was a merger of sorts). I think it remains an interesting business, and while it is not the most compelling, if it remains cash flow positive then it may be able to trade on a multiple of 6 – 8 times revenue for a long time. If revenue is growing, then that means shareholders should do pretty well from here.

Subsequent note on Sunday 24 October: Ansarada has been promoting this acquisition and its subsequent quarterly report via Hotcopper, which is always a bad sign, and suggests that the recent share price rise to $1.90 might be unsustainable. I am therefore inclined to sell some shares (though have not done so yet).

Please remember that these are personal reflections about a stock by author. I own shares in Ansarada at the time of writing, and will not sell them for at least 2 business days after publication. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Did you know that I appear on the Ausbiz show “The Call” every fortnight?

If you want to be alerted of interviews I do as they happen, you can follow me on Ausbiz, you only need a free account.

And if you’d like to hear my views on a certain stock, you can suggest a stock by emailing [email protected]. Just make sure you mention you’d like me to answer it, or it will probably end up with another guest!