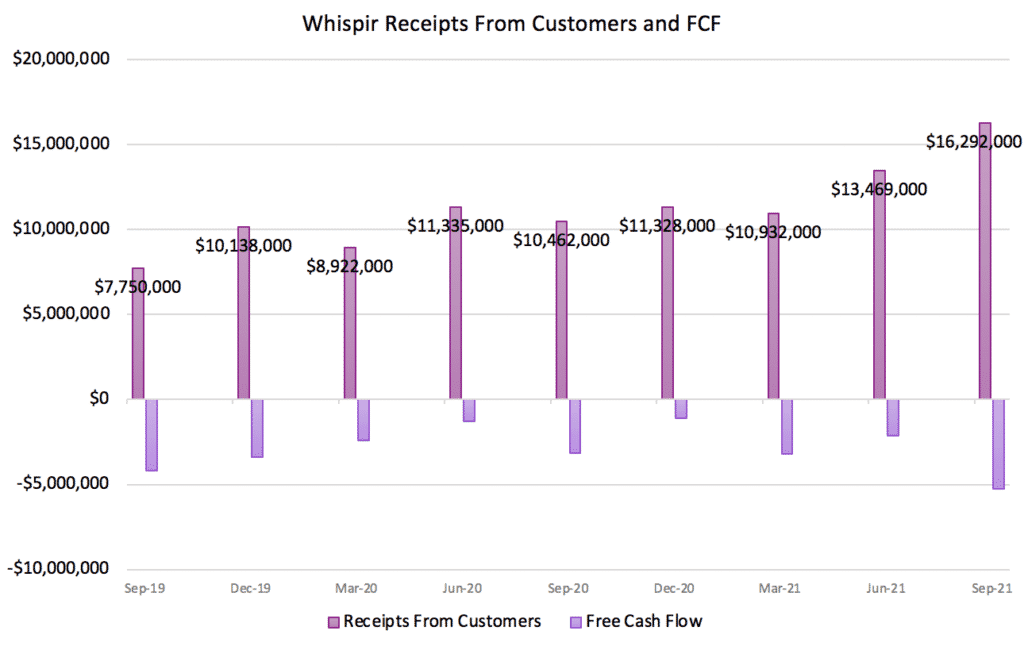

This morning, automated customer communications workflow company Whispir (ASX:WSP) reported its quarterly cashflow, showing record receipts from customers of $16.3 million. Unfortunately, its cash burn also reached record levels, with the business incinerating over $5.1 million in just three months. Importantly, this increased expenditure was forecast by the company, and is well supported by a cash kitty of over $43.9 million.

As you can see below, this result is the best ever quarterly receipts from customers, suggesting strong demand for its services.

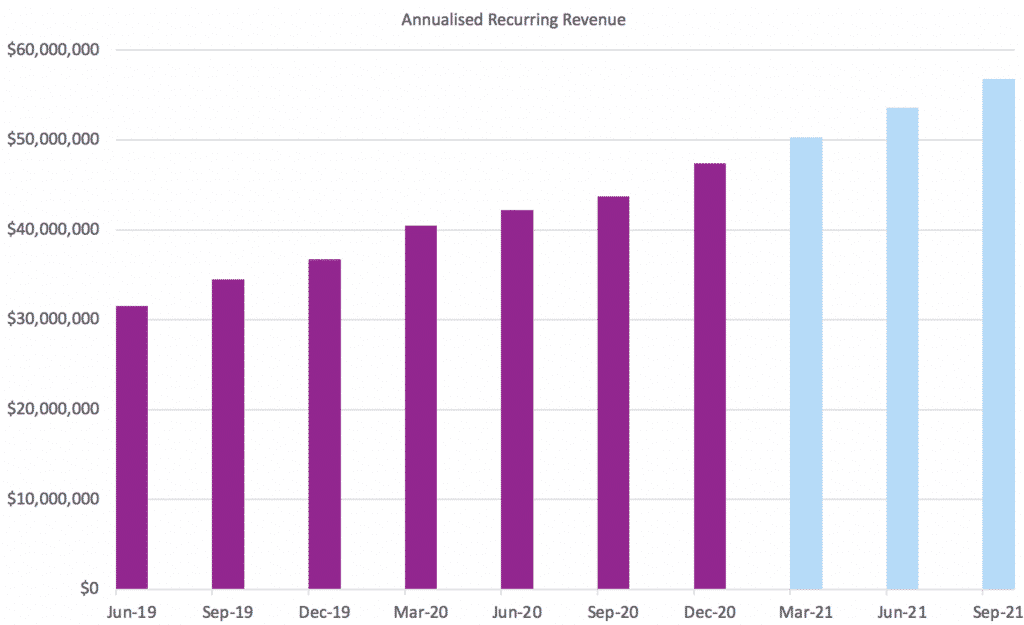

What is Whispir’s Annualised Recurring Revenue?

For the quarter ending September 2021, Whispir report ARR of $56.8m. In the chart below, the colour change denotes when they changed their definition of ARR slightly.

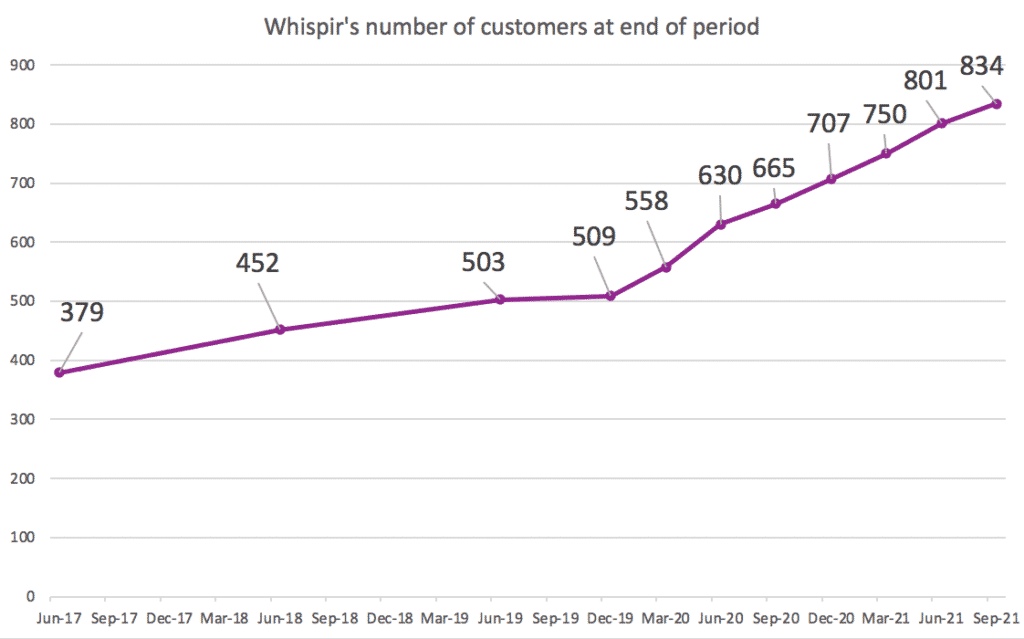

The company looks reasonably healthy, with net revenue retention of over 115% and low customer churn. As you can see below, the company added just over 30 customers in the last quarter.

After the Whispir share price rise of about 9% today, Whispir’s market capitalisation is about $275 million, which is about 4.85 times annualised recurring revenue. With a gross margin of about 62.5%, Whispir deserves a fairly low multiple of revenue, so to be conservative we could also look at its multiple of forward gross profit.

If the company achieves the low end of revenue guidance ($57.2 million), and even if gross margins fall to 60%, that would be gross profit of $34.3 million, putting the company on about 8 times gross profit at current prices. One could argue is too low given the ARR growth rate of over 5% per quarter.

While I don’t own Whispir (ASX:WSP) shares at the time of writing, I’m somewhat tempted to buy some in the hope that this quarter proves a turning point for the company. That said, the large losses and increasing cash burn are less enticing, and mean that the investment should be considered very high risk.

It is somewhat noteworthy that just last year the company raised capital at $3.75, but this year its shares languish some 33% lower. With that performance there might be some cranky investors on the register. At this stage, much hinges on whether the extensive multimillion dollar R&D spend planned for the next two years results in improved margins or accelerating growth.

Please remember that these are personal reflections about a stock by author. I do not own shares in Whispir but may buy shares in the company at some point in the future. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.