For a few years now, I have intended to start investing through my superannuation (which is currently with Australian Ethical). In 2021, I have sold a bunch of shares in my former employers Simply Wall St and Motley Fool, as well as in my private portfolio. I have been a massive net seller because we wanted to buy another house so I we could go to the beach (amongst its many failings, Canberra, where we moved from Bronte, does not have a beach).

All this selling crystallised some nasty tax bills, which has been particularly annoying because my actual salary income is lower than ever. In order to avoid this sticky situation again, I’ve decided that I want to move my focus to a self managed superfund.

Why Am I Starting a Self Managed Superfund?

These days, the costs of starting a self managed superfund have dropped magnificently, to around $1,000 to start it and about $1,000 for ongoing administrative costs. However, the main reason I want to invest in superannuation is because I think that I can drastically outperform Australian Ethical, simply because I’m managing such a small amount of money compared to them. Our self managed superannuation fund will be a drop in the ocean compared to the $5 billion and growing that Australian Ethical handles.

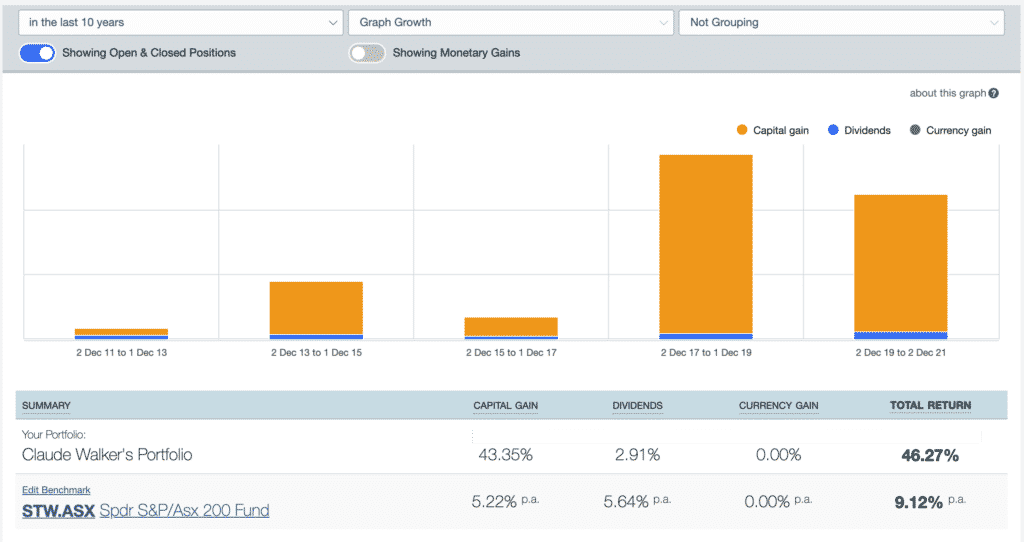

And after achieving a money weighted return of over 40% a year for 10 years (noting that I let the money compound, so the later years had more of an impact) I feel confident that I can make a fairly big difference to our retirement savings.

But the biggest reason I want to start a SMSF is that it will result in a more favourable tax environment. You see according to a casual look around the internet (I am not an accountant) for an SMSF in the accumulation phase, tax on investment income is capped at 15 per cent and compliant SMSFs receive a 1/3rd CGT discount for assets held over 1 year.

This is considerably better than the 24% to 48% tax rate I have been paying on gains over the last few years. It simply makes zero sense for my higher earning investment activities (my portfolio) to exist in a high tax environment, while my lower earning (but still decent) superannuation enjoys the low tax environment.

Now that we have accumulated enough cash in our own names, it makes sense to start building the retirement nest egg a bit more seriously.

Step One, Create An SMSF

When I started thinking about this process, I had a look around at the options. It seems to me that for a basic SMSF, it now costs about $1000 to create and $1000 for ongoing administration. You can see examples from Selfmade and eSuperfund. For a cheap’n’cheerful SMSF, I was also tempted to look at Stake.

However, in terms of pure ease and low cost, it’s hard to go past Australian Super Member Direct option, which allows you to invest in your own mix of ETFs and shares in the S&P/ASX 300 Index. I really should have done that years ago.

In the end, however, I decided to go the old fashioned route of just having my family accountants set it up for me. I’m sure this will end up costing me more, but I want to have full flexibility to invest in unlisted companies, listed companies, crypto, art, property, and basically anything I feel like. I live my life trying to optimise for “I do what I want” even when it costs me. So I called my accountants in Sydney.

So far, I’ve only just signed the documents to create the SMSF, but I guess the next step will be creating a bank account and then migrating our superannuation into it.

I’ve also got to choose a broker. I’ve decided on interactive brokers, because I really hate CommSec’s International Share Trading portal, and I prefer have a big large well capitalised company as my broker, and I want to be able to trade all sorts of instruments easily.

In preparation for this process, my superannuation is currently invested very significantly in cash, so I’m not too worried about the current sell off. However, I definitely want to get this all sorted as quickly as possible, so I can start deploying it.

Strategy

I am a strong believer in dollar cost averaging, so I’ll be looking to employ my capital gradually, but after 18 months I would expect to be approximately 100% invested. If my current family situation is a good guide, the money in our SMSF will not be particularly relevant to our “needs” in retirement.

However, the more capital I have the more I can use it to try to conserve nature. We already bought one forest and trust me when I say those things do offer good returns on capital unless you’re willing to cut the trees down, which I am not.

Therefore, my preference is to yolo my superannuation into whatever assets I think offer the best risk reward imaginable. For me, super is long term money, so I’d be willing to a larger number of higher risk v reward bets and just leave them long term. However, I’ll happily sell broken theses, and let ideas that are working compound.

At first, I’d be thinking of having about 25 positions in high risk and high reward listed stocks.

Of course, the SMSF will be shared between me and my partner Chloe, so she also gets input into strategy. Having spoken to her, she’s happy with the performance of the managed funds she has invested in (most of the funds I disclose having an interest in are actually Chloe’s investments.) Therefore, part of the strategy is going to be in managed funds.

On top of that, Chloe wants me to put some in blue chip big tech stocks. We’re having an ongoing discussion what those will be, but one is guaranteed to be Alphabet, which will likely end up being the biggest single exposure in the fund (at least until one of my higher risk stocks mutli-bags, and that will take a few years at least).

Finally, I also invest in a number of private businesses, and going forward, I’ll be looking to do that through my superannuation.

A Fresh Start

In some ways, I have found managing a mature portfolio to be less exciting than the early days of building one. In part, that’s because a lot of what I have been doing lately is selling. Ever since we bought the house in April 2021, I have been deleveraging, so I’ve had to constantly sell stocks to buy more new stocks. That’s ok, but it’s not as fun as just buying stocks.

At present, my intention is to disclose all the listed stocks in our SMSF in one single pie chart. Once I start deploying capital, you’ll be able to find the SMSF under the “Disclosure” tab. I am looking forward to sharing this journey with my Supporters and I hope you will email me ideas about how I can make my diaries as interesting as possible for you.

Please remember that these are personal reflections about a stock by author. I own shares in Alphabet and Australian Ethical. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.