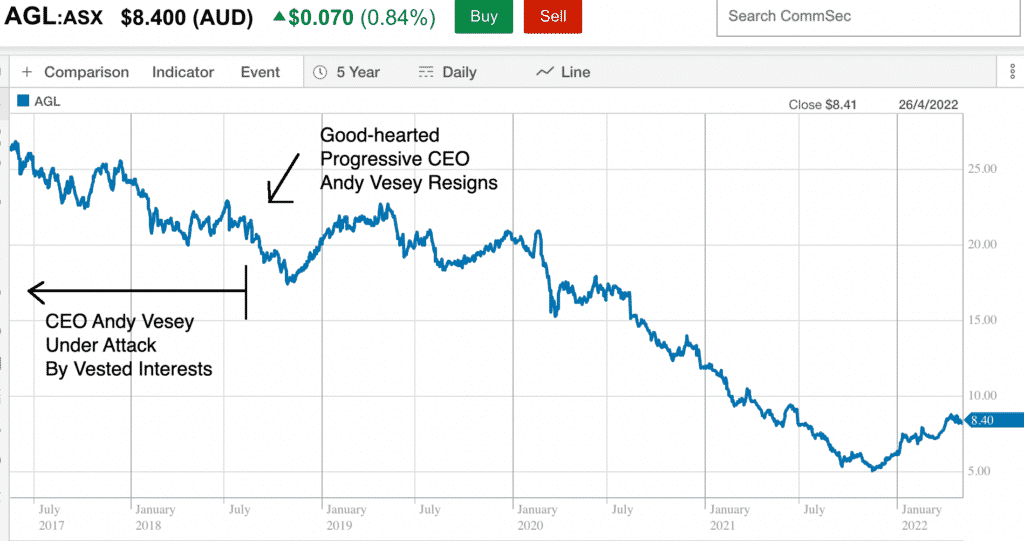

AGL Energy (ASX: AGL) is one of Australia’s largest energy generator retailers, alongside Origin Energy (ASX: ORG). In recent years, it seems AGL Energy has damaged its brand, its profits, and its future by failing to sufficiently invest in renewable energy. That has seen the share price decline from above $20 per share to just over $5 share, before the company received a takeover offer from Grok Ventures and Brookfield Asset Management. Although that takeover offer was not accepted by the board, it did result in share price appreciation, to around $8.40 today.

Why Has AGL Energy Stock Performed So Badly?

Prior to 2016, AGL Energy was investing too heavily in coal fired generation, but this mistake was set to be corrected by the former CEO Andy Vesey. Vesey planned to use the company’s market power to orchestrate the orderly closure of coal fired power generation, and had begun to invest heavily in renewable energy generation plus battery storage. And he planned to do this without making workers redundant.

However, it’s possible that this plan clashed with the interests of the mining companies that had supported many powerful politicians. In 2018, then environment minister Josh Frydenberg was actively trying to prevent Vesey’s planned closure of the Liddell coal fired power plant, actively lobbying for the company to instead sell the asset, to ensure its continued operation.

It was clear at the time that there was immense political pressure on Vesey to cease the company’s transition away from coal. However, it subsequently emerged in this exclusive report from The Saturday Paper that Frydenberg was actively lobbying the board to have Vesey fired. Esteemed journalist Mike Seccombe wrote that, “in multiple phone calls, Frydenberg pressured the board to drop Vesey over his plan to close the Liddell power plant.”

Subsequently, Vesey abruptly resigned and Brett Redman, the prior CFO who had overseen investment in coal generation, took over as CEO. According to an un-named senior executive quoted in Seccombe’s article, “AGL had built up quite a big pipeline of projects, new potential solar and wind projects. And Brett set about selling those off.”

On top of that, AGL has pursued a costly, damaging and unsuccessful attempt to sue Greenpeace for breach of copyright because the activists were making fun of AGL, calling them “Australia’s Greatest Liability” and using their logo for legitimate political parody. In my opinion, the decision by AGL to pursue this legal action gives you a good guide to the moral values of the company, while the share price chart below gives you a good guide to their business capabilities.

With the benefit of hindsight, the resignation of Andy Vesey was a massive sell signal, because it meant that AGL Energy was no longer sufficiently aggressive in its preparations for a world increasingly powered by renewable energy.

The end result has been that the current board of directors now wants to split up the company, into one that owns the (mostly dirty) generation assets, and another that owns the (supply agnostic) retail assets.

Why Is AGL Energy Stronger As Generator Plus Retailer?

There are many reasons why the market is dominated by two generator-retailers (gentailers), so for the sake of brevity, I’ll focus on just one. Basically, the retail arm of the company provides a large amount of demand, which allows the generator arm of the company to invest in generation capacity with confidence.

Put simply, if you want to start a wind farm today, because you have the best farm for it, you first need to get a bank loan. In order to get a bank loan, you need a power purchase agreement. In order to get a power purchase agreement you need to sign a contract with a big user of electricity, such as a large energy retailer.

That puts large energy retailers in a privileged position, because, more so than anybody else, they get to decide which new renewable energy or energy storage projects actually get financing. If you seperate out the retailer and the generator, then the generator will not control sufficient demand to achieve financing for new renewable projects. Only a gentailer can do this at scale.

The fact that AGL is also in a position to close down dated coal generators, means that it can ensure that when large renewable energy and storage comes online, coal can come offline, thus keeping the market in balance. I’ve oversimplified it massively, but this was essentially Vesey’s plan for AGL, and it was the right plan.

The current AGL Energy plan of de-merging the retailer and the generators means that they will create a coal power generating company that will not take its coal generators offline if AGL (the retailer) were to subsequently decide to build solar + storage generation capacity. The lost co-operation will delay the transition to renewable energy, because it would be in the interest of the coal generator to try to keep going as a coal generator and under-invest in renewables, because that will push energy prices higher. The plan to split the retailer out is inane, because a big retailer should be integrated with a generator, to ensure maximum efficiency.

This is just one of many reasons why retailer generators are stronger than standalone retailer or generator. But if you don’t believe me, then believe Angela Macdonald-Smith, Senior Resources writer for the Australian Financial Review when she wrote in June 2021 that “Investors have given AGL Energy’s long-awaited demerger plan a humiliating reception, carving another 10 per cent off the heavily coal-reliant group’s market value amid doubts the two new companies that emerge from the process can thrive in a rapidly changing market.”

Macdonald-Smith further quoted MST Marquee analyst Mark Samter who made the point that, despite atrocious performance, the de-merger would “give board members all more power and prominence.”

While the de-merger may or may not be in the personal interest of directors and management, it has not been in the interest of shareholders. When the intention to de-merge was announced on 30 March, 2021, AGL shares traded at around $16. Today, the AGL Energy share price is about $8.40; and it would probably be it a lot lower if the de-merger was fait accompli.

If AGL Shareholders Have Brains, The Demerger Will Not Proceed

The de-merger proposal for AGL Energy seems to rely on retail shareholders flaccidly yielding to the wishes of a board that has overseen massive value destruction, and completely failed to make the most of the company’s unique positioning. While AGL Energy could already be profiting massively from new renewable energy and battery technology, the company instead remains beholden to dated and failing infrastructure, such as the failing Loy Yang A power station which was taken offline in April due to “an electrical fault with the generator.”

At present, AGL Energy trades on a trailing dividend yield of over 5.8% and about 10x underlying earnings for FY 2021, or 14 times underlying earnings for H1 FY 2022, annualised.

The company is in weak shape, and probably does need to cut that dividend for a few years while it rectifies past mistakes. But I bet at least some savings could be made by changing the members of the board and replacing them with higher performing, lower paid individuals. In FY 2021, non-executive directors received over $2m between them. Given their backing of the deleterious de-merger proposal, my view is they are not the right people to serve on the AGL Energy board (though I reckon former CEO Andy Vesey could make a great contribution).

Happily, there is a real prospect that, gradually, we might see some change of control at AGL Energy. The biggest factor here is that co-founder of Atlassian Mike Cannon-Brookes has built up a stake of over 11% of AGL Energy through a derivative position, and is lobbying against the de-merger.

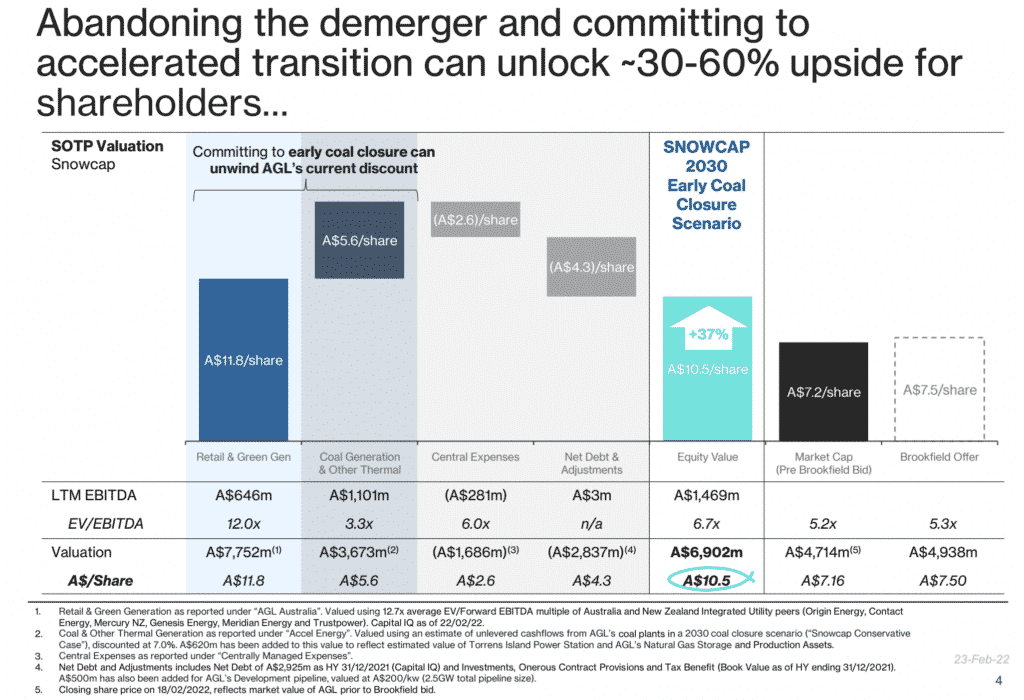

In this mission Cannon-Brookes is supported by fellow AGL Energy shareholders Snowcap Research who argue “AGL must abandon the proposed demerger and commit to close down its coal plants by 2030 as part of a broader, accelerated transition plan. Doing so has the potential to unlock 30-60% of upside for shareholders and avoid 385 million tonnes of future greenhouse gas emissions.” You can see a slide from their presentation, below.

Ultimately, I believe that the upside described by Snowcap can only be achieved by the orderly removal of most of the current board. In my view, it seems likely that the company is worth at least $7 per share, and probably wouldn’t trade too far below that even if the de-merger does go ahead.

On the other hand, I actually believe it could be a really good long term investment if former CEO Andy Vesey or a similarly strong leader took over steering the ship.

In any event, my interest in the stock is because I think that it’s worth more than its current price if the de-merger does not proceed. In my view the de-merger is similar to the attempt to sue Greenpeace; a folly of fossil fools.

Therefore, I have bought shares in AGL Energy and will vote against the de-merger. If the de-merger proceeds, I will sell my shares. If the current board remains in place but the de-merger fails, I will probably sell my shares, I hope for a profit. If the de-merger is defeated and key members of the board resign, I will consider holding my shares.

In order to succeed, the de-merger must receive the support of 75% of the shareholders. In my view the de-merger is against the interest of shareholders. Retail shareholders hold around half the shares on issue, so if just 40% of those shareholders vote against the de-merger, then that would probably be enough to defeat the proposal, alongside Mike Cannon-Brookes, Snowcap and other reasonable institutional holders. Retail shareholders alone could block the de-merger if 50% vote against it. I cannot be sure, but I believe there is a good prospect that sense will prevail in this instance.

Edit 17 May: Bloomberg reports that Cannon-Brookes’ “derivatives give an economic interest without moving the share price”. On May 17, a 5% stake of the company changed hands for $8.75 which may be an attempt by Cannon-Brookes to build up a stake that can be used to vote against the de-merger.

I don’t expect fantastic returns from my investment in AGL Energy, but I can’t resist the temptation to participate in some genuine shareholder activism, and maybe make a dollar along the way.

This article should not form the basis of an investment decision, and my thinking around any of these stocks may change at any time for any reason. It is an investment diary valuable only for the cognitive process it demonstrates and you should cultivate our own thinking. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer. If you are seeking financial advice, which you should, you are in the wrong place.