This morning aerial mapping company Nearmap (ASX: NEA) announced its FY 2022 Nearmap results and held its conference call. Nearmap’s FY 2022 revenue was up 29% to about $146m, but its net loss increased 64% to $30.8 million, demonstrating the ‘reverse operating leverage’ that I hold in such low regard.

I have followed Nearmap since 2014, owning it at times. When I sold in early 2020, I said I needed to see positive cash flow, to get interested in the stock again. These results are notable because the company indicated it expects to be free cash flow positive in FY 2024.

In FY 2022, Nearmap burned through about $28m, once you include the investing cash out flows. Some of these investing expenses are probably optional, but the company could not simply eliminate capture costs for long, because customers want up to date information. In any event, on the conference call Nearmap (ASX: NEA) said that it will reach peak cash burn in H1 FY 2023, and there should be “a flattening of the expense base” in H2 FY2023, followed by positive free cash flow in FY 2024.

If so, that means the company is getting close to the inflection point that would make it more attractive to me. I eventually grew tired of Nearmap’s very fast expense growth and multiple decisions to raise capital rather than just run at breakeven. After these results, Nearmap still has over $90m in cash, so it is funded to breakeven, based on the management forecasts.

In recent weeks, Nearmap has received a potential take over offer from Thoma Bravo at $2.10 per share, and due diligence is currently ongoing. There is no certainty that the deal will go through, but I believe a private acquirer would probably be able to reduce some costs at Nearmap.

The board and management of Nearmap do not come cheap. Directors took home around $700k not including the CEO’s total remuneration of about $1.6m. The CFO’s total remuneration of about $1.6m includes significant deferred equity incentive granted during the financial year worth around $1.2m. The company has offices at Barangaroo plus all the costs of being a listed entity. And with all that, it’s slated to be free cash flow positive in FY 2022, anyway.

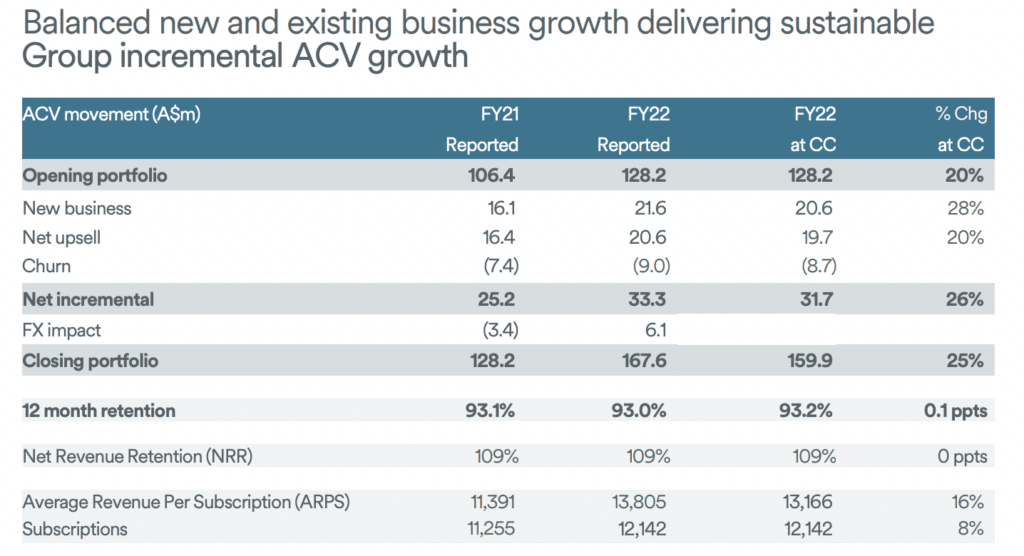

With churn steady and all the growth metrics moving in the right direction, I don’t see any reason why these results would scare off Nearmap’s suitor. You can see some of the high level metrics in the slide below, from the Nearmap FY 2022 Results Presentation.

As a lower growth (but larger) business, you could easily imagine Nearmap making more than double its current revenue (due to growth in North America) and even making NPAT margins of 10% or higher. At the current share price of about $2 the market cap is about $1b, so about 33 times that far-off forecast. But if margins were 15%, then it would only be about 22 times. And even beyond that point, the company would quite possibly have growth potential. So I’m not saying that Nearmap is cheap, but I don’t think it’s crazy someone would want to take it over at $2.10.

In conclusion, these results make me think it’s more likely the deal will go through, though I am not buying shares myself for the 5% upside. I suppose the market may be speculating about another potential offer. If the deal does fall through, then I’ll definitely keep an eye on Nearmap as it approaches its forecast for free cash flow breakeven in FY 2022.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author does not own shares in NEA. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.