Insurance broker Steadfast Group Ltd (ASX:SDF) reported typically uplifting results for the first half of 2023. Underlying revenue improved 27.2% to $662.8 million, underlying NPAT rose 18.2% to $90.2 million and underlying diluted earnings per share (EPS) increased 7.7% to 9.1 cents.

Investors were rewarded with a generous 15.4% boost to the interim dividend to 6 cents per share fully franked. The good news didn’t stop there, as management upgraded guidance for the full year from between 5% and 11%, to between 10% and 15%.

It is worth noting that Steadfast’s underlying results differed from their statutory results in that they excluded “non-trading” items. These primarily relate to acquisitions and disposals and appear to be reasonable adjustments to reveal the underlying performance of the business.

We can also take comfort from the fact that more than 100% of underlying profit after tax was converted into cash during the half year. Operating cash flow (net of lease obligations and excluding movements in trust accounts and premium funding) increased 22.1% to $129.6 million.

Steadfast’s balance sheet remains robust. At 31 December, the group had $507.7 million of corporate borrowings and $100.9 million of deferred consideration outstanding versus $250.7 million of group cash. Netting these amounts gives us a debt position of $357.9 million which is less than the midpoint of earnings before interest, tax and amortisation guidance (EBITA) for 2023 of $425 million. This leverage is more than comfortable for a business as cash generative and resilient as this one.

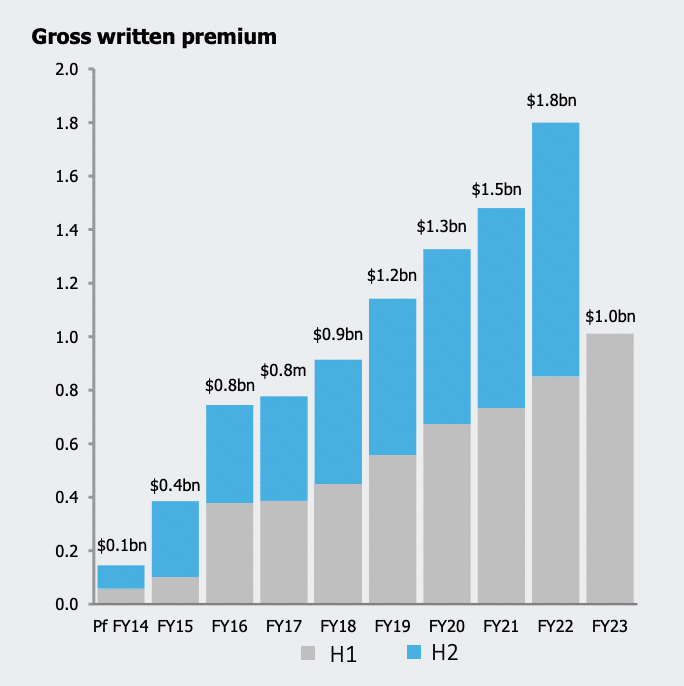

As you can see below, such strong financial performance is nothing new. Since listing in 2013, Steadfast has delivered compound growth in underlying EPS of 13.9% whilst paying out three quarters of profits in dividends.

Source: Steadfast 2023 half year presentation

Let’s turn our attention to the possible drivers of this exemplary track record.

An insurance broking distribution network

Steadfast is a classic network distribution business. Its network connects insurance companies to small and medium businesses via 417 brokers and 29 underwriting agencies. It is both the largest general insurance broker and group of underwriting agencies in Australia. In addition, Steadfast has equity stakes in 9 businesses which provide complementary services to the rest of the group and a modest but growing international presence in the UK, Asia and New Zealand.

The group also owns a 60% stake in UnisonSteadfast, one of the world’s largest global general insurance broker networks offering multi-jurisdictional coverage. UnisonSteadfast has 272 brokers across 140 countries. It is strategically important to Steadfast, informing its long-term geographical expansion plans.

Source: Steadfast 2023 half year presentation

Steadfast only holds equity stakes in 70 of its 417 strong broking network and operates an ‘offer and acceptance’ model whereby it is not compulsory for brokers to take up Steadfast’s products and services. This means brokers are free to act in their own best interests and those of their clients which should ensure that the network remains healthy and competitive.

Steadfast brings greater choice and efficiency to brokers through its relationships with the major insurers, its niche underwriting capabilities (offering more than 100 specialised insurance products) and centralised support services, particularly technology. These broker benefits accrue with scale, whilst on the other side of the network insurers get access to a growing underlying SME customer pool.

It is challenging for insurers to serve SMEs directly because each small business has bespoke requirements. Both the attentive service provided by local brokers and the niche insurance products created by Steadfast’s underwriting agencies are highly desirable to insurers.

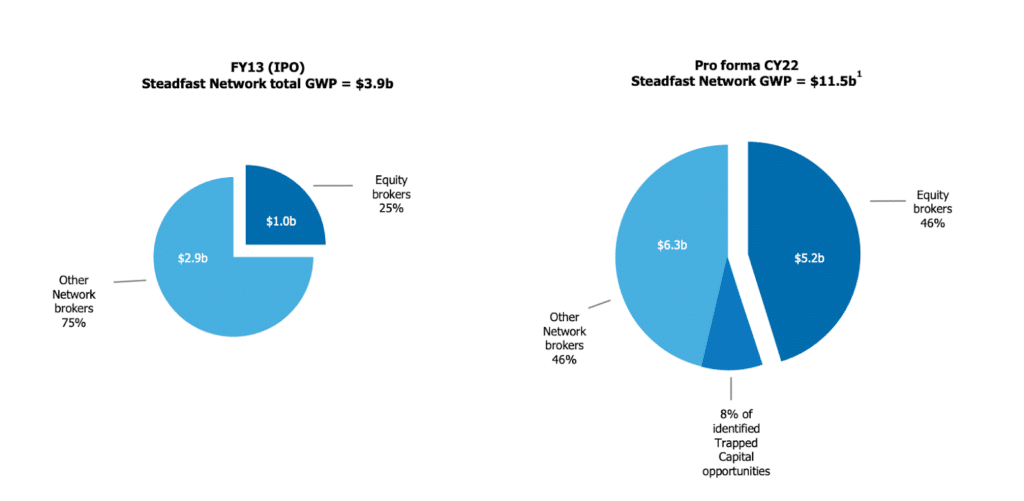

The following charts demonstrate how Steadfast has been able to grow both the equity and external components of its network over time.

Source: Steadfast 2023 half year presentation

The insurance cycle

Insurance brokers essentially “clip the ticket” on the insurance premiums that they sell on behalf of insurers without taking on underwriting risk themselves. However, they are still exposed to pricing risk caused by the insurance cycle.

Premium pricing fluctuates over time because there is a lag between writing an insurance premium and realising claims against it. A period of strong pricing encourages competition which drives down prices and erodes underwriting standards. Subsequent adverse claims performance eventually leads to higher underwriting standards and stronger pricing once again.

Over the past several years in Australia we have seen a sustained “hardening” cycle. Most recently this has been driven by high inflation, but low interest rates are also responsible.

Insurers earn returns on the premiums which they put aside to pay out claims later by investing them in safe assets. Since returns on these assets have been so low in recent times, insurers have needed to charge higher premium prices to maintain margins.

Taking a look at the share price performance of listed general insurers globally, it is clear that they have not been benefiting from rising prices over the past few years and therefore it seems unlikely that we are approaching a peak in the cycle just yet.

Furthermore, climate change implies that insurance is likely to get more expensive as destructive weather events increase in frequency.

Nonetheless, it is important to remember that the recent trend of rising prices is unlikely to persist indefinitely and therefore we should be wary when extrapolating past investment performance.

The favourable pricing environment has benefited the entire broking industry, but it is important to understand what differentiates Steadfast from its peers. There are two other insurance broking groups listed on the ASX, AUB Group Ltd (ASX:AUB) and PSC Insurance Group Ltd (ASX: PSI). Let’s take a closer look to see how they compare to Steadfast.

Business models and strategy

All three businesses have the advantage of operating distribution networks and all three have some degree of complementary underwriting capability, but there are also significant differences.

Steadfast has the most established underwriting operation with 24.7% of group revenue derived from underwriting agency activities versus 11% for AUB and 7.5% for PSC.

The situation is even more pronounced on an absolute basis. Steadfast’s underwriting business generated $163.7 million in revenue for the first half of 2023 compared to $58 million for AUB and just $10.3 million for PSC.

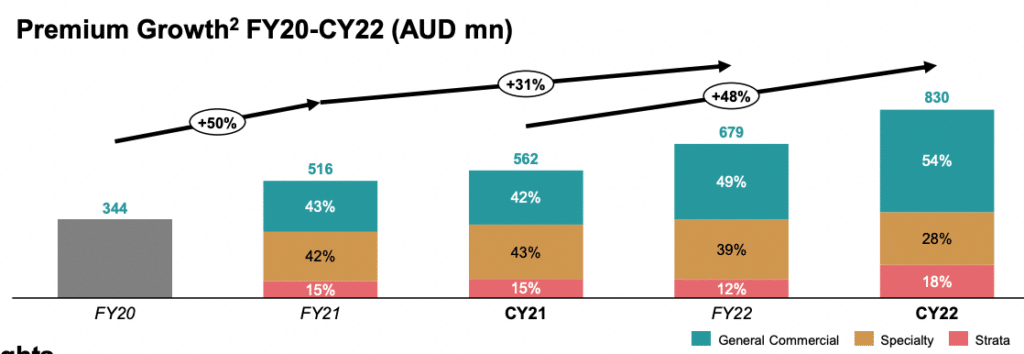

Indeed, Steadfast’s underwriting agency business is the largest in the Australian market and has grown rapidly in recent years as can be seen below.

Source: Steadfast 2023 half year presentation

In Steadfast’s recent half year 2023 investor call, CEO Robert Kelly said that Steadfast’s success in this area is due to the fact that it offers underwriting services to the broader market and not just to Steadfast network members. He argued that Steadfast’s underwriting group was more competitive as a result.

AUB is also having significant success in its underwriting operation as can be seen below.

Source: AUB Group 2023 half year presentation

Both AUB Group and Steadfast own online insurance distribution platforms. As far as I am aware PSC does not own such a platform.

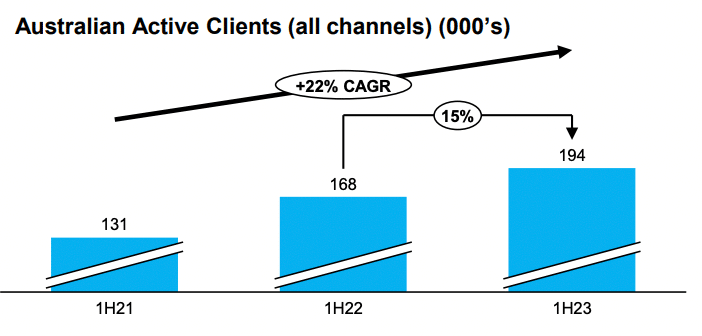

AUB owns a 40% share in Bizcover which it acquired in February 2020. Bizcover offers insurance both directly to SMEs and through broker intermediaries. It is growing nicely as you can see below.

Source: AUB Group 2023 half year presentation

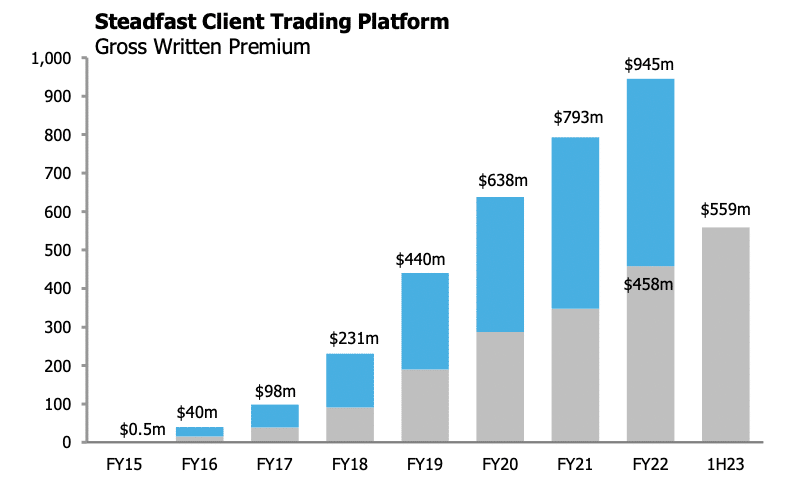

Meanwhile, Steadfast has developed its own platform internally which is called the Steadfast Client Trading Platform (SCTP) and exclusively serves the Steadfast network.

Source: Steadfast 2023 half year presentation

There are a couple of things to note here.

Firstly, Steadfast is so focused on strengthening the value of its network that it is willing to forgo potential third party revenue by making SCTP exclusive to Steadfast members. I believe that this approach will strengthen Steadfast’s competitive position over the long-term.

Secondly, Steadfast tends to develop IT systems in house demonstrating its ability to innovate. It is unclear if AUB and PSC have similar capabilities, but it seems unlikely given AUB’s decision to acquire Bizcover and PSC’s apparent lack of a similar offering.

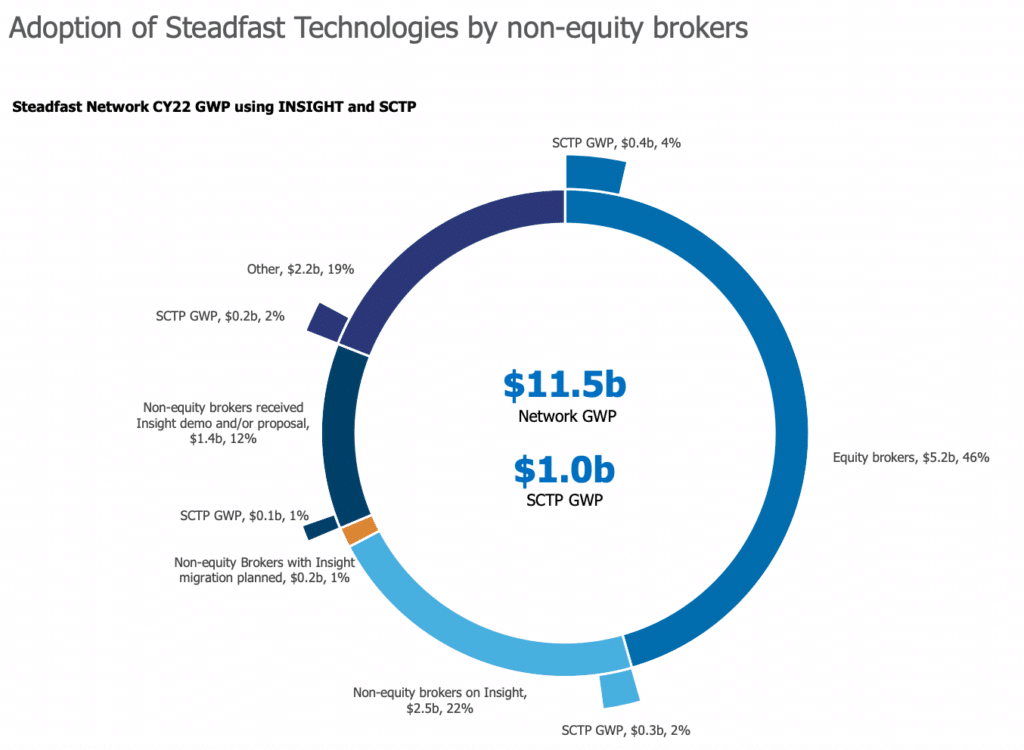

Another clear example of Steadfast’s technological prowess is illustrated by its internally developed cloud based broker management software called Insight which provides brokers with a single view of client transactions and compliance. Again, to the best of my knowledge neither AUB nor PSC can boast such a system.

There was some scepticism when Steadfast launched Insight in 2016 due to prior failures by other broker groups attempting to build something similar. Therefore, it is pretty impressive that there has seen such a significant uptake of the product, particularly among non-equity brokers who are free to shop elsewhere.

Source: Steadfast half year 2023 presentation

Source: Steadfast half year 2023 presentation

The above chart appears to show that the rate of adoption for Insight is slowing, but this is not the case as some brokers have merged.

Steadfast, AUB and PSC are all highly acquisitive, but they do not go about deals in the same way.

For one thing, PSC generally buys businesses outright whereas Steadfast and AUB Group tend to acquire partial stakes.

As we’ll see later, this hasn’t stopped PSC from being similarly successful to Steadfast and AUB. It somewhat surprised me to learn this as I had previously thought that partial ownership helped to maintain alignment of interests between the acquirer and vendor (who typically remains within the business) and that this explained some of the success of the latter two.

Although Steadfast and AUB group both buy partial interests, one difference between their approach is related to Steadfast’s expansive non-equity broking network.

Steadfast methodically and systematically purchases equity from brokers in its broader network through its “trapped Capital” project. This benefits brokers who want to monetise capital in their business and allows Steadfast to acquire stakes in businesses which it knows very well.

Whilst AUB does provide some services to external brokers, its network is nowhere near as developed and so it does not enjoy a similar informational advantage when acquiring businesses.

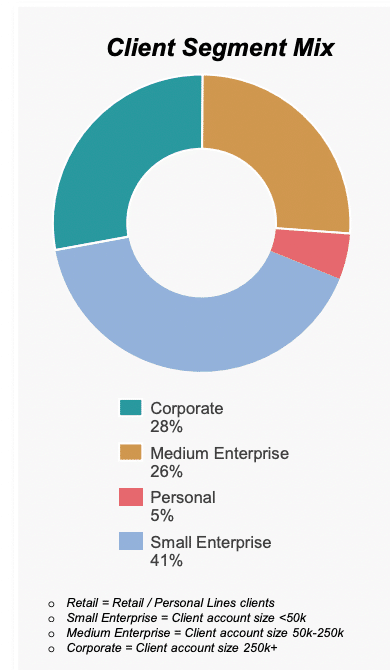

Client mix

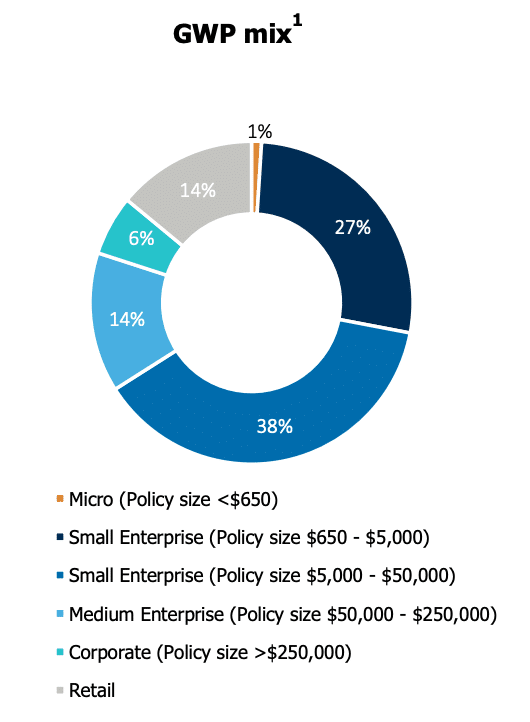

The following charts show a breakdown of PSC, Steadfast and AUB’s client mixes, respectively.

Source: PSC FY22 presentation, SDF HY23 presentation, AUB FY22 presentation

We can see that Steadfast is particularly strong in the smaller end of the market whilst PSC and AUB are more weighted towards enterprise clients.

Customer diversification is a strength, particularly in an intermediary business and so once again I am minded to prefer this aspect of Steadfast’s business over its peers. It would make sense that this difference is related to Steadfast’s unique non-equity broker network.

Geographical footprint

All three companies are looking to explore expansion opportunities overseas, but they are going about it in different ways.

AUB Group recently acquired Tysers, a leading specialist international wholesale insurance broker operating in the Lloyd’s marketplace. The Lloyd’s marketplace is the largest insurance market in the world with US$110 billion gross written premium (GWP) annually.

The Tysers acquisition provides AUB with a more differentiated offering through access to specialist products on the Lloyd’s market. It also has the scope to enhance group margins on GWP by redirecting GWP currently sourced from third party international wholesale brokers. Finally, the acquisition provides AUB with a beachhead within the UK retail broking market.

Tysers generated $322 million in revenue in 2021, representing roughly a third of AUB’s revenue on a pro forma basis. The size of the transaction and substantial rise in debt accompanying it makes the move somewhat risky, but the strategic rationale appears to stack up.

PSC is planning to team up with AUB Group through the acquisition of 50% of the Tysers UK retail brokerage business which will create a joint venture between the pair.

Unlike Steadfast or AUB, PSC has a long established presence in the UK which already accounts for 50% of group revenues, prior to the joint venture.

Meanwhile, Steadfast is more circumspect in its approach to expanding overseas. It has established a small broker network in Hong Kong including two equity investments and has opened an office in London to seek access to the Lloyd’s market.

It also has a 60% ownership stake in UnisonSteadfast, one of the world’s largest multi-jurisdictional broker networks.

Robert Kelly confirmed that Steadfast is looking into further international investment in the recent 2023 half year investor call, but that management is yet to decide on the right strategy. He suggested that the company will likely adopt an approach combining the introduction of Steadfast’s technology along with establishing a distribution footprint in a chosen foreign market.

Leadership

Insurance veteran and current CEO, Robert Kelly, founded Steadfast in 1996.

Mike Emmett is the current CEO of AUB Group having joined the business in 2019. He was previously the CEO of Cover-More, a global travel insurer.

Paul Dwyer founded PSC in 2006 and is currently deputy chairman. Antony Robinson is the current managing director of PSC having joined the group in 2015 and was formerly CEO of IOOF Holdings, now Insignia Financial Ltd (ASX:IFL).

The board of AUB holds a combined 94 thousand shares worth $2.3 million versus more than 8 million shares held either directly or indirectly by Steadfast directors worth over $45 million. Meanwhile, PSC boasts a combined board shareholding of 142 million shares worth a whopping $687 million!

The lack of insider ownership at AUB puts it at a slight disadvantage as a potential investment in my view. It is also the only one of the three companies which does not maintain a founder on its board, although this is unsurprising given it was founded in 1985.

Size

AUB Group Ltd (ASX:AUB) generated $327.6 million in revenue for the first half of 2023, about half of that generated by Steadfast over the same period. PSC delivered underlying revenue of $137.8 million and so is less than half the size of AUB and less than a quarter as big as Steadfast by this measure.

However, revenue figures are a little misleading in this case since both AUB and Steadfast have investments of varying sizes in many brokerages. The level of ownership in each case determines whether or not the revenue of the subsidiary is consolidated into the group financial statements. In other words, not all of the revenue disclosed in the financial statements is attributable to shareholders while some revenue which is attributable is not reported.

In terms of market capitalisation which is a better measure, PSC is valued at $1.7 billion, AUB is valued at $2.6 billion and Steadfast is valued at $6.1 billion.

It is interesting to observe that despite being founded a decade before Steadfast, AUB is valued at less than half of its larger rival. Meanwhile, PSC has grown rapidly to almost catch up with AUB in terms of market capitalisation even though it has only existed since 2006.

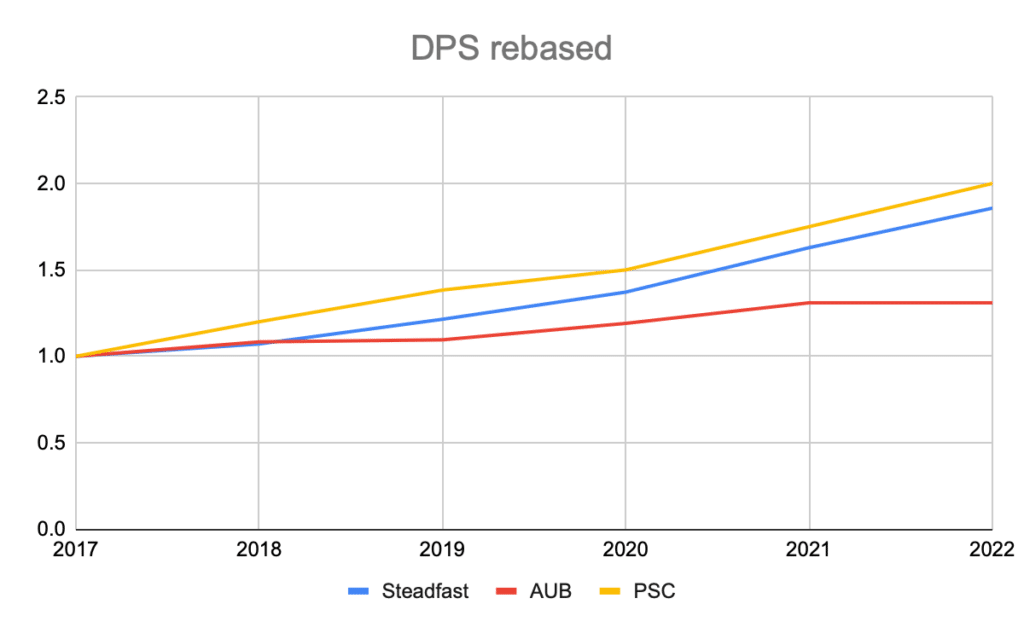

Growth is fine, but shareholder returns are what ultimately count and so let’s see how the companies fare on this score.

Shareholder returns

Since it listed in December 2015, PSC has delivered a total shareholder return (TSR) of 282% compared with 354% for SDF and 242% for AUB.

This calculation is based upon the closing prices of each stock on the first day of trading for PSC rather than PSC’s listing price of $1. PSC closed up 42% on that day and, given its subsequent performance, I think it is fair to say the IPO was underpriced and so using the closing price makes for a fairer comparison.

Source: Google Finance

As can be seen below PSC has outperformed the other two stocks in terms of EPS growth, with Steadfast in second place and AUB lagging behind in third. Given Steadfast has the highest TSR, this implies that its stock has become more expensive relative to PSC over time. At current prices, both stocks trade on a price to earnings ratio (PER) in the low 20s based on consensus analyst forecasts and so are similarly priced. Source: company annual reports

Steadfast has demonstrated the most conservative and consistent payout ratio,

Source: company annual reports

whereas AUB’s dividends have lagged behind its EPS growth.

Source: company annual reports

One possible reason why PSC has outperformed both AUB Group and Steadfast in terms of EPS and dividend growth since listing is that it is growing from a smaller base.

Furthermore, it can be more selective in terms of the price it pays for acquisitions whilst still “moving the needle”.

Indeed, in the first half of 2023 Steadfast executed 27 small acquisitions adding $15 million in EBITA and paying an average multiple of just under ten times. This compares to $2.4 million of EBITDA acquired by PSC for three acquisitions at a multiple of 7.1 over the same period.

I suspect that PSC will be forced into paying higher multiples for acquisitions as it grows and that its growth rate will moderate.

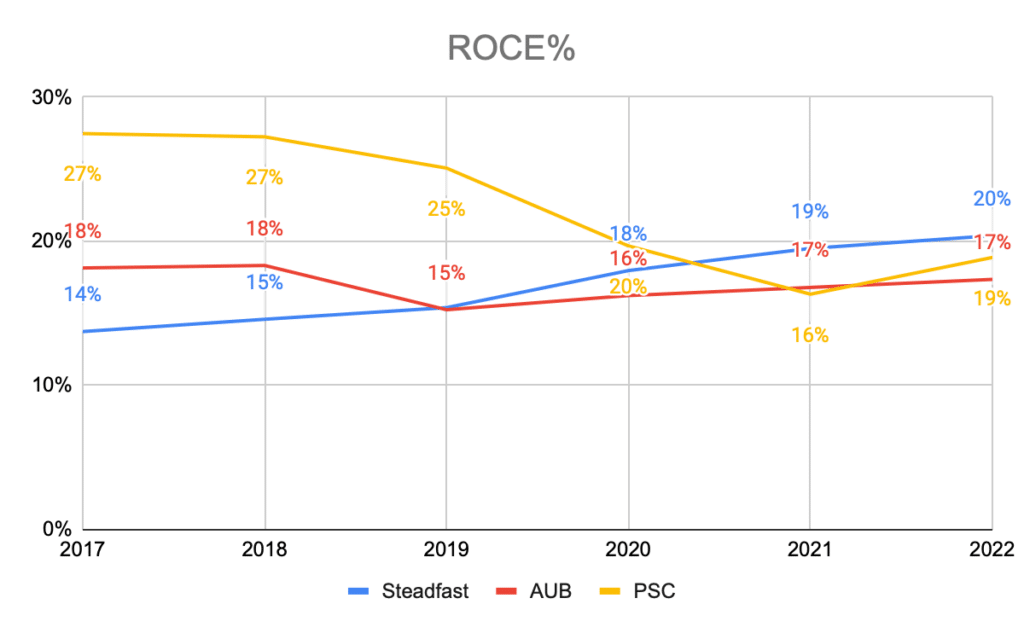

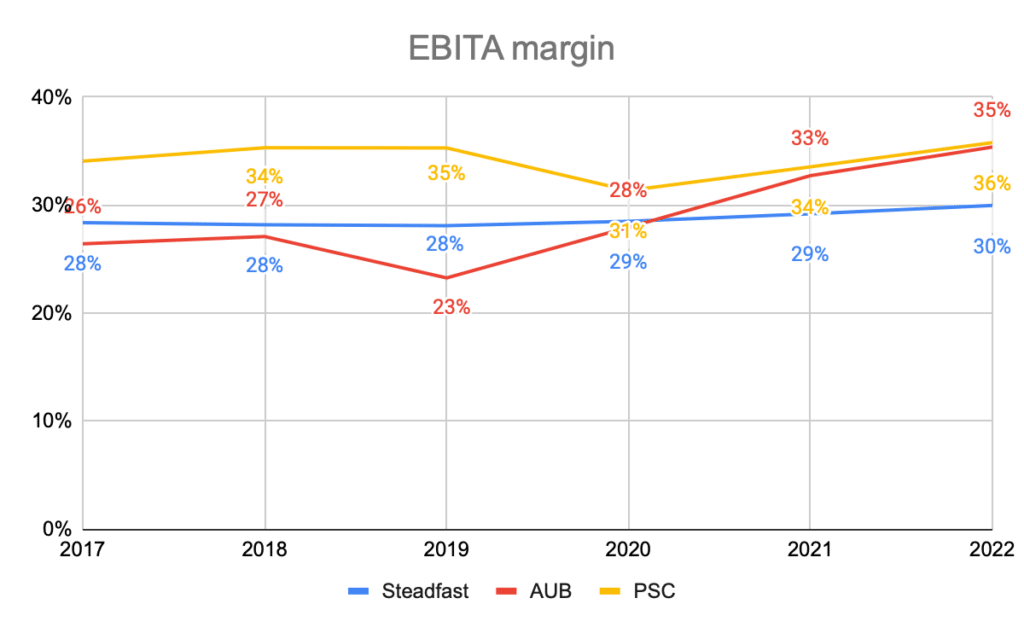

Profitability

The following chart may support this view with PSC seeing a dip in returns on capital employed (ROCE) in recent years.

Source: company annual reports

Interestingly, Steadfast has achieved its steadily improving ROCE at lower EBITA margins than its peers. Perhaps its lower margins reflect its focus on the smaller end of the market and the nature of its non-equity broker network business.

Source: company annual reports

All three businesses have seen margins improve over time with the effect being most pronounced at AUB.

The reason for AUB’s improvement is the “optimisation” of its brokerage network according to management. This generally means the merging of businesses and I can’t help wondering if there are some longer term risks associated with this strategy as it appears to be a bit too easy.

Balance sheet strength

AUB Group is significantly more leveraged than Steadfast. It has $690 million of net debt and a net debt to EBITDA ratio of 2.7 compared to less than one for Steadfast. This is at the upper end of what I’d be comfortable with, but is acceptable given the resilience of the business.

In addition, insurance brokers earn interest on the significant amount of cash they hold in trust for clients which provides a natural hedge for interest rate rises.

The proposed Tysers UK retail joint venture between AUB and PSC should see AUB’s debt reduced in the nearterm to under 2.5 times EBITDA. On the other hand, PSC will see net debt to EBITDA increase from 1.4 to 2.3 as a consequence of the deal.

Competitive tension

PSC was a member of Steadfast’s broker network until last July last year, albeit not a significant revenue contributor.

Having severed ties with Steadfast, PSC is now joining forces with AUB Group via the planned Tysers UK retail broker joint venture.

In Steadfast’s 2023 half year investor briefing, Robert Kelly had the following to say about PSC leaving the Steadfast network:

“We’re often asked about PSC, and they’re friends of ours, and they’re no longer a seed – they’re a flower. A flower needs to water its own self and feed itself, so none of these figures include PSC which effectively haven’t been part of us since July last year, although we have helped them by keeping them on our client trading platform through to May this year,”

Whilst Mr Kelly may claim that Steadfast and PSC are friends, the same may not be true of the relationship between Steadfast and AUB Group.

Back in 2019, Steadfast acquired a broking group known as Insurance Brokers Network of Australia (IBNA) consisting of 90 independently owned member companies generating a combined $1.4 billion of GWP. At the time, IBNA was in a joint venture with AUB Group called Austbrokers & IBNA Marketing Services (AIMS).

Steadfast did not acquire any equity interest in the brokerages themselves, but rather acquired the network and its associated professional service fees.

Verdict and closing thoughts

Winners keep winning and so my pick of these similarly priced stocks is Steadfast. Not only has it outperformed the other two on a TSR basis over the past seven years, it is the only one to demonstrate a steady improvement in ROCE over that time.

Furthermore, following the completion of the Tysers JV, both AUB Group and PSC will be significantly more leveraged than Steadfast. Although this does not necessarily pose a risk to AUB and PSC, Steadfast has more borrowing capacity with which to grow its business.

Most importantly, Steadfast is the only one of the three to boast a broking network which encompasses both equity owned and external businesses. Non-equity brokers are becoming increasingly dependent on Steadfast through the adoption of its technology platforms and the network now represents a third of the Australian intermediated insurance market.

Insurance broking is a complex area and I have only scratched the surface here. However, it is clear from the track records of Steadfast, AUB Group and PSC that the industry offers attractive opportunities for superior shareholder value creation.

Disclosure: The editor (Claude Walker) of this article does not own shares in any of the stocks mentioned, whereas the author (Matt Brazier) owns shares in SDF only. Neither will trade shares in any of the stocks mentioned for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter