The people I write for most are you, the paying supporters of A Rich Life. One of the things I hope to do better is to let you know about those companies I am most keen to recommend (and buy myself) but haven’t quite decided to pull the trigger. I think that this can be helpful, because I possess no special ability to time my trades perfectly. Sometimes I get lucky with timing, sometimes not.

So without further ado, I want to write about a quality business with a great long term track record that I am very much inclined to recommend, at some point; Data3 (ASX: DTL). But please, keep in mind, I’m not arguing that Data3 will get into the ASX 200 in the near term.

Even though I think it’s a strong candidate for inclusion, there will be no changes to the ASX 200 at the end of June, so the next time for potential inclusion would be September this year. And it will likely take longer than that. Perhaps the fastest path would be if its next set of results are positive, and that pushes the share price up a little and creates a bit of extra trading volume. However, when predicting what companies could make it into the ASX 200, it is best to look a couple of years out, because once it becomes obvious the company will be included, the share price may well rise as fund managers look to front run the index inclusion.

I’ve covered Data3 plenty of times before, and I think its current price is actually pretty attractive. Other than the (very questionable) impulse to (greedily) wait for a better price, I have no real reason for delaying it as a recommendation. I’ve been rather tempted to recommend it, and it remains on the top of my watchlist.

However, this article isn’t a Buy recommendation, because I’m not quite ready to buy myself (after the recommendation of course).

Rather, it’s more just a quick summary of why, amongst the companies that I think could graduate into the ASX 200 in the next couple of years, it is my favourite.

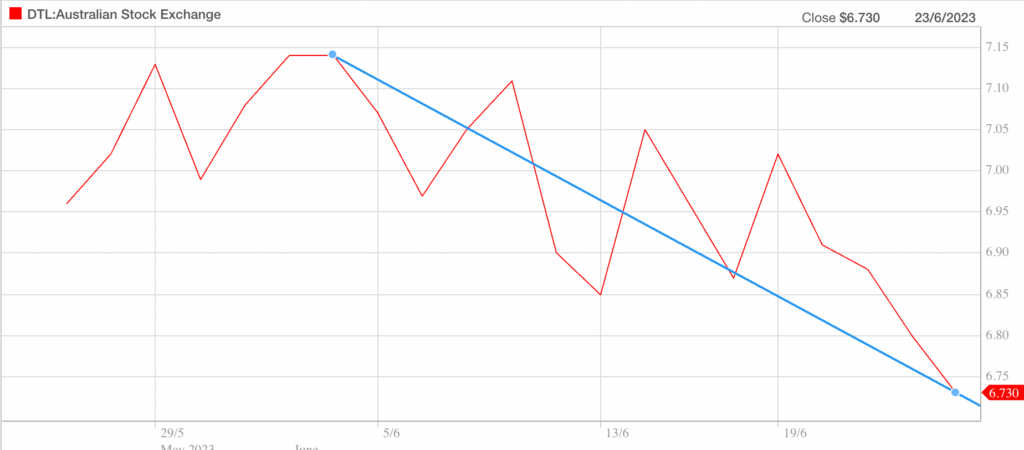

In fact, I can’t help wondering if the fact that Data3 didn’t make it into the ASX 200 has contributed a bit to the share price, since it has been going down ever since the day the lack of changes for the June rebalance was announced. However, if like you I’m out on a limb with that speculation, I can’t really disagree with you.

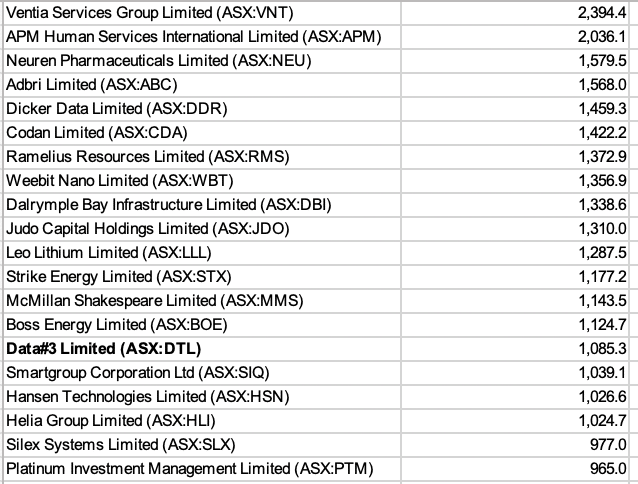

If I take the list of companies that are in the ASX 300, but are not in the ASX 200, order them by market capitalisation, then remove those that are dual listings, I’m left with the following top 20.

Now, I don’t know exactly how S&P calculates the float adjusted capitalisation for each of these, but some of them obviously have large insider holdings that would significantly reduce the number of shares.

For example, because Ventia was established in 2015 when CIMIC Group merged its Leighton Contractors Services, Thiess Services and Visionstream divisions (with Apollo part of the deal), its top to holders (owning about 14.6% each) could be considered strategic holdings and excluded.

APM has a founder who owns 23%.

Neuren pharmaceuticals frankly seems even more likely to be included than Data3, as do Adbri and Codan, both of which have been in the ASX 200 previously.

On the other hand, Dicker Data has a huge founder holding, so absent a sell down, it is probably less likely to join the ASX 200 than Data 3. Dalrymple Bay (ASX: DBI) is a solid candidate, but has been less liquid than Data3, over the last month, so I’d probably give Data3 the edge.

Compared to others on the list, Data3 has a very distributed shareholder base. It was added to the ASX 300 way back in September 2019. Either way, Data3 will probably need one more share price boost before it makes it into the ASX 200 (or at least, for existing constituents to fall much more than it.)

The broader point, however, is not that I think Data3 is the most likely stock to actually graduate to the ASX 200, or that I think it will join in September. Rather, the point is that it is my favourite of the contenders, because it stands out to me as being a reasonably priced, enjoying long term tailwinds, and one of the better quality businesses, in the group.

Why I Like Data 3 (ASX: DTL)

Microsoft has called Data3 “one of the world’s largest Microsoft device resellers”. However, these days Data #3 is much more than a device reseller. In fact, most of its revenue now comes from software solutions, as you can see from the pie chart below, depicting the H1 FY 2023 revenue.

Infrastructure Solutions includes sales of hardware, device-as-a-service and managed print services, while Software Solutions includes volume licensing and public cloud subscription services. Obviously, this Software Solutions revenue is quite low margin, but both the infrastructure and software segments facilitate higher margin revenue from consulting, managed services and project services.

Ultimately, there is no getting around the fact that Data #3 is mostly a low margin reseller, whether it be reselling hardware or software. However, as I noted in my coverage of the H1 FY 2023 Data #3 results, the low margin revenue is producing steady and significant earnings growth.

While there is some risk that the departure of long serving Data #3 CFO Brem Hill could upset the apple cart, Data #3 has been one of the best run IT companies in Australia. Ten years ago, it looked very much like a large number of other IT companies that eventually received unattractive takeover offers.

While IT consultant companies like ASG Group, DWS, SMS Technologies and Empired went essentially nowhere, Data#3 has grown its revenue, earnings, and dividends at a very solid rate, reaching over $1b market capitalisation and record profitability.

These days, it is on dozens of pre-approved government panels, meaning it is one of a limited number of resellers that government departments can use for all sorts of IT purchases. Over the last decade, it has also built its brand within government. To a degree, I believe it now represents a safe choice for bureaucrats. Where a decision to purchase from Data #3 or a competitor is a close run thing, it’s quite likely that bureaucrats will choose the known quantity in Data #3. In that way, its ever increasing size is making it stronger. It is reminiscent of the (now completely dated) aphorism that “nobody gets fired for choosing IBM”.

So the first reason Data #3 is my favourite stock sitting just outside the ASX 200 is that management has a good track record, particularly under the current CEO Laurence Baynham, who has been in that role for almost a decade now. And the second reason is that I think as it grows, it improves its competitive advantage over at least some would-be competition.

The third reason is that I think the company will benefit from increasing automation arising from digital transformation.

We don’t really know what work will look like in another 20 years, but I’m pretty happy to bet that algorithms, AI and automated systems will all be doing a lot more heavy lifting than they are today. Those systems will require hardware to run on, and humans to design, implement and manage them. I think most of those services will be provided by the same behemoths we know today (such as Microsoft), and Data #3 therefore stands in a good position to capture some of that growth. I own Microsoft shares (happily!), but I’m also very tempted by Data #3 shares, since think they both benefit from the same tailwind.

Disclosure: the author of this article does not own shares in any of the above mentioned companies, and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.