Earlier this morning, managed service IT provider Cirrus Networks (ASX: CNW) updated the market regarding its unaudited FY 2023 profit result, disclosing that it expects to record $3.06 million in profit before tax. Assuming a 30% tax rate, this would translate to about $2.142 million, above my minimum forecast of $2m, when I previously explained why I like Cirrus Networks shares.

As a result of this news, the Cirrus Networks share price is up about 15% to $0.039, at the time of writing.

The best news in the update today is that the cash balance has grown from $9.5 million at the end of December 2022 to $13.9m at the end of June 2023. I said previously, that “the weakest part of the [H1 FY 2023] results was the free cash flow outflow (after lease repayments)”. However, H2 looks to have strongly reversed this trend, as forecast.

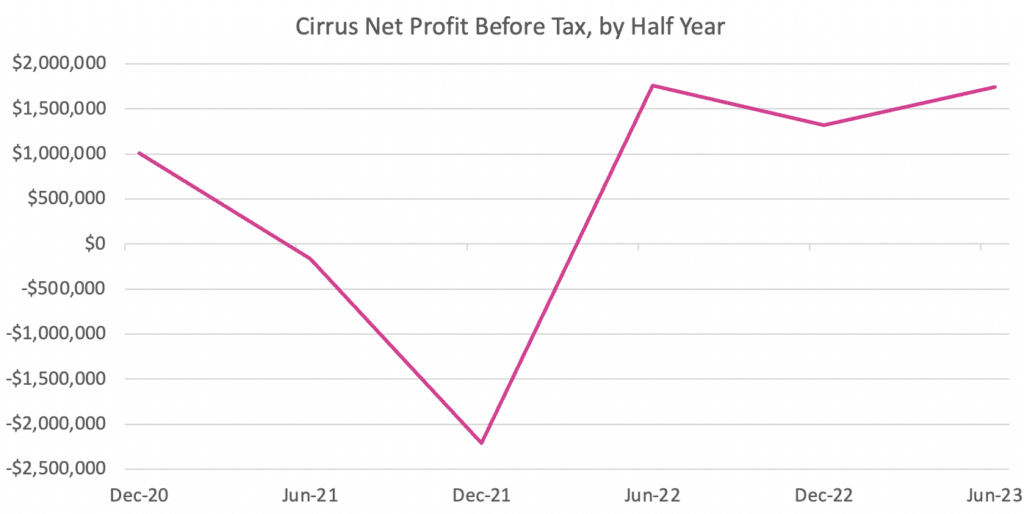

On the negative side of the ledger, I note that the second half profit before tax is pretty much flat on the prior corresponding period, as you can see below. This indicates organic growth is far from guaranteed.

Happily, though, Cirrus Networks says:

“The record annuity Managed Services revenue and margin were delivered without any contribution from the Icon Water Managed Service contract. Revenues from this large Managed Services contract are now anticipated to commence in early FY24 and together with a strong pipeline of new contracts and qualified opportunities (including a number of tenders lodged awaiting final outcomes), Cirrus is confident its Professional and Managed Service revenues will continue to grow during FY24.”

Since the lion’s share of Cirrus Networks’ profit comes from the professional and managed services segment, this bodes well for profit growth in FY 2024.

With the Cirrus Networks share price up almost 15% today, the market capitalisation now sits at about $36.3 million, putting it on a forecast P/E ratio of about 17x FY 2023 earnings, assuming a 30% tax rate. However, Cirrus now has cash significantly in excess of its working capital requirements.

Cirrus is interested in making an acquisition, and if we imagined Cirrus used about $8m to buy a business on around 8x earnings (which is realistic for a small IT consulting firm), then it could easily boost its profit to at least $3m and possibly higher. That would put it on closer to 12.1x earnings.

Another way to look at would be to imagine if Cirrus simply paid out $10m to investors, reducing the market capitalisation to around $26 million. At that point it would be on closer to 12.1x earnings.

Any way I look at it the Cirrus share price remains undemanding. However, as I stated previously “Cirrus looks like good value at the current price of $0.035”. I subsequently put my money where my mouth is and bought shares at just above that price, and I am content to continue holding after this update.

Disclosure: the author of this article owns shares in CNW and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.