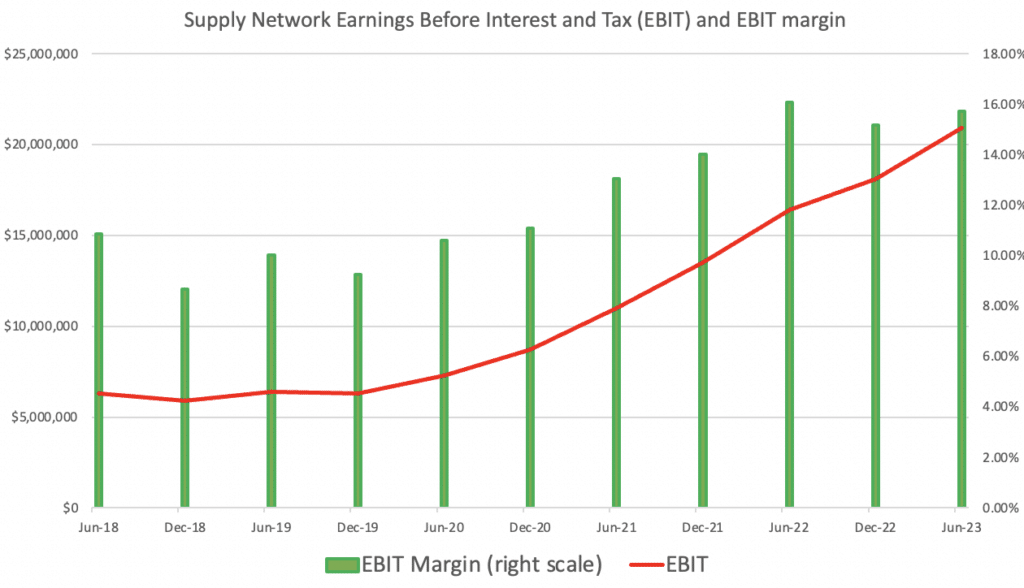

Yesterday evening truck and bus part distribution company Supply Network (ASX: SNL) released their results for FY 2023, boasting revenue of $252.25 up 27%, and net profit of $27.4 million, in line with guidance, up a whopping 37%. Supply Network earning 65c per share and bumped the final dividend up to 28c, bringing the total dividends for the year up to 48c, being a yield of 3.2% fully franked at the last traded price of $14.60.

As you can see below, net profit before tax margins inched up in what was a stronger second half, as usual.

Pure free cash flow (operating cashflow less investing cashflow and lease repayments) was $9.8 million, down slightly on last year due to slightly increased investment in the distribution network, slightly increased receivables relative to payables, and 25% increase in inventory (roughly in line with revenue). This serves as a reminder that while Supply Network is an admirably well run business with a genuine (though not unsurpassable) competitive moat in its established distribution network and broad inventory, it is also a capital intensive business, so it is unlikely to be as much of a performance outlier due to the somewhat difficult economics of its business.

Speaking of which, Supply Network does carry around $9.9m in debt, some of which now costs the company up to 6.8% per year in interest. However, net debt declined slightly to $2.2m. You could argue the discounted dividend reinvestment plan — in which I will once again participate — is somewhat justified based on the fact it offsets debt.

Operationally, Supply Network notes that the new branch in Truganina (Melbourne) opened for trade on 1st June 2023 and has been performing slightly ahead of budget. Meanwhile, the Yatala (Gold Coast) branch commenced trading on 1st August 2023 and has also started well. Finally, “the Truganina DC has been operating since February and has quickly settled as an arm of distribution with costs and performance in line with expectations.”

Therefore, the commentary and results support continued strong execution in FY 2023.

Looking forward, the company expects FY2024 “revenue growth at close to or slightly above our 10-year average of 14%,” and notes that “they are laying plans for two new branches we consider priorities for network expansion in FY2025.”

As is so often the case, the installation of a new Enterprise Resource Planning (ERP) system is dragging on, probably costing more, and certainly taking longer, than originally expected. The company says that:

“Current investments in our operating network and IT systems, previously reported as extending over FY2023 and FY2024, are now scheduled for completion in FY2025. The main elements of these investments revolve around an upgrade to the sales interface to our ERP system and its supporting server environment, with primary goals to deliver transaction efficiencies, better disaster recovery, and faster, more secure platforms.”

Obviously this is a negative, but I wouldn’t hold that against management. Installation of a new ERP is the one of the most common sources of cost or time blowouts that you see (and may simply reflect inaccurate information given to the client by the IT service provider who tendered on the work and therefore had an incentive to underestimate cost and time).

While it has to be said that management aren’t big on investor communications, results remain a testament to their long term honesty and competence.

Management plans for the year continue to focus on organic growth opportunities in existing business

units. The company says that “continued expansion of the product range and service network and further development of transaction systems are primary considerations in our three-year outlook.”

I still remain positively disposed to Supply Networks, have zero intention of selling my shares, and may in fact buy more.

To access all our subscriber only content, join the waitlist to become a supporter, via this link.

Disclosure: the author of this article owns shares in SNL and will not trade them for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.