This morning, close ended investment listed investment trust Forager (ASX: FOR) announced that it would work towards turning itself back into an open ended trust. The difference is profound.

You see, a close ended fund is a structure that entraps capital into a fund, making the investors dependent on finding another investor to buy their units. Let’s call these arithmetically-challenged investors “derps”.

The close-ended structure works ok as long as there are plenty of new derps willing to buy units. For a time, Forager had so many derps willing to buy shares in its closed ended fund that its units actually traded above net asset value.

However, Forager responded to this by issuing more units at NAV, thus satisfying demand amongst derps. By this time, many of the more savvy investors would have sold their units (happily pocketing a premium to the net asset value of the fund).

Then, a period of poor performance meant it was extremely difficult for Forager to find new derps willing to buy units from the old derps who owned them. As a result, entrapped derps were forced to sell their Forager units to non-derps, representing a breakdown in their “greater derp” investment thesis.

Non-derps do not buy closed-ended funds at Net Asset Value, because they know those assets may be subject management fees forever, and that when they most want cash themselves — during a market dislocation for example — the discount will be greatest.

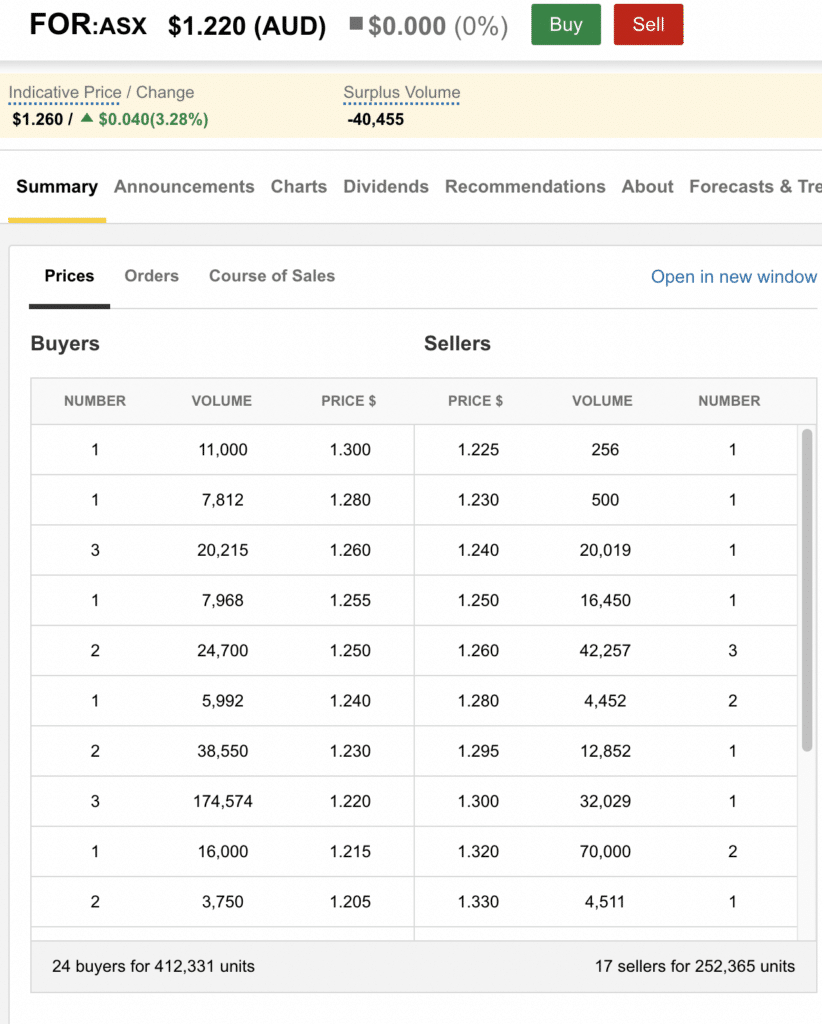

At the time of writing, the non-derpish price for Forager units is $1.22, whereas the latest net asset value is $1.47. That’s a discount of 17% to net asset value.

Today, Forager has decided to help its derps.

The company says:

“The Manager’s current view is that the magnitude and sustained nature of the discount to NAV now outweighs the portfolio management benefits of remaining a closed-ended fund.

The Manager has considered a range of additional measures to further improve the traded market price of FOR units. The Manager currently considers that the solution which will be in the best interests of FOR unitholders is likely to be the orderly transition of FOR back to an open-ended fund.

Significant work is still required to determine what would constitute the best way to implement an “orderly transition” and the future form FOR may take.”

It is extremely rare and surprising to see a fund manager take mercy on derps who agreed to a close ended fund. Sure, any unfortunate baggies who cannot afford to wait (or have already sold) will be solidly rinsed on the way out — which to be frank is probably what they deserve for agreeing to hold a close ended fund in the first place. However, this new approach by Forager could well allow many holders to exit their investment without being rinsed to the tune of 17% on the way out.

So who loses?

Forager itself. You see, allowing holders to exit at closer to NAV (say 98% or so) instead of 83% of NAV will actually incentivise people to withdraw their funds. That means less funds for Forager to manage.

In that sense, Forager is absolutely doing the right thing, in looking after its investors’ interests. Good on ’em, I say.

But where this gets interesting to me is whether there is now an opportunity.

As I write, Forager units look set to open at around $1.26.

If you believe, as I do, that Forager will follow through with their plans, then perhaps there is an opportunity here.

The idea would be to buy shares in Forager now, and simply wait until you are able to exit the investment at Net Asset Value. All else being equal, that might mean buying at $1.26 and selling at around $1.45 (depending on what fees they charge on the way out.)

The announcement itself says that:

“The Manager currently intends to propose a transition period of up to 12 months where investors who wish to redeem their units pay a redemption fee that declines throughout the transition period. This fee would accrue to the remaining investors’ benefit. The quantum of fees and the rate at which they may decline has not been determined.”

This means that (to be conservative) we might want to allow about 2 years for the process to pay out fully. In that scenario, over 2 years we would get the benefit or detriment in any change in the value of Forager units, plus about 15%.

Edit at 10:15am: After opening this morning FOR units are trading at $1.32. That means buyers would get the benefit or detriment in any change in the value of Forager units, plus about 11%. While this makes the opportunity a little less attractive, I still think it is unlikely Forager would underperform by more than 11% over the next 2 years (and of course they may outperform, too!)

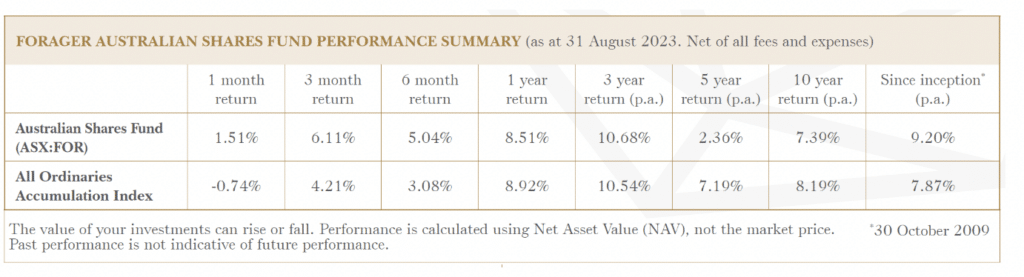

Now, as you can see below, Forager has a patchy record when it comes to outperformance, but at the same time, its performance (measured by NAV, not actual realisable prices) is pretty decent over the last 10 years, and since inception (though it’s not good measured over the last 5 years).

Either way, my bet is that over 2 years any underperformance will be compensated by the (potential) future ability to sell units at close to NAV.

I’m not jumping on Forager myself, but I thought that some people might be interested in considering the idea, at the very least.

To me, this sort of opportunistic thought-bubble isn’t an investment thesis, but it is the sort of potential opportunity that entertains me over coffee in the morning. I will be interested to see if the plan works.

If you would like to be among the first to receive articles like these, and even suggest small-cap mailbag articles yourself, then you can click here to join the waitlist to become a Supporter.

Disclosure: the author of this article does not own shares FOR and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.