SDI Limited is an Australian manufacturer of specialist dental materials that was established in 1972. These specialist materials are marketed in over 100 countries globally. All products are manufactured in the company’s manufacturing warehouse located in Melbourne, Victoria, and are sold through distributors and retailers across the world. The company has warehouses in Chicago, Cologne & Sao Paulo. Since 2016, SDI Limited has been headed up by Samantha Cheetham, the daughter of the company’s founder James Cheetham, who still sits on the board as chairman.

SDI first came onto my radar a couple of years ago. Back then, I took a cursory look at the company and decided it was one for the watchlist, however the most recent trading update released to the market in January 2024 prompted me to take a closer look.

The tone of this update was in complete contrast to their previous announcement at their AGM in November 2023. Within the AGM announcement, they stated that company sales were down 7% on PCP to the end of October 2023, while the most recent trading update released in January 2024 implies that they have turned this around in the last 2 months of the year and now expect revenue to increase around 3% according to updated guidance.

Net profit after tax is expected to be in the range of $2.8m to $3.4m, a 15% increase if we take the middle of the range. This is a big turnaround in just 2 months, so what was driving this change?

A potential reason for this may relate to major dental distributor Henry Schein suffering a disruption to their systems after a cyber hack in October and November 2023. On the back of this attack, they were forced to destock and take orders manually for about a month around this October/November period.

With Henry Schein being a major global distributor of SDI’s products, this may have had a negative impact on October sales, followed by a sales spike for SDI in November and December as the company returned to normal business and went about restocking.

Another possible reason for the uptick in revenue over the past 2 months of 2023 is a large uptake of a new product (Stela), released to the market at the back end of 2023. Stela is being marketed as a replacement for amalgam fillings. As amalgam fillings (which are made from silver) haven’t been used widely in the dental industry for almost 30 years, a dental practice owner friend of mine believes this product is more of ‘an alternative to resins that resembles the longevity of amalgams.’

When I asked him to explain this further, he explained that amalgam fillings ‘have been replaced with composite resin (white fillings). Resins are superior in every way to amalgams except for longevity and they are more technique sensitive to put in.’ It appears that these 2 issues are what Stela is aiming to solve as ‘resins take approximately 2 minutes and multiple steps to place’ whereas according to Bite Magazine’s article – ‘The future of composites’ ‘Stela takes approximately 15 seconds to apply’ (The future of composites – Bite Magazine).

On the face of it, this looks as though it could be a major time saver for most dentists. In the end, my dentist friend summed up by saying, ‘I don’t think it’s going to revolutionize the dental world. It’ll probably have some uptake in some factions, but I can’t see it taking over resins as the gold standard’.

In addition to the revenue momentum seen at the back end of 2023, any potential investment thesis relies on the company increasing its margins.

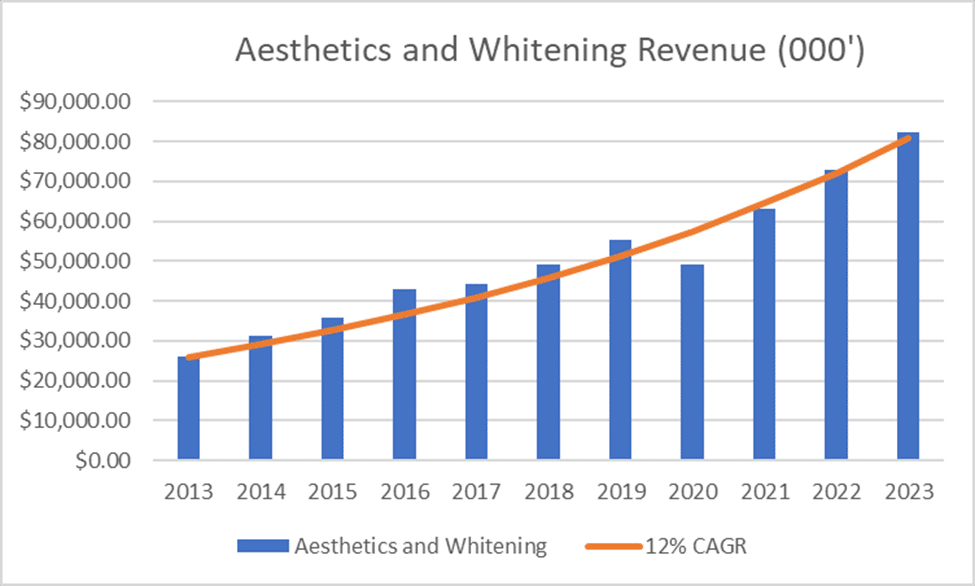

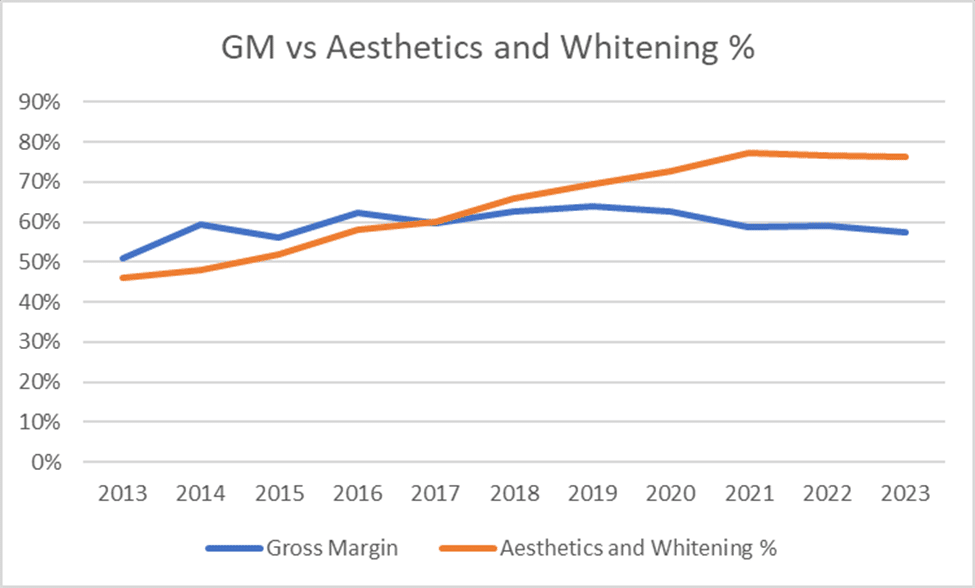

This could be possible if the product mix continues to trend towards aesthetics & whitening products. My dentist friend says: ‘A lot of products based on aesthetics want things to look good. Often, they charge a premium for that as well because patients wanting a good smile are more particular on how it looks vs someone who wants to be out of pain.’ These segments have performed extremely well over the last 10 years, growing at a CAGR of just over 12% p.a. This type of revenue growth over a 10-year period is very impressive. While logically this theory makes sense, the correlation between the increase in these segment’s revenue and overall gross margins is mixed.

We can see in the chart below that this product mix had a correlation to increasing gross margins up until 2019 when it then diverged. However, the increasing divergence since 2020 could very well be attributable to factors relating to COVID.

As COVID cost pressures ease, it will be interesting to see how this correlation plays out as SDI continues to increase the proportion of aesthetics & whitening revenues. We may be seeing the answer to this starting to show as the most recent trading update stated, ‘product margins increased by 5%, reflecting further improvements in logistic costs and regional market and product mix’. When compared to the 59% gross margins announced at the AGM, this would mean margins have increased to the mid-60s which is higher than it has been in the last 10 years.

On top of this, SDI has committed $60m to construct a new manufacturing facility to drive production efficiencies, and in turn profit margins moving forward. This committed capital is the big risk I see when looking at SDI.

From 2022 to 2023 FY, balance sheet debt has increased a staggering $23.5m from $669,000 to $24.1m. Given the higher rate environment, this is risky. However, operating cash flow in FY 2023 was $13m, the debt is asset-backed, and the company can sell the old facility once it moves operations to the new one. Therefore, I see this debt build-up as manageable, however while the debt remains on the balance sheet, the interest payments will continue to weigh on net profit margins.

One thing management could do to control the amount of debt being used to fund the construction at Montrose is to cut the dividend. This is $4m (as per 2023FY) of cash per year that could assist in this construction rather than being paid to shareholders. However, with management insider ownership being around 48%, I feel this dividend may continue to be paid.

Perhaps controversially, it would be a real positive in my mind, if management were to cut the dividend at the Half Year report, due out later this month.

At the a price of 72c and a market cap of ~$86m, SDI is on a trailing price to earnings ratio (PE ratio) of under 12.5.

However, if you take SDI’s tendency to have a 40/60 split in profit between HY1 & HY2, I would estimate FY 2023 profit to be around $8m, which would put SDI stock a forward PE ratio of below 11.

I (Benjamin Sayers here) own SDI shares and my short-term investment thesis for this company relies heavily on the potential increases to margins outlined above. Over the medium to longer term I think that as the aesthetics and whitening segments take over, we should see revenue growth closer to the historical 12% CAGR achieved by these 2 segments. This is the classic investment thesis of a hidden gem segment emerging through the decline/weakness of other ones. For me though, the big risk here is around the increasing debt on the balance sheet and how management intends to fund the remainder of the construction of the Montrose facility.

Disclosure: the author of this article owns shares in SDI. The editor of this article does not own shares in SDI. Neither will trade shares in SDI for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.