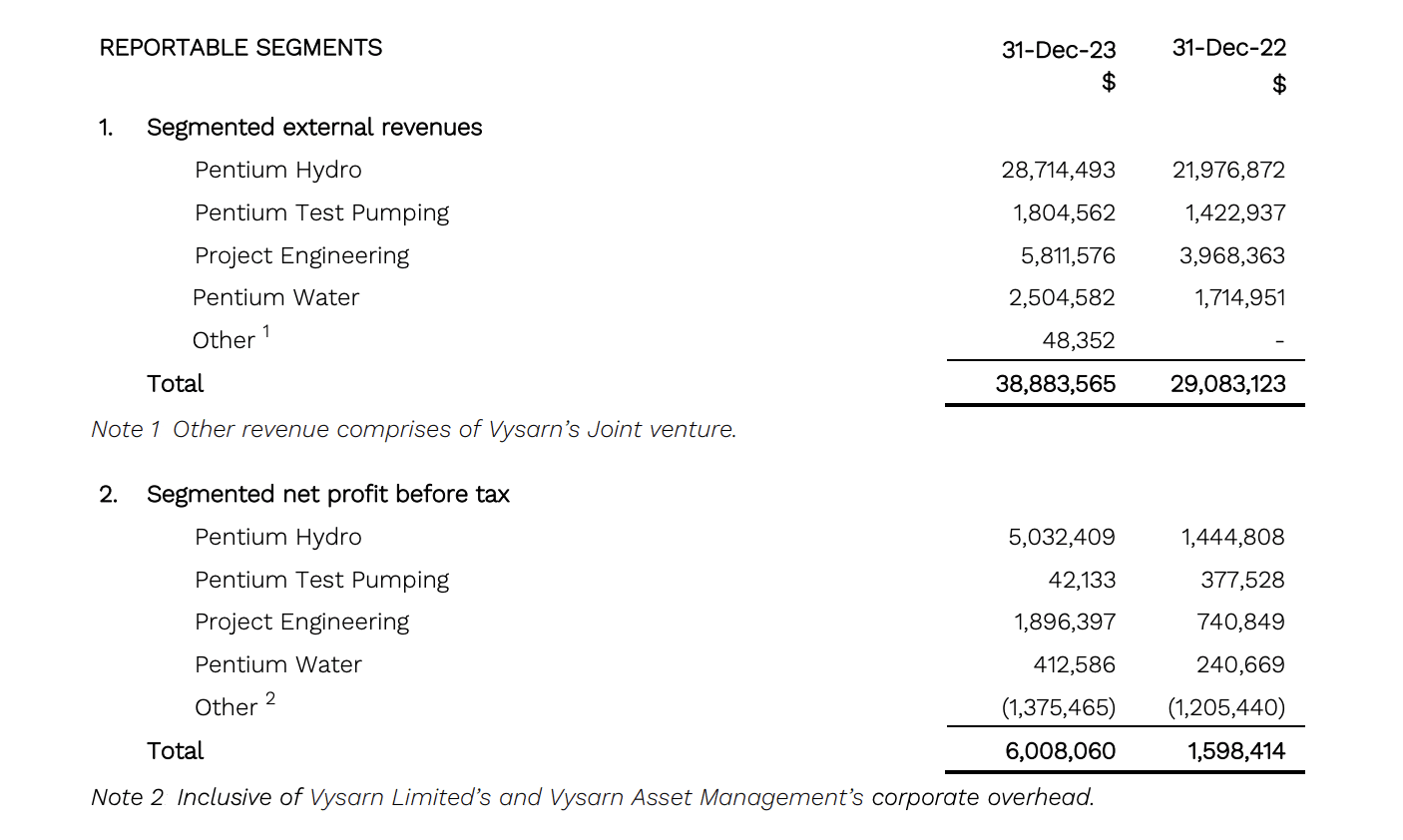

Vysarn (ASX: VYS) reported their H1 FY 2024 results recently and since I have covered Vysarn a few time before, I thought I would share a few thoughts on the results. The company produced a record half yearly NPBT of $6.01m. While this is impressive, it was largely in line with expectations set at the AGM back in November 2023.

This result showed an increase of 10% on the results of HY2 2023 and was mainly driven by their Project Engineering segment of the business which contributed $1.9m of NPBT, at a fantastic NPBT margin of 33%. That is not something that the market would not have anticipated when Vysarn acquired the business back in 2022, for just $2.8m. This segment along with the fantastic cash conversion of $8.3m in the half were the 2 highlights in my opinion.

Management have guided to a slightly weaker second half of 2024 due to their expected investment into the next leg up of growth for all segments, in particular Pentium Water, Vysarn Asset management and Project Engineering.

In the case of Pentium Water, which is the company’s water management consulting arm, management has aggressively targeted a 50% increase in staff numbers on a year-on-year basis. This increase in staff is needed to help service growing client demand and to drive internal water supply and carbon farming projects.

The segment of the business that I believe can be the biggest value driver for shareholders, however, is Vysarn Asset management. Vysarn Asset Management is the segment of the business that was set up late last year to take advantage of projects that have been identified by the Pentium Water team, with the view to Vysarn owning, controlling, and tolling water.

The commentary laid out in the HY report indicates to me that management sees great potential in this segment and are committing to invest further resources to ensure this segment has the best chance of succeeding. Quotes such as this one from the often-conservative Managing Director James Clement indicate to me that management see this segment as a game changer ‘the optionality now provided by the parallel asset management strategy to own, control or toll water could be a significant value driver should the Company execute this strategy successfully.’.

Project Engineering is the arm of the business that manufactures managed aquifer recharge systems and continues to go from strength to strength posting a NPBT of $1.9m in HY1 2024. This business is producing NPBT margins of 33%, which makes it no surprise that management is in the process of making investments into this segment to double production by the end of the 2024 FY. If margins can be maintained or even improved as they scale up, it could also be a real value driver moving forward.

On the other hand, it looks as though issues with the 2nd test pumping unit over the first half of 2024 impacted earnings in the Pentium Test Pumping segment of the business as NPBT fell from $377k in HY1 2023 to just $42k in HY1 2024. This is something to keep an eye on, however, it is not a segment of the business that I would consider to be integral to the growth moving forward.

Lastly the Pentium Hydro segment of the business produced a half almost identical to HY2 2023 finishing the half with $5m NPBT. This is while continuing to only have 1 drill rig double shifting. The opportunity to double shift more rigs this year is still called out by management; however, I would be happy for this segment of the business to continue generate cash as it has been, in order for management to expand growth initiatives in other segments such as Project Engineering, Pentium water and Vysarn Asset Management.

All in all, a solid half from Vysarn, one that looks to be a base to build from. Nothing in this set of numbers suggests to me that there can’t be material earnings growth into the future for this company, while at a run rate of about $8m NPAT for 2024, it seems reasonably priced at around 14 times earnings. That said, I did top up my holdings a bit on Monday 26 February, after the release of these results.

The big question is whether Management can pull together the asset management side of the business. If they can, this could be a major catalyst moving forward.

Disclosure: the author Benjamin Sayers owns shares in VYS and will not trade shares within 2 days of publication. The editor Claude Walker does not own shares in VYS and will not trade within 2 days of publication. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter