Readers, welcome to the quarterly report season. I (JP Picard here) love this season; it’s my equivalent of the playoffs or the World Cup. There’s no better time to grab a cup of coffee, sit down, and stare at the screen for three hours while the children scream in the background. I do check in on them every 15 minutes or so to make sure everyone is safe.

In this article, I’ll highlight four reports that stood out to me as largely positive. Some of these businesses I own, while others I’ve added to my watchlist. So, without further ado, let’s go.

BSA Ltd (ASX : BSA)

BSA Limited, formerly known as Broadcast Services Australia Limited, derived its name from its focus on technical services contracting, primarily involving the construction and maintenance of network infrastructure for clients such as Optus.

Despite their extensive history as a company, a quick review of their historical performance will prompt many investors to overlook them outright. I can’t blame anyone for this given their declining revenue and frequent losses.

However, a recent shift has occurred; the company has achieved two consecutive quarters of positive operating cash flow. How did this come about?

Well, the company embarked on a transformation journey some time ago. In March 2023, they made the somewhat contentious decision to appoint two joint CEOs. While this approach may seem unconventional, certain companies can benefit from it.

Historically, BSA had often accepted contracts with razor-thin margins. However, as labour costs escalated, profitability became elusive. Recently, they made the strategic choice to divest from unprofitable segments, such as their APS Fire division. This strategic shift is expected to gradually propel them towards their target of achieving double-digit EBITDA margins.

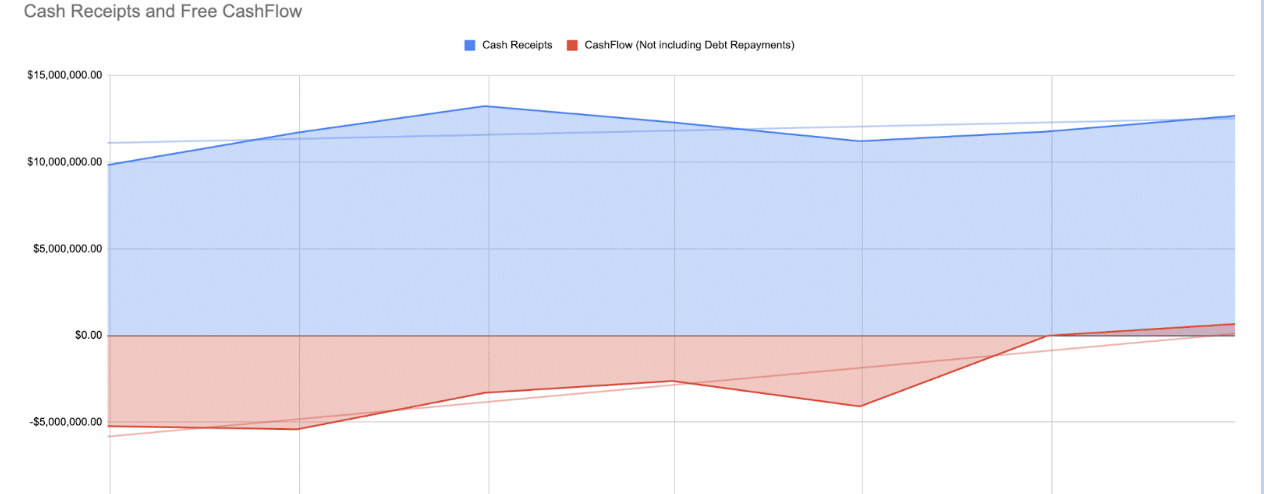

For valuing BSA, looking at Free Cash Flow is a useful metric (take their operational cash flow, deduct their investments in “property, plant, and equipment”, and subtract lease repayments as well). Note that debt repayments are not deducted from their FCF. The rationale behind this is that they have now repaid their debt entirely, implying that this repayment won’t recur in future quarters.

This quarter’s free cash flow represents a significant milestone, reaching a record high of $2.16 million. Over the past 6 months, the company has generated approximately $3.27 million in cash flow. If they maintain this performance over the next 6 months, annual cash inflows would total around $6.54 million.

Considering a market capitalization of $52 million (calculated from 72.16 million shares outstanding at $0.715 per share), this yields a multiple of around 8x free cash flow. This multiple could present an opportunity if the company successfully executes its ambitious growth plans aligned with the tailwinds from the demands of the EV market. But we haven’t seen evidence of this yet and will need to.

Despite these positive developments, BSA still faces numerous risks. The nature of their business means that it will likely always remain low-margin, even after a successful turnaround. A misstep could easily plunge them back into painful losses.

Also, the discontinuation of certain operations will inevitably continue to lead to a decline in revenue, complicating future projections and making the business less appealing in general.

Nonetheless, the transformation into a company that produces free cashflow, if that is what is happening, is worth noting.

EZZ Life Science Holdings Ltd (ASX: EZZ)

EZZ is a manufacturer of premium health supplements. They own two brands: EZZ and EAORON, distributed across the APAC region and China.

Looking at the prices of some of their supplements online tends to evoke a sense of unease in me. It’s challenging to imagine how expensive non-medical pills and creams can significantly enhance one’s health and wellbeing. However, it’s probably fair to acknowledge that I am not their primary target customer.

EZZ delivered a strong quarter, with cash receipts up 111% on PCP and operational free cash flow totaling $1.85 million (I calculate free cash flow the same way I describe above for BAS). This inflow brought the company’s cash reserves to $14.47 million.

Looking at the company’s quarterly cashflow reports, a positive narrative seems to be unfolding. We can see good growth combined with the nascent stages of a transition toward sustainable free cash flow.

Now, management did call out that this was somewhat of a lucky quarter, explicitly mentioning that “a substantial portion of the cash inflow arises from delayed payments.” Therefore, it would be imprudent to extrapolate this quarter’s results as indicative of normal ongoing operations.

Looking at the valuation more closely, with $14 million in cash reserves and a market capitalisation of approximately $40 million (based on 44.41 million shares outstanding at $0.88 per share), EZZ currently trades at an Enterprise Value (EV) of $26 million. Over the last 12 months, the company generated cash flow of approximately $3.5 million, resulting in an EV/Free Cash Flow (FCF) ratio of approximately 7.5. This valuation appears reasonable (potentially even cheap) considering the company’s decent growth in the last 2 years.

One obvious risk associated with EZZ to me lies in its reliance on product marketing efforts. Marketing expenses are currently accounting for a significant portion of revenue (58% in the most recent quarter). This high marketing expenditure suggests to me that organic demand for their products is not yet established, and it would need to be for long-term growth to be sustained. Over time, I would monitor this metric and would like to see it slowly decrease from quarter to quarter.

Additionally, being a manufacturer entails the inherent risk of requiring substantial capital investment at irregular intervals to sustain production.

Despite these risks, the improving metrics and potential for continued growth means this is a stock worth watching.

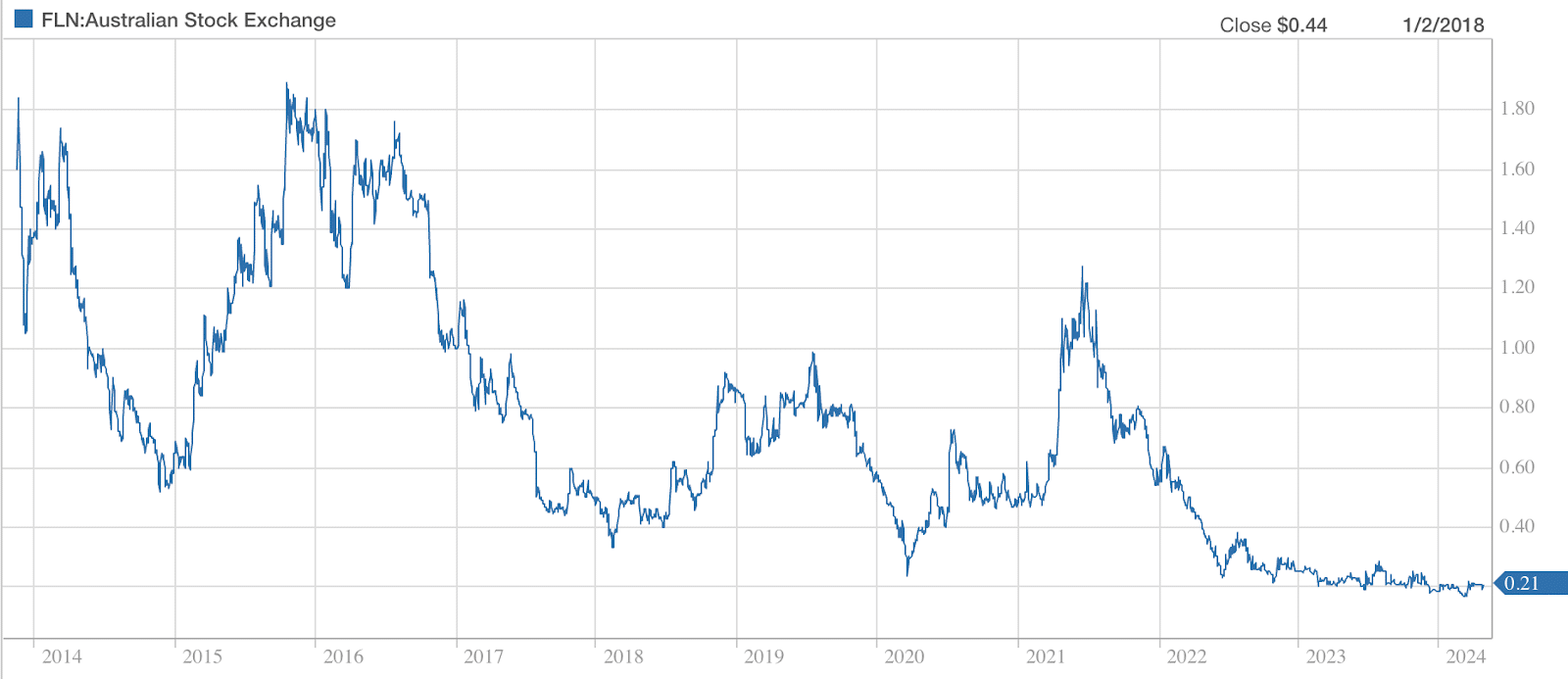

Fineos Corporation Holdings Plc (ASX : FCL)

FINEOS (FCL) operates as a software provider catering to insurers. They specialise in solutions for life, accident, and health insurance carriers on a global scale. They proudly boast that their software is being used by 7 out of the top 10 largest employee benefits insurers in the U.S. and hold a commanding 70% market share in group insurance within Australia.

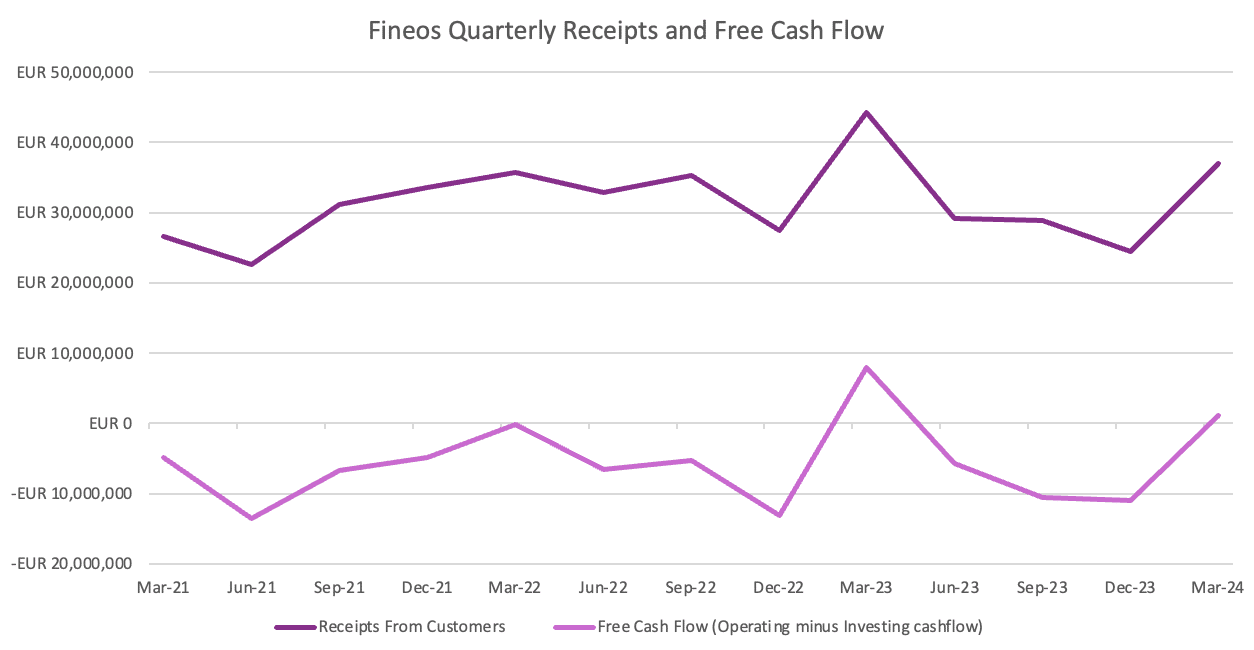

A consideration when analysing their reports is their reporting currency in Euros. Adjusting these figures to Australian Dollars (AUD) provides a clearer perspective on their valuation.

In the last quarter, they generated €8.3 million in cash flow from receipts of €36.9 million. When converted into AUD, this equates to $13.6 million in operating cash flow on receipts of $60.44 million.

In fact, even once you subtract investing cashflow (which has been steady at around €7m per quarter) the company produced a mild free cashflow surplus.That said, you can see in the chart below that the March quarter is always the strongest, in terms of cash flows.

Nonetheless, the improved quarter is a positive for FINEOS, considering its historical tendency to burn through cash.

Seeing a software company taking steps toward profitability is always nice, but it’s premature to deem this a definitive trend.

With a current market capitalisation of ~$630 million, I’m not finding the current FINEOS share price compelling. On February 21 this year, when they provided their latest growth figures to the market, subscription revenue growth stood at 10.5%. Total revenue (based on annualising the latest half) sits at aroundaround AUD $200m per year. That puts Fineos on around 3x revenue, which is not cheap enough for me to be excited, given the company rarely manages a single quarter of free cash flow, let alone a whole year.

Despite this, the potential strength of FINEOS’s vertical software business model remains. I’ll keep them on the watchlist for future evaluation, given the potential operating leverage in the business if it can only manage to grow revenue sustainably while controlling costs.

Airtasker Ltd (ASX: ART)

Airtasker is a name likely familiar to anyone who’s ever enlisted help assembling the difficult IKEA wardrobe or other odd jobs around the house. While I’ve yet to cross paths with the elusive “trampoline whisperer” reportedly earning $10,000 a month assembling surprise gifts for kids (Source : Daily Mail), perhaps I’ll encounter them one day.

Operating in the gig economy, Airtasker connects users with skilled individuals for various home and office tasks.

Historically, what has given me pause about the company is the inherent difficulty in successfully navigating online labour marketplaces. A prime example can be found in the locally listed Freelancer, which has struggled with unattractive unit economics despite its longer tenure as a listed business. Its long term share price performance has been disastrous, making me cautious of Airtasker.

The other challenge is that we’ve got some very big gorillas in the space such as Fiverr and Upwork who could be considered to be potential competitors.

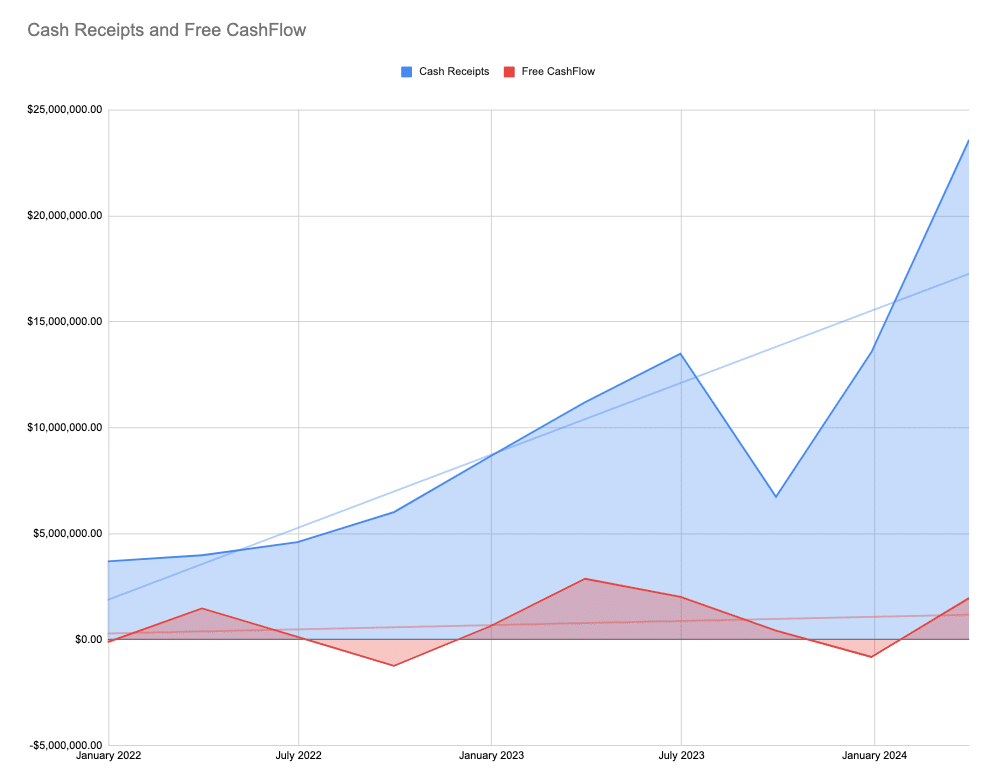

But Airtasker has grown in its niche of odd jobs and what I liked about their quarterly report is that their metrics are improving without a doubt.

The March quarter had also marked their strongest performance last year, indicating positive seasonality likely working in their favour. This year, it translated into a nice outcome of $2.24 million in free cash flow, defined as operational cash flow minus investments in IP, and subtracting lease liabilities as well.

You can see how the free cashflow has improved over the last seven quarterly reporting periods, below:

As pleasing as it is to see the positive developments on the bottom line, we quickly notice the top-line appearing to flatten out.

I’m also not expecting cash to start gushing in now, given the company is telling us “Given the strong 3Q24 free cash flow result, and with northern hemisphere seasonality peaking in 4Q24, Airtasker expects to accelerate international growth through investment in a number marketing initiatives during 4Q24.”

As demanding as this sounds, what I would like to see from Airtasker is the continuation of positive cashflow results, even after funding growth. There is no doubt the company is led by a motivated founder, but the plan seems to be to operate around breakeven while the Australian business funds expansion in the UK and USA.

While there is therefore every expectation that the company will only hover around breakeven, if it can even modestly grow free cashflow while also boosting revenue from the nascent international operations, then shareholders would be on to a winner.

Conclusion

And there you have it, folks. We’re seeing that the pursuit of profits has placed pressure on growth for many of these companies, leading to a slowdown in revenue expansion. The true gems are those rare ones that can continue to grow while demonstrating profitability and avoiding dilution. Ideally, they would accomplish all this while flying under the radar of institutional investors until I have the opportunity to invest in them.

If you have any names like these to share with me, I’m all ears! Until the next update, take care of yourselves fellow investors.

Disclosure: The author of this article Jean-Philippe Picard owns shares in BSA Ltd and EZZ Life Science Holdings Ltd, and does not own shares in Fineos Corporation Holdings Plc or Airtasker Ltd. The editor Claude Walker does not own shares in any of the companies mentioned. Neither will trade shares in any of the companies mentioned for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter