When I last covered Alcidion (ASX: ALC), I noted that “in the last week, we have seen the Alcidion share price move up 25% percent. You can see below how this has been accompanied by larger-than-usual volumes of shares traded. To me this is a mildly positive indication that there may be some good news coming up.”

It would seem we discovered the (potential) reason for the rise when Alcidion announced in July that it has, under negotiation, an NHS contract likely to be worth A$30-40M over 10 years.

However, it is not even targeting deployment until the quarter ending March 2025. As I understand it, Alcidion initally took on expenses during FY 2023 in anticipation of winning NHS contracts like this. Then, after blowing a hole in its balance sheet, it had to raise emergency capital and lay off many employees. Now, if it does sign this contract, it is not even targeting deployment until the latter half of FY 2025.

If it is not the job of Alcidion CEO Kate Quirke to ensure that expense growth is timed to coincide with revenue growth, then whose job is it?

Given Alcidion CEO Kate Quirke’s large shareholding of Alcidion, and the fact that this error is an error of execution, not a failing of integrity, there seems little chance that she will leave the role. That creates a problem because the execution here was sufficiently bad as to undermine confidence in her decision-making. I currently intend to vote against the remuneration report.

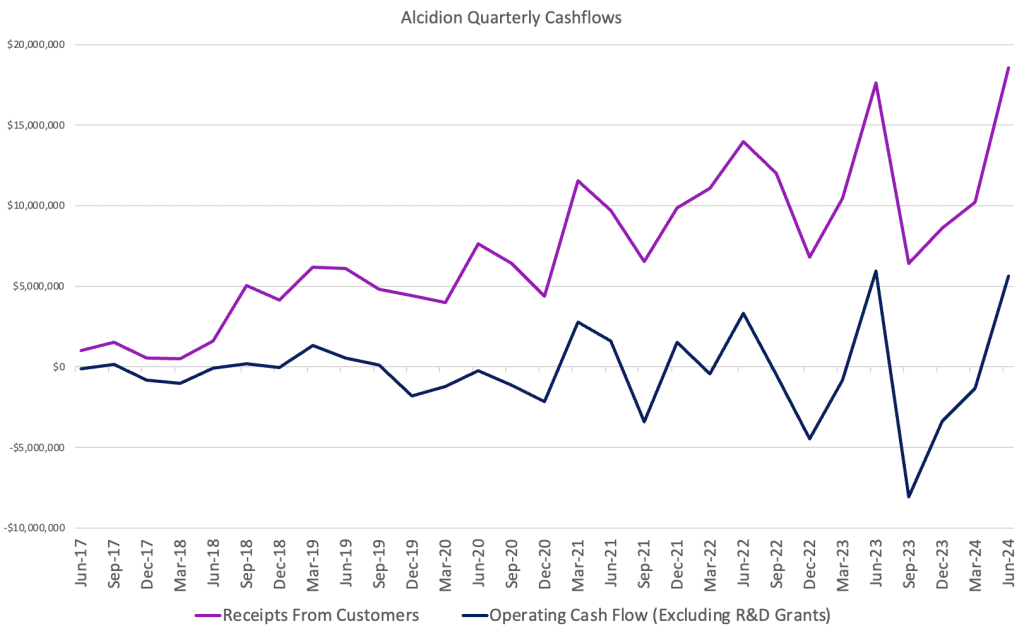

During July, Alcidion reported its seasonally strong fourth quarterly cashflow result, with receipts from customers coming in marginally above last year, and positive operating cashflow of over $5m.

However, since the fourth quarter is always the strongest, we can’t take too much confidence from the strong cashflow result.

The company also announced that “FY24 revenue (unaudited) is expected to be in the range of $37.0M to $37.5M with approximately 74% relating to recurring product revenue and the remaining being services revenue including product implementation and technical services.”

In FY 2023, revenues were $40.4m. During FY 2024, the company burned about $7.5m in cash. For that effort, shareholders will be rewarded with a decline in revenues of around 8%. The CEO presiding over this (lack of) return on investment remains in place.

During July, the company also announced that it has, under negotiation, a contract likely to be worth somewhere in the range of A$30-40M over 10 years. However, it is not even targeting deployment until the quarter ending March 2025. The fact that it took on expenses during FY 2023 in anticipation of a contract that will not (at best) be implemented until the end of FY 2025 really underlines how absurdly run this company has been. The core mistake here was taking the timelines intially published by the NHS as being accurate.

Fortunately, the company says “Cost saving initiatives implemented in Q3 reduced the annualised cost base by approximately $6.4M”, so I expect the cash bleed to reduce.

I believe Alcidion is a valuable business trading at a very low price, given it has “approximately $130M of contract and renewal revenue able to be recognised from FY25 to FY29,” but trades at a market capitalisation of only $95.3 million. Cynically, I imagine once it goes cashflow positive, the company may receive a takeover offer that undervalues the stock (but is nonetheless a premium to the prevailing price).

The full-year result will give us better visibility into the (lack of) profitability of the company. I’m bracing myself for disappointment.

Please note that this advice is general advice only. I have not considered your investment objectives and this is not personal advice. This advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937). The author owns shares in ALC at the time of publication.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.