Gentrack (ASX: GTK / NZE: GTK) is a New Zealand-based software company with listings on the ASX and NZX, providing billing and customer management software to utilities companies and airports. Its financial year ends on 30 September, so its half-year results are expected to be released in mid-to-late May.

The Gentrack share price is up an impressive 766% from its lows in 2022, despite having fallen 22% from its all-time high in November 2024, so many long-term investors may be considering whether it’s time to take profits.

Gentrack’s turnaround story is phenomenal

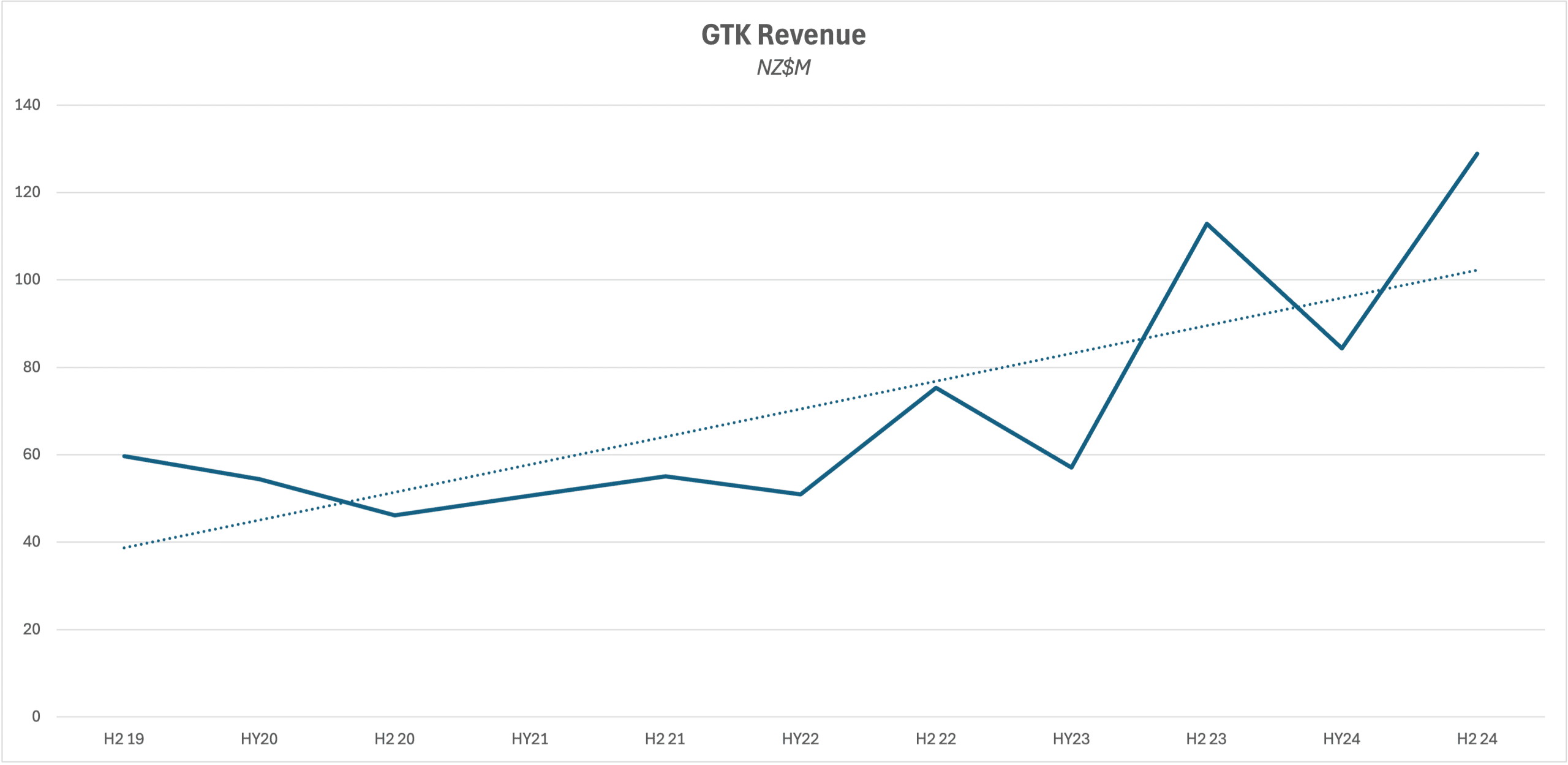

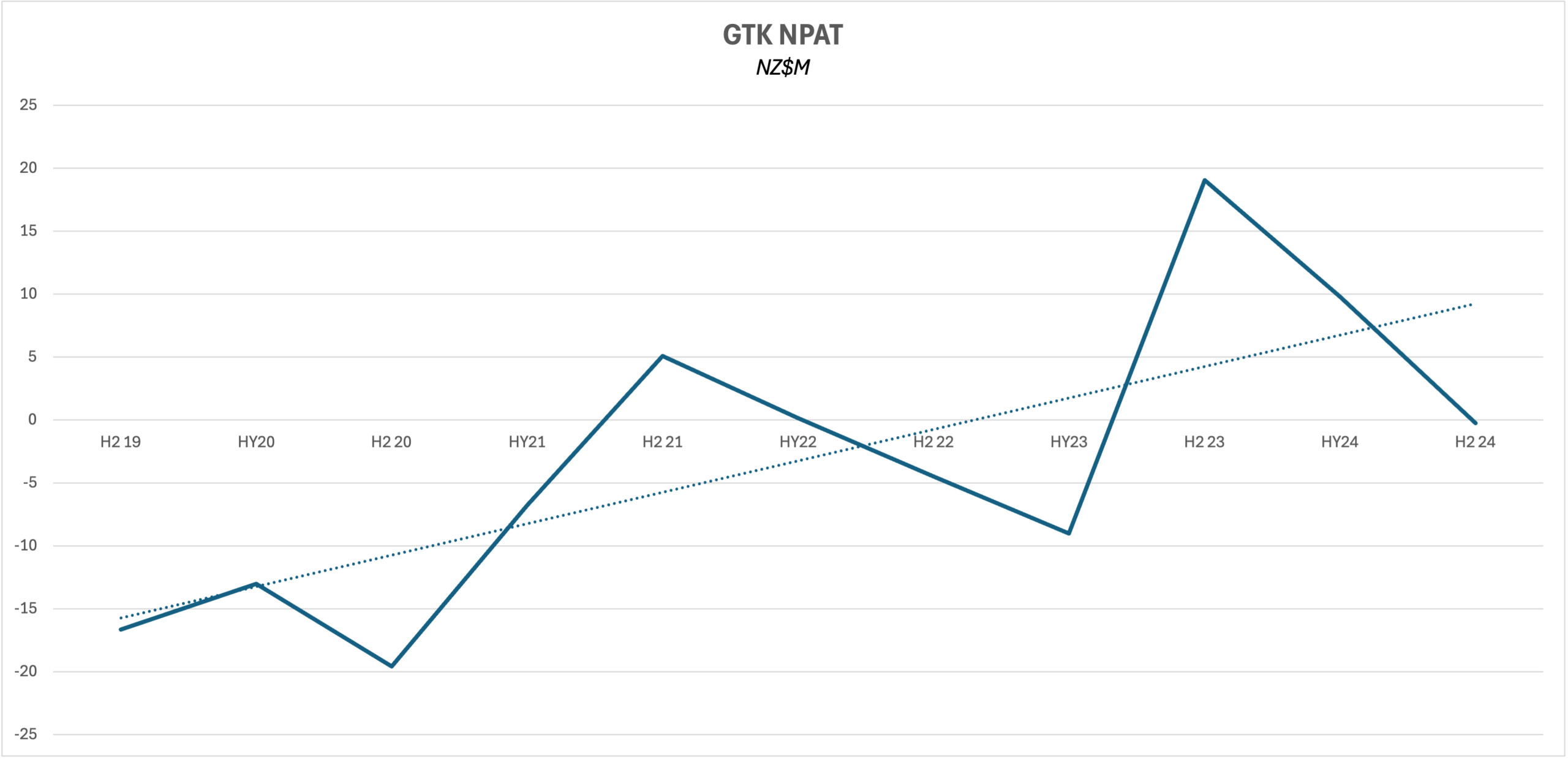

In 2022, Gentrack was struggling. Its revenue had stagnated for several years following a period of strong growth up to FY19, profits were low or non-existent, and the share price had fallen from highs of over AU$6.50 to a low of AU$1.18.

In the prior years, Gentrack had made a string of acquisitions and investments at the expense of investing in the development of their core software, and its competitors had passed it by.

For most software companies, this would be a death knell. Perhaps not immediately, but rarely do disrupted companies return to growth once they’ve passed their prime.

Full credit to the company’s then-new CEO, Gary Miles, who saw the problems and came up with a plan. He stepped up investment in the company’s core software – and pleasingly, chose to expense most of it – focused on delivering outstanding service to key customer segments, and ensured a high level of employee satisfaction.

And it’s paid off. Gentrack has posted consistent revenue growth, achieving double-digit percentage growth over every rolling 12-month period since the second half of FY22. While profits and free cashflow have been lumpy, the trend has been positive. The share price has responded too, rallying as high at AU$13.01 in late last year, before pulling back to AU$10.18 as of 23 April 2025.

Gentrack Key Financial Metrics

The transformation strategy outlined in June 2021 is now largely complete. At the time, the Gentrack identified four key ‘external metrics’ for success:

- Annual recurring revenue (ARR): >10% CAGR vs FY21 (>NZ$106.5m)

- Total revenue: +~30% vs FY21 (~NZ$137m)

- Strategic R&D spend: ~15% x total revenue

- ‘Cash EBITDA’: 15-20% x total revenue.

For FY24, ARR was NZ$121.3m, and total revenue was NZ$213m – well over target on both fronts. Neither ‘Strategic R&D spend’ or ‘Cash EBITDA’ are line items in the annual report, nor are they standardised accounting terms, so we must rely on the company’s assessment of these figures. What was surprising though, was that I couldn’t find mention of either in the Chairman’s address to the AGM in February 2025, in the commentary to Gentrack’s FY24 Financial Statements, or in the FY24 Results Presentation.

EBITDA, calculated in the traditional method, stood at NZ$23.6m for FY24. Gentrack’s explanation of Cash EBITDA states that it includes non-cash share scheme costs and all R&D spend, but excludes property lease costs. Again, these items aren’t individually expensed lines, but the cashflow statement shows lease payments and finance charges totalling NZ$3.64m, so by my estimate, that puts Cash EBITDA at NZ$27.2m, or about 12.8% of total revenue. Short of the target, but not egregiously so.

I could not locate sufficient information to come to an estimate on Gentrack’s performance against the Strategic R&D spend target.

On the technology front, the product appears to have improved significantly, though it faces stiff competition from the likes of UK-based Kraken, a subsidiary of Octopus Energy, which is 22.7% owned by Origin Energy (ASX: ORG). Continued investment will be required here to keep up with competitors.

NPAT was down 5% in FY24 to NZ$9.5m, putting Gentrack on a trailing PE ratio of 117x, and a price to revenue ratio of 5.2x.

Free cashflow was NZ$18m, down 17% from FY23, giving us a price to free cashflow ratio of 64x. However, this includes an AU$12m investment in Amber Energy.

It’s debatable whether this investment should be considered ongoing or a one-off. Given Gentrack’s statement that the investment includes an agreement to develop and deploy software, and Gentrack’s history of investments in other companies to acquire IP (plus a history of later writing down the value of those investments), I’d favour including it as an ongoing technology cost.

If you were to exclude this investment from the calculation, you’d get underlying free cashflow of NZ$30m, up 43% on FY23, for a price to (underlying) free cashflow ratio of 37x.

The balance sheet is strong, with NZ$66.7m of cash and no debt. There are NZ$17.2m in lease liabilities, with most coming due in one to five years.

The Outlook for Gentrack Shares

In the FY24 results commentary, Gentrack provided mid-term guidance of revenue growth exceeding 15% CAGR, with EBITDA margins of 15-20% after expensing development costs. This is good practice and encouraging to see.

Assuming 15% growth, FY25 revenue would be NZ$245m. Using the mid-point of EBITDA guidance, we’d get to NZ$42.9m. Depreciation and Amortisation has averaged around NZ$9m in recent years, and if that stays steady, it would imply EBIT of roughly NZ$34m. Though the company has no debt and cash on hand, it has $NZ2.7m of lease liabilities due in FY25, and should earn around 4% p.a. on its cash at current rates – also NZ$2.7m, so effectively netting out finance costs/income. New Zealand’s’s corporate tax rate is 28%, which gets us to an NPAT estimate of around NZ$24m or AU$23m, implying a forward-PE ratio of around 46x and price to sales of 4.5x. If we use the more optimistic end of EBITDA guidance and 20% revenue growth, the forward-PE drops to 37x and price-to-sales drops to 4.4x.

In my opinion, the EBITDA margins in this guidance are optimistic, but the revenue growth might be conservative.

All things considered, Gentrack appears to be a business of reasonable quality, but with high investment needs, at a reasonable valuation. I don’t think it’s a bad business to own, but I think there are better uses for capital elsewhere, and if I was sitting on reasonable gains, I’d consider taking those profits.

Gentrack’s turnaround has been impressive — but if you’re looking for a business with similar traits and more upside, don’t miss this under-the-radar stock we backed before it jumped 30%.

Join The Waitlist To Become A Supporter, And Receive Our Free Special Report Directly To Your Inbox

Disclosure: Niether author of this article, Patrick Poke, or the editor of this article, Claude Walker, owns shares in GTK. They will not trade shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Ethical Investment Advisers Pty Ltd (ABN 26108175819) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.