Yes, this article is about Brainchip (ASX: BRN) and the enormous rise in its share price. But it’s also about sociology, and psychology. So let me start with a question: do you ever have that moment when you are waking up from a particularly vivid dream, and for a moment you believe it’s all real?

It has happened to me. I am blinking awake and for a few seconds I’m exhilarated but dismayed because I somehow managed to pop two back tyres drifting fast around a bend in the Kimberley on a track that looked halfway between something out of Gondwana land and Koopa Troopa Beach.

And then reality hits; I’m not in the Kimberley, and the car is safely in the driveway with a chunky top-of-the-line child seat installed. I haven’t driven a Nissan 300Z in 15 years and my car has definitely never done any drifting. But my mind grasps at the dream a little longer; it might not be real but it was something magnificent.

Well, the same mental powers can be used to make stock prices do some very strange things. As long as the company itself provides a structure, and a loose outline of what might be possible, punters’ brains can take over and do the rest.

And the dream can be a lot bigger if there are virtually no existing revenues, because revenues would give scale. My Gondwana land race track was on such an epic scale too; I could almost feel how dinosaurs used to tread the land. For a hype stock, real revenues add scale, and that limits the dream. But the success of a company with no existing revenues can be imagined on any scale whatsoever.

There is nothing particularly unusual about seeing small cap ASX stocks become very very overhyped. The hype cycle is common. By way of example, you can see how Getswift (ASX: GSW) reached $4, a few years ago, before dropping all the way down to 40c. It’s been rather flat since then.

At the time, Getswift was a remarkable example of multiple forces combining to create a tasty mirage for retail investors. In the months leading up to its peak, one particularly popular stock newsletter company lead the charge with dozens of articles, luxuriating in imagined potential. One of its authors wrote; “If you add in the other deals it has on the table, excluding those that are in the works, then I see the company being worth upwards of $700 million in two to three years.” Years later the market capitalisation is $88 million. Imagination is a powerful thing.

Of course, stories of imagined potential also appeared in plenty of other newspapers, including the Australian Financial Review, though that publication deserves credit for subsequently leading the charge in exposing some of the company’s most overhyped claims. Hotcopper posters were, as usual, counting chickens before the coop had been built.

Brainchip (ASX: BRN) Shareholders Are Buying The Dream

In recent weeks we’ve seen perhaps the most heavily hyped share price action I’ve ever witnessed on the ASX, in a company called Brainchip (ASX: BRN). Brainchip supposedly has technology that will allow the manufacture of better computer chips. Even more incredible, it has achieved this with very little spending, having only allocated about $3.5m to R&D in the last half year up from just $1.5m in the prior corresponding period.

It’s not exactly clear how Brainchip has snared the semi-conductor engineering talent to pull off this feat, or indeed who they are. If they have turned a few millions of R&D into hundreds of millions of value, I would have thought they’d receive employment offers from the likes of Nvidia, IBM, AMD and the other gigantic semiconductor companies.

That’s because the companies that make microchips measure their R&D spend in billions, not millions. For example, back in 2015, IBM said it would spend $3b over five years on developing the future generations of microprocessors that it thinks will replace silicon microchips. “Beyond that,” wrote Wired, “IBM is also investing in brand new ways of number-crunching—quantum computing, or Neurosynaptic chips – that use computing models that go beyond the digital computing paradigm that has dominated the tech industry for fifty years.”

Brainchip doesn’t have much revenue or customers to speak of, having booked just $13,397 from an unknown customer for “development service revenue,” in the six months to June 2020. That’s less than a month’s pay for a single top tier data scientist or software engineer.

I’m not sure how many actual prototypes Brainchip has built, but I do know that punters pushed the market capitalisation to over $1.3b at its Brainchip share price peak of 97c. I’ll leave it to the reader to decide whether that is ludicrous or not, but one thing I am certain of is that Brainchip is perhaps the most aggressively promoted stock I have ever come across.

You see, social media has increasingly become a free, high traffic, low value method for — wait for it — not just idea generation but actual stock research. Now, this might make a lot of sense if you’re observing, for example, customers of an online retailer like Kogan (ASX: KGN) or even a direct to consumer BNPL company like Afterpay (ASX: APT). But it is a pretty strange resource for understanding a highly technical subject matter like neuromorphic computer chips.

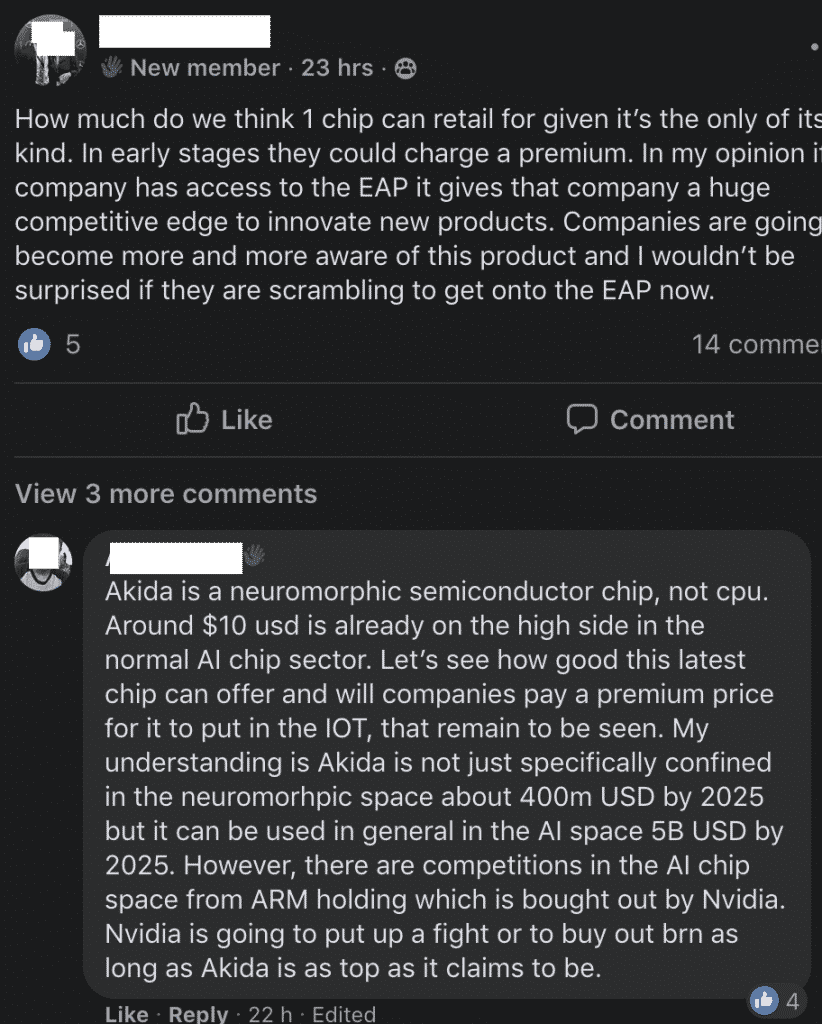

But the discussion of Brainchip definitely goes beyond the usual ticker + rocket emoji format developed years ago on twitter by cryptocurrency fanatics. There are multiple entire groups dedicated to singing the praises of Brainchip and keeping the dream about its amazing fundamental potential alive. You can see an example below:

On top of that, Brainchip holders make it explicitly clear that they think that this near-zero revenue company may well be the next FAANG stock. The tweet below is a response I received when I warned the stock was hyped. The high expectations show how strong, and beautiful the dream for this company is. But the tweet also shows the dream’s fragility; anyone who questions it must be an inferior “kind of person.”

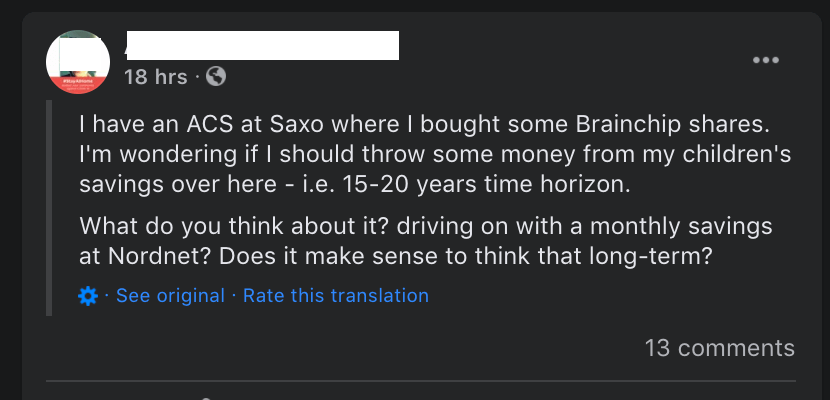

Now, have you ever tried to wake up someone who is having a nice dream, and doesn’t want to be disturbed? It doesn’t usually go great. But the problem is there are certain times when you shouldn’t be dreaming, like when you are driving a car, or investing the savings you were building for your children. And unfortunately, that is exactly what some people are considering. Sometimes, waking someone up can be doing them a favour.

Now I have no idea where Brainchip shares will trade at in 15 to 20 years. But for a company with virtually zero revenues, and a big chunk of expenses, it’s always possible that it won’t exist at all. My guess? It turns out something like Getswift.

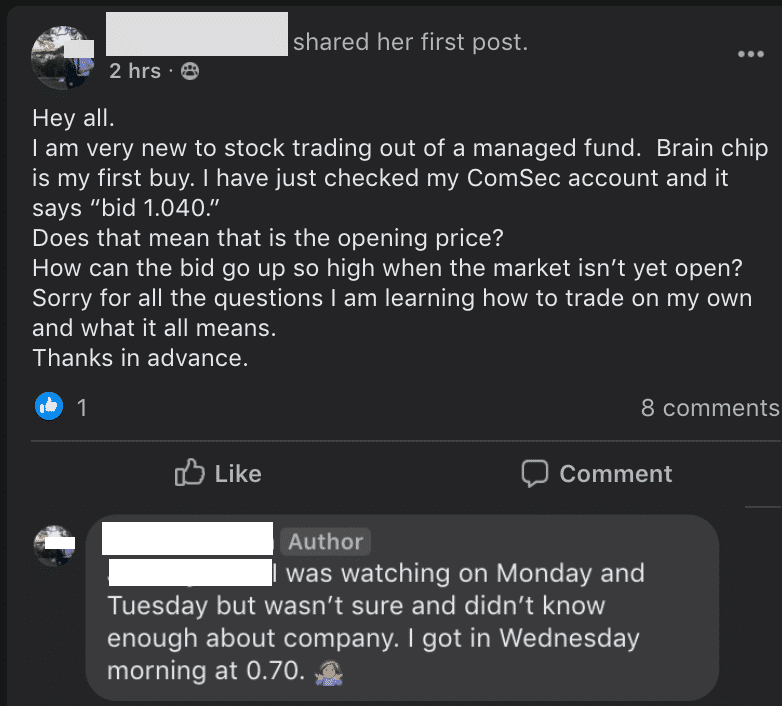

Importantly, though, I don’t pretend to understand the technology, and if the company starts winning huge contracts (and actually receiving payment for them), I would likely change my mind. But the point is that no newly minted stock trader understands the odds of Brainchip having success. And the point of this article is that the buyers of Brainchip are newly minted stock traders. If you’re still learning about your online brokerage account, how likely is it that you have an edge when it comes to understanding the bleeding edge of the semi-conductor industry?

Now, I have no view on where the BRN share price moves from here. It could be up, it could be down, or it could be sideways. If I had to bet, I’d say the stock is meaningfully lower in 2 years than it is today, but I simply don’t know, because I don’t understand the technology.

What I do understand is the sociology of what is happening. A huge effort is going in to keeping new retail punters excited about purchasing shares. And they are buying in droves.

But who is on the other side of the trade? I don’t know for sure, but I have a couple of friends who owned BRN before the massive run up recently. They both sold at least some of their shares at around the same time Facebook, reddit and twitter exploded with chatter about the stock. And it is not surprising that the peak approximately coincided with shares miraculously becoming available to short; and from my observation some of the most experienced and successful traders and investors I know promptly did exactly that. Most would have made a profit (and even I managed a small profit shorting the stock).

The fact is that experienced investors and traders were betting the stock would drop from a Brainchip share price of 70c and above, while some very new and inexperienced investors were buying the shares at 70c, or more. I think shorting is a risky, and usually silly game (for myself, anyway), but I think that the chances that the company can sustain a market capitalisation of $1b for long seem very low indeed. Of course, I might be wrong.

Whether it is deserved or not, Brainchip will certainly go down in history as one of the most hyped up stocks the ASX has ever seen as of September 2020. Certainly, I have never seen $1.3b in market cap for a company with $14,000 in half year revenue, before. But if dedicated Facebook groups, and meme-generating Reddits remain as dedicated to promoting speculative stocks as they have been these past few months, we may well see other stocks rise just as high on the power of the dream.

Disclosure: While I have previously shorted Brainchip (with inconsequential amounts of money), I have no open position in the stock at the time of publication and nor will I open one within 2 days of publication.

This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive an occasional Free email with more content like this, then sign up today!